Australian house prices are starting to fall. In August the stats showed that they'd dropped for 11 consecutive months. The drops so far have been modest - about 0.3% a month. But still, it adds up and makes people nervous.

In addition, three of the biggest Australian banks have raised their variable mortgage rates, provoking ire amongst existing home-owners on variable mortgages.

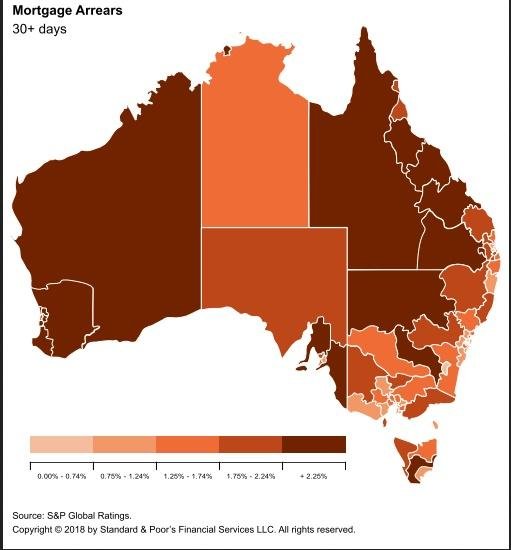

As you can see from the image, mortgage arrears are pretty low - and that is thanks to Australia's economy, which continues to grow, which in turn means that unemployment is low.

As long as people have jobs they will continue to pay their mortgages and will weather the storm.

However, Australia is dependent on selling raw materials like copper and iron to China - so they are exposed to the trade war between the USA and China.

So what caused the drop in prices?

One element is that they just got too top-heavy. Australians were finding it harder and harder to afford to buy a home, and some had just given up even saving for a deposit, opting instead to rent. In addition, the Chinese government has finally managed to enforce it's capital controls, which means less Chinese money is entering the Australian property market. Combine that with extra taxes on foreign purchases levied by cities like Sydney and Melbourne, and you get a cooling of foreign interest.

The Foreign Investment Review Board (FIRB) said that in 2016/17 foreign property purchases of residential property totalled 25 billion Australian dollars, down from 72 billion Australian dollars the year before. It's likely that has fallen back even further this year.

Australia is an important test case: can you cool a housing market without it affecting the underlying economy?

House prices are falling in London as well - though in London I suspect that frightened foreign investors are selling and trying to get their money out before Brexit.