Back in 2001, Warren Buffet gave an interview to Fortune magazine, and shared an indicator that he uses to judge whether the stock market was over valued.

It is the Market Cap to GDP indicator.

It's simple to calculate. It is the total market capitalisation of all the stocks listed in a country, divided by that country's GDP.

His reasoning is this: most businesses arn't even listed on the stock exchange (think your local hairdresser and a bunch of other small businesses). GDP is the total activity in a country, both private sector and govt, and includes the income of small businesses as well as large businesses listed on the stock exchange.

Therefore if the Total Market Capitalisation of just listed stocks exceeds a nation's GDP, something is way out of kilter and the market is overvalued.

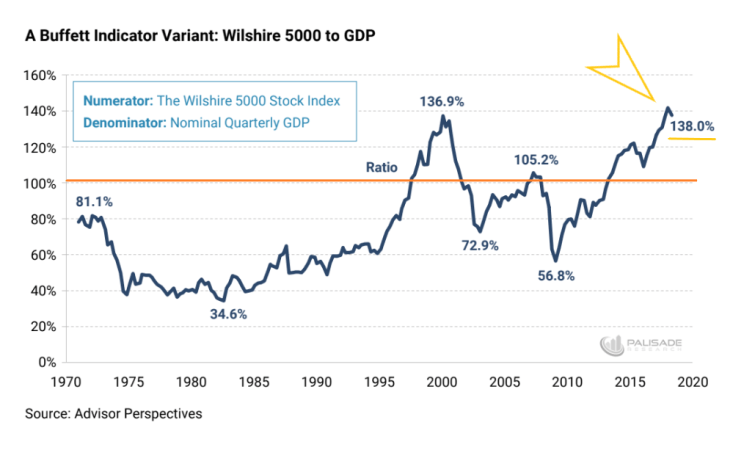

Now check this out:

The indicator was way up at the height of the dot-com boom in 1999/2000. It was over 100% just before the 2008 Great Financial Crash. And look at it now.

The indicator says that we're due for a correction. It might be wise to take some profits.