In this video I explore further into Blockchain technology and this time discuss the big picture as to its purpose and driving force. In this Part 1 video I specifically look at the concept of digital ownership, value, and the numbers on your bank account. In the physical world, the concept of ownership is taken for granted because we can physically hold in our hands the physical objects that we claim to own. But in the digital world all we are holding is copies of information, or more specifically copies of a series of pulses of light from the magical all encompassing internet of inter-connected computers, linked through a grid of deep-sea fiber optic cables. Thus the focus gets shifted into replicating physical objects through mathematical one-way functions and understanding just who owns the numbers in “our” bank account.

To change the numbers on our bank account without needing to go through the bank requires developing our own ledger, which is just a history of events, and ensure that only one version is upheld through the science of cryptographic consensus. The numbers on any ledger only has value when the network believes it has value. And the ability to digitally form decentralized consensus of a history of events and laws, means blockchain based ledgers can be viewed as digital countries. And this transition is of profound significance and which I will explore in more detail in Part 2, so stay tuned!

The topics covered in this video are listed below as well as their timestamps:

- @ 1:16 - Topics to Cover

- @ 2:35 - Recap on My Earlier Blockchain Videos

- @ 5:08 - Introduction

- @ 5:42 - Note on Part 1

- @ 6:21 - What Do You Own?

- @ 7:03 - The Numbers On Your Bank Account

- @ 8:30 - Your Entire Digital Existence

- @ 9:39 - The Internet: Cables of Light

- @ 13:21 - World Wide Web: Language of Light

- @ 17:09 - Decentralization of Information

- @ 18:34 - Decentralization of Information But Not of Value

- @ 20:14 - What is Value?

- @ 22:27 - Physical and Mathematical One-Way Functions

- @ 24:26 - Physical Boxes and Cryptographic Hash Functions

- @ 27:48 - Digital Keys, Passwords, and Cryptography

- @ 33:38 - Digital Signatures

- @ 35:45 - The Numbers On Your Bank Account (Again)

- @ 37:34 - Whose Ledger is it Anyway?

- @ 38:50 - Where Are the Ledgers Located?

- @ 40:13 - Value is in the Collective Belief of a Network

- @ 42:21 - Trust

- @ 44:24 - Chain of Signatures

- @ 45:12 - Copy and Paste and Double Spending

- @ 47:29 - Chain of Digital Signatures

- @ 53:02 - Consensus is Everything

- @ 58:03 - Digital Gold: Consensus via Mathematical Work

- @ 1:04:36 - Digital Governance: Consensus via Network Stake

- @ 1:07:18 - Variations in Digital Consensus

- @ 1:12:30 - Decentralized Consensus: Everywhere and Nowhere

- @ 1:15:23 - Digital Countries

Stay tuned for Part 2…

Watch video on:

- 3Speak: https://3speak.tv/watch?v=mes/azdcrnin

- Odysee: https://odysee.com/@mes:8/blockchain-the-big-picture-part-1-what:9

- BitChute: https://www.bitchute.com/video/pzX42CNEdrZC/

- Rumble: https://rumble.com/v1rcahu--blockchain-the-big-picture-part-1-what-do-you-own.html

- DTube: https://d.tube/#!/v/mes/QmZyJcNSDZcQaFt4N6Esst3XzamauDj3msCDPoPQ4WRtjm

- YouTube: https://youtu.be/sEkip6F4Mv0

Download Video Notes: https://1drv.ms/b/s!As32ynv0LoaIiLwHuBXhHKEDrRTBqA?e=51919G

View Video Notes Below!

Download these notes: Link is in video description.

View these notes as an article: https://peakd.com/@mes

Subscribe via email: http://mes.fm/subscribe

Donate! :) https://mes.fm/donate

Buy MES merchandise! https://mes.fm/store

More links: https://linktr.ee/matheasyReuse of my videos:

- Feel free to make use of / re-upload / monetize my videos as long as you provide a link to the original video.

Fight back against censorship:

- Bookmark sites/channels/accounts and check periodically

- Remember to always archive website pages in case they get deleted/changed.

Recommended Books:

- "Where Did the Towers Go?" by Dr. Judy Wood: https://mes.fm/judywoodbook

Subscribe to MES Truth: https://mes.fm/truth

MES Links Telegram channel: https://t.me/meslinksJoin my forums!

- Hive community: https://peakd.com/c/hive-128780

- Reddit: https://reddit.com/r/AMAZINGMathStuff

- Discord: https://mes.fm/chatroom

Follow along my epic video series:

- #MESScience: https://mes.fm/science-playlist

- #MESExperiments: https://peakd.com/mesexperiments/@mes/list

- #AntiGravity: https://peakd.com/antigravity/@mes/series

-- See Part 6 for my Self Appointed PhD and #MESDuality breakthrough concept!- #FreeEnergy: https://mes.fm/freeenergy-playlist

- #PG (YouTube-deleted series): https://peakd.com/pg/@mes/videos

NOTE #1: If you don't have time to watch this whole video:

- Skip to the end for Summary and Conclusions (if available)

- Play this video at a faster speed.

-- TOP SECRET LIFE HACK: Your brain gets used to faster speed!

-- MES tutorial: https://peakd.com/video/@mes/play-videos-at-faster-or-slower-speeds-on-any-website- Download and read video notes.

- Read notes on the Hive blockchain #Hive

- Watch the video in parts.

-- Timestamps of all parts are in the description.Browser extension recommendations:

- Increase video speed: https://mes.fm/videospeed-extension

- Increase video audio: https://mes.fm/volume-extension

- Text to speech: https://mes.fm/speech-extension

--Android app: https://mes.fm/speech-android

Ⓑ Blockchain: The Big Picture - Part 1: What Do You Own?

Topics to Cover

- Recap on My Earlier Blockchain Videos

- Introduction

- Note on Part 1

- What Do You Own?

- The Numbers On Your Bank Account

-Your Entire Digital Existence

- The Numbers On Your Bank Account

- The Internet: Cables of Light

- World Wide Web: Language of Light

- Decentralization of Information

- Decentralization of Information But Not of Value

- What is Value?

- Physical and Mathematical One-Way Functions

- Physical Boxes and Cryptographic Hash Functions

- Digital Keys, Passwords, and Cryptography

- Digital Signatures

- The Numbers On Your Bank Account (Again)

- Whose Ledger is it Anyway?

- Where Are the Ledgers Located?

- Value is in the Collective Belief of a Network

- Trust

- Chain of Signatures

- Copy and Paste and Double Spending

- Chain of Digital Signatures

- Consensus is Everything

- Digital Gold: Consensus via Mathematical Work

- Digital Governance: Consensus via Network Stake

- Variations in Digital Consensus

- Decentralized Consensus: Everywhere and Nowhere

- Digital Countries

Recap on My Earlier Blockchain Videos

I had made 3 tutorials on blockchain technology, while the 4th video was indirectly about blockchain since it was in regards to the Brave browser which just so happens to use the Basic Attention Token (BAT) cryptocurrency.

My earlier videos can be seen in the following playlist.

https://www.youtube.com/playlist?list=PLai3U8-WIK0Fgp_lR0a0rscxWYrHARtkN

Short URL: https://mes.fm/blockchain-playlist

Retrieved: 17 August 2020

Archive: https://archive.vn/wip/zHdO9

The internet brought about decentralization of information. Blockchain provides verification of information. The combination yields the internet of value in which money and ownership flows like information. Follow along my Blockchain tutorial series to understand this major shift humanity is undergoing.

Short URL: https://mes.fm/blockchain-playlist

Old archive: https://archive.is/b30lY

Note that I had primarily focused on the Steem blockchain as this was prior to the recent "cryptocurrency war" between Steemit and Tron vs. the Steem community which resulted in a large portion of the Steem community jumping ship and creating the Hive blockchain, which is just a "hard fork" of Steem, which I will discuss further in this series.

For a technical overview of blockchain technology, decentralized information sharing, and the mathematics of cryptography, check out my Blockchain Overview video:

https://peakd.com/blockchain/@mes/blockchain-overview-bitcoin-cryptocurrency-cryptography-and-satoshi-nakamoto

Introduction

In this video series I will be looking at the "big picture" of blockchain technology and by extension the overall direction and philosophy of mainstream technology in general.

Technology, mathematics, science, and language are all tools.

But tools for what?

This is the guiding question that also serves as the answer to making sense of the past, present, and future technology.

Blockchain technology, however, is a very unique tool and one in which humanity has been pushed consciously and subconsciously towards since the dawn of life.

Note on Part 1

I was planning on making just one video on the "Big Picture" of blockchain technology but I felt the need to first fine tune my own understanding of blockchain and present an overview of its fundamental purpose.

This differs from my earlier "Blockchain Overview" video which was focused on more technical aspects and specifically on the mathematics of cryptography.

In this video, however, focus is on the driving force of blockchain technology and in particular just what exactly it means to "own" something in digital form, such as the numbers on your bank account.

What Do You Own?

This is an easy question to answer… or is it…

If you take something physical, like your phone, book, or any other object, you can in fact be "satisfied" by stating you "own" that object.

Note that even this ownership is contingent upon the ability by which someone else can take it away, either legally or otherwise.

For the purposes of illustrating the difference between physical and "digital" objects, I will define "ownership" as being physically in your position.

The Numbers On Your Bank Account

What about the digits on your bank account which we call money, do you "own" them?

Can you physically hold these digital numbers?

They can be viewed on your computer or smart phone but they are not located there.

So where are they?

There are two ways by which you can claim to actually own these digital numbers.

The first is if you go to your physical bank location and ask politely to the bank teller, showing your bank card and/or government ID of course, to withdraw the digital numbers into physical cash paper, and hope they actually fulfill your request.

Does your bank have enough cash on hand?

Did you go beyond any arbitrary withdrawal limits?

Did you read the fine print?

Are you suspected of having dangerous independent thoughts on the internet?

The second way to claim ownership is to locate the exact computer that stores the digits of your bank account and ask if you can take that computer home; by which you will be asked to "be calm, be kind, and be safe" until the police arrive….

It is clear the owner of the bank account is not us, and we can only hope the actual owners allow us to pretend like it is actually our money.

Your Entire Digital Existence

Let's take our example of the numbers on your bank account and generalize it to everything digital.

Your recent Facebook, Twitter, or YouTube post got censored, or deleted, or stamped with a Snope's "Fact Check" and you are upset?

First of all, what gives you the right to be upset?

How can you claim ownership that it was "your" post?

Where is "your" post?

Can you locate it?

Can you physically grab it?

And since you can't go to your local Facebook branch office and withdraw your post, then you have even less claim of ownership than the numbers on your bank account!

Your social media profiles, and all the data you have fed into them, along with your email accounts and your entire internet existence, is not yours and never was so stop pretending otherwise.

Thus your frustration as to how "your" social media post was treated by (government subsidized) tech giants is better aimed not at the censorship but the fact that it can be censored…

The Internet: Cables of Light

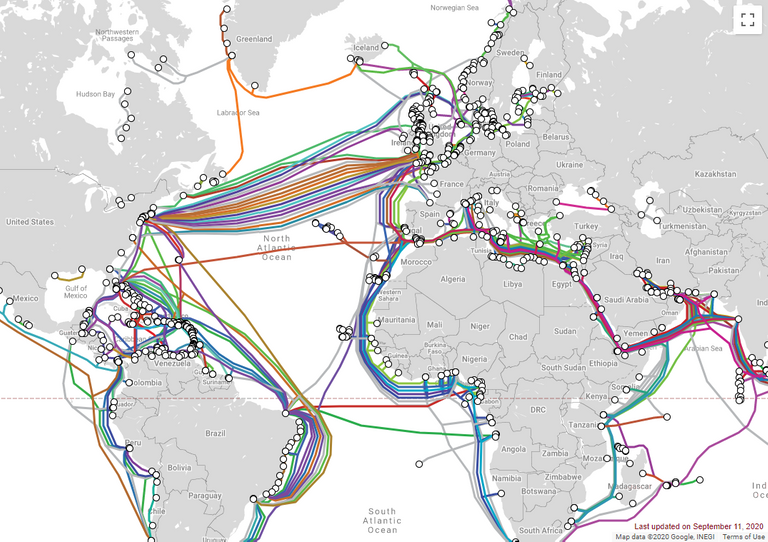

The internet can be viewed as the inter-connected network of networks; which is essentially a bunch of computers "communicating" with each other.

This communication is the literal transfer of light across cables, satellites, and electromagnetic transmission towers.

And for the aether scientists, light is a vibration in the aether.

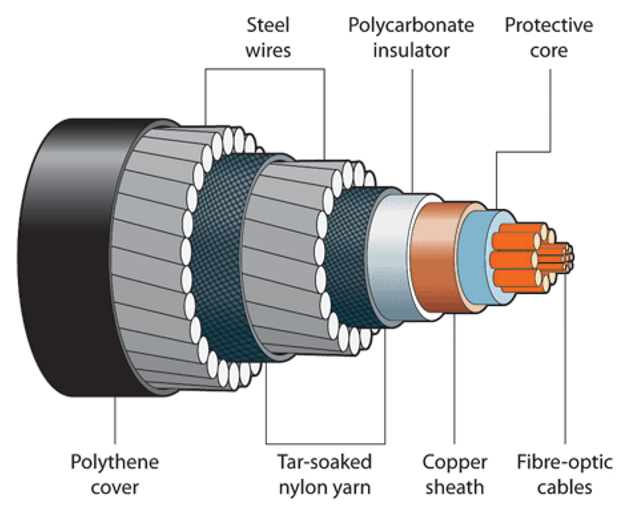

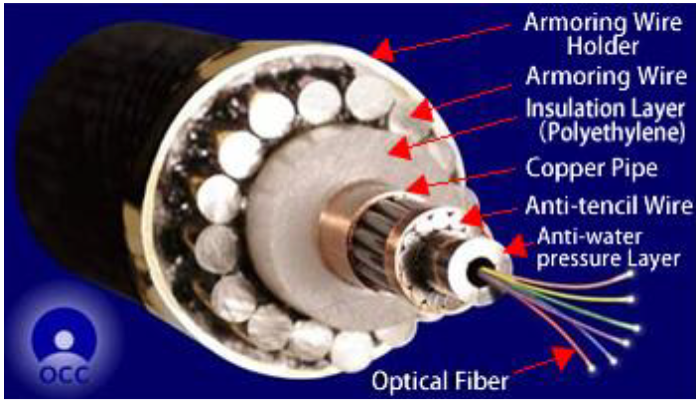

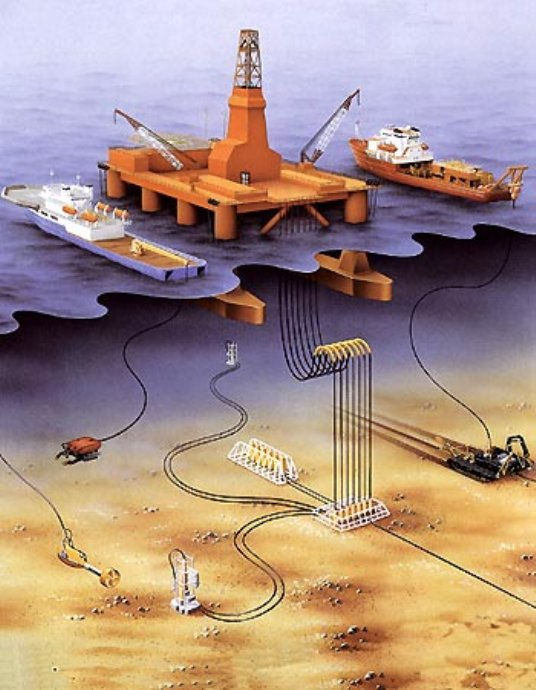

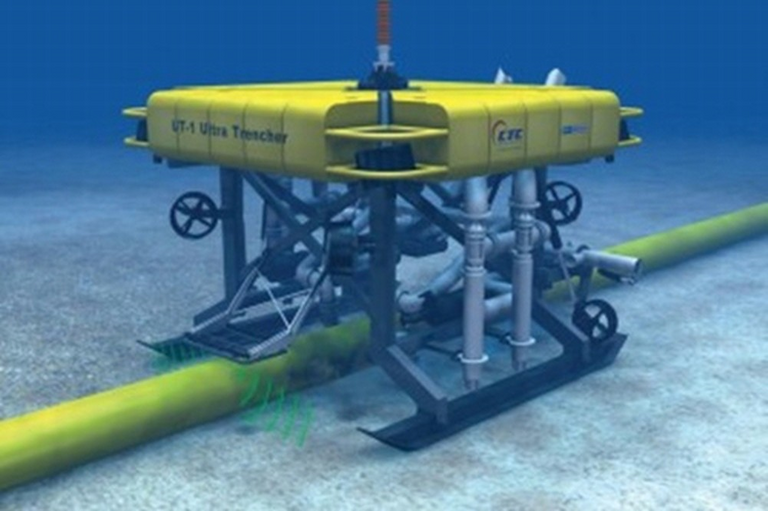

The transfer of light is in the form of "wave packets" or pulses and the transmission is currently almost entirely transmitted through MANY deep-sea fiber optic cables.

https://sciencedemonstrations.fas.harvard.edu/presentations/bucket-light

Retrieved: 14 September 2020

Archive: https://archive.vn/wip/ahtlh

http://www.richardpalmergraphics.com/technical-infographics/infographics4.html

Retrieved: 14 September 2020

Archive: https://archive.vn/wip/dJWUO

https://www.slideshare.net/choudhurygargi/cable-landing-station

Retrieved: 15 September 2020

Archive: https://archive.vn/Gfb1s

MES local PDF download: https://1drv.ms/b/s!As32ynv0LoaIiLtc6Tac4IfDY4OrFA?e=RO3y6i

https://harikishanreddy.blogspot.com/2010/10/how-internet-comes-at-your-place.html

Retrieved: 15 September 2020

Archive: https://archive.vn/wip/pyBQm

Retrieved: 14 September 2020

Archive: https://archive.vn/rUlKo

https://www.submarinecablemap.com/

Retrieved: 14 September 2020

Archive: https://archive.vn/wip/drzoj

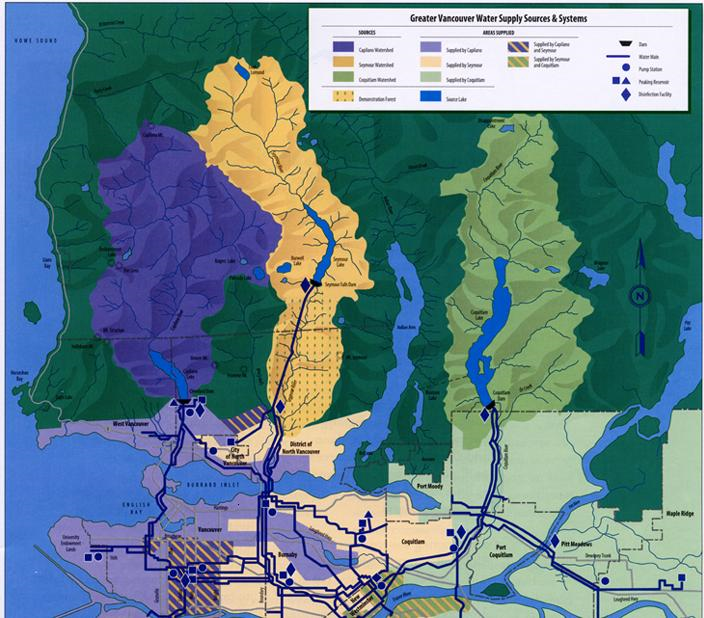

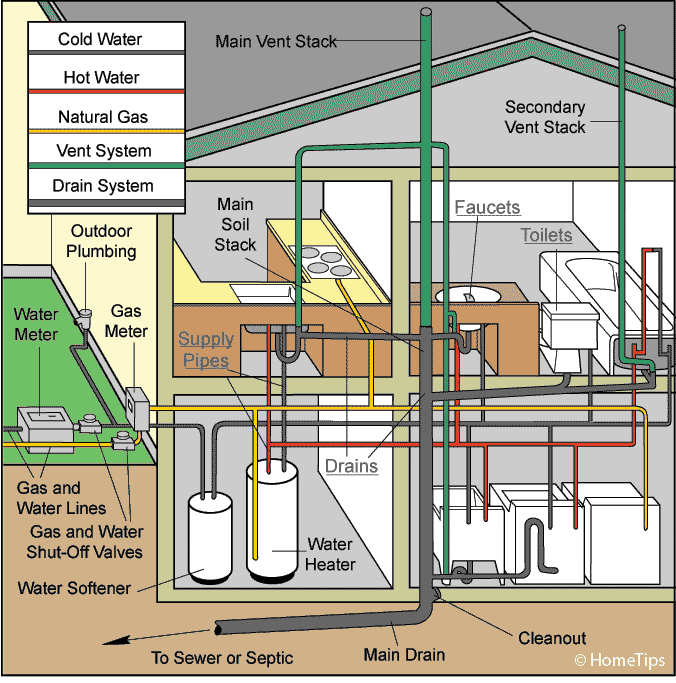

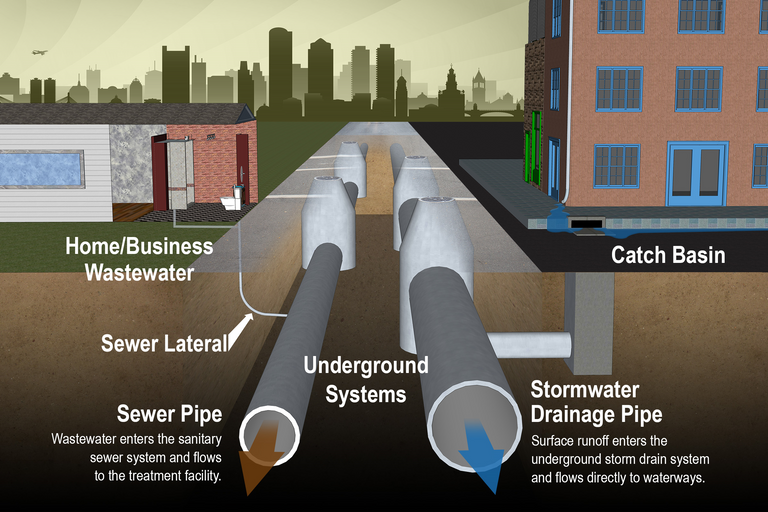

The internet is just the infrastructure and plumbing of light, just as a city water grid system is the infrastructure and plumbing of water.

http://www.sfu.ca/geog355fall02/yjang/1.conceptual%20Outline.html

Retrieved: 16 September 2020

Archive: https://archive.vn/wip/GP7vo

https://www.hometips.com/plumbing_fixtures.html

Retrieved: 16 September 2020

Archive: https://archive.vn/wip/9Sox5

https://www.woodardcurran.com/blog/using-stormwater-compliance-to-drive-better-sewer-system-planning

Retrieved: 16 September 2020

Archive: https://archive.vn/wip/jglEk

World Wide Web: Language of Light

Although both light and water are transmitted primarily through cables and pipes, the ability to structure and pulse light at very fast speeds means it is a good medium for communications.

The communication of light can be digitized, structured, and standardized in a specific set of protocols, TCP/IP, HTTP, and the World Wide Web (WWW), which collectively form the basis for a uniform language that all computers and devices must follow to uniformly transmit and render information, such as the images on your screen or the audio of my beautiful voice.

Thus, any computer can communicate to any other computer around the world so long as they have access to the internet communications infrastructure and use the same uniform internet language.

Since the World Wide Web and the "internet" are used synonymously, we can view the internet as a language of light.

And the Earth is a giant computer….

https://ar.pinterest.com/pin/484981453599275786/

Retrieved: 15 September 2020

Archive: https://archive.vn/wip/TSJ1U

https://klubjagiellonski.pl/2019/04/14/techno-polis-pod-zarzadem-googlea/

Retrieved: 16 September 2020

Archive: https://archive.vn/wip/CP2xn

Interestingly, the World Wide Web was founded in 1989 and the first internet browser in 1990 and both of them at the European Organization of Nuclear Research or CERN, the same folks smashing particles together with the Large Hadron Collider.

The story goes, https://en.wikipedia.org/wiki/World_Wide_Web, that CERN computer scientist Tim Berners-Lee was frustrated with the lack of an efficient system to retrieve research and other information found in different computers, so he decided to develop the "web".

The internet itself, https://en.wikipedia.org/wiki/Internet, was developed by the USA Department of Defense as a means to share computational resources, or time-sharing, of multiple computers in real time.

The first (public) communication between two computers via the internet, then called Advanced Research Projects Agency Network (ARPANET), was on 29 October 1969, just 3 months after the (alleged) moon landing on 20 July 1969.

In other words, while the world was focused on the (alleged) moon landing and multi-billion tax dollar particle smashers, the Internet and the World Wide Web were being developed.

In summary, yes the world is becoming a giant computer and just as it was always designed to be… #BuckleUpFolks

Decentralization of Information

The internet, defined as the infrastructure of inter-connected computers transmitting wave packets of light mainly through fiber-optic cables and using the same standardized protocol communication language, allows for information to be sent by anyone to anyone and thus enabling the decentralization of information on a large scale.

This transmission of information, however, involves sending duplicates or copies.

While the ramifications of a digital printing press that can copy and paste entire books and transmit across the world in seconds is not to be understated, the issue arises when I want to send you just my exact digital book, and not a copy.

In other words, I would like the ability to send a digital book in the same exact way I can give someone, or sell someone, a physical book.

Better yet, how can I send someone cash digitally, and without having to show my entire life's paper trail to my bank in hopes of them allowing me to transfer a few numbers on my bank account to another person with a different bank account (or without a bank account) and in a country listed as part of the USA Empire's "Axis of Evil"?

Decentralization of Information But Not of Value

The internet allows for the decentralization of "information" but not "value".

I can send anyone in the world "information" such as what the numbers on my bank account are but I can't "transfer" those numbers across the world without first pleading to my bank.

I can send anyone a digital copy of my book but I can't ensure that they pay me for it without first "pleading" with giant corporations like Amazon to allow me to post my e-book on their website and allow me to use their infrastructure of banking connections to facilitate the changing of digits of different bank accounts, and hope that no one copies or sells my digital copy of my book.

I can send anyone images of my house but I can't sell them ownership of my house without first making a legal contract with my realtor, lawyer, and/or bank; and only if the physical and legal infrastructure is in place between countries to do so.

The issue goes back to our banking problem:

I would like to send someone numbers from my bank account without going to a bank.

In other words, I would like to give people cash digitally in the same way I can physically.

Is this a difficult question to ask?

What is Value?

The question of "transferring" value requires first defining "value".

"Value" is a subjective term and depends on who you are asking, but in practical terms it is the dollar amount people price things at.

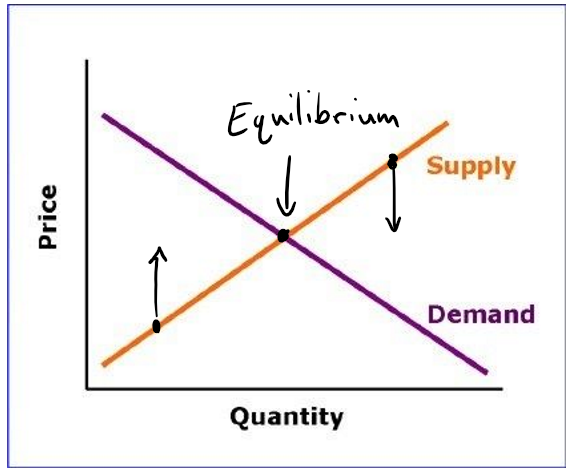

As in Economics 101, we learn that the price depends on supply and demand.

The higher the supply, the lower the demand.

The lower the supply, the higher the demand

But regardless of the demand, if the supply is infinite (such as copying and pasting digital information) then the price or value tends towards zero.

Demand for air is high but supply is infinite.

Thus, effectively the first step to create digital value is to lower the supply.

Air is free (for now) because it is abundant.

Gold is expensive because it is rare.

Physical and Mathematical One-Way Functions

In the physical world, I can hand someone a book very easily but if I were to duplicate it, I would have to either buy another one or type up the entire book and figure out how to print and bind it.

It is easy to hand the book to someone but it is difficult to duplicate it.

This can be viewed as a physical one-way function.

One-way functions are possible in mathematics too.

We can multiply prime numbers easily but we can't easily determine the primes that make up the number!

17 * 31 = 527 but going backwards 527 = 17 * 31 is hard!

Note that prime numbers are just numbers that can only be divided cleaning by 1 and themselves.

Now imagine the prime numbers are 100+ digits long and require a super computer to compute!

This crude example of a mathematical one-way function is the key to mimicking the physical one-way function of being able to hand someone our book easily but having difficulty magically duplicating it.

And this concept of functions that are easy to calculate one way but difficult in the opposite direction serves as the basis for all of cryptography; as well as serving to bridge the gap between digital and physical objects.

Physical Boxes and Cryptographic Hash Functions

If we place our book inside a box and then close it up and tape, how would anyone else know what was inside the box?

For others to find out what was inside the box, they would have to physically open it, or to get an X-Ray machine and scan inside it; either way, it is not easy.

To drive the point further, since boxes are easy to open, let's instead put our book inside a metal safe box and then forget the password (or throw away the key) so that even we can't open it.

No one will open this box.

This is just another type of a physical one-way function, we can easily place any arbitrary object inside the box but for others to find out what is inside the box, they would physically have to open it to know what is inside.

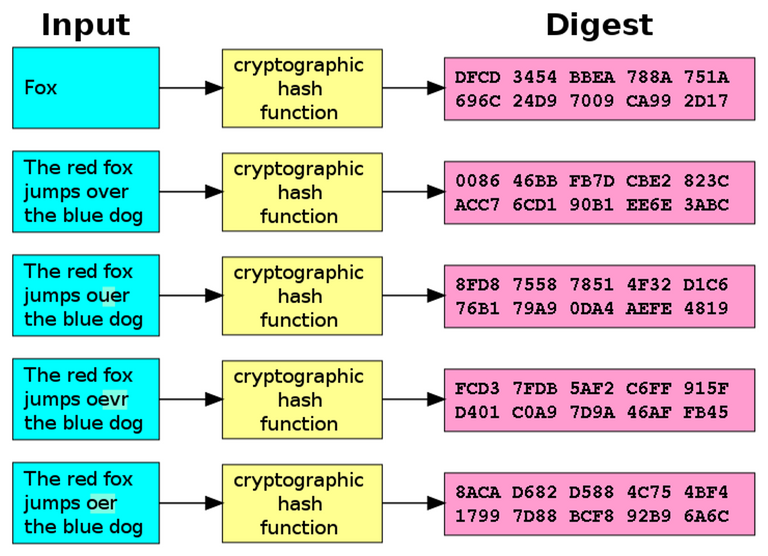

The mathematical equivalent is called a "Cryptographic Hash Function" and which I went over in my Blockchain Overview video.

Retrieved: 22 August 2020

Archive: https://archive.vn/GOuP5https://en.wikipedia.org/wiki/Cryptographic_hash_function

Retrieved: 9 October 2017

Archive: https://archive.is/RxVEx

Hash functions involve mathematical algorithms to convert arbitrary information into a standardized string of information.

To convert data into a "hash" or "digest" is easy but to go in the reverse direction is very difficult.

Thus effectively, we have placed our digital book inside a digital box.

Although in the digital world we can still copy and paste the digital box or hash, but like the physical world, we still can't easily see what is inside our box.

What good is copying and pasting a random string of data if we can't read our book?!

Digital Keys, Passwords, and Cryptography

In our safe box example, I purposely "forgot the password" or "threw away the key".

If instead we keep the password/key, we now can open up our safe box to see our book inside.

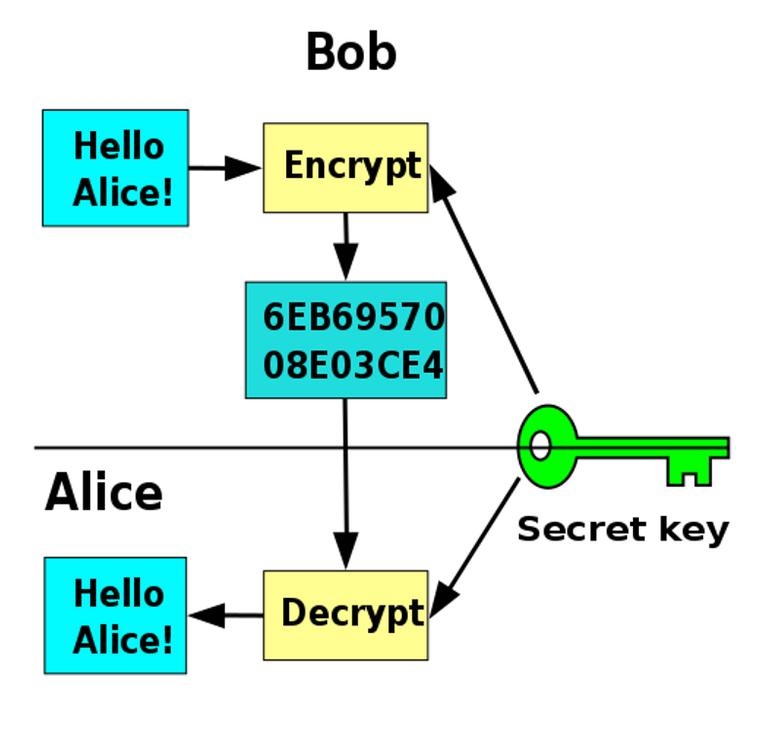

And mathematically, we can do the same with our one-way hash function by ensuring that the function has a "Secret Key" to "encrypt" and "decrypt" our digital book in our digital safe box.

https://en.wikipedia.org/wiki/Cryptography

Retrieved: 9 October 2017

Archive: https://archive.is/iwD8W

This basic lock and key form of encryption (or mathematical/digital safe boxing) is known as "Symmetric-Key Cryptography" since both the sender and receiver share the same key.

The term "cryptography" refers to the entire discussion we are having now, and is just the science of sending private or cryptic messages; or as per my own practical definition:

MES Definition: Cryptography is the exploration of one-way functions.

A major issue that arises with this form of lock and key encryption is that the more digital locks we have the more digital keys are required, and managing a million keys is no easy task; while using one key for a million locks raises a "few" safety concerns.

The other major issue is that the secret key needs to somehow be shared among sender/receiver privately as well!

Symmetric-key cryptography was the only publicly known form of encryption until June 1976 when Whitfield Diffie and Martin Hellman (interesting totally non-secret society occult last name signaling trickle-down technology #sarcasm) published a paper on "Public-Key" or "Asymmetric-Key" Cryptography.

https://en.wikipedia.org/wiki/Public-key_cryptography

Retrieved: 10 October 2017

Archive: https://archive.is/VC6a6

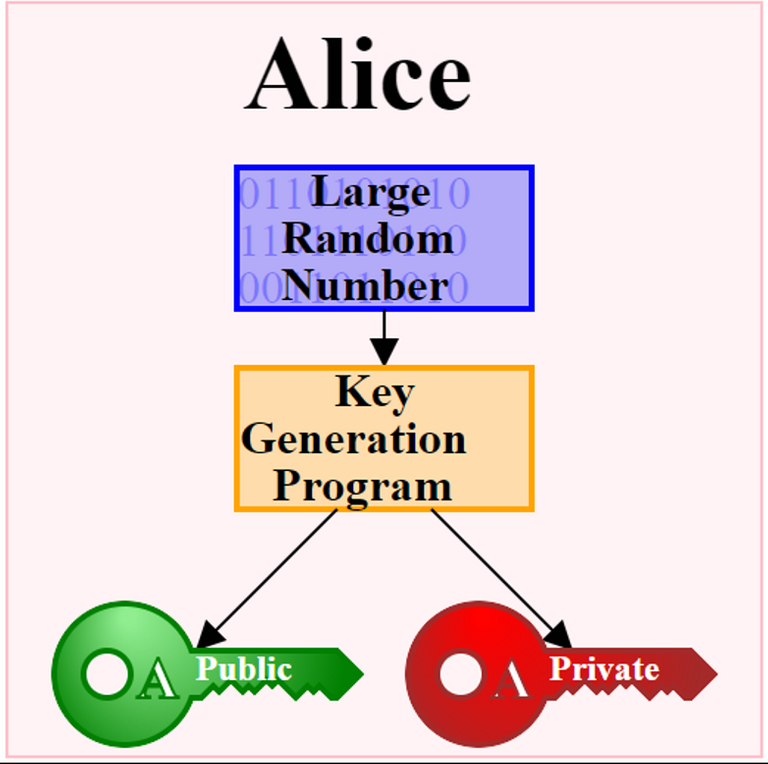

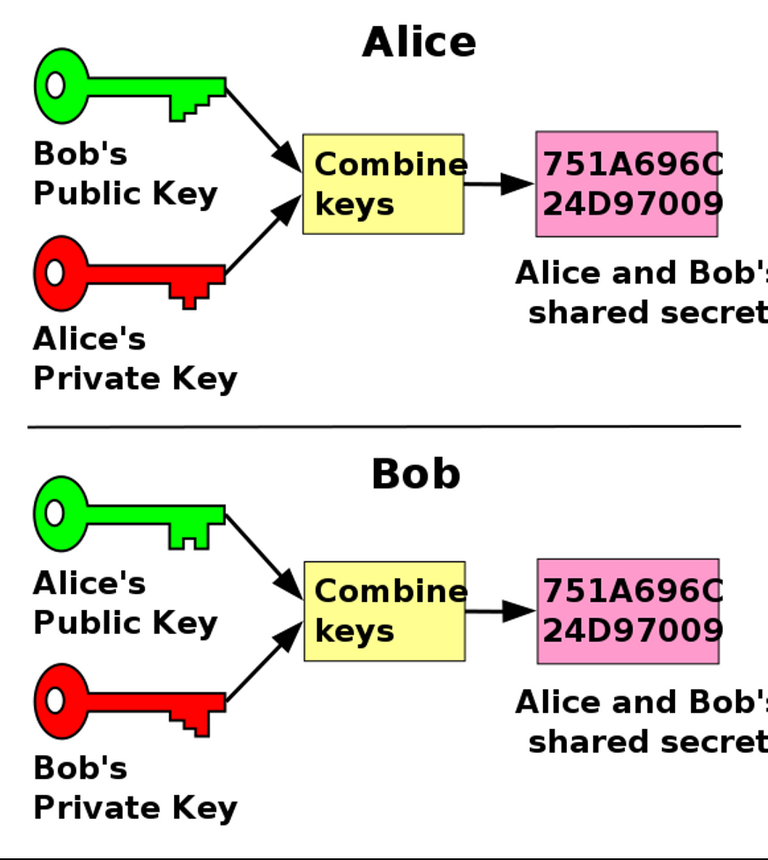

This form of cryptography involves a second one-way function, this time using our private or secret key to mathematically generate a secondary "Public Key".

Thus, we can use our private key to easily generate a public key but it is difficult going the other way to generate a private key from a public key.

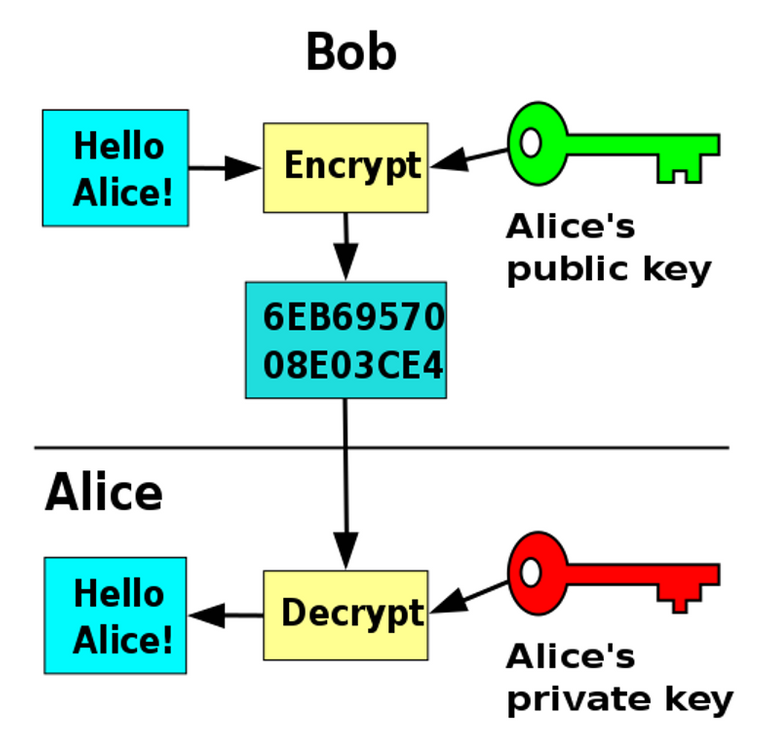

The public key, which anyone can publicly see, can now be used in our newly upgraded one-way hash function to encrypt any message; and in general this means that anyone can encrypt any message using our public key; but the decryption can only be done with our private key!

The physical equivalent of this new digital public-private key scheme is akin to our house public address and private house key.

Anyone can look up and deliver a box to a home address, but only the home owner can bring it inside using the house key.

Digital Signatures

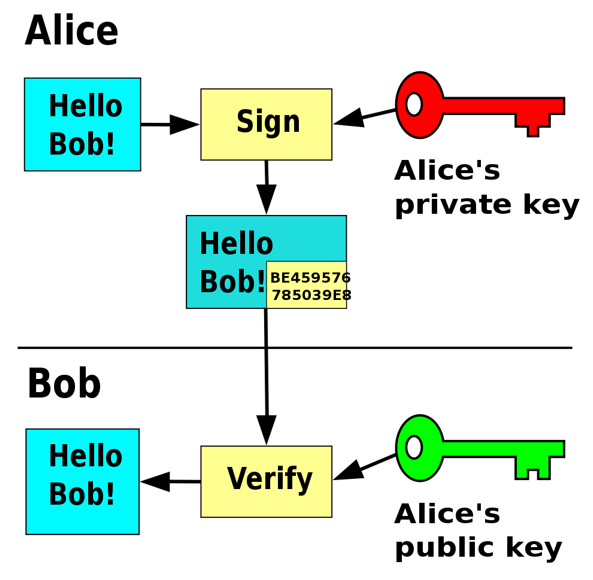

If the mailman, I mean mail-person, delivers mail to our home address, he or she or they may require our physical signature.

The concept of signatures is another example of a one-way function, in that it is easy to sign something but it is difficult (in theory) for others to replicate our signature.

Converting physical signatures to a digital equivalent can also be done using public-key cryptography, this time using the private key to sign while anyone can publicly verify using the corresponding public key.

https://en.wikipedia.org/wiki/Cryptography

Retrieved: 22 August 2020

Archive: https://archive.vn/wip/57wcL

This example shows that even if the message is not encrypted or secured, the digital signature gets stamped onto the specific message and any changes to the message will remove the signature; thus we can verify whether the message has been modified or not since the time it was signed.

The Numbers On Your Bank Account (Again)

Thus far, we have shown that mathematics and computing allows for the mimicking of physical objects such as books, boxes, houses, and signatures.

But what about the numbers on our bank account that started this entire discussion? How do I change those without begging my bank?

The answer is simple: You can't because your bank has both the private key and public key, and you have nothing.

The only person that can change the numbers on the screen is the one that they physically belong to; thus the bank owns "your" money and merely allows you to have the illusion of ownership so that you deposit more of your cash to them.

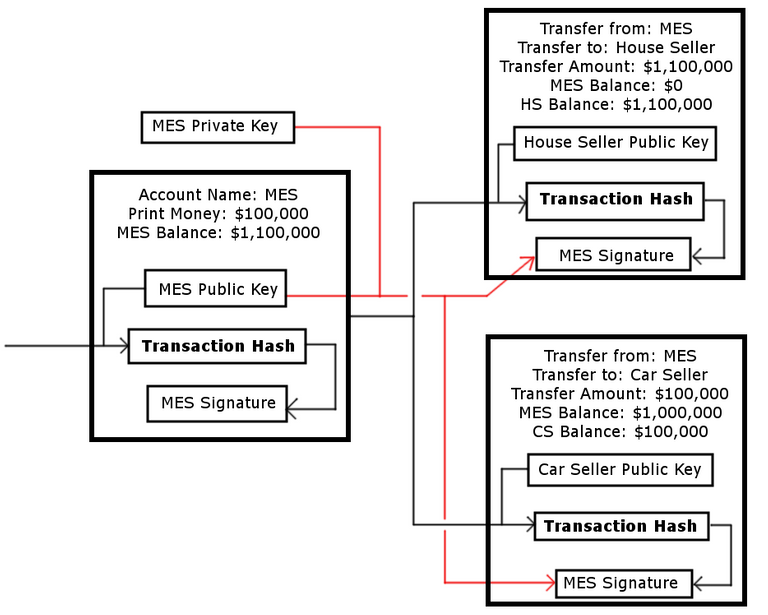

To claim ownership of the numbers on your computer screen, although not on your bank account, we can follow the steps thus far covered:

- Generate a random private key.

- Mathematically generate a public key using our private key.

- Print the private key and hide it under my bed.

- Type $1,000,000 into a message box.

- Mathematically generate a hash of our message using our public key.

- Mathematically sign the hash using our private key.

Congratulations, we are now millionaires!

We now can rightfully claim to "own" a piece of digital text that says "$1,000,000" secured by a unique private key that no one can access but us.

There is only one tiny little issue, no one will accept our million "dollars", because they don't have to.

Physically all we did was write the number $1,000,000 onto a piece of paper and hid it under our bed.

We claim ownership of the paper that the number is written on, and that's it.

Whose Ledger is it Anyway?

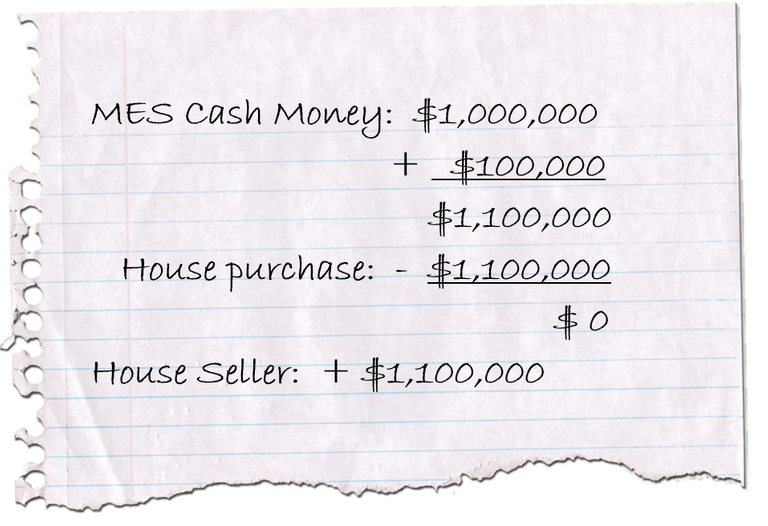

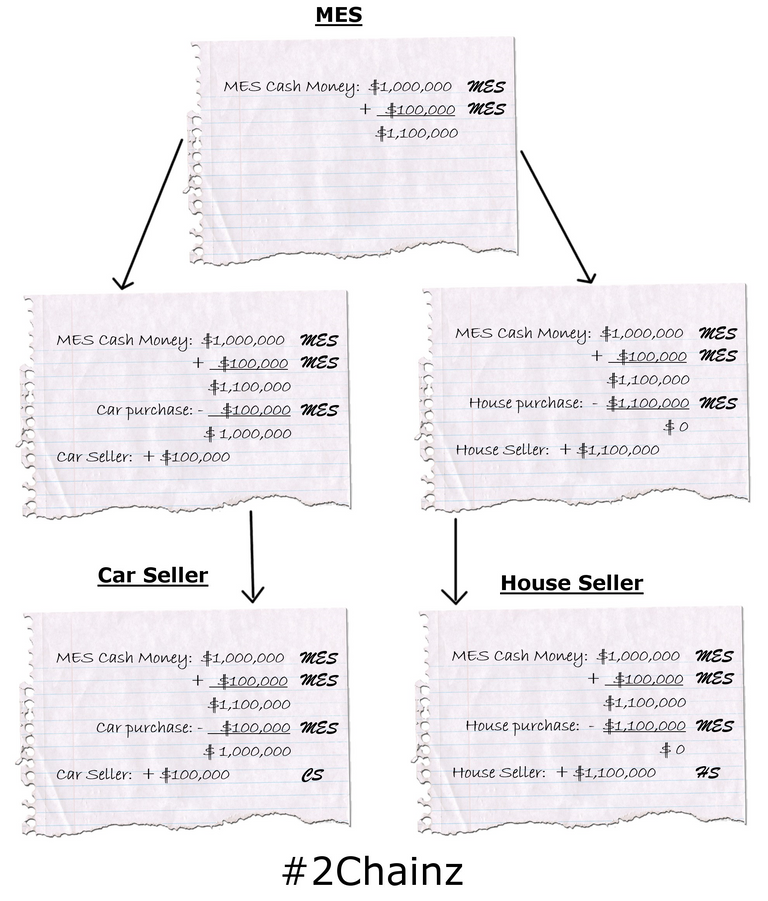

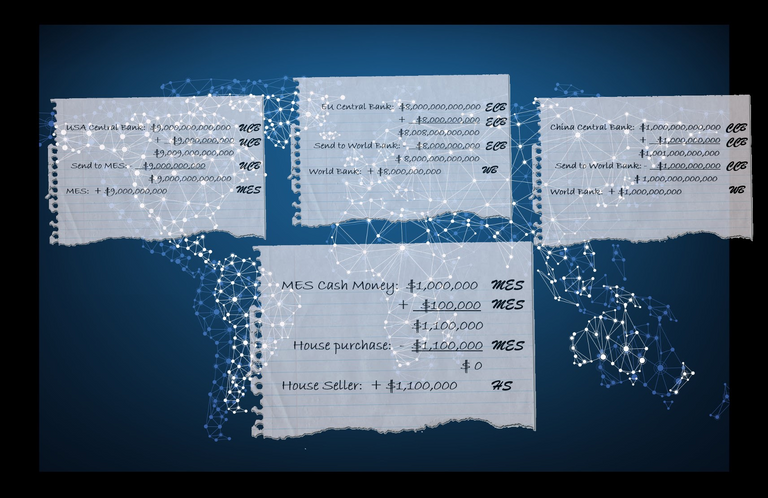

So far, what we have done is effectively created a ledger with the first entry as being a money printing of $1,000,000 to ourselves by ourselves; we are now our own central bank.

A "ledger" is just a record of events, while the term refers mainly to financial transactions.

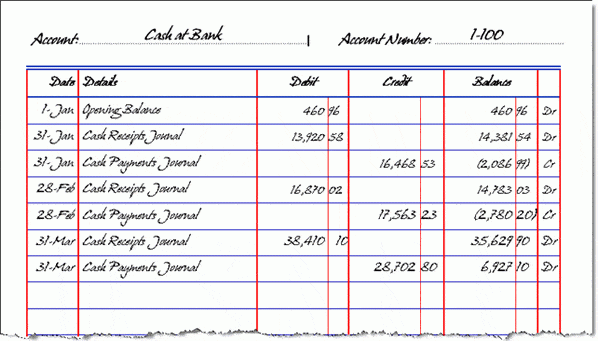

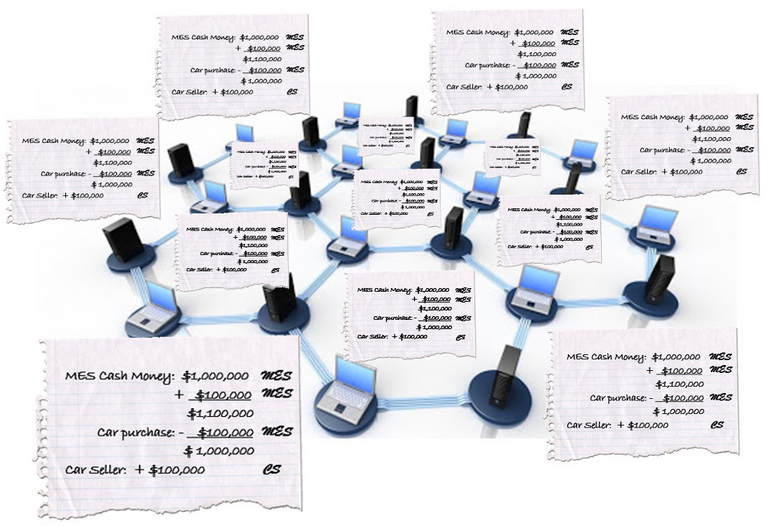

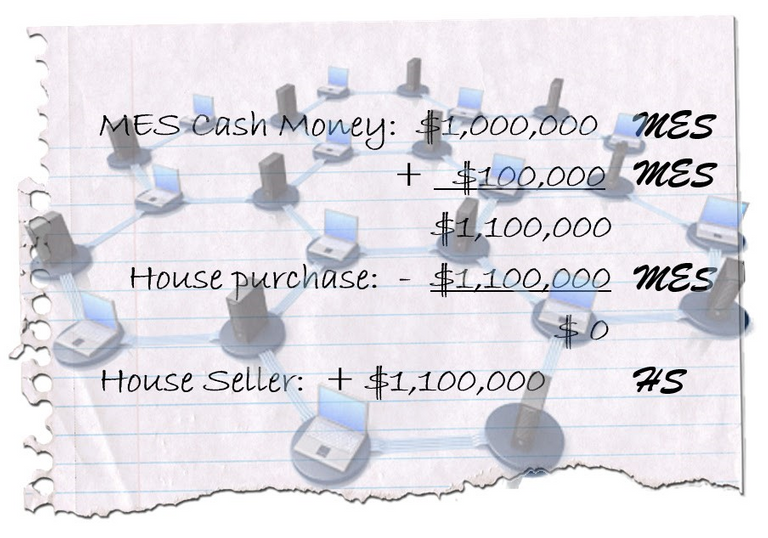

Our ledger so far looks something like this:

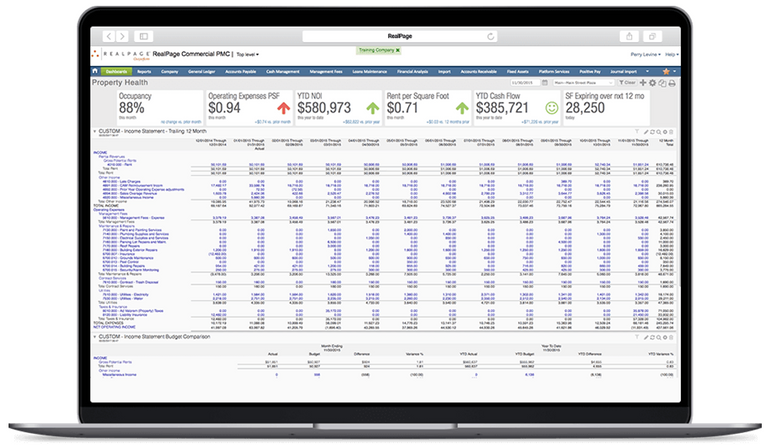

Our bank's ledger looks something like this:

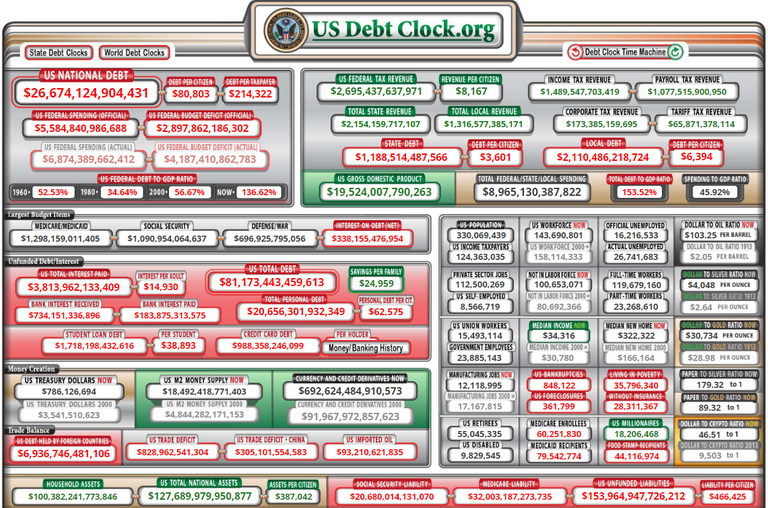

USA's government ledger looks like this:

https://www.usdebtclock.org/index.html

Retrieved: 23 August 2020

Archive: https://archive.vn/wip/8Wb14

And the world's ledger looks like this:

https://www.usdebtclock.org/world-debt-clock.html

Retrieved: 23 August 2020

Archive: https://archive.vn/84FPH

Where are the Ledgers Located?

To change the numbers in each ledger we would have to go to "where" the ledger is stored and update it.

Our digital safe-box ledger is stored on our computer and we can change the numbers using our private key to open up are digital safe-box and then digitally update our digital paper ledger.

Our bank's ledger is also located in computers, but not our computers, and we can represent this by the physical bank location.

The USA ledger can be represented as being at the Federal Reserve.

And the upcoming world central ledger will likely be constructed as per the Biblical Tower of Babel…

https://fineartamerica.com/featured/the-building-of-the-tower-of-babel-marten-van-valckenborch.html

Retrieved: 24 August 2020

Archive: https://archive.vn/pmmkw

The "Great Work" is upon us.

Value is in the Collective Belief of a Network

Our digital piece of paper with $1,100,000 is worth $1,100,000 to us, or more specifically, to me since only I have possession of it and only I have pledged allegiance to this all-mighty MES Dollar.

To me it is worth $1,100,000 but that is all, I'm a "network of one".

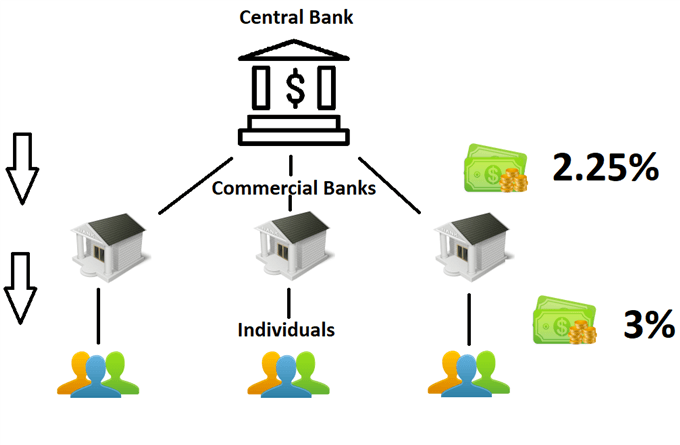

Compare this with the "fiat" money network, which typically involves central banks printing money and lending to commercial banks at interest, by which commercial banks lends to the public at higher interest.

MES Money Note: "Fiat" simply means an arbitrary decree; and "interest" is simply the cost of money itself.

https://www.dailyfx.com/education/forex-fundamental-analysis/how-central-banks-impact-forex.html

Retrieved: 24 August 2020

Archive: https://archive.vn/wip/Nc5MQ

Fiat networks have many people entrusting their hard earned cash in the collective belief that others will accept it in exchange for goods and services.

$1,100,000 USD is worth a house to millions of people but $1,100,000 MESD is worth a house to 1 person.

Trust

Even if a network of people believe in the value that numbers on the bank account represent, they still have to place their trust that the banks, governments, and other institutions of people are accurately maintaining a ledger of all the transactions within the network.

If I buy a house for $1,100,000 then my bank balance should subtract it from the current numbers on the bank account.

Now let's assume that I can somehow persuade (or mind-control) others to join my network, as well as convince them that $1,100,000 MES Dollars is worth their house, and now we just need to update the ledger accordingly.

We are now effectively a bank and have full ownership of our digital paper money.

But just one problem here…

The person that bought our house from now has the same issue which we started off with:

They have to trust that we accurately maintain the ledger and trust that we will change the numbers on their bank account upon request.

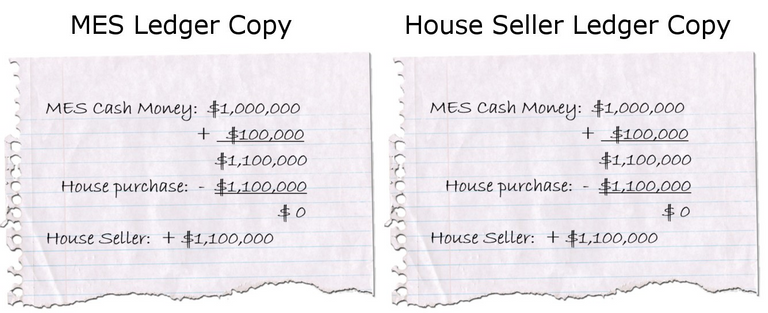

If instead of maintaining just one ledger, we could give a copy to the other member of our banking network.

Now the issue is we need to ensure we have the exact same ledger for all new transactions, and that neither one of us tamper with the ledger.

Chain of Signatures

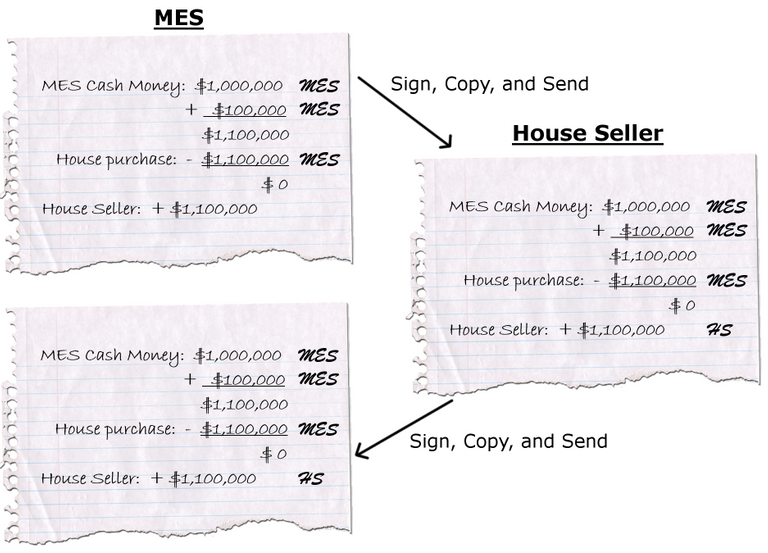

To ensure that the ledgers are not tampered with, we could ensure that each transaction is signed off by each person sending money.

Physically this would involve both accounts to sign, copy, and send the ledger to each other to ensure both are in agreement as to the latest up-to-date ledger.

Copy and Paste and Double Spend

The issue that arises in decentralized systems is that information can easily be copied and pasted which raises an issue known as "double spending", which is effectively counterfeiting money.

This is an issue that arises more frequently as the size of the network increases.

If we add another person to our network, and instead of just buying a house, we can copy and paste our ledger and then purchase both the house and a car with the same money!

We have effectively spent the same money twice and are now left with 2 ledgers.

But a ledger is a record of transactions, and NOT 2 records!

If you have two ledgers you have none.

Chain of Digital Signatures

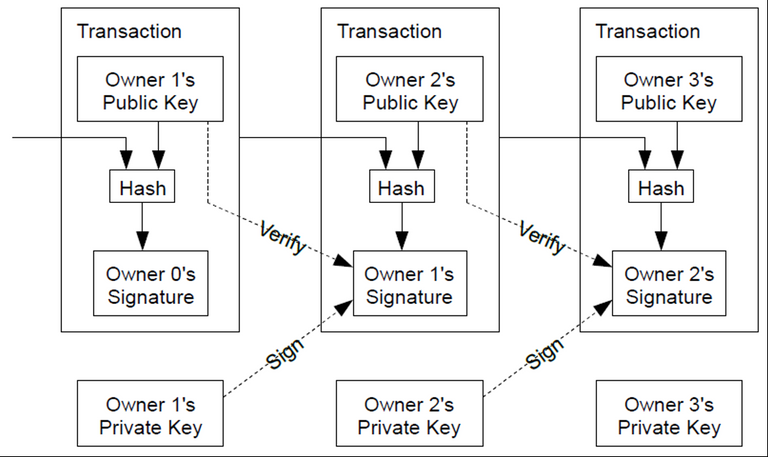

Digitally this is the same as a chain of cryptographic signatures, in fact that is all a digital ledger is:

A digital ledger is a chain of digital signatures.

The bitcoin "white paper" illustrates the use of transactions signed with private keys, verified with public keys, and linked with hashes (our magical digital one-way functions).

Note that "white paper" is an informational document describing the general design and purpose of a concept or product and used for promotional purposes and not a technical manual.

https://bitcoin.org/bitcoin.pdf

Retrieved: 10 October 2017

Archive: https://web.archive.org/web/20171004042710/https://bitcoin.org/bitcoin.pdfWe define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership.

The problem of course is the payee can't verify that one of the owners did not double-spend the coin. A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending. After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent. The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

We need a way for the payee to know that the previous owners did not sign any earlier transactions. For our purposes, the earliest transaction is the one that counts, so we don't care about later attempts to double-spend. The only way to confirm the absence of a transaction is to be aware of all transactions. In the mint based model, the mint was aware of all transactions and decided which arrived first. To accomplish this without a trusted party, transactions must be publicly announced [1], and we need a system for participants to agree on a single history of the order in which they were received. The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received.

Our double spent chain of digital signatures looks something like this:

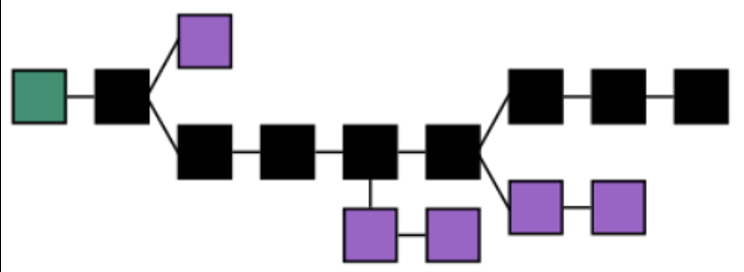

Consensus is Everything

Double spending means our ledger can always branch out into multiple ledgers.

But we don't need one ledger, we just need "consensus" of enough people to only consider one ledger valid.

A common way is to view only the longest chain to be the valid.

https://en.wikipedia.org/wiki/Blockchain

Retrieved: 9 October 2017

Archive: https://archive.is/8DeoZ

Blockchain formation. The main chain (black) consists of the longest series of blocks from the genesis block (green) to the current block. Orphan blocks (purple) exist outside of the main chain.

In this scenario, the "side-chains" have the possibility of overtaking the longest chain, which thus compromises the entire ledger because it would mean the reversal of transactions!

If someone sent you $1,000, imagine if it was reversed a week later when the side-chain becomes the main-chain!

Effectively, we need to incentivize the network to add to the longest chain and only the longest chain so that the side-chains become increasingly further behind.

Note that the nature of the internet is such that information has varying sending and arrival times, so new side-chains may occur unintentionally.

But even if new side-chains occur, the network of computers upkeeping our ledger can temporarily maintain the new side-chains until one is longer and then switch over.

This is why many blockchains suggest users to wait until multiple blocks are confirmed before designating their transactions as "confirmed", which is indicates that it is mathematically unlikely to get reversed.

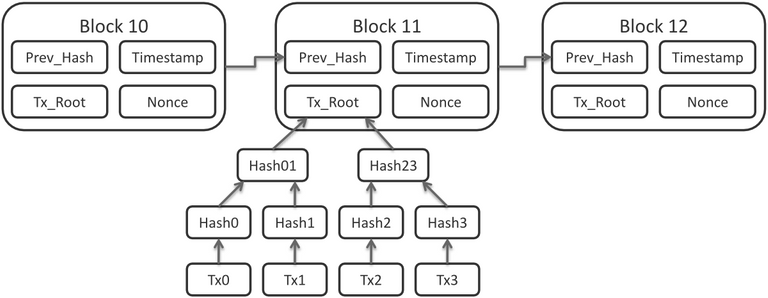

Digital Gold: Consensus via Mathematical Work

The bitcoin whitepaper was the first publicly shown method of overcoming the double spending problem, and thus was able to create a "stable" consensus.

The general method is summarized below:

- Batching up multiple transactions into a "block".

- Maintain the hash of the hashes of the transactions. #hashception

- This is called a hash tree or Merkle tree.

- Timestamp the creation time of the block.

- Chain to the Hash of the previous block.

- Increment an arbitrary number, called a "nonce", until the hash of current block including the nonce is below a specific target hash value.

- The successful block producer is rewarded with bitcoin.

- Periodically increase the mining difficulty to account for future advances in technology and/or mathematics.

Essentially, this just slows the block production time so that there will be enough time for consensus to be reached.

https://en.wikipedia.org/wiki/Bitcoin

Retrieved: 28 August 2020

Archive: https://archive.vn/wip/r6gNa

Data structure of blocks in the ledger

This effectively involves mathematically solving a hash or a one way function; recall our example of finding primes!

17 * 31 = 527 but going backwards 527 = 17 * 31 is hard!

This process means one thing, we can't just copy and paste our ledger and then double spend for the house and car, we have to work for the money.

This is akin to going into a mine and start digging into the ground to find gold.

We now have ourselves "digital gold".

If we wanted to keep our $1,000,000 gold bar, and "double spend" it instead, we would have to do this to the ground (unless you can figure out suppressed alchemy science):

Retrieved: 28 August 2020

Archive: https://archive.vn/wip/F5Jgj

But to do mathematical work, we need mathematical tools, we need computers.

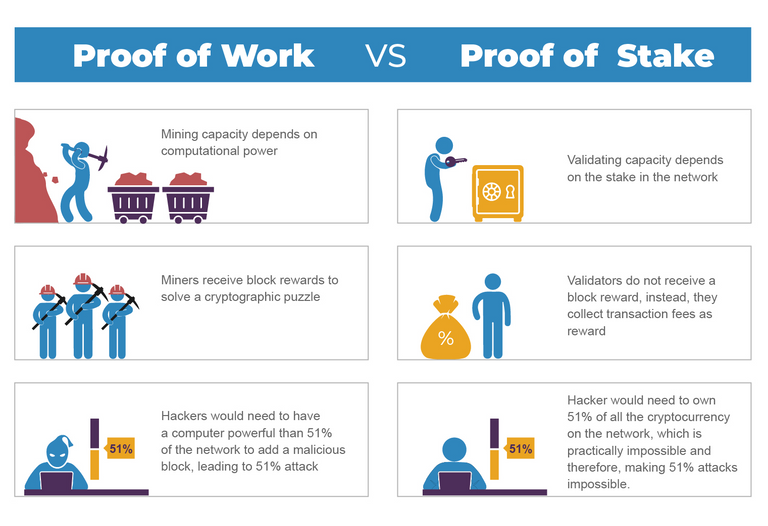

In a "Proof of Work" consensus model, consensus is "voted" upon through computational power.

And when the incentive is to be rewarded for digital blocks of digital bitcoin gold, then the new gold rush is located at massive digital mining facilities.

https://spectrum.ieee.org/computing/networks/why-the-biggest-bitcoin-mines-are-in-china

Retrieved: 28 August 2020

Archive: https://archive.vn/wip/o2S4F

This means that in our ledger for 3 people now, we can't simply add new transactions as we wish, but rather we have to compete with the network in digging through a digital mathematical mine in hopes of earning a profit in the form of new printed/created/mined MESD tokens.

Digital Governance: Consensus via Network Stake

The consensus mechanism of mathematical work employed by the bitcoin blockchain has spawned different approaches to consensus.

A common consensus method is called "Proof of Stake".

While proof of work involves competing with the network to compute the next block, proof of stake, however, shifts the block production process towards specific "validators" based on their stake in the network, that is, the amount of tokens they have.

In general, proof of stake or POS consensus schemes involves randomly selecting validators and their "validation capacity" based on the amount of tokens they have and then rewarding validators through fees for each transaction/block they "validate".

The main difference between proof of work and proof of stake is that the commodity that is incentivized is computational power in the POW and obtainment of tokens in POS.

https://www.leewayhertz.com/proof-of-work-vs-proof-of-stake/

Retrieved: 28 August 2020

Archive: https://archive.vn/wip/qhUm2

Variations in Digital Governance

While proof of work and proof of stake were amongst the first consensus mechanisms achieved, even more variations have branched out and some that don't even utilize a blockchain.

One variation is "delegated proof of stake" in which stake holders vote on the validators or "witnesses" and can unvote any bad actors; the Hive and Steem blockchains utilize DPOS for consensus.

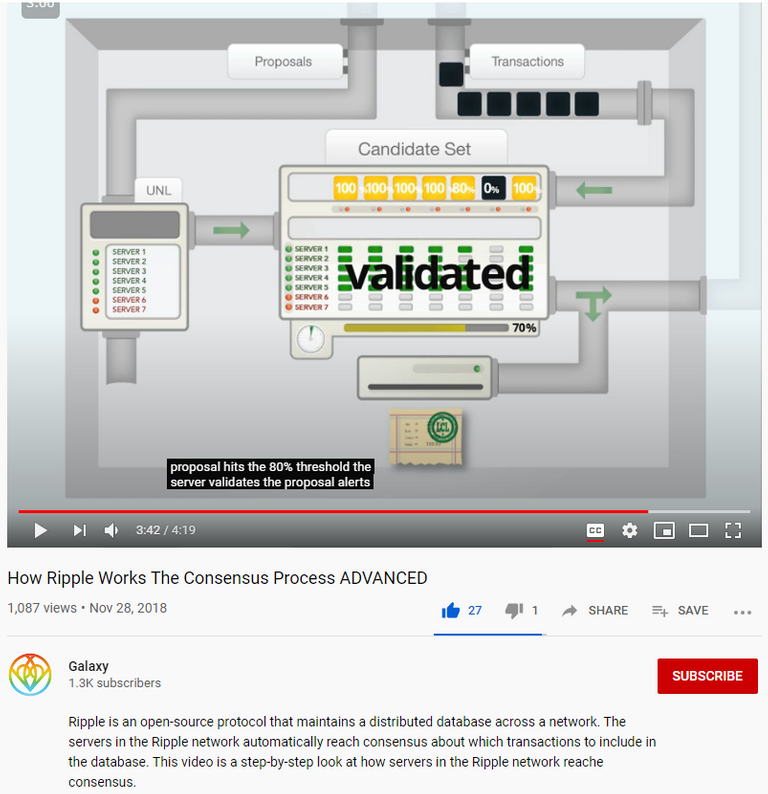

Ripple's XRP cryptocurrency uses an "iterative" consensus process in which a node receives and sends transactions to the rest of the network while maintaining a specific list of trusted nodes, called Unique Node List (UNL), to check each transaction with.

Each iteration is batched together and given an "approval percentage rating" based on how many times it matches the UNL.

When the approval rating reaches an 80% threshold then the ledger is "closed" and deemed to reach consensus and a new ledger is started and all previously discarded transactions have a chance to get approved in the new ledger.

Retrieved: 13 September 2020

Archive: https://archive.vn/wip/iNfh7

Thus with the XRP ledger there is only one ledger at all times instead of a chain of blocks, and thus no side-chains either.

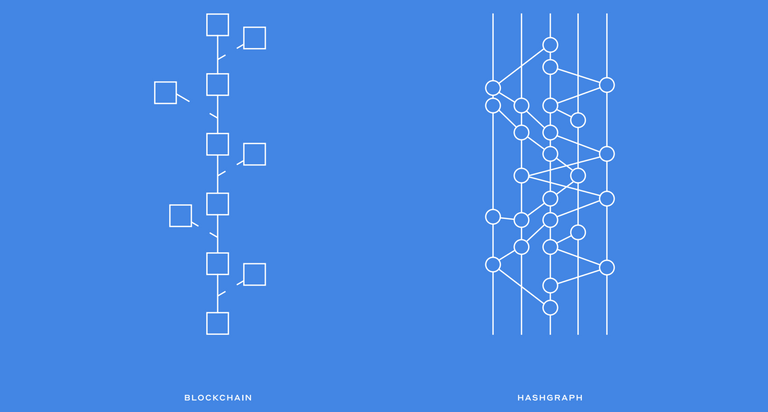

Another new consensus mechanism is utilized in the Hedera Hashgraph cryptocurrency which differs from the basic blockchain mechanism of maintaining only the longest chain of blocks, by instead incorporates the entire transaction history and "weaving it together".

https://www.hedera.com/learning/what-is-hedera-hashgraph

Retrieved: 13 September 2020

Archive: https://archive.vn/wip/r0W7D

Such a mechanism focuses on speed rather than complete linearity in the transactions and has suitable applications in live-streaming videos in which a split second duplicate or double-spend of an image that the human eye may not even detect is worth the resulting increased consensus speed without needing a proof of work mechanism to slow down the blockchain.

These are but a few concepts in the science of reaching consensus.

Decentralized Consensus: Everywhere and Nowhere

The main discussion in this video was in regards to the concept of "ownership", and in particular the numbers on your bank account.

Physically, we can be satisfied with our claim of ownership when we can hold a physical object in our hands, such as the fiat government printed paper money.

But digitally, the numbers on our bank account are just bits of information, which are just tiny duplicated pulses of light in our internet plumbing network.

Information is just the abstractions of communication, the abstractions of a language.

Thus the question of physically holding "information" has no fundamental meaning in of itself.

Rather, information only has meaning or "value" when others agree that the numbers on my bank account have value.

Information only has value when it has "consensus".

In a centralized consensus scheme, the value of the information has the additional burden of trust in the central authority managing the numbers on your bank account.

Our use of mathematical one way functions used to develop private keys and public addresses means trust is placed instead on the mathematics of cryptography.

With the trust placed firmly on mathematics, the next step is just the consensus of people and computers to accept, value, and maintain transaction history of information; information such as the numbers on my bank account.

When a network achieves a secure uniform agreed upon consensus of one single ledger of events, then the ledger can be viewed as being everywhere, since any computer in the network has a copy, yet at the same time nowhere, since removing any one computer doesn't remove the ledger from the rest of the network.

A network of computers upholding a single ledger is akin to a group of people upholding a single set of laws.

In other words a decentralized ledger on the interconnected giant Earth computer is just a digital country and is as open, closed, borderless, or bordered as any other physical country.

And just as conflicts, mergers, trade agreements, and war arise between countries the same will inevitably arise in the digital countries that are rising out of the ashes of the old world being currently set on fire…

Stay Tuned for Part 2…