*see disclaimer at the end of the text

In the popular Netflix series "The Crown", a caring Queen Elizabeth II, Head of the Commonwealth, wants to support the Commonwealth member countries in condemning the South African "apartheid" regime of 1985. All member countries would like to issue a common political declaration menacing South Africa with "economic sanctions". The only Commonwealth member opposing such a declaration is ... the United Kingdom itself, led at the time by Margaret Thatcher. The "pragmatic" (and rather callous) British Prime Minister refuses to sign anything which might imperil the strong economic ties between the UK and South Africa. When compromise is finally found, the declaration speaks not of "sanctions" but of "economic signals".

Project 7637

The Luxembourg economy relies heavily on financial services which are going through a continuous upheaval due to the rapid pace of technological progress. The Luxembourg Government is keenly aware that if it is to stay competitive, the local financial industry needs to embrace technological innovation, including new technologies such as "blockchain" (or DLT). Moreover, the Government has a strong focus on everything "digital", in line with the European priorities.

In order to allow the local actors to innovate and leverage blockchain / DLT, a first law was promulgated in March 2019 which basically recognized the transfer of ownership of financial assets recorded in "electronic, distributed, secure systems of record" or DEES in its French abbreviation, which is the legal term chosen to designate blockchain / DLT systems.

However this first law has been considered a mostly symbolic gesture and had almost no impact. Anyone looking at the legal situation was able to make an instant observation: while the March 2019 law was talking about the transfer of ownership of financial instruments recorded in a DEES, nothing was said about how such instruments would have gotten there (on the DEES) in the first place ... In other words, there were no clear legal means to create (legally sound) financial instruments on a DEES ... hence there was hardly anything to transfer ...

The upcoming law, which should be adopted in a plenary session of the "Chambre des Députés" (Luxembourg Parliament) in about two weeks and which for the time being is simply known as "project 7637", should address that issue.

Securities issued in Luxembourg should by law be recorded in a "securities account" ("compte d'émission").

The upcoming law specifically allows such a "compte d'émission" to use a DEES (blockchain) for record keeping. However, it should be noted that a rigorous definition of what counts as a "DEES" in the Luxembourg legal system does not yet exist.

On the other hand, what counts as a "compte d'émission" is well defined. And these accounts can only be held by a "liquidation organisation" ("organisme de liquidation") or a "central account registrar" / "central custodian" ("teneur de comptes central")

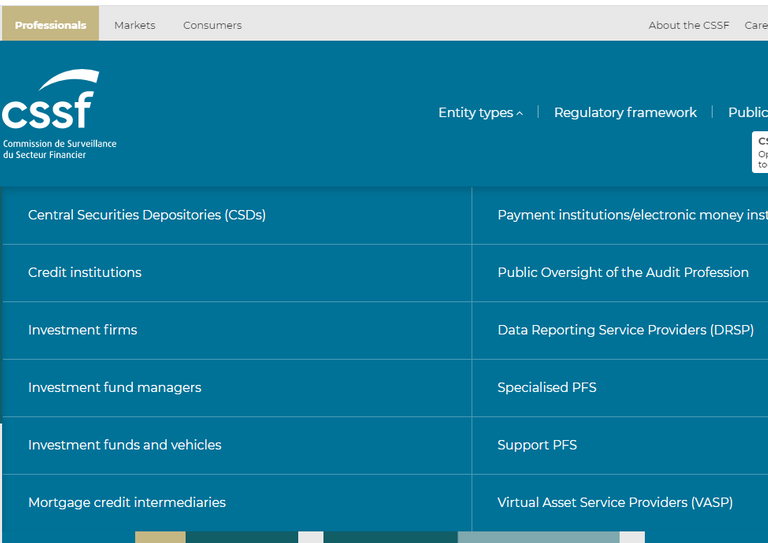

In practice, these organisations, also known as CSD (central securities depositories) are few, big, and enjoy quasi monopolies on the rather lucrative "custody" business.

Now comes the interesting part: what the second article of the soon-to-become-law "project 7637" aims to do, is to open the custody business in a targeted manner (for non-listed securities only), to two other categories of financial organisations (as defined in Luxembourg law): "investment firms" and "credit institutions" established in the EU.

If we try to analyse the reasoning behind, one might imagine the following: being de facto monopolies, the existing CSDs have little incentive to innovate and introduce blockchain / DLT systems. The "credit institutions" (among which one finds the banks) might want to seize the opportunity to use technological innovation in order to reach for a (limited) piece of the CSD pie.

In practice, the law is wary to keep "a level playing field" by requiring any new entrant to have in place

- "specific mechanisms and procedures" as well as

- "operational and technical capabilities"

to operate as a "teneur de comptes central" (CSD).

While a bank or other big "investment firm" could afford to put those in place, it is hard to imagine a cash-strapped "fintech" startup mustering the resources needed to comply with a very demanding regulator's requirements.

And this is where the Government's (and the legislator's) good intentions meet reality ...

In charge of judging whether a regulated entity has indeed put in place the "specific mechanisms and procedures" and possesses the "operational and technical capabilities" of a CSD is ... the highly regarded "Commission de Surveillance du Secteur Financier" (CSSF), the Luxembourg financial regulator.

The CSSF mission is to protect the reputation of the Luxembourg financial center and avoid anything that might imperil it (such as, for instance, the Wirecard scandal which a bigger country can more easily dust off). It has thus taken a very cautious approach to "fintech wizardry" in general and to anything "blockchain / crypto"-related in particular.

Conclusion

The upcoming "project 7637" law is a powerful "economic signal" which the Luxembourg Government and legislator want to send, in favor of innovative technologies for the financial sector.

But as Margaret Thatcher observes in "The Crown", "a signal can point in any direction".

In practice, whether the new law will lead to actual innovation or will remain largely a political symbol will depend on the CSSF ...

*Disclaimer: as I've seen people write in their blog posts: "not a lawyer, not your lawyer". Any legal misinterpretations in the text are entirely my fault and I am happy to stand corrected by legal professionals.

Congratulations @sorin.cristescu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP