A lot of people I know invest in the stock market, but most of them are long term investors. They have lost money because of some bad stock selection as well as earned money because of good stock selection. But mostly they are better than break even. I am talking about people are who have remained invested in the market for more than 5 years.

But if I talk about day traders or the new investors, for them making money in the market is a big task and their average is always on the loss. I am not talking about the masses but the people who ignore one important thing always losses money. They either end up making very little profit or no money at all or even in loss. Now they lack the money making is because of the human nature, but if they change their habit which we are going to discuss they will start making good profits in their future trades.

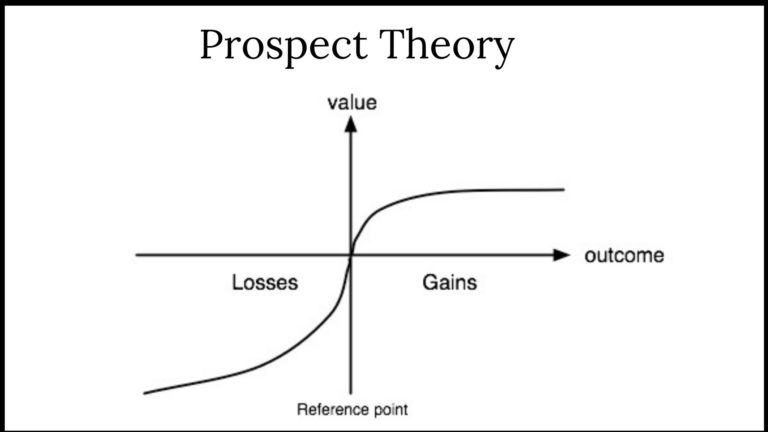

I was reading somewhere about how the human mind will behave when it comes to taking risks and accidentally read about The Prospect Theory. This theory is about how the investor will value the losses and gains and what decisions he will make under both circumstances. The theory is simply that if an investor is given two choices, one is gain and one is loss the investor will always choose the gain. That's actually quite true given Amy investor, but it's not only about valuing gain but again all about making less losses. If it is good to make 10% gain and 50% loss, no right.

PC: https://www.marketing91.com/prospect-theory/

Also if we gave to deduce the theory then we know that we are risk-averse at the time of profit and risk-taking at the time of loss. That means if we have gained some profit and the stocks are going up we will book the profit as little as possible but in case of losses we just keep the stocks hoping that it will become up someday.

The one thing which makes people make money is to go against human nature and book the losses as soon as possible. And the best way is to always keep a stoploss and we should not be emotionally attached to the stock and if the stock is not doing good we should come out of the trade as soon as possible. It's better to take a 10% loss than watch your stocks go down to pennies. Also at the time of stock rising, we should not keep any target and try to gain as much as possible with stock instead of selling it with minimum profit.

You are right. People try to beat the market, when the reality is to beat oneself. Control over fear and greed is what is required to win in the market.

That is something that people are not very good at.

Posted Using LeoFinance Beta

Yes and that's why we need to change our nature to actually do well in the market.