From all the defi apps we have seen in the previous bull market, Uniswap has kept its dominance and continued to develop and grow. It was the first defi app to bring in users thanks to its simplicity and incentives. Following the FTX collapse and the multiple other collapses centralized entities in 2022, its importance grew even more.

Let’s take a look how is the protocol performing under the current market conditions.

Here we will be looking at:

- Total value locked

- Trading Volume

- Uniswap V2 VS V3 in trading volume

- Number of users

- Top Pairs

- Price

The period that we will be looking at is 2020 - 2023.

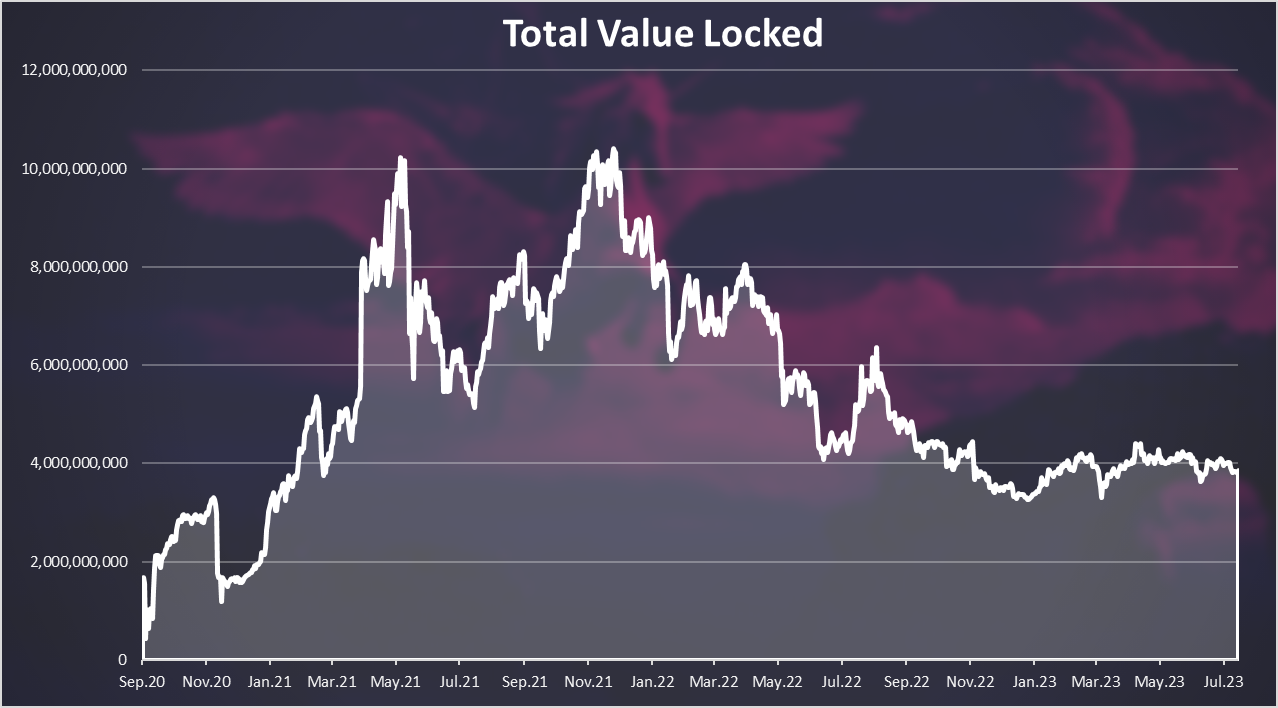

Total Value Locked

Here is the chart for the TVL on Uniswap starting from September 2020.

Uniswap launched its token back in September 2020, and the liquidity grew fast then. A record high of 10B was reached in April 2021, and again in November 2021. Since then it has been a downtrend and reached around 4B, where it has been hovering for more than a year now.

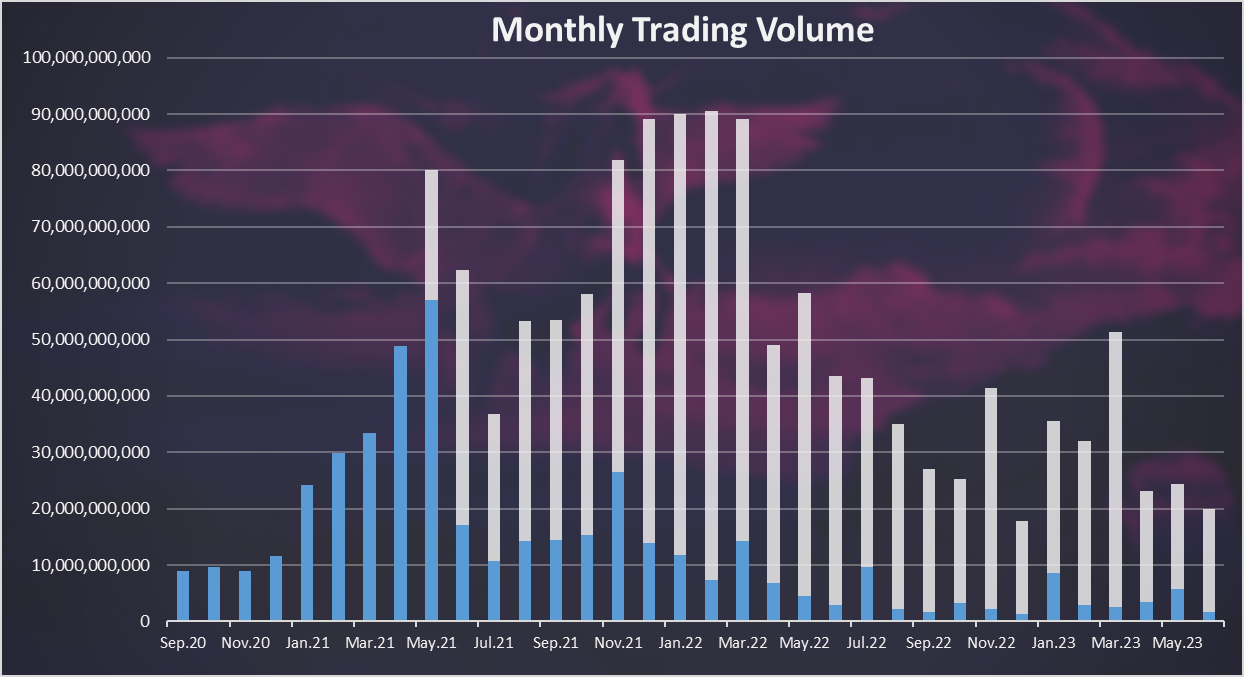

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

We can see that most of the volume is now from Uniswap V3. The V2 version has dropped behind. V3 was launched back in May 2021, and we can see that it has become dominant.

The daily trading volume has also been has been more constant in the last year, similar to the TVL, with occasional spikes whenever there is some volatility in the market.

On average the daily trading volume has been in the range of 500M to 1B and more on occasions.

The monthly trading volume looks like this:

A clearer picture here then the daily volume.

We can see the monthly trading volume reached an ATH at the end of 2021 and the beginning of 2022, when it was around 90B for a few months.

In the last months the trading volume has been around 20B per month.

We can notice the spike on monthly level that happened in March 2023, because of the market volatility.

When it comes to the share of the trading volume on V3 vs V2, more than 90% of the trading is now on V3.

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for the last 24 hours:

Uniswap ranks on the 4th spot now, and has dropped from the third spot where it was for a long time. ByBit has emerged on the third spot, after the big two Binance and Coinbase.

At one-point Uniswap has surpassed Coinbase being number two of all exchanges.

Obviously DEXs are now serious competitors to CEXs, with Uniswap leading the way. There is two more DEXs that are in the top exchanges, Curve and Pancake.

Active Users

How many users Uniswap has? Here is the chart.

In terms of active users, we can see a reverse trend in the last few months, and now we have almost the same amount of DAUs as the previous years.

The number of daily active wallets reached 60k just recently. It has spiked from a previous lows of around 30k.

On a monthly basis the chart looks like this:

Some take the MAUs as a more relevant number, as not all the users are making daily transactions.

We can see that the number of MAUs has been in the range of 300k to 500k and it is significantly higher than the DAUs, on an order of magnitude of x10.

June is around 500k MAUs, while there was a spike in May up to 700k. The record high was back in May 2021, when the number of MAUs reached 1M.

Top Trading Pairs on Uniswap

Here is the chart for the top trading pairs ranked by liquidity.

The USDC-ETH pair is on the top with more than 400M combined liquidity. The BTC-ETH pair is on the second spot, followed by another Ethereum stablecoins pair, ETH-USDT.

The DAI-USDC pool is on the fourth place as a stablecoins only pool. A few others stablecoins pairs in the top as well.

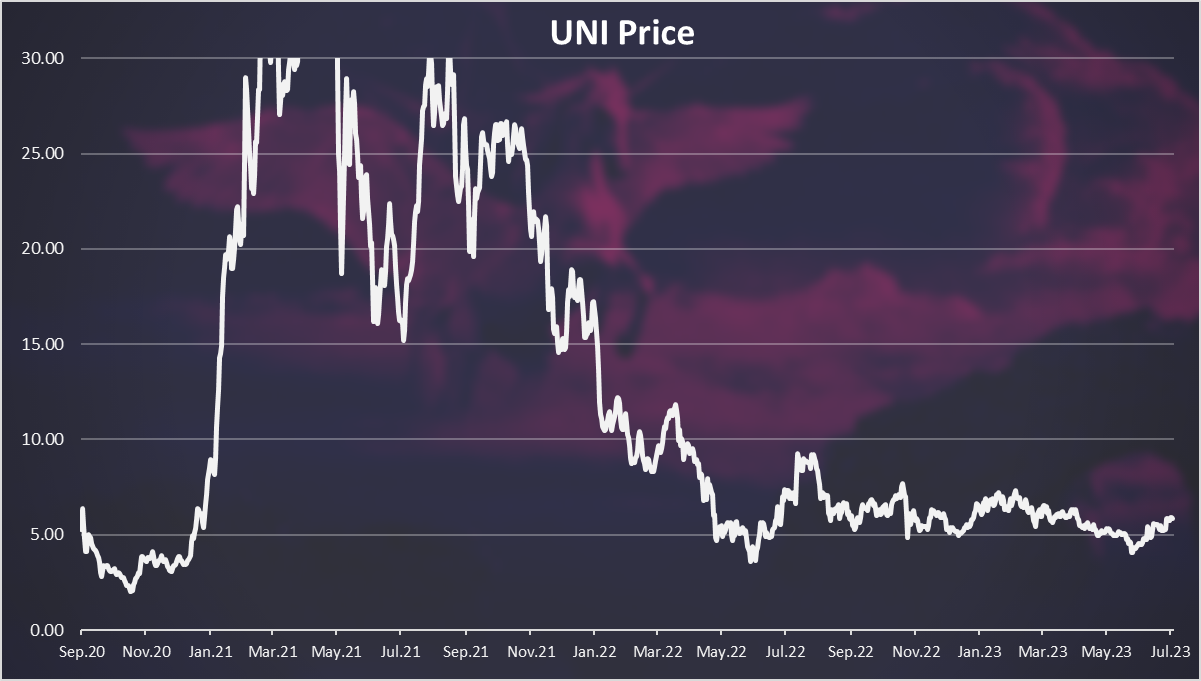

Price

The chart for the UNI price looks like this.

The UNI token has been on a wild ride, reaching $40 at some point in 2021. Since then, it has dropped, and in the last year it has been in the range of $5 to $10 dollars.

All the best

@dalz

Posted Using LeoFinance Alpha

Thanks for the great overview Dalz. I still didn't use Uniswap yet as Binance serves my needs at the moment but might test it out soon.

Investors did not favor DEX coins. Since the start of the year, LIDO DAO, Maker DAO, Synthetix, and Compound have gained 89%, 117%, 101%, and 125%, respectively. DEXs such as Uniswap, Pancakeswap, and Thorchain performed poorly.

Uni has done quite well ... the other dex, not as much

It's good to see these detailed reviews. I personally believed that DEXs were going to grow much faster.

Awesome analysis @dalz and thanks for sharing.

Uniswap team has done a great job, i'm using it since my first day and I love how easy it is to use. I also got the uni airdrop, Thanks for these great analysis about uniswap.

Thank you for this awesome overview of Uniswap, especially in comparison with other CEXs and DEXs.

!PGM

!ALIVE

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @tuisada. (5/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power and Alive Power delegations and Ecency Points in our chat every day.

Thanks for sharing.

such a great analysis about the exchange. Although I've not traded with them but your input indicates the exchange is actually a credible one.

When Uniswap was launched, I never knew it was going to grow fast even though a lot of people said that...

Its growth is so fast

Kudos!!!

When I first came up in this industry, I used this exchange first and it has been going like this till date and the way it has been it is becoming more and more successful and people are doing it.

Great article and data. If we are being honest #Uniswap is the only game in town. The only #DEC which is competing with CEXs. There is a misspelling on the graph showing it as number 4: “Coinbiase”

Gracias por compartir, información muy valiosa sobre Uniswap, espero utilizar algún día esa aplicación ya tengo una ligera idea de cómo usarla, buen contenido explicativo amigo.

Gracias por compartir, información muy valiosa sobre Uniswap, espero utilizar algún día esa aplicación ya tengo una ligera idea de cómo usarla, buen contenido explicativo amigo.

I was struck by the fact that Uniswap has maintained its leading position among DEXs, despite competition from other protocols such as SushiSwap, PancakeSwap or Curve. I was also surprised to see that Uniswap has more unique users than all other DEXs combined, demonstrating its high popularity and adoption.