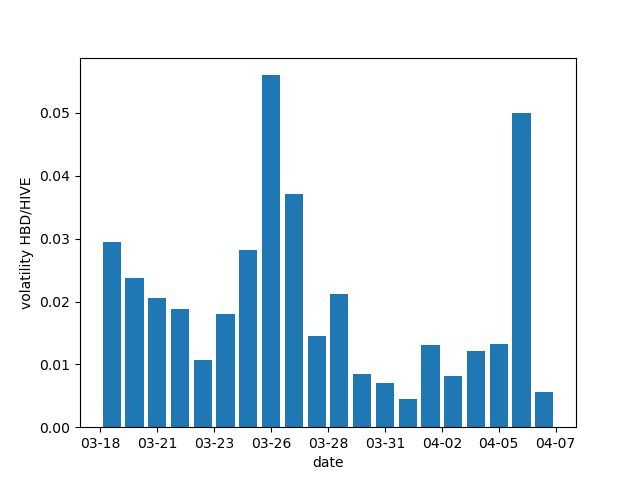

Now I can compute volatility for the internal market. Here is the one hour scale per day volatility:

I forgot when Hive launched so I am probably picking up on some Steem data. I am also guessing that computing volatility on day basis might not be so useful. Maybe 5 min per hour? Maybe implied volatility would be interesting too but I am not sure what to reference HBD/HIVE against. Maybe Bitcoin/Ethereum?

Btc and USD, iyam.

Btc for the future, and USD for the past.

Most people will fall in those two.

I am mostly interested in the smaller cryptos. More specifically, my aim would be to have a robust trading method for Hive, Hbd and some of the big guys. I am not sure how BTC/USD affects crypto-economies within crypto so I was thinking of restricting everything to crypto. But I am absolutely new to trading cryptos so I am not sure what I am doing.

Yes, pricing in crypto is the way to go, but the readers will be better able to understand the price in dollars.

I'm still for both.

Implied volatility probably makes the most sense.

Implied volatility for Hbd should be interesting since you have the option to convert it to Hive but then I would have find/create a pricing equation.

I think you should set HBD equal to 1 and calculate the implied volatility of Hive only.

HBD is set to 1 for the witness price feeds. Hive price is derived as an exchange rate with regards to HBD = 1.

Check me out witnessing and setting prices as an example:

https://www.hiveblockexplorer.com/tx/e5d5a575446c8b0fd1750eff8f4855a71ad95a77

It looks prettier if you look at my last feed publish here:

https://www.hiveblockexplorer.com/@blue-witness

:D

Congrats on the witnessing.

This seems like a chicken and egg problem. It is possible to view Hive as the asset and HBD as the option and vice versa.

Hahahaha! I didn't want to impress you with my witnessing. Just wanted to point out that HBD is always assumed as 1. Hive is the only thing moving. That means you can calculate an internal Hive price from that relationship and get your implied volatility. ;)

oh haha. :o) I think we might have different definitions of implied volatility. Yours is volatility of the market versus feed price? And mine is volatility of an option contract with the contract being the ability to convert HBD to HIVE. The conversion rate is determined by the feed price but because conversion takes 3.5 days it is different.

Fucking geeks

Where's the cat :))

It died :(

Please tell me this is not true

Haha, it's not true. I think. I am just messing with you 😂

:))

Thanks 🐈

^-^ it is still alive. Proof in my new post