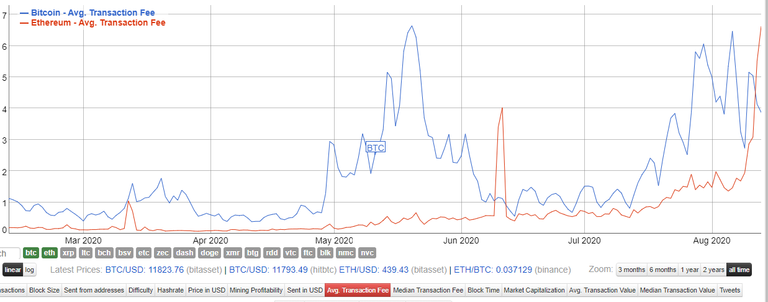

Ethereum users rejoice!

For the cost to use the network has skyrocketed past Big Daddy Bitcoin himself. This is a great time to take gains, and one of my friends sold half of their ETH yesterday in anticipation of a dip. He's a lot better at the trading game than me (more of an emotional game) and I wish him the best with that gamble. However, as I have been predicting BTC ATH soon™ I'm just too afraid to sell anything right now.

Him and I played a lot of World of Warcraft together. We were what the community called "Goblins", as that race (much like Ferengi in Star Trek) are normally obsessed with accumulating wealth. We'd make millions of gold (translating to thousands of dollars) using sophisticated auction house addons and mods and various other tactics to flip products and end up in the green.

He was always better at it than I was; always willing to go the extra mile and take massively more risk. Whenever I would take a big risk and lose (same in poker) I would go on emotional tilt and make even worse decisions down the road. I always found that the best way for me to play the game personally was to tone it back and play a safer game, even if it meant I couldn't turn the highest overall profits.

When 2017 came around I thought of my friend immediately. I waited a little while for the market to crash, but eventually (a bit too soon) I called him up and told him he absolutely had to get into crypto and that he would love Ethereum. I don't know how I knew Ethereum was the coin for him but I was absolutely right.

Over the years he's spent thousands on mining equipment and he loves speculating on the market. He's really good at this stuff because of his WOW experience, but also because he was one of those big players in Magic the Gathering who would speculate on cards and sell them at a profit as well. I think at one point he had enough product to open his own store. Crazy stuff.

In any case, I decided to throw out a text to him yesterday seeing as how ETH is going bonkers and he told me about his little sell-half-my-stack play. You see, he can get away with something like that because he knows how to accept losses and roll with the punches. People like you and me... just don't. We lock up; we panic; we wait for a recovery/crash when we should be capitulating.

Again, this is why I must promote responsible trading by reminding everyone that the safest play in crypto is to reduce volatility as much as possible. We shouldn't be margin trading or betting on futures. We should simply be cost-average selling/buying small chunks at choice times. That's the best way to maneuver in this space without feeling you want to gauge your own eyes out with an ice pick when shit hits the fan. 99% of traders are not emotionally capable of staying objective while keeping a cool head, and I say this as someone who was called Mr. Robot in highschool.

On a side note, there were a few more things I wanted to say about our sister-chain Blurt.

Check out the readme file:

https://gitlab.com/blurt/blurt/-/blob/dev/README.md

Several parts of the network have already diverged from Hive/Steem:

- No resource credits (charging real money for transactions)

- No stable-coin

- No downvotes

- All-powerful regent account that chooses all witnesses.

- Diminishing returns over two years to zero power.

Pretty cool!

Now, do I agree with any of these changes? No. I truly do not understand the point of this network. The tokenomics and even community do not make sense to me. Regardless, it does not matter. Blurt has already distinguished its network further away from Hive and Steem than they have of each other. In a way, Blurt accomplished more development and diversity than both of the other two sister networks comined. From that perspective, it's a pretty cool thing.

Again, what happens if I make progress with escrow smart contracts and connect that functionality to our sister-chains? That's just free value, no matter how little it may be. Just sayin.

Link

You know Bitcoin Cash is fuming when their community feels as though they are the real Bitcoin and some Ethereum shittoken just flipped them. Haha.

Link #5 market cap

Crypto is hilarious.

Speculation is entertaining.

When flip BTC?

Seeing all of this speculation is a staunch reminder that anything could happen in this space. I've been predicting for a while that ETH would flip BTC in 2025, if only for a moment. However, this whole DeFi craze shows us that such a thing could happen within the next 18 months. Is it really so ridiculous to think that ETH could go x5 while Bitcoin stayed relatively flat? Seeing as ETH seems to have 100 times the development power, it's certainly not out of the realm of possibility.

That being said, I'm more and more bullish on Bitcoin every day. The liquidity, security, staying power, and simplicity of it are unmatched. This is especially true during these times when I believe governments and corporations are going to be forced into switching to Bitcoin as the primary reserve currency. It's already starting to happen; the floodgates will open soon enough.

It only takes one bug; one hack, for Ethereum's DeFi speculation to come crashing down like a house of cards (perhaps even just network fee capitulation). If/when that happens Bitcoin will be waiting to gobble up all those frightened traders who took a huge risk and likely didn't know any better as they retreat to the safer asset. Let's be real, the safer network in this case is still a unicorn asset with exponential gains and still considered extremely risk-on to the legacy market.

MakerDAO

I'm still pretty SALTY that MakerDAO is outperforming the market. These corporate slugs pitch the ridiculous idea of allowing people to use real-world assets as collateral even though that can't be enforced on chain? Perfect example of how you can lower your fundamental value while at the same time greatly increase your speculative value because people are greedy and don't know any better. I'm still cashed out from principal ideals and it will remain that way for a while at least.

That being said I'm still using MakerDAO smart contracts to give myself loans and margin trade the market. Obviously I'm up a good amount over the last few months. Imagine if I was right and the fundamentals of allowing fluff assets as collateral did blow up in their faces. What would happen?

What does the collateral do? It gives DAI value. Therefore if the system fails the value of DAI breaks the peg and heads downward. This is why it still makes perfect sense for me to use the system because if this happened I could pay back my loans for a fraction of the cost. Ironically enough, using the MakerDAO smart contracts in this context acts as a hedge against DAI and Maker failing. MakerDAO is a hedge against itself, which is hilarious. It's all about Ethereum.

Hive

As for many of us, it pains me to see Hive floundering below the top #100. However, there are a lot of new shiny things out there. Speculation is massive. I was taking a look at our competition and saw so many unknown projects.

Recently the coins that stood out most to me were cETH and cDAI. WTF is that?! Turns out these are Compound ETH and Compound DAI, another DeFi loaning platform that pays users interest to stake coins there. cDAI's market cap ($900M) more than doubles DAI itself ($415M), which is truly mindblowing. So that's three coins right there that all have a higher market cap than Hive pretty much out of nowhere. Pretty crazy.

The nuttiest part of all this is that the real bull run hasn't even come close to starting yet, as Bitcoin practically still sits on the doubling curve (x1.13)

2020 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

$20k-$30k

A nice bull-run bubble would put us around x2-x3 above the curve.

An epic 2017ish bubble would put us around x10 the curve ($100k).

Hard to sell this time around.

This could be it, folks. This could be the death of fiat this time around. Nobody knows but the FED themselves, and maybe not even them. Are you going to trade your hard assets during a mega-bullrun back into a failed centralized experiment? That's a tough choice with a lot of speculation involved. Personally, I'm thinking more and more about buying mining equipment, gold, and silver... maybe even guns, food, greenhouse supplies, and solar panels if things start getting truly batshit.

We are living in a time when people, even the rich, think that we can just print our way out of this one. The supply of money is going up and the supply of actual goods and services you can buy with the money is plummeting. I don't need to explain how disastrous of an equation that is. If we don't have food and/or water, nothing else is going to matter.

The guys who shorted the housing market in 2008 are buying water rights in the mountains. Not a good sign.

In fact, watching this clip take itself so seriously is kind of comical compared to this COVID situation we are in today. Can't wait to see where we are at in two years.

"Can't... Wait..."

Rural land is looking better and better. If only I had the spare funds…

Anecdotally it seems like there’s surprisingly high interest in finding property way out on the edge of metro areas. Not the complete boonies, but out beyond the exurbs, i.e. beyond comfortable commuting range. Definitely true here in the Minneapolis/St. Paul area and I saw a story (somewhere?) a few days ago about a similar trend in St. Louis.

The gas fees on ether lately are absolutely INSANE. Proof of Work is horrible, its very irritating that the rest of the crypto world has not moved past this yet to something that is much more economical...we will get there.

Posted Using LeoFinance

It's very hard to accomplish that considering the level of decentralization these networks want to maintain.

I agree, we'll figure it out eventually.

Ah shit the big short. I gotta watch it again. Such a great movie.

I've made the mistake of selling most of my ETH portfolio when it reached 280$ and than bought again when it was 305$ for a loss. Then I have promised myself that I will not sell ETH under 1000$ and so I am patiently waiting for that to come this year or the next one.

Posted Using LeoFinance

I'd say you got off easy. Imagine if you had never bought back in (as I'm sure many others did). Personally I'm waiting for BTC to hit ATH before I even think about selling anything.

@tipu curate

Upvoted 👌 (Mana: 14/21)

That ethereum shitcoin has more real world implementation than 4 cryptos above it combined.

Blurt did end up making lots of changes huh. Not a place for me but good for them to get out there and make their chain. Wonder how long it will last. Hell they might get away with some publicity if posts reach 300$ regularly. I’ve never logged in so I don’t know what they’ve got for values.

I’m glad I exchanged and got more Ethereum a few weeks ago but looks like I should have waited to exchange my link. Ah well, at least I made a decent profit off it.

Hi, would you like to look at Ethereum eRush (EER) which bringing new innovation about mining and poof of live consensus protocol? I would like to hear your critics.

Please, take a look at my last post.

https://hive.blog/hive-125125/@hayirhah/ethereum-erush-eer-brings-new-perspective-on-cryptocurrency-proof-of-live-protocol-and-the-easiest-mining-on-the-world