The tariffs got banged in after markets closed. Cannabis is becoming a carnival melting pot. Trade action is in payments, insurance and interest rates. I am pleased I do not make price predictions as cryptocurrency markets decided to sag again.

Portfolio News

Market Jitters - Tariff Tantrum I said the head banging about tariffs would not stop.

The tariff announcement was released after market close. Though the market knew the announcement was coming they did not behave as if they knew what was in the detail. Biggest casualty was NASDAQ with a drop over 1%. I fully expect that tomorrow will be an ugly day. In my portfolios, the market was wanting to believe that everything was just fine. In Europe, Italian stocks were up 2 to 4%. Even the somewhat beaten up German banks were up 3/4 to 1%. There was very little down. There were bright spots in the US markets too with a few surprising moves up from fertilizer and Russia. The downs were in shipping and oil services and technology stocks.

China got tariffed with a big stick - about $200 billion worth of trade hit with a starting 10% tariff from September 24 (next Monday) and ramping up to 25% if there is no action to fix the problems

The list has been adjusted from the initial published list but does include a lot more consumer goods compared to what has been tariffed already.

https://www.businessinsider.com.au/trump-china-trade-war-tariff-chinese-goods-2018-9

It is time to step back a bit and look at what might be going on. Is this a battle about fair trade or is this a bigger game? We all know that China is steadily building a new economy to challenge the world order. We all know that it is investing heavily in initiatives like the Belt Road and in Africa and in Australia - with a view to dominating more than its fair share. We also all know that they have much more control over how they respond to these tariffs because they do not run free markets - called Autocratic Capitalism. If this is the big game they are playing, maybe the US should be responding with a similar game of investing and infrastructure support. It would be a whole lot less disruptive to world peace than the military war game they like to play.

You know what? I don't think Donald Trump gets it - he is playing the smaller fair trade game. He does not have all the cards that the Chinese have. They can just trim margins and cut prices and still export.

Furthermore, the harsh reality is that a lot of American business is going to be hard pressed to start manufacturing the tariffed products. Employment is getting pretty tight with the unemployment rate now at 2008 lows which will eventually push up wage costs. And borrowing costs are rising too as rates rise which will crimp the desire to invest.

Cannabis Carnival Marijuana market is hotting up as we get closer to Canada legalization day.

The talking heads talk about cannabis markets every day now. In this morning's segment, Steve Grasso talked about the way the potential applications are widening into a whole new asset class. Think pharmaceuticals, beverages, lifestyle, wellness, consumer products, and data applications. The big players are lining up to take their places - Coca Cola (KO) today and Johnson & Johnson (JNJ) Canada get big mentions.

The puritans may get their way in the US but this is going to be a global industry. Watch the video - it will open your eyes about stuff I have been saying for ages.

Bought

Afterpay Touch Group Limited (APT.AX): Australian Payments. APT offers three payments solutions for retailers. Buy now pay later. Secure delivery of non-physical products. Voucher, tickets and token delivery. They have made good headway in building their Australian and US presence. They are running a share purchase plan (SPP) to fund the development of their UK business where they have acquired a UK player operating in the arena (ClearPay Finance). Rights price was to be no higher than price paid in the recent institutional placement but it could be lower. SPP closed on September 17 and SPP price will be announced thereafter - price has collapsed today by 6% which suggests that the SPP price was a bit lower than the market expected or there was a big shortfall in applications.

Now that I am a shareholder, I see the Afterpay logo everywhere. See TIB270 for the original rationale

Sold

QBE Insurance (QBE.AX): Australian Insurer. QBE has quite large exposure to US insurance markets. With Hurricane Florence expected to drive quite a large claims book, I chose to exit the trade for a 1.7% profit since August 2017. My original rationale for the trade written up in TIB129 was to benefit from growing US business and weakening Australian Dollar. With one leg of that premise under threat from the flooding claims, I took the exits with a small profit and the last dividend.

Shorts

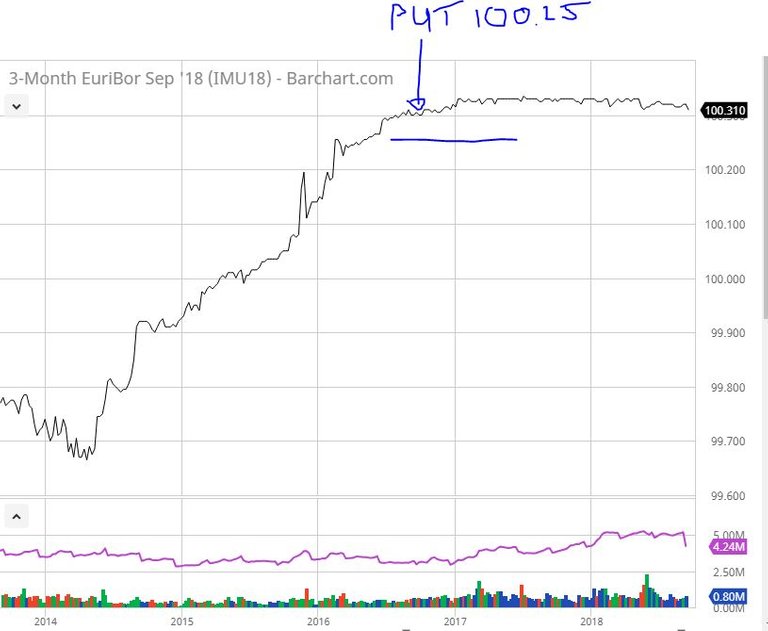

Euribor 3 Month Interest Rate Futures I was holding strike 100.25 put options on Septembr 2018 futures bought in November 2016 and April 2017. Those expired worthless. One would think that 2 years was enough time to see interest rates rise in Europe. With a strike price of 100.25 this implies that I was looking for rates to move from minus 25 basis points perhaps to zero and maybe even go positive. I was wrong - they did not move at all. First chart shows the life of the futures contract over the last 5 years and the point at which I entered. Price never did go below 100.25.

The next chart shows what I was basing my expectations on. US interest rates had already started moving up when I did the Euribor contracts. They kept on going BUT Europe did not.

Note: these are price charts. Price falls when rates rise.

One could argue that a better idea would have been to exit the trade, say with 3 months to go, to recover some time value in the premium. I chose not to do that as I know from the Eurodollar chart that once rates start moving, they move very quickly. The good news is I have been exposed to the US rates moves - so all was not lost.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $330 (5.1% of the high). It never pays to get confident about price moves. After a weekend of indecisiveness price made its move firstly a little higher and then decisively lower. The level around $6500 is proving to be a stubborn resistance level and there I had been thinking it might hold as support.

Ethereum (ETHUSD): Price range for the day was $34 (15.1% of the high). Price chart looks a lot like Bitcoin with a fake higher and then a decisive move lower to close below the support around $200. We really need to see price not make a lower low and to move and close above $200 to have any confidence about the sellers state of exhaustion.

CryptoBots

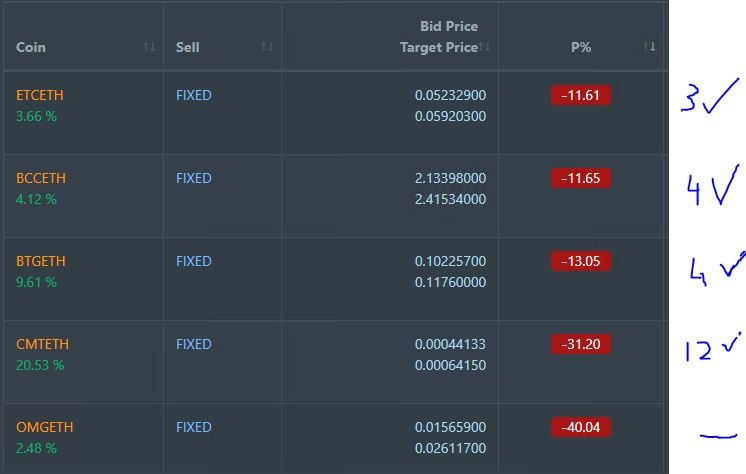

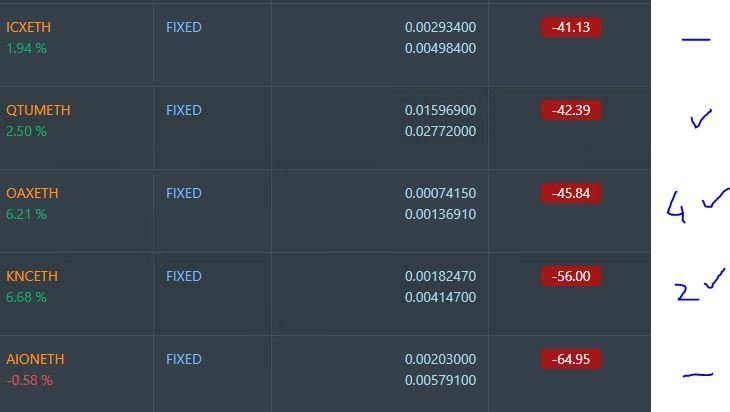

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-69%), ZEC (-68%), DASH (-61%), LTC (-51%), BTS (-46%), ICX (-80%), ADA (-75%), PPT (-81%), DGD (-84%), GAS (-84%), SNT (-64%), STRAT (-77%), NEO (-80%), ETC (-54%), QTUM (-81%), BTG (-72%), XMR (-37%), OMG (-69%).

All coins dropped between 1 and 3 points. PPT (-81%), LTC (-51%), ICX (-80%), QTUM (-81%), and NEO (-80%) all dropped a level with the 80% down club getting crowded with 4 coins joining the worst pair of DGD and GAS

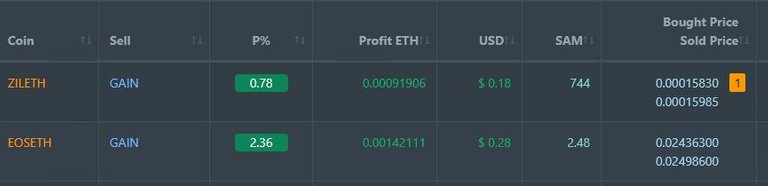

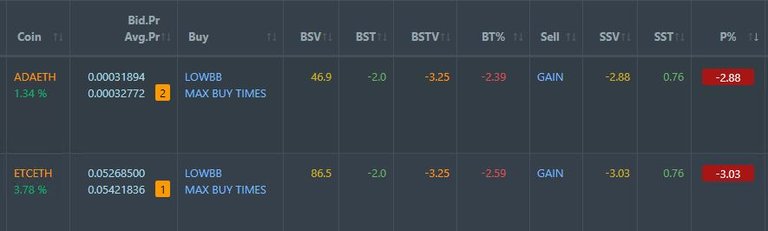

Profit Trailer Bot Two closed trades (1.57% profit) bringing the position on the account to 2.57% profit (was 2.53%) (not accounting for open trades). ZIL traded out with one level of DCA.

There are two coins on the Dollar Cost Average (DCA) list with ZIL moving off and onto profit after one level of DCA.

Pending list remains at 10 coins with 7 coins improving and 3 coins trading flat. CMT was the stand out up 12 points. Too bad PT Defender did not get a chance to open defence trades on it.

There is a smart question in here. Why did all the trades on the outsourced bot go down yet all the pending trades on this bot went up or flat? The answer is in the base. The one trades Bitcoin and the other trades Ethereum as the base. ETH dropped nearly 3 times more in percentage terms than BTC.

PT Defender continues defending 4 coins with no change in status.

New Trading Bot Trading out using Crypto Prophecy. No closed trades with trades still open on DGD, SNT and TRX. I did look for new trades but chose to stay away.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 20.2% (lower than prior day's 24.4%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Business Insider. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

September 17, 2018

The US President trying to strongarm China to getting what he wants is a dangerous game as China holds so much power as to the financing ability of the US that they could potentially impact the effectiveness of the tax reform long term which needs to be financed by more debt which are already at staggering levels. I am surprised that China has not sent these signs yet although they probably still have some room with retaliations of their own.

I saw that China has stepped up sales of US Treasuries which explains to me why yields spiked back over 3% with a big 7 basis point move. The next Treasury auction could be very important. I will predict that we will see 3.25% before too long.