Background

I am passionate about designing investment and trading strategies using AI and data analytics. In my spare time, I am doing it since 1993 when I had my first stock market success from an IPO. And being a geophysicist by education and profession - it is in me to enjoy working on ill-posed problems.

I have designed and run a successful trading strategy for Indian stock market using proprietary computations on options data , AI, and cloud computing using lambda functions of AWS for one full year (2016-2017). I also designed and run stock investment strategy, using AI with fundamental and price data, for two years (2015-2017). The results are published on my website vulturespick.

In 2017 my interest switched to crypto world and since then I have been trying to develop a reasonably reliable crypto trading system.Options on crypto are in infant stage with very low liquidity and so not useful as of now. So with my experience from stock market based research - I kept looking for some additional data beyond OHLCV before I embark upon designing the strategy.

And that is when I realized that data on blockchain of any asset itself is important as it provides other important information about market participants beyond OHLCV. I tried developing tools to get relevant information from blockchain of crypto assets.

But then I came across Santiment. Santiment is a dApp that runs on Ethereum blockchain and it provides blockchain data for any ERC20 asset along with OHLCV plus social discussion volume, gitbub activity etc. The data can be accessed through their API sanpy. This is very important information for me and saved me development time/cost.

The data that one can access from sanpy is - Open, close, high, low, volume, marketCap, outInDifference, activeAddresses, burnRate, activity, mentionsCount.

Methodology

I used very simple SMA (simple moving average) based methodology to evaluate if the additional data beyond OHLCV has any value. Below is the description about how i analyzed:

- Downloaded EOD data for 10 crypto assets for last 365 days

- A trading signal is computed for each field for a crypto asset using simple moving average crossover. That is if SMA of short window is > SMA of large window then BUY signal and if SMA of short window is < SMA of large window then SELL signal

- The trading signals from step 2 from different fields (Total 11) are combined to produce one trading signal such that if all are buy then buy and if all are sell then sell.

- The trading signals from step3 for each asset (total 10) are combined to produce one trading signal by simply adding all of them.

- The small and large window sizes are varied in a range 2-5 and 2-9 to know which combination produces maximum profit. A brokerage of 0.5% is applied. In charts below these results are marked with "With Santiment Fields"

- Same step 2-5 are repeated but only for using OHLCV fields for each asset. In charts below these results are marked with "Without Santiment Fields"

- Above analysis from step 1-6 is repeated for hourly sampled data for last 15 days, and 10 minute sampled data for last three days

- A starting equity of 1000$ is used.

Results

Results are presented below in three sections named - EOD, Hourly, and 10Minute.

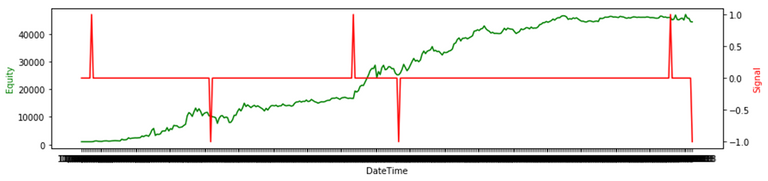

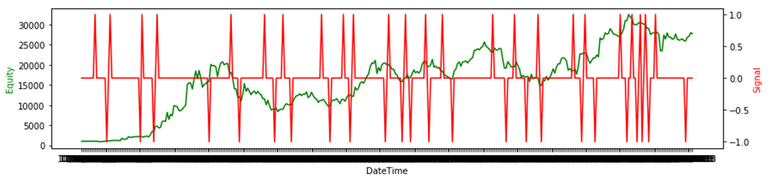

EOD

The results are given below in two charts. First chart shows gain in equity with final trading signal "with santiment fields". And second chart below it shows gain in equity with final trading signal "without santiment fields".

Window parameters from scanning are Short Window=2, Long Window=5

Start Equity= 1000, End Equity = 44313, Number of Trades=6

Window parameters from scanning are Short Window=6, Long Window=7

Start Equity= 1000, End Equity = 27768, Number of Trades=48

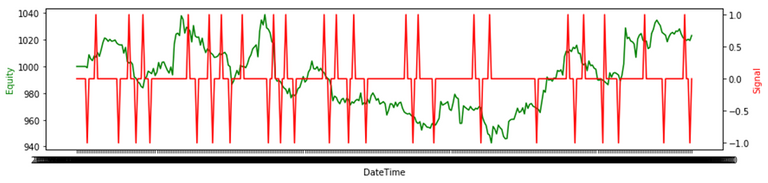

Hourly

The results are given below in two charts. First chart shows gain in equity with final trading signal "with santiment fields". And second chart below it shows gain in equity with final trading signal "without santiment fields".

Window parameters from scanning are Short Window=6, Long Window=12

Start Equity= 1000, End Equity = 1067, Number of Trades=8

Window parameters from scanning are Short Window=3, Long Window=5

Start Equity= 1000, End Equity = 1023, Number of Trades=43

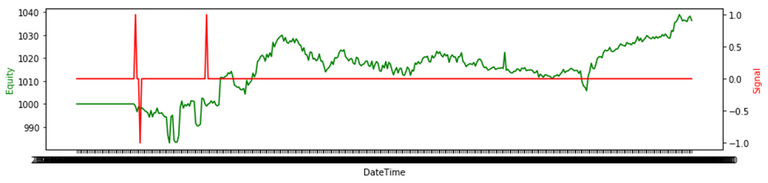

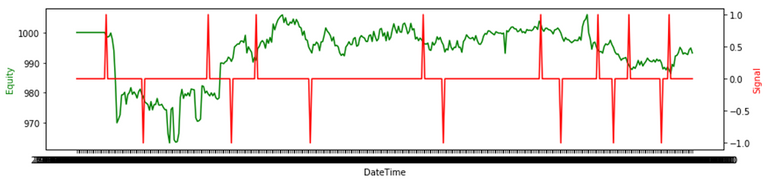

10 Minute

The results are given below in two charts. First chart shows gain in equity with final trading signal "with santiment fields". And second chart below it shows gain in equity with final trading signal "without santiment fields".

Window parameters from scanning are Short Window=6, Long Window=8

Start Equity= 1000, End Equity = 1036, Number of Trades=3

Window parameters from scanning are Short Window=7, Long Window=18

Start Equity= 1000, End Equity = 993, Number of Trades=15

Analysis

Looking at results we can make below observations

- Number of trades reduce significantly when Santiment fields are used

- In all the three data sets (differently sampled data, and different time zones) the profitability increases significantly when Santiment fields are used

Conclusion

Any successful trading signal has to have less number of trades and we do see that trading signal with santiment data does reduce number of trades and has much higher profit across all three sampling and time frames.

We believe the results are encouraging and more testing is needed including use of AI and more complex trading strategies to increase profitability and minimize the return volatility.

I invite your comments, suggestions, and feedbacks.

You should indicate your strategy vs hold

methodology results are way better than buy and hold so did not feel it necessary.

Congratulations, your post received 42.95% up vote form @spydo courtesy of @prameshtyagi! I hope, my gratitude will help you getting more visibility.

You can also earn by making delegation. Click here to delegate to @spydo and earn 95% daily reward payout! Follow this link to know more about delegation benefits.

You got a 40.74% upvote from @redlambo courtesy of @prameshtyagi! Make sure to use tag #redlambo to be considered for the curation post!

Great post!

Thanks for tasting the eden!

You have been defended with a 44.43% upvote!

I was summoned by @prameshtyagi.

You got a 34.27% upvote from @upmewhale courtesy of @prameshtyagi!

Earn 100% earning payout by delegating SP to @upmewhale. Visit http://www.upmewhale.com for details!

This post has received a 47.89 % upvote from @boomerang.

You got a 40.25% upvote from @joeparys! Thank you for your support of our services. To continue your support, please follow and delegate Steem power to @joeparys for daily steem and steem dollar payouts!

BOING! You got a 32.51% upvote from @boinger courtesy of @prameshtyagi!

Earn daily payouts by delegating to Boinger! We pay out 100% of STEEM/SBD!

You got a 37.33% upvote from @emperorofnaps courtesy of @prameshtyagi!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

You got a 39.26% upvote from @oceanwhale courtesy of @prameshtyagi! Earn 100% earning payout by delegating SP to @oceanwhale. Visit www.OceanWhaleBot.com for details!

Congratulations @prameshtyagi!

Your post was mentioned in the Steemit Hit Parade in the following category:

Data improves any kind of decision making.

that is right. thnx

This user is on the @buildawhale blacklist for one or more of the following reasons: