I have a Mutual Fund and Stocks portfolio where the Large Cap funds or stocks are almost 80% of the total equity value that means I am taking a conservative approach. So in the long run I expect the return to be around 10-12% and not more. This portfolio is tied for Retirement + Child's Education goals and thus I do not want to take much risk and want to keep it a moderate risk portfolio.

PC: Pixabay.com

Along with that, I am also creating another portfolio (All Equity) where I am taking a much higher risk to get higher rewards. This portfolio is for fun and thus even if I lose money in this, I will not have any regret. All my primary portfolio is in Groww but I have opened a Zerodha account for creating this new portfolio only to get much more analysis and how good I am doing. I must say Zerodha is much better than Groww in terms of analysis and other things.

So this portfolio is having only 55% Large Cap and others are small-cap and mid-cap funds. Will be adding more midcaps and small caps to keep a portfolio of 20% Large Cap, 30% Midcap and 50% Small-Cap portfolio.

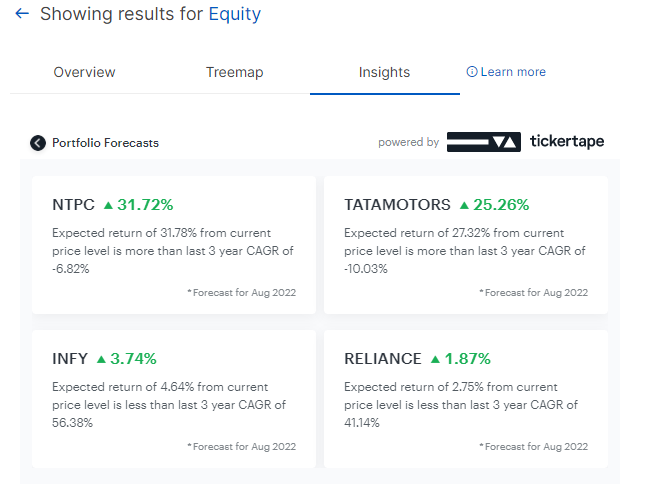

The current holdings I have in this portfolio are Infosys, Indian Pesticides Limited, IRCON, IRFC, Laxmi Chemicals, NTPC, Reliance and Tata Motors. Though these are not great stocks but still looking at the potential of each and every stock, I guess in the long run they will be good or I might be wrong that's why this is called a riskier portfolio.

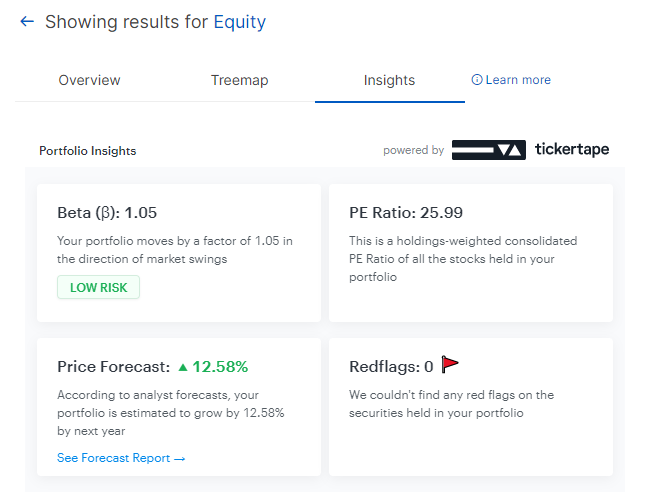

In Zerodha, I have an insight into the whole portfolio which are powered by ticker tape and thus I get to see any red flags or any problem with the stocks beforehand itself. Since I have 55% in Large Cap, it is showing Low-Risk portfolio but will change once I add more small-cap funds into it.

It also shows the Price Forecast for the future year and thus two stocks that will do good in the coming year is NTPC and Tata Motors and my overall portfolio will rise at a rate of 12.58%. As I have already said in one of my posts is that seeing the potential of the future I am adding more Tata Motors and NTPC stocks in coming days.

Do you have any riskier portfolio where you can play around with the stocks? What do you think is the best mid Cap or small Cap stock which can be added into the portfolio?

As I said it is just a backup portfolio, I don't mind taking that extra risk by investing based on tips, but still the core portfolio will revolve around the stocks which I already have.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.