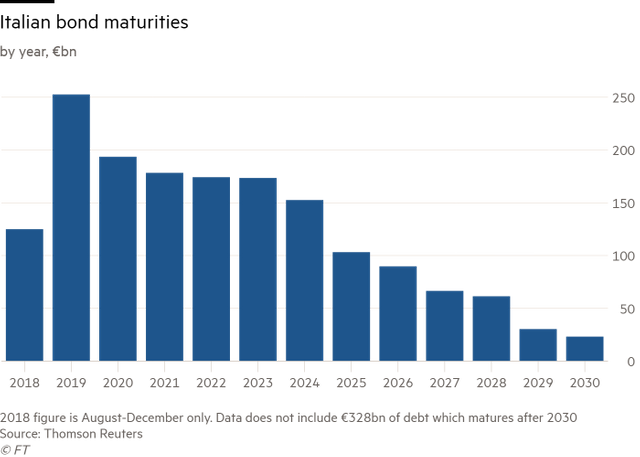

About five months ago I posted an article, which explained Italy's steps out of the euro. It included the following graph:

This is what I wrote:

The above graph shows the maturity profile of Italy's govt debt, and as you can see, most of it is very short term (in contrast to a country like the UK which prefers long term debt).

One reason the UK bond markets were unphased by Brexit is because the govt had already ensured that most of it's debt had long maturities and there wasn't a lot of debt that needed refinancing. The fact that the budget deficit narrowed sharply this year was just a happy surprise on top.

Italy on the other hand hasn't managed it's profile too well. Because of the huge amount of debt that needs refinancing in 2019, they dare not upset the markets with a risky budget this year.

If I was Finance secretary Tria, I'd produce as boring a budget as possible, and focus on changing the maturity profile of my debt. When they roll over the 2019 maturities, they need to do it with longer maturity dates to give themselves a five year breathing room where they don't need to do any rollovers or new borrowing, and are thus given the space to take a few risks.

Well, Italy managed to get it's budget approved by the EU Commission (with help from France which blew it's budget on appeasing the gilet jaunes and made Italy look prudent - the Commission had to choose between coming down hard on France as well or letting Italy off, and they chose the latter).

The next stage for the Italians is to roll over their existing debt with longer term maturities. And lo and behold, just as predicted, they're doing just that.

In mid January Italy successfully issued a 16 year bond. This month they are trying for a 30 year bond.

The idea is to refinance the debt that is maturing this year, and do it with long redemption times, so that they don't have to constantly face roll-over risk, which will give them room to plan their exit from the euro.

My prediction: after they have got through 2019 and refinanced all debt with long maturities, they will issue their parallel currency the mini-bot in 2020. Then they will let existing debt run off the books and issue most of their new debt in mini-bots (which are basically pepetual bonds of 1 euro each that never need to be redeemed, in order words a new currency). Once the mini-bots are the main currency in circulation and the existing euro debt has been paid down, it is simple to switch out of the euro. The whole thing will take about ten years.

I think the EU has underestimated just how smart the current Italian govt are. The Italians have a plan and thus far they appear to be executing it step by step.

For an explanation of the mini-bot, see the following article: https://steemit.com/busy/@teatree/is-the-new-italian-government-planning-to-introduce-a-parallel-currency

Hello @teatree! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko