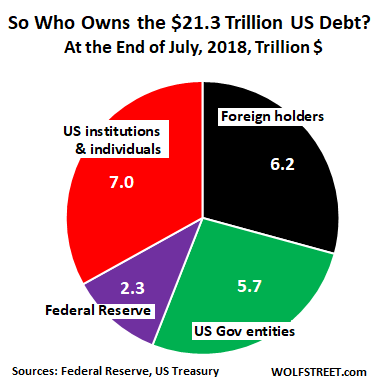

There was an interesting article on Wolf Street today, which pointed out that foreign ownership of US treasuries and govt debt had fallen by $21 billion in the 12 months to July 2018.

Japan alone dropped by $78bn in the 12 months to July 2018, and Russia also offloaded, Chinese holdings stayed stable, and some tax havens increased their holdings, so that the overall foreign holdings dropped $21bn to $6.2 trillion.

The interesting thing is that the void was filled by American private institutions and savers.

The rising yields on US Treasuries make investing in US govt debt much more attractive than taking a risk on the stock market or an even greater risk in emerging markets.

I would expect emerging market debt and equities to drop even further as American institutions sell and repatriate the money home and park it in the safe but now decent yielding bonds issued by Uncle Sam.