Out of curiosity, I counted all the coins currently listed on CoinMarketCap the other day and was astounded to learn there are now over 1100 different tokens!

I've been following the Blockchain/Distributed Ledger/Cryptocurrency scene for a few years now and have an active interest in the blossoming technology. I spend most of my free time reading and understanding the new use cases being addressed and the new tokens being released to facilitate these ideas. However, it's becoming impossible to keep up with the sheer volume of new information and I often miss opportunities for gains from rising coins.

More recently, I've had family members approach me with questions about onboarding into Blockchain investments. I've had moments of explosive growth from my bullish sentiments (BTC, ETH, NEO, OMG, IOTA), but there were also a lot of duds I'm still bagholding (BTS, 0x). The point is, all of that time spent researching has gotten me ahead, however it's clear that it's impossible to pick winners all the time. While I feel OK when I'm picking duds for myself because I can remind myself of the logic I used to get there, I don't feel good advising others and having them panic.

Inspired by Warren Buffet's million dollar bet against a hedge fund manager, I've decided to buy an equal proporation of 48 random top 100 coins whenever I have some spare money. The thought process is that luck and timing can possibly give you a few moonshots, however, it's a much smarter bet if you're bullish on Blockchain Technology to just buy it all.

I'm still going to continue to buy and hold the long term coins I truly believe in, but this is a nice supplementary index I can do alongside my current investment as a sort of "piggy bank" fund.

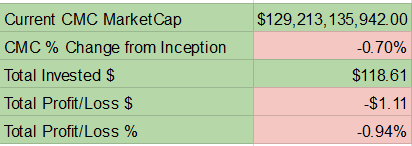

I started the collection of coins on September 22nd 2017 and will update the progress on here along the way.

Progress Summary:

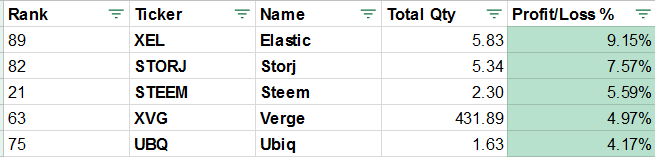

Top 5 Gainers

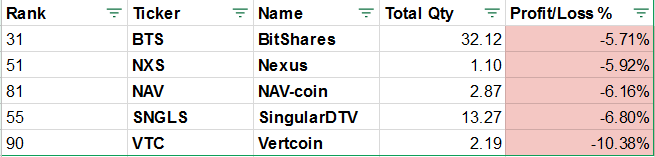

Top 5 Losers

An interesting article. I appreciate your effort, and HONESTY on the cryptocurrency market. I see so many people posting articles and videos, having the audacity to advise others on what they should be investing in, as far as this 'digital money.' Personally, the one thing I believe we all know is, we really don't know. We're in almost entirely new territory here. You sound as though you're really doing your homework, and trying to learn all you can, as many of us are, but at least for now, I would never tell someone to put their money into this coin or that technology. Bitcoin is the closet thing we have to a 'Blue Chip,' -semi-long term history investment, and we all know what it's been like. A definite upvote.

Thanks for visit :)

I agree, I think it's very difficult to pick the winners who will stay standing in 5 years. However, I'm quite certain blockchain and digitial assets are here to stay. Therefore buying a variety of these assets to spread the risk around is the way to go.

If the market goes to $500B in the next few years, I think my index would increase but an equal amount. It's much better than pulling your hair out every time a favourite of yours has a dip :)

This post has received a 4.28 % upvote from @booster thanks to: @elowin.