ICO meaning?

An ICO (Initial Coin Offering) is a boon for every startup aiming to raise funds. It is similar to an IPO (Initial Public Offering) or crowdfunding in which new projects sell their underlying crypto tokens in exchange for cryptocurrencies. Most ICOs operate on blockchain technology.

At times it gets difficult to raise capital through traditional IPOs due to regulatory issues and restrictions on investors. An ICO however, allows anyone with internet access to invest.

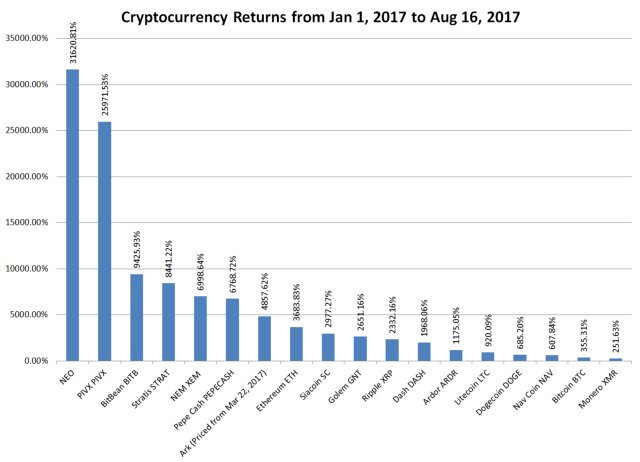

The world is swiftly moving towards digitalization and so is the global economy. As the buzz around “ICOs” has been going on for quite some time, a lot of angel investors, venture capitalists, and institutional investors are choosing to invest in cryptos and ICOs for a reason- It gives great returns when done right!

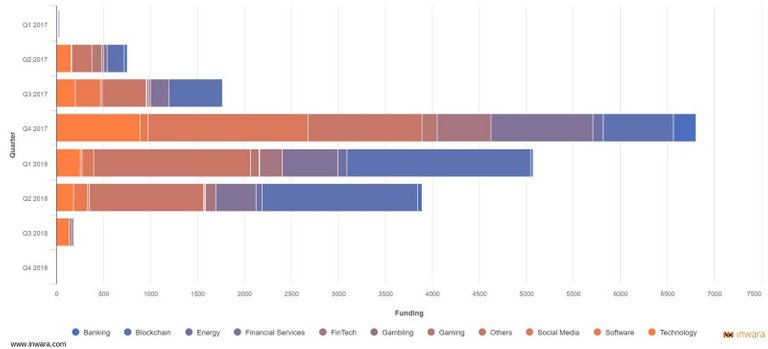

In a very short time, ICOs have achieved tremendous success by raising a total of more than $19 billion (source: inwara.com) so far. The record for the highest earning ICO is with EOS sitting at $4 billion.

The Blockchain technology market is predicted to grow at a CAGR 61.5% by 2021(source:statista.com). Also, according to coinmarketcap, the whole cryptocurrency market was worth about $800 billion at its peak.

Most people who have experience investing in IPOs and private rounds assume investing in ICO/cryptocurrency is similar. But they fail to acknowledge — Crypto market is way more volatile and tends to be much more sensitive to external stimuli than traditional markets.

This essentially means that due diligence is essential to making an informed investment decision, especially when it comes to ICOs (where the number of scams and failure is significant). Even though due diligence is not rocket science, it needs time, correct data and a checklist of essential things to be analysed.

Checklist

- Understand the company that is offering an ICO

It is crucial to understand the management of the company to be able to define the potential in the roadmap of the project. Certain key factors to look for are:

Expertise of the team managing the project: Understanding the team hierarchy from media platforms like LinkedIn, Twitter could be very useful to determine involvement, credibility and capability of the team.

Experience of the company in the blockchain field: It is important that the management team has an in depth knowledge of blockchain technology or has enlisted the services of an expert.

Advisor panel: If the company has a list of reputed personalities in the advisory panel then it’s an add-on to the credibility of the project. However, it is not the sole factor that determines the credibility. Their absence is not the key issue to focus on, rather, their presence should be seen as just a cherry on the cake.

- Check the Roadmap

Roadmap offers an action plan for the company and can be viewed as a blueprint of the company’s operations and milestones. Poor project planning is an indicator of a clear lack of strategic vision and may cause the project to fail in the long run.

Besides, the roadmap also defines the credibility of an ICO when the company is being transparent about every detail of the project with its soon-to-be investors.

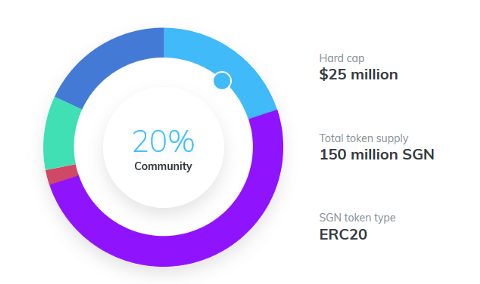

- Soft cap, Hard cap and the amount of funds raised

Soft cap is the minimum investment required to start the project and hard cap is the maximum targeted investment. It is imperative to know how many tokens the company plans to create and how they will be sold.

It shows how transparent the company is with its investors and also, its always better to avoid the risk of unpleasant surprises afterward.

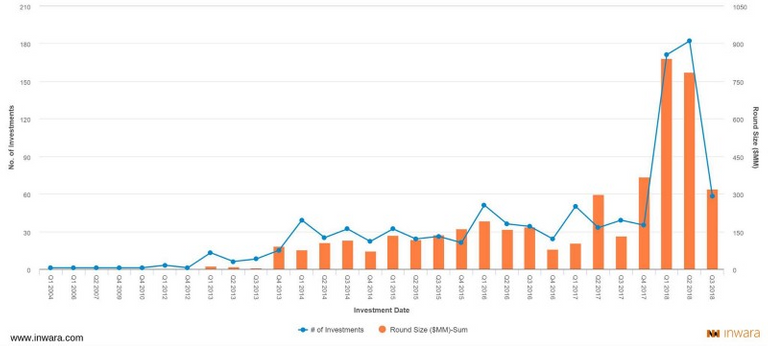

- Involvement of Venture Capitalists, Institutional investors etc.

An indication of the success of a project can be measured by the type of investors that have previously backed the project.

When top venture capitalists, hedge funds, institutional investors back a particular ICO, then the credibility of the project is high.

In 2018 alone $4.2 billion has been invested by VC firms in blockchain companies in 2018. Add (source : InWara.com)

- Return on investment (ROI)

It is very critical to understand the ROI of the sector to understand better the macroeconomic picture of the play before investing in an ICO. Return on Investment (ROI) is a performance measure, used to evaluate the efficiency of an investment or compare the efficiency of a number of different investments.

Return on investment is calculated by analyzing the net profits and total investment in a particular year. Investing in an ICO whose industry has a good avg. weighted ROI is a great investment strategy.

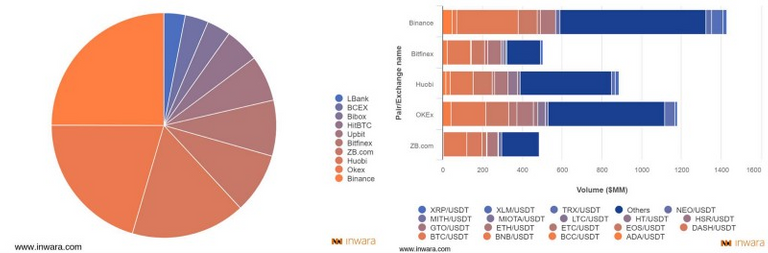

- Top listed exchanges

It always helps to know the ICOs that are listed in top exchanges. Looking at fund allocation to understand listing is a key factor for investing. If ICOs list in a low volume exchanges, you could be stuck with your tokens and nowhere to sell.

These are few starters that will definitely help in making an informed investment decision.

It is apt to say that the process of analyzing an ICO is not done even after investing. The crypto market is highly volatile, so it’s vital to stay updated with latest trends and fluctuations in the market.

While analyzing at this granularity seems like a tedious task , it actually isn’t that complicated if you have a single reliable platform to get all the data!

InWara is one such specialized platform dedicated to ICOs. InWara’s database allows you to access real stories on companies behind ICOs: their competitors, funding, road maps and management of more than 3000+ ICOs.

InWara also publishes newsletters with latest trends and upcoming ICOs to keep its clients always updated about crytpocurrency news.

Real time analytics and data provided by InWara to its client base has been helping them achieve better returns on their investments and testimonials from their loyal client base speaks for the success of InWara.

Anyone who wishes to know more about crypto world and making the right investments in ICOs, a free demo from InWara’s expert will definitely put you on the right path.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/inwara-global/https-medium-com-inwara-global-understanding-ico-and-cryptocurrency-4ebe1d7faf89

Congratulations @inwaraglobal! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP