Hi Steemians,

here is my weekly sample portfolio update for Friday, March 22nd, 2019.

A lot happened today in the markets, so first let's have a look at some charts.

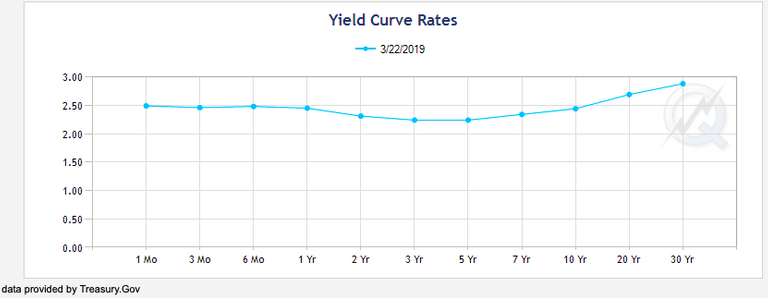

Bond Markets

We see an inversion in US yields:

Image Source: CNBC.com

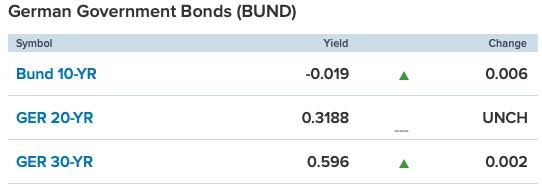

German 10 year yields went negative:

Image Source: CNBC.com

Bond futures spiked accordingly:

Eurodollar Futures spiked, too:

So did implied volatility in bonds:

Index Futures:

A big sell off in S&P 500, Nasdaq and especially in the Russell 2000:

S&P 500 Future:

Nasdaq 100 Future:

Russell 2000 Future:

Volatility Indices:

VIX:

RVX:

Now let's have a look at my sample portfolio:

XLE May 30 Delta Strangle

I sold this strangle for a credit of $2.05 (just a small position).

As always for higher delta strangles, my profit target is still 16 delta strangle credit ($1).

So I'm going to close this position, when it trades for $1.05 or at 21 DTE.

At the moment this position is up 17 cents ($17 per one lot).

GLD Inverted Strangle

My overall credit for this position is $5.59.

Since this inverted strangle is 5 points wide, the max I can make is 59 cents ($59 per one lot)

I probably will close this position, when I'm able to scratch it or at 21 DTE.

At the moment this position is down 31 cents ($31 per one lot).

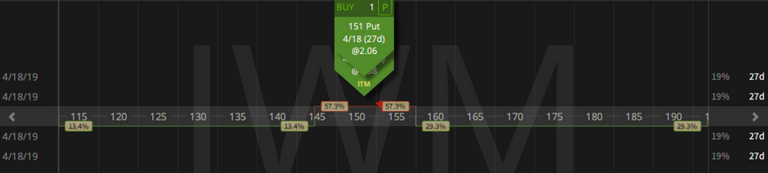

Closing IWM April Straddle

I closed this position today for a profit of $43 per one lot.

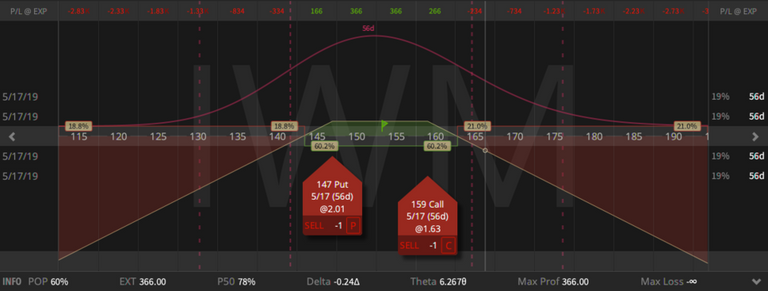

New IWM May 30 Delta Strangle

I sold this strangle earlier today for a credit of $3.66 today.

My profit target as always is the 16 delta strangle credit ($1.71).

So I'm going to close this position when it trades for $1.95 or at 21 DTE.

At the moment this position is down 52 cents ($52 per one lot).

Closing RUT Put Calendar Spread

I closed this position for a profit of $60 per one lot today.

Closing SPX Put Calendar Spread

I closed this position today for a profit of $85 per one lot.

QQQ May Straddle Assignment:

As expected I was assigned short stock on this position on Monday.

Today I sold a put against it and created a covered put.

My basis of this position is $161.29.

At the moment I'm down $20.94 ($2,094).

So I have a lot of puts to sell against this position, until I'm back to even.

New TLT May Straddle

On Monday March 18th, 2019 I sold this straddle for a credit of $3.32 (just a small position).

As always for higher delta strangles, my profit target is the 16 delta strangle credit (75 cents).

So I'm going to close this position, when it trades for $2.75 or at 21 DTE.

At the moment this position is down 71 cents ($71 per one lot).

New SPY May Aggressive Short Delta Strangle

My regularly readers know the deal:

When IV spikes you need short deltas.

I sold this position today for a credit of $8.08.

As always for higher delta strangles, my profit target is the 16 delta strangle credit ($2.98 cents).

So I'm going to close this position, when it trades for $5.10 or at 21 DTE.

New IWM May ATM Short Call

A little more short deltas for my portfolio.

As I keep stressing in my books:

Instead of selling more contracts, move your strikes closer to the money.

I sold this call today for a credit of $4.72.

My profit target for this position is the 16 delta strangle credit ($2.08 cents).

So I'm going to close this position, when it trades for $2.64 or at 21 DTE.

Books Update

An updated version of my first book, which contains three new chapters which could be game changers for a lot of traders, is available for several weeks now.

Everyone who has already bought it will get the update for free.

The updates are available on Amazon, Apple, Google and Barnes and Nobel.

It is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

Interview with 10minutestocktrader.com

I was interviewed several weeks ago by the host of 10minutestocktrader.com Chris Uhl.

If you haven't watched the video yet, it is is available on Youtube:

The Podcast is available here:

Chris Uhl is a great host and I highly recommend subscribing to his channel.

Forbes Article

Three weeks ago author John Tamny quoted me in Forbes Magazine.

Have a great weekend!

Stephan Haller