Experimenting with micro/nano loans on the Bitshares DEX

Did you know that the Bitshares DEX has a full credit offer mechanism built into it?

You can create your own loan offers, with your own configured accepted collateral, fees, durations, etc.

You can accept any loan offer given you have the requested backing collateral.

Let's get to the point

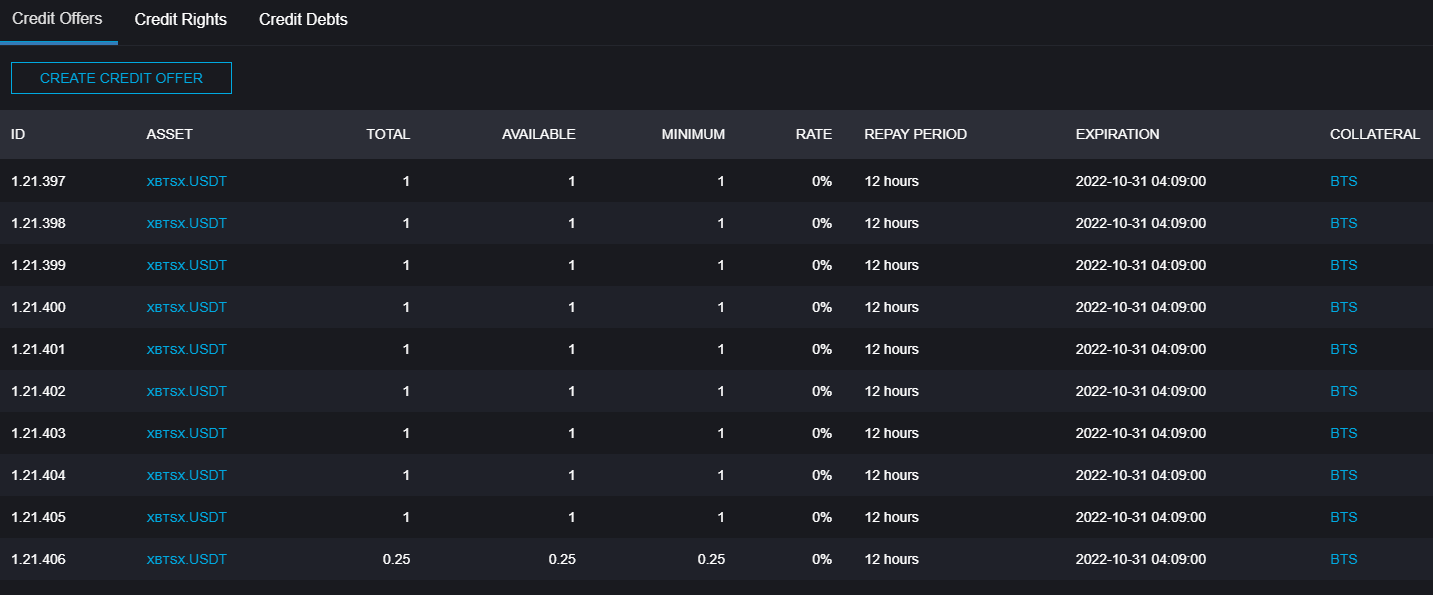

In order to drive the usage of this functionality up, I have created several micro/nano sized loans on the Bitshares DEX using their recently introduced credit offer mechanism.

The following are available to all until 31st October 2022, whereby new credit offers will be created to reflect the changing value of BTS over time.

| Quantity | Borrowable | Collateral | Fees | Duration |

|---|---|---|---|---|

| 1 | 10 USDT | 1000 BTS | 0% | 12hrs |

| 3 | 5 USDT | 500 BTS | 0% | 12hrs |

| 10 | 1 USDT | 100 BTS | 0% | 12hrs |

| 5 | 0.5 USDT | 50 BTS | 0% | 12hrs |

| 8 | 0.25 USDT | 25 BTS | 0% | 12hrs |

So I make nothing from the above, the backing collateral is effectively 100% of the borrowed asset value & since there's no 'max borrowable' per credit offer I created many copies of the above for many users to get individual opportunties to borrow rather than all at once by a large borrower.

Whilst the fees are set to 0%, there are still network fees to account for.

For an LTM user, the total fees for borrowing are 0.4 BTS, where as for a non-LTM user the fees are 2 BTS.

Do you want to earn fees on crypto assets?

Consider creating your own credit offers on the Bitshares DEX!

Creating a credit offer cost as little as 0.1 BTS (LTM) to 0.5 BTS (non-LTM), you can set the acceptable levels of collateral which suit your risk profile (can be higher than 100%), and you can set whatever borrow fee you desire.

Hopefully these ultra-micro loans will get into the right hands, take advantage of them if they're not yet claimed!

If you had to lend out your crypto assets, what settings would you choose?

What do you think of these tiny loans? Would you take one up if you only had a few BTS to hand?

Links:

- Credit offer system:

Are you going to update the rate over time? If not, you're effectively buying BTS at 0.01 USDT/BTS.

Yeah, I'll need to update the rate over time, however at the moment they're set static to expire by 31st October. If I was to run them year around I'd need to run price feed scripts to periodically update their 100% backing collateral rate.

True if I lent at the wrong rate I'd effectively just be buying the BTS, however the other party in the deal would have to fail to repay and surrender their collateral, this in traditional finance would have credit score consequences, perhaps in the future people will track who fails to pay back loans over time

Interestingly, an user accepted a credit offer then 12hrs later let the deal expire, thus I have the collateral and they have the token.

A key take away is that if the borrowed amount and the collateral 100% equal, to repay the debt offer before the time limit would incur a fee of 0.2-1 BTS for no benefit, other than their theoretical DEX credit score impact.

By letting it expire there are no fees for the same effect, so it's likely that I'd need to continuously top up my USDT balance within each credit offer as they'll likely let it expire without repayment.

By the end of the month, 4 credit deals were accepted by 2 users, they both chose to let the repayment expire.

I wonder if this was fully intentional, if they were aware of the short duration and just mistimed their next step in the full credit offer UX, however considering debt and collateral were near equal at the time it maked fiscal sense to not pay an unnecessary fee for the same outcome (minus theoretical credit score risk)