So today I bought some silver. I don't mean silver derivatives, but actual physical coins.

Of course I love crypto, but my portfolio is at 100% in that allocation, and I need to diversify further. So yeah, precious metals. And specifically silver because of its industrial uses. Even the military uses it, so sadly it's usage isn't going anywhere anytime soon.

Why make that particular diversification play?

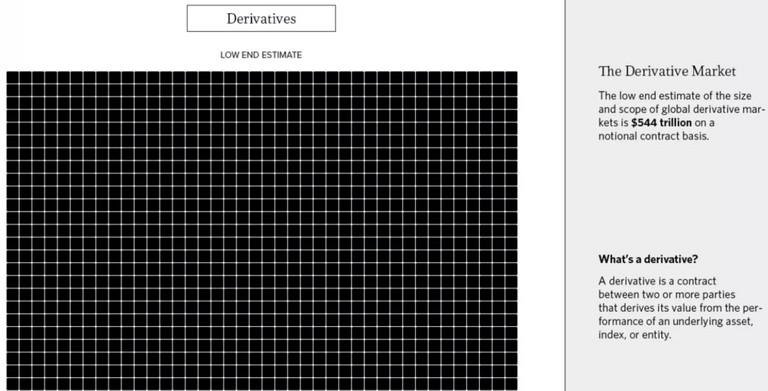

Well take a look at the charts on this page: Global money supply

Notice how much of the "money" is actually derivatives. That's another word for "pretend money."

I'm not going to go on and on about the stock market bubble the fed has been driving us into by buying up bonds.

(It's counter intuitive, but buying bonds reduces yields which makes people not want them and prefer stocks. IMHO, as NOT an investment advisor, about now would probably be a good time to lock in stock market gains by moving money into bonds or other instruments available in your 401k, even money markets, no matter how low the yield. Preservation of capital is sound policy, particularly after a bull run like the one we're at the height of right now. You got your gains already! Now keep them. But not financial advise, cause I'm just a retired business consultant.)

Anyway, I'm also not going to go on and on about the student loan bubble, the real estate bubble in all major cities globally, the debt crises looming for emerging markets that will probably take out Spain first then come for the rest of the "developed" world, or the fracking bubble.

Did you know there was a fracking bubble? The US fracking industry falls into debt by $9 Billion every quarter. That's $36 Billion a year. As soon as the government stops subsidizing them they're all going to go bust. But I digress, because I'm not going to talk about that.

The Bottom Line

All I want to say is, this is a time that each person needs to be tuning into their inner guidance system and figuring out what they are being guided to. I feel good about my overall picture in terms of weathering what I foresee coming these next few years, although I do wish I had a greenhouse and more gardening skills. I will probably look to see if I can find a community greenhouse to become a part of, and learn better gardening skills than I had from the tiny garden I had in CA.

Your inner guidance system might lead you to completely different decisions than the ones I've made, though I think we can all agree that crypto is something to accumulate. But we may not agree on which coins to accumulate, the importance of using decentralized exchanges (which can't run off derivatives of crypto the way the centralized ones absolutely do), or what other forms to hold "money" in.

That's why I don't need to be an investment advisor. I want to be a heart advisor. I want to inspire you to feel into your heart space as you think about what the most loving way to prepare to take care of yourself and your family might be if they shut down the banks.

Are any of you in Venezuela? Someone told me recently that in Venezuela they are now going to the zoos and eating the animals there. I couldn't believe it and won't believe it until someone living there confirms it for me.

Did you know that people with money in their pockets had a hard time buying food during the Great Depression back in the '30s? At that time 50% of Americans lived in rural areas and only 50% in cities. Now only 2% of our land is agricultural and most people live in cities. And much of that farm land is used to raise livestock feed, no human food. How will we feed the people if we lose the ability to import food at low prices because the dollar is falling?

But maybe the dollar will be fine. I mean, currency is a global thing. It's all relative. It's not about how much your currency is "worth," but rather how much more or less it is worth than the currencies of other nations you wish to import from. Since this is a global smack down/correction coming, maybe the dollar will fair okay simply because all the other currencies are fairing so poorly. Who knows.

Well a part of you knows, for you at least.

There really is an inner guidance system we have available to us. Ultimately it is your inner guidance system that must lead you. But before you know to interpret that sense of "all is not actually well" as an urge to action, you may need to frame some of these ideas in a way your intellectual mind will accept. Otherwise you'll dismiss those urges as paranoia or just general dis-ease in the state of the world.

That's why I share this with you. So that you'll start taking seriously those urges you get to start making different sorts of financial decisions than you may have considered before, but which Spirit is in fact whispering to you.

Can you hear it?

If you hear something, do something. Now!

I would like to know where to buy silver, can you offer a suggestion or guide me where to look. @indigoocean. Thanks.

I like golden eagle coins. You pay a bit above spot price, but get an attractive coin and delivery to your door. You can even pay with BTC if you want.

Posted using Partiko iOS

Thank you for this information I will look into them.

Just note that some are coins which are "official legal tender" and also silver in same purity. Those cost a couple dollars more each, but if you ever wound up needing to use them as cash in theory no merchant can refuse them. Whereas they can say they won't accept payment in rounds/bars since they're are not issued by a government like coins, and are not legal tender.

I agree with you on this! But bring on that fracking bust, the sooner the better. They are poisoning our state, and the governor is totally in the pocket of oil and gas. The shenanigans around them trying to stop a measure that doesn't even ban fracking, but simply says it can't be within 2500 feet of occupied buildings like homes, hospitals, and schools, because you know, it damages health and can be hazardous (as evidenced by explosions; there was one case where they were building a well right next to an elementary school that didn't have adequate fire escapes. If that well blew, all the kids would be dead. The community was fighting it, but I don't know what the outcome ultimately was) ...well, let's just leave it at "shenanigans," because I don't want to overtake your post, lol. But fracking can die yesterday, as far as I'm concerned!

I wish I had more money now to stock up on some supplies and buy some cryptos, but I struggle to pay rent as it is. However, I'm pretty good at surviving this mess, so I think I might do better than your average bear who is used to their creature comforts and doesn't know how to cook beyond sticking things in a microwave and popping over to the drive thru, so...

I so agree on the fracking bust. Stupid self-destructive industry if there ever was one. Did you know that the productivity of one of those wells drops 85% in the first year? Ridiculous.

Posted using Partiko iOS

Ugh, that makes it even worse. All that destruction and pollution for a year of gas, essentially? Can we say, "not worth it"? Plus, renewables create way more jobs to begin with. Good paying jobs. That don't make people sick. BAH

While in the military I got lucky and had a higher ranked individual tell me on day one to open a TSP account and start contributing right away without any hesitation. Luckily I listened even though at the time I wasn't quite sure why I was trusting him. That single piece of advice allowed me to be on track for retirement for someone my age when none of my friends are.

I too am anticipating the bubble popping in coming years so I'm trying to figure out the best strategies moving forward. One I have mentioned before is not investing in any Real Estate until a dip occurs. The next thing I have been considering is what you mentioned about moving stock funds. With that TSP account I have a safe little haven called the "G" fund that I plan to use to shelter from the storm.

I'm not familiar with those military funds, but I'm glad you've got them. I'll have to mention those to my nephews, who are both in the military.

Hopefully we've got a couple more years. I don't think there's much chance it's longer, and could be just 6 months. May we be able to help the people who trust us prepare.

Recently I was asking someone about how I could get a silver coin, because has if I could foresee some kind of doom in fiat in future and so I wanted to diversify my portfolio, but my lack of fiat couldn't make me purchase the silver, so I will just stay with cryptos for now.

You're in a great position with crypto. I'm trying to diversify, so want some of different things, but I fully expect my crypto to do way better for me than anything else. It's very different here in the US, where our dollar is strong but interest rates are less than inflation. We are disincentivized to save in cash in the bank, but able to buy various kinds of assets and commodities. The govt. of course wants us to buy stocks, but I already locked in those gains and bid that market adieu for the foreseeable future.

If at some point it works out for you to trade some crypto for actual silver coins though, and you can authenticate the purity of the coins, if only based on the reputation of the seller, then it might be a good idea to diversify a little. In times when currency is being devalued and inflation is going wild, some people will take crypto, but pretty much everyone will take silver or gold. Gold is much harder to carry and to buy with in small amounts. It's just too expensive for the weight.

Where I bought my silver accepts BTC as payment.

OK. I think that is what I will do, look for a place in my area that can trade cryptos for precious metal at some point.

Diversification is key as everything is possible and those that are properly diversify among various asset classes could help subsidize losses in other if things go south. However, we also need to consider that some bubble and irrational exuberance can last much longer than thought especially if supported by these policies we are seeing. I have been expecting a downturn for some time now but have diversified in a way to continue participating in the valuation increases while also allocating some part to cryptocurrencies and precious metals in case of these crisis that can occur.

I like how you say "especially if supported by these policies we are seeing." Indeed!

Right now we've got a bubble in the stock market and real estate, with record personal and national debt levels, stagnant incomes, and meanwhile the Fed is buying bonds and Congress is cutting taxes on the rich!

In short, the government and Fed are acting as if the economy needs to be stimulated BEFORE the bubble pops, so it's just inflating the bubble and setting us up for an even greater pop. Meanwhile another part of that has been interest rates that have been kept low, so don't have much room to be lowered to stimulate the economy once it actually tanks.

So yeah, this is supposed to actually be a self-correcting system, but that only works when our "leaders" play their roles properly. When they see it as a money grab for their rich friends, well we really do need to each be looking out for ourselves, because it's going to be a painful deleveraging.

I didn't know there are bubbles in so many domains. But I've seen the signs in stocks and I'm pretty much out. The longer the upwards cycle, the harder the crash probably. It will be interesting to see if bitcoin (or other coin) will be seen as a safe heaven during the first global crash they'll encounter. That will be a test which, if passed, will probably help immensely with the crypto market adoption.

It probably was a good idea to lock in your gains already. We may have another year of road before they finally stop propping it up, but I can't imagine the Fed will be so irresponsible as to just go on doing it forever. And as soon as they stop, reality will begin setting in.

I also am very curious to see what happens with crypto. The reality it, old money is already holding a lot. And even though early tech adopters probably hold much more, they don't trade on exchanges where the spot price gets tracked. That means they don't set the prices no matter how much they exchange or what price they would insist on to sell.

The same people who have always manipulated markets, and who have kept precious metals artificially suppressed for years can do the same with crypto. They can particularly do it on centralized exchanges, because they are all trading derivatives and only settling when people withdraw their coins to private wallets. (If we all withdraw all our BTC of any exchange on the same day, the exchange would crash, because they couldn't cover all that BTC.)

This means crypto will rise if they decide that's where they WANT the money to go next. I'm not sure what to even want myself in the entire situation, as I have competing desires. Of course I want my holdings to go up in value, but I also care about the decentralized mission behind crypto in the first place, which isn't exactly served by just becoming another place the old guard can create and pop its bubbles.

Yeah, I agree we need to move toward decentralized exchanges as soon as possible to avoid this game probably all centralized exchanges are playing.

Do you think in the future fiat currencies will co-exist with crypto, or they will gradually (or abruptly) become obsolete?

I think there will always be fiat currencies, because governments will always create them. They may all become digital though. But maybe not. Who wants to be unable to pay for something simply because there is no electricity to power one's devices to? Paper money does have some use.

So, given various developments and trends of the future, you think there will be no "upgrade" to fiat currencies (other than a potential all digital perspective)? 50 years ago there were no digital money and US dollar was backed by gold. Change happens, even when government and banks are involved.

It happens, but generally in a way that benefits the ones in charge. If there is a radical transformation of governance, then of course the idea of money could change radically with it. But right now fiat (the idea that money is unlimited and backed by nothing but the police/military threat of the country issuing it) serves the powers that be quite well.

I think the thing we have to be more concerned about as we try to transition towards alternative forms of money that are digital like crypto is that the govt. might co-opt this idea and turn it into completely traceable money tied to our biometrics. There is already a thing called AML bitcoin that works that way, which thankfully is not catching on.

Say what you will about paper money, but at least a poor person with no legal identification can earn it and spend it without the government stopping them. And you and I can also have lots of private transactions with cash also. Even out in the middle of nowhere with no cell service, we can still buy water from a roadside stand or pay for gas. And if we criticize the government, we don't have to worry that we'll suddenly lose the ability to do all these things.

I see governments becoming more authoritarian lately, so the likelihood is that any new money would be more authoritarian.

Yes, unfortunately I agree. Governments will fight to keep and increase control, now that control may be slipping through their fingers, when people realize there can be more freedom and less bureaucracy. I also agree about paper money, I still use them, as well as digital.

I've always wanted to invest in some precious metals but have yet to have the opportunity too. Even last year when I was making good money I was supporting others and also didn't have a fully functional bank account at the time so I was never able to purchase any at the time. As for the guidance part, well, I've been trying to figure that out a lot more myself recently. I quit my job and am setting out on the road for a while because that's what my guiding hand is telling me to do. Thanks for sharing and great words as always <3

If the urge to get precious metals comes up again, just realize you can buy them online with crypto.

I'm so glad you're getting a clear enough "signal" to know how to follow it, and have the commitment to do so. I look forward to hearing what comes of your trip once you have a chance to start digesting it. In my experience it takes some living of it in a very open way without trying to take anything particular from such a journey, and then at some point the dots start connecting and we shift to a new level of understanding. The integration before that is happening beneath the conscious mind and we do best not to drag it up to consciousness to dissect it prematurely. In other words, I look forward to hearing it when you're ready to share it, and not a moment before. 😊

I don't have much of that, either, unfortunately. Again, though, that will change in the near future I hope :) I think I was kind of on this journey some years back and it got cut short long before the time was up. Recently I decided after all these years to resume it. Thank you for your kind and inspiring words :)

The best part to store physical silver coin is that it can’t be hacked but it can be stolen 😂 @indigoocean

Well, so can the cash in one's wallet, computers, cell phones etc. You can't deny yourself things just because you worry someone else wants them too or you'll have nothing to live your own life with. The main thing about physical precious metal coins is that they are accepted by anyone, even if paper money is rapidly devaluing. Not everyone accepts crypto yet. So it's definitely a "worse case" hedge in my book. You would buy silver derivatives and not take physical delivery at all if you were trying to do it as a significant portion of your portfolio, where the amounts would get up into the thousands or tens of of thousands.

You got a 53.79% upvote from @ocdb courtesy of @indigoocean!

Hi @indigoocean!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.327 which ranks you at #2311 across all Steem accounts.

Your rank has improved 8 places in the last three days (old rank 2319).

In our last Algorithmic Curation Round, consisting of 441 contributions, your post is ranked at #58.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server