The entry on the scene of the blockchain in scenarios previously reserved only for traditional financial systems has forced the banking sector to reinvent itself, now it is not only about providing a secure and reliable transactional base, but also that the client feels independent and free at the moment. to be able to manage your assets and the information related to them.

One of these innovations is the one that serves as the central theme of this publication, we refer to 'open banking', would you like to know what it is about? How does it work? What benefits does it bring? in the following paragraphs, I will be developing such an interesting topic.

What is Open Banking?

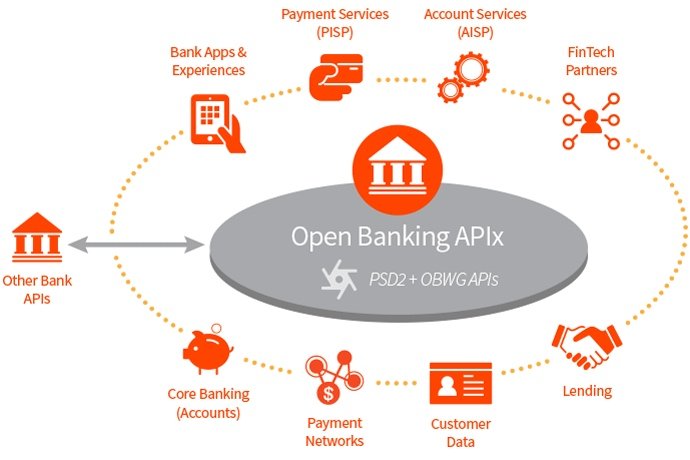

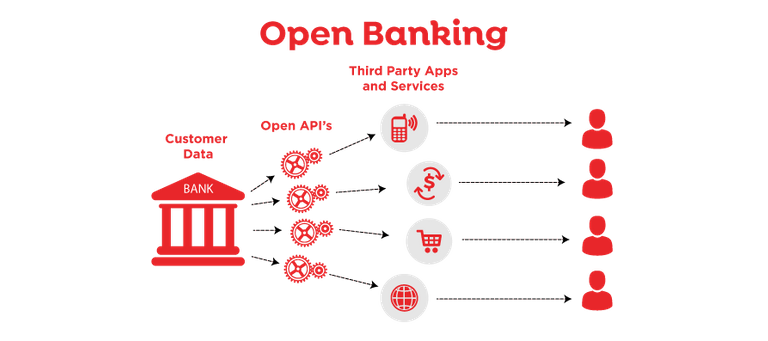

It is a business model developed by the banking sector in which the exchange of data is allowed in the financial ecosystem and even between the banking entity with companies from different sectors, this through the prior authorization of the user and the use of APIs.

Open Banking is a banking modernization process in which the business revolves around the needs and requirements of the client, giving them the necessary independence to decide what to do or not do with their banking and financial data and statistics.

"We all operate in a digital ecosystem in which we do our daily tasks as individuals or as companies and we generate a lot of data that, if we are willing to share, can facilitate access to products and services that are much more appropriate and prepared for us," explains Carmela Gómez Castelao, Global Head of Open Banking at BBVA. |

|---|

How does Open Banking work?

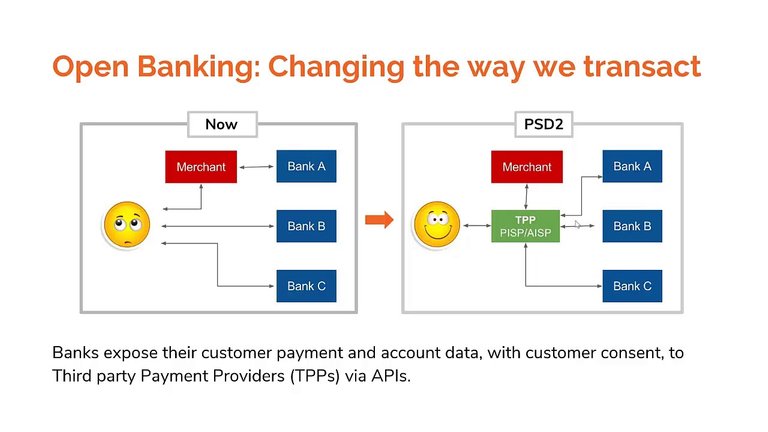

This new banking strategy is based on the use of the 'Application Programming Interface' (API's.) Which allows the information systems of two companies to communicate safely and reliably. These applications act as a ‘communication bridge’ between the bank and the companies that provide financial services or other sectors, authorized by the client to access their banking information. For the transfer of data to be secure, the APIs must require strong authentication measures in all transactions carried out.

APIs are open by which external developers can create programs, tools, or applications adjusting to the information provided by banks to offer more relevant products for customers. To be introduced into banking services, they must first comply with legal and technological regulations that guarantee the security and protection of the user's financial information.

How could Open Banking benefit us?

To answer this question we must see the context from three different points of view and determine the benefit of each of the parties involved: the customer, the bank, and the third party (service companies).

Benefits for the user

The 'open banking' focuses on providing the client with the best possible experience in terms of simplicity and comfort to carry out their financial operations, this allows, for example, to have access to different financial services when they are introduced in their usual processes, without being necessary to change of platform or website.

This type of service is not limited to financial services in terms of granting credits immediately, but rather they open a wide range of possibilities avoiding long registration processes or providing them with information to control their expenses and improve their financial habits, as well. how to interact directly with the information systems of your preferred services and providers.

Imagine a single application that from which you can immediately pay for your services and consumption, regardless of the bank account you use, the type of services you require and that also shows you your global financial position. Sounds good right?

For service companies

As for the companies that use the ‘open banking’ model, it allows them the possibility of offering their clients more efficient, fast, and personalized services. Also, keep track of consumer habits based on which they can adapt their marketing strategies and offer exactly what the customer requires.

For banks

Open banking is considered one of the levers of transformation of banking since it represents the definitive entry of the sector into the modern era by placing the interests of the client as its focus of attention, giving them full control over their data.

The equation is simple: the more innovative the bank, the more attractive it will be to financial technology companies -the so-called Fintech- and that will mean that the client will have priority access to the cutting edge of the sector and to more relevant offers.

A report published by the global strategic consultancy Mckinsey & Company concluded that: “Change is rarely comfortable, but as the evolution of the market in the United States and other countries illustrates, the forces of change are inevitable. Banks would be better off anticipating and defining the trend rather than waging a futile battle to repeal it ”, this referring to the use of new business models and the use of technological tools.

"Let's think, for example, of how convenient it is to have the means of payment incorporated into the taxi trip, instead of having to carry cash or a card with us to make the payment or the possibility of paying in installments incorporated into the process of purchases ”, explains Carmela Gómez, adding that“ open banking 'promotes an environment in which everyone wins: the customer by obtaining more personalized services adjusted to what they need, companies because they can sell more or be more efficient in its internal processes, and the financial industry because it allows it to reach new groups of clients and get to know them through its digital activity." |

|---|

What did you think of open banking? Have you had the opportunity to take advantage of these technological resources? Do you think that with these adjustments you will be able to adapt and stop the growing use of alternative payment methods to the banking system? comment box and if you want me to delve into this topic or develop a particular point, do not hesitate to ask me.

Thank you very much for your attention

We keep reading!

Congratulations @karupanocitizen! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 4500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!