Nowadays, nobody would think of protecting anything of value using laser beams, when you can get a good movement detector for less than $50. But back in the day laser beams were a fixture in thrillers, such as the well known "Entrapment (1999)", featuring Catherine Zeta-Jones (Cathy) and Sean Connery.

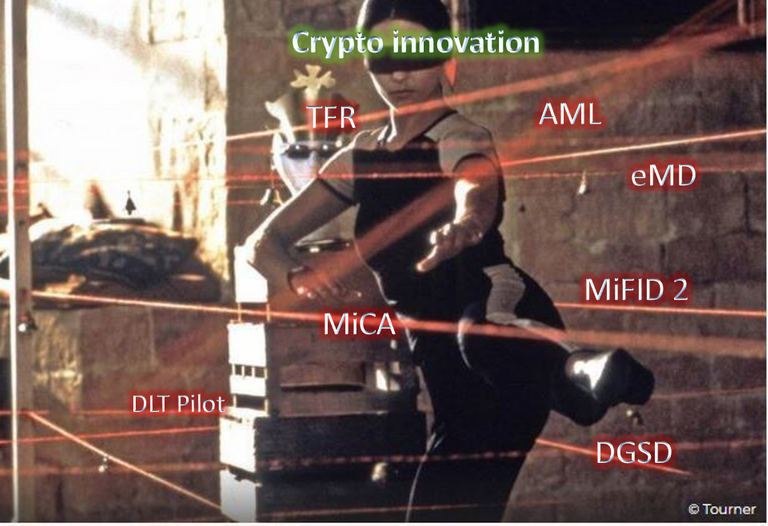

If blockchain and crypto innovation are to bring the benefits of digital finance to European consumers and businesses, they will need to navigate carefully a thicket of national laws, european directives and regulations, of which MiCA is only the latest, but by far not the only one.

Patrick ("Paddy") Hansen, a German who has long tweeted about crypto policy in Europe and now works as a Director, EU strategy & policy at Circle, has recently posted a comprehensive review of the MiCA Regulation. I started commenting on it in my previous post and I aim to wrap it up in this post.

MiCA's rules

Paddy starts this chapter by observing how MiCA sits within the existing regulatory framework. For parts of the proteiformous cryptoverse, such as tokenized securities, "Markets in Financial Instruments Directive II" (MiFID II) clearly applies and MiCA states as much from the beginning. Moreover, many MiCA commentators have noted a distinctive intellectual kinship between MiCA and MiFID II.

But MiCA extends its oversight to "centralized" stablecoins such as Tether or USDC with a title dedicated to "electronic money tokens" (EMT) where it bridges over with the "E-Money Directive" (eMD). Counter-terrorism and money laundering concerns are addressed in the "Transfer of Funds Regulation" (TFR) and the proposed "Anti Money Laundering Regulation" (AML) (slated to replace the successive Directives), and MiCA does not overlap with those, nor does it try to cover deposits, which fall under the Deposit Guarantee Schemes Directive (DGSD). MiCA is accompanied (as part of a "package of measures") by the smaller and more specific "DLT Pilot Regime" regulation.

It is quite interesting to note that Paddy ends this short panorama of the regulatory framework by paraphrasing Tolkien's "Lord of the Rings":

While paraphrasing, the choice to keep the word "darkness" might (or might not) be revealing of his views on MiCA. To get a better understanding of Paddy's views, I can only recommend you read his previous acclaimed article, published in the Stanford Law School blogs, when he has not yet a EU Strategy and Policy Director for a big US crypto business.

Crypto-asset taxonomy

MiCA usefully introduces a crypto-asset taxonomy. However, most of the definitions remain open to interpretation, so they might need further clarification from subsequent "delegated" and "implementing" acts as well as "regulatory technical standards" which are going to be developed over the next 18 months by ESMA and EBA

At this point, suffices to say that MiCA focuses on three main categories:

- Crypto-assets (other than ARTs and EMTs)

1.1. A sub-category identified here is the "utility tokens" - Asset Referenced Tokens (ARTs, and "significant ARTs") - as revealed in my previous article, I am unable to identify even one ART currently in the market, nor have I heard of any being prepared. As Paddy explains, the extensive treatment given by MiCA to a non-existent category is a tribute to Facebook's original "Libra" project, which would have fallen in this category.

- Electronic Money Tokens (EMTs and "significant EMTs") - in this category we have the classical "centralized stablecoins" such as Tether and USDC

Paddy discusses the various categories and dedicates significant space to discussing the requirements for issuers, starting with the issuers of crypto-assets (other than ARTs and EMTs).

His conclusion is that

Overall, these [...] disclosure requirements for issuers of crypto-assets seem reasonable and measured, and won't pose an insurmontable challenge for most projects.

I agree with this assessement, but these requirements are certain to raise costs for issuers. A very simple workaround for innovators on a scrappy budget would then consist in issuing in another jurisdiction which imposes less costs, and only coming to Europe once they can afford it. Basically, MiCA "prices out" all but those who can afford the extra regulatory costs, thus decreasing the chances that the "Google of crypto" will spawn in Europe.

I think it's useful at this point to contrast the EU legislators' approach with that of US lawmakers, referring again to the hearings in front of the Joint Economic Committee (JEC) of the United States Congress from May 22, 2018, titled "Breaking through the regulatory barrier: what red tape means for the innovation economy".

Thus in his testimony, Dr. J. Kennedy encourages the regulators to follow a set of principles the fourth of which reads:

... place more emphasis on reducing the cost of overregulation. Regulators should actively seek input from industry and major stakeholders on ways to reduce the cost of compliance without affecting public goals.

Wasn't an increase in the cost of compliance inevitable, you might say? Well, no, as on the other hand Europe pours billions into "research and innovation" through bureaucratic structures such as the "European Innovation Council" (EIC). It might have been smarter to slightly reduce such budgets and offer "vouchers" to cover the regulatory costs imposed by MiCA (like a "social transfer" for innovators). BTW, such vouchers could have been issued on a public, permissionless blockchain ...

The elephant in the room

I have read and re-read his review and am still puzzled that he doesn't directly confronts "the elephant in the room": all issuers of crypto-assets have to be legal entities, or else exchanging a newly created crypto-asset for another crypto-asset or fiat money would not be legal.

That might not seem such a big deal until you realize that:

- We wouldn't be talking about "crypto-assets" and their regulation today if not for Bitcoin.

- Bitcoin, Ethereum and many other cryptocurrencies being traded today have not been issued by "legal entities", but by pseudonymous persons or groups of persons, who went to great lengths so as not to be identifiable as "legally responsible".

In other words, if MiCA's provisions had been applied, nobody could have legally offered Bitcoin, Ethereum, Litecoin, Dash, ZCash, Decred, Doge and many other "early era" cryptos for sale in Europe. In other words, if the regulators all over the world had insisted in applying, between 2010 and 2015, the provisions which MiCA todays lies down in writing, the cryptoverse would not have existed, the blockchain and crypto innovation would not have happened.

At any rate, with MiCA in force, the law guarantees that such innovation - people who have no particular confidence in each other collaborate without having to go through a neutral central authority - could not happen anymore, at least not in the EU. In other words Europe is closed to decentralized, permissionless innovation!

To paraphrase another witness in the above testimony before the US Congress:

"Discouraging this type of innovation in Europe [was: the United States] doesn't necessarily mean this innovation will not occur. Rather than fighting with regulators, innovators will simply go where they are welcome. This is what my colleague Adam Thierer refers to as 'innovation arbitrage.'"

If the MiCA-mandated provisions had been applied all over the world, nobody could have legally offered Bitcoin or Ethereum for sale. In other words, there would have been no "crypto-assets today", no blockchain nor crypto innovation!

It is perhaps this realisation that made Paddy keep the original word used by Tolkien in Lord of the Rings: darkness.

Discouraging euro stablecoins

However, if that seems too alarmist to you, it doesn't stop there. The EMTs are subject to strict limitations, which might seem familiar and uncontroversial to the traditional financial actors but strike any crypto innovator as arbitrary and innovation killing, such as the interdiction of trying to come up with innovative exchange-risk management methods (reserves can only be held in the currency of reference), the interdiction to offer interest on EMTs (why ?) and other conditions which can be read either as:

- babysitting the consumers, treating them like children unable to understand the information provided, or

- trying to raise a regulatory barrier in order to protect the incumbent big banks and other traditional actors from the crypto competition.

Or perhaps both ...

In his previous article in the SLS Blogs to which I refer above, Paddy Hansen was writing:

stablecoins will play a major role in the future of payments. The current proposed EU rules for crypto (MiCA) will effectively suppress EURO-denominated stablecoins even before the emergence of this market.

If the EU wants the EURO to play a major role in the future of global payments, stifling EURO-backed stablecoins is literally the opposite of what should be done.

ICO prohibition

There are other requirements which make one think that the EU legislator, perhaps with a little nudge from the lobbyists, really wanted to rein in any competition to traditional banks.

Thus Article 9(2) of Title II stipulates that:

Issuers of crypto-assets, other than asset-referenced tokens or e-money tokens, that set a time limit for their offer to the public of crypto-assets shall have effective arrangements in place to monitor and safeguard the funds, or other crypto-assets, raised during such offer. For that purpose, such issuers shall ensure that the funds or other crypto-assets collected during the offer to the public are kept in custody by either of the following:

(a) a credit institution, where the funds raised during the offer to the public takes the form of fiat currency;

(b) a crypto-asset service provider authorised for the custody and administration of crypto-assets on behalf of third parties.

Now let's go back a bit to the 2017 - 2018 era and think of ICOs. You'd write a whitepaper and deploy an ERC-20 smart contract on Ethereum. People who'd read your whitepaper and wanted to participate would have sent ETH to the smart contract ("crypto-assets collected during the offer to the public") and the smart contract would have credited them back with your newly minted token.

Where would the "crypto-assets collected during the offer to the public" be "held in custody"? On the blockchain itself, in a smart contract, NOT by a "crypto-asset service provider authorised for the custody and administration of crypto-assets on behalf of third parties." The public, permissionless blockchain, a "non legal entity", non authorised by anyone for anything, was providing custody of the assets. That was part of the real innovation!

Thus again, this MiCA article effectively prohibits classical ICOs, and prohibits decentralized and permissionless innovation by requiring that a "trusted third party" acts as a "gatekeeper" or "chaperone".

To make sure ICO's, such as those that oversaw billions of capital flowing toward crypto projects such as Ethereum, Tezos, EOS, and many others are dead for good, Art. 12 introduces a "Right of withdrawal" which stipulates that

"Consumers shall have a period of 14 calendar days to withdraw their agreement to purchase those crypto-assets without incurring any cost and without giving reasons."

"2. All payments received from a consumer, including, if applicable, any charges, shall be reimbursed ..."

Now that might seem to a casual reader like nothing special and just the application of the same rules as in the fiat-based, traditional finance. However, to those who have even a superficial knowledge of ICOs, it might raise an alarm bell.

Indeed, in exchange for providing aspiring innovators with no means with "custody services" and "secure systems" (see below), the blockchain often compensates the "miners" / "validators" through transaction fees, which are proportional to the "total addressable market" of a blockchain. Thus for an innovator to be able to reach the vast numbers using the popular Ethereum blockchain, the transaction fees for this blockchain are particularly high. In this instance, what Art.12 implies is that the issuers of crypto-assets will need to incur the costs of the two transactions (subscription and withdrawal) so as to make indecisive customers full.

To put another nail in the coffin of the original ICOs, Art. 13(1) of the same title adds:

- Issuers of crypto-assets, [other than ARTs or EMTs] shall:

[...]

d) maintain all of their systems and security access protocols to appropriate Union standards

These "appropriate Union Standards" are going to be defined later, but ... wait a minute ... if you think again of the 2017 - 2018 ICOs, many project teams had, at the time of the ICO no money and no systems to speak of. Their system was the blockchain itself! That was part of the real innovation!

This MiCA provision seems bent on preventing frugal innovation from happening in Europe.

All clear for the incumbents

The whole MiCA can basically be reduced to:

- banning from Europe any decentralized and permissionless innovation: chaining blocs of data and circulating crypto-assets can only be done through classical business arrangements using "trusted third parties".

- overwhelming aspirant-new-entrants with costs, delays and regulatory risks, many of which the incumbent "credit institutions" and existing "e-money institutions" will be exempted from.

MiCA's impact

Paddy's latest chapters look at the potential impact MiCA will have in the EU and beyond. One clear silver lining is that "MiCA will, in all likelihood, lead to more institutional adoption and activity in the EU crypto market." He expects "major European banks to roll-out crypto-asset services in the next 48 months, be it custody, exchange, or issuance of [...] stablecoins."

However, the clouds are also clearly identified:

The worst case scenario is one where only a minority of EU crypto startups manage to shoulder the substantive legal and compliance costs during an ongoing bear market, stablecoin issuers make a big detour around the EU, and exchanges face overly burdensome disclosure requirements and liabilities that don’t benefit consumers and make their offerings uncompetitive compared to their offshore counterparts. EU consumers would either be cut off from innovation or continue to use (and be exposed to) the largest offshore pools of liquidity and utility.

Crypto innovation in Europe

"I was prepared for everything ... except YOU!" ... if only the real world worked like Hollywood movies ...

The close analysis of MiCA has revealed that it is a law deeply adversarial to innovation, contrary to the claims of the legislator. Unlike Hollywood movies such as "Entrapment" (1999), where Cathy successfully manages to reach her goal despite the laser beams, things in the real world do not always have a "happy ending".

"In other words, if the regulators had insisted in applying, between 2010 and 2015, the provisions which MiCA todays lies down in writing, the cryptoverse would not have existed, the blockchain and crypto innovation would not have happened."

I disagree a bit with this statement. Instead, of "killing" crypto, I think crypto already had enough momentum at that time to not be stopped by legislature. If anything Definitely would probably have been invented earlier to get around it. The coming restrictions will once again be a catalyst for innovation imo. DeFi cannot be regulated and is definitely one important highway for future crypto

Keep in mind that the very first "real-world fiat transaction" which ever happened was on May 22, 2010 (the famous 2 pizzas). If MiCA had been in force on 2010 there could have been no Bitstamp (which began in Europe) because no crypto-asset exchange could have exchanged Bitcoin for fiat. By design, Bitcoin has no "legal entity" which could qualify as an "issuer".

Selling Bitcoin for ever increasing sums of fiat money is what brought needed investment and allowed crypto to develop. Otherwise, it would have remained a toy project for cryptography geeks.

Yes, of course, Bitcoin could have been sold for fiat outside the EU jurisdiction, but for the purposes of this article I'm looking from the point of view of Europe.

If not for Bitcoin, a lot of us will not know about any cryptocurrency or even learn about it today. I believe that Bitcoin paved way for every other cryptocurrency...

More than that, Bitcoin created the category and gave the very definition of "cryptocurrency"

This prompted me to have a look at what's happening in the UK.

I can see there has been consultation and a similar approach to the EU to there having to be some sort of legal entity that can be registered with the FCA (Financial Conduct Authority, the UK regulatory body), and cryptoassets are being viewed as another category of financial instruments/services. It looks like entities that are not registered will be prohibited from advertising, but none of the consultation appears to consider non-entities like Hive.

There is some regard for the opportunity for innovation with blockchain technology and London has one of the largest blockchain industries outside Silicon Valley.

I haven't investigated yet the Data Protection and Digital Information or the Online Safety Bills and how these might impinge on cryptocurrencies, but the UK is ever the opportunist and, as it is quite happy to welcome oligarchs from around the globe and launder their monies with impunity and protect them with the rule of law, and we still retain offshore dependencies and protectorates, I am confident that the UK government will find ways to make cryptocurrencies available to the wealthy.

Interestingly, and indicative of the opportunistic attitude that prevails, cryptocurrencies have already been brought into the UK's tax system.

Yes, exactly, a HUGE difference: in the EU you can't sell a crypto-asset which you created if you are not a LE. In the UK, you simply are not allowed to advertise it!

Oh blimey, there is possibly a benefit to Brexit?

yes ! :)

As I wrote in one of my posts, it is likely the involvement of Wall Street, banks in general, VCs, and now regulators will eventually bury the ideas from bitcoin's whitepaper, from where everything started.

"bury" or "borrow" ? îngropa sau împrumuta ?

Bury! Bitcoin's whitepaper was, in part, a manifesto against such institutions, organizations, etc. A way to build an alternative system. With their deeper involvement, the two worlds will eventually merge, and I don't see them merging onto the progressive side of things.

great

Thank you

Congratulations @sorin.cristescu! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 85000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!