Are cryptocurrencies just a vehicle for unsound and highly volatile speculative investment schemes?

Authorities have always been uneasy toward bitcoin and its suite of emulators (the other "cryptocurrencies"). Depending on the place and moment in time, the authorities' attitude swinged from benign ignorance to resolute bans and back. Even though they probably didn't understand the technology, they often appeared to understand how an autonomous system of financial assets could challenge the existing financial hierarchies which they control.

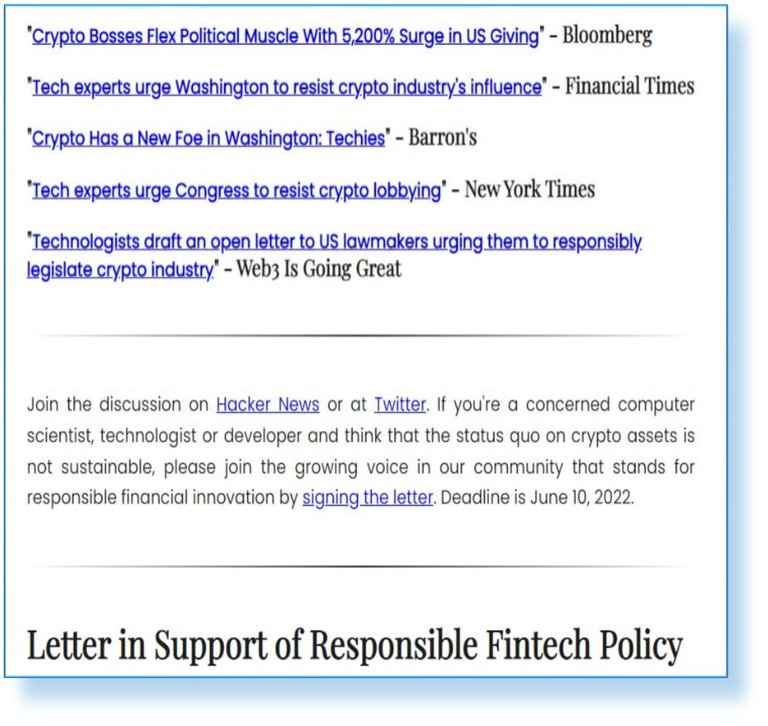

Lately though, a hostile grassroot movement of mostly computer scientists and known IT developers has taken shape and began agitating against bitcoin and anything "crypto"-related.

Are we facing a watershed moment?

I found the letter to be poorly written, intellectually muddled and strongly biased. But we have no right to dismiss it out of hand

Bitcoin and its intellectual progeny (the "cryptocurrencies") sprang into existence as a grassroot movement itself: of techies against the financially- and politically-powerful. It attracted people who saw in it a promise to restore the balance of power and control, and to offer a tool defending the meek against abuses of power. Those who joined the community were implicitly holding the moral high-ground. They believed that, in time, more and more people will understand what bitcoin did and were going to join too.

This letter, though, marks a reversal: for the first time, the raise of bitcoin and crypto cannot be cast anymore as a clear struggle between the meek and the powerful. For the first time, regular people appear to be siding with the authorities and are voicing opposition to cryptocurrencies.

Although the letter's arguments are muddled and lopsided, some of the criticism is justified (for a level-headed debunking, you might want to read Preston Byrne's analysis).

How did we get here and what does this mean?

Bitcoin succeeded technologically but failed as "peer-to-peer electronic cash"

For a decade-long obsever, the "cryptoverse" which Bitcoin opened has evolved a lot during the past ten years, and not only in good ways. Bitcoin itself failed in many ways (while succeeding in others). At the risk of upsetting many Bitcoin fans (among which I count myself), its assessment by The Economist back in 2011 still stands true.

"Bitcoin is technically sophisticated. As a monetary system, it looks primitive"

Indeed, for Bitcoin to really play its role as a "peer-to-peer electronic cash system", Satoshi wanted everybody to be able to earn it by mining with their CPUs. That proved a bit naïve as quite rapidly the bitcoin mining industry became concentrated in the hands of quasi-industrial actors who were able to invest heavily. As a consequence the little guy was left with no other choice but to buy bitcoin from them, using fiat currency - the only currency everybody could earn with their hard labour and no capital outlay.

The fact that little to no economic activity was denominated in Bitcoin made its price "untethered" and subject to wild short-term swings. Meanwhile its strongly deflationary nature combined that short-term volatility with a long-term appreciating tendency. Together, the two factors strongly weighed against bitcoin's usage as a means of exchange:

- for commerce, you need to exchange a currency rapidly: you invoice your customers and pay your suppliers and your workforce; and for that in turn you need the value of a currency to remain as stable as possible against a large basket of goods. It's not for nothing that the mandate of Central Banks often revolves around "price stability"

- the long-term tendency of an asset to appreciate in value discourages its circulation and encourages saving rather than borrowing or spending.

Notwithstanding the refusal of many Bitcoin fans (the so-called "maxis") to understand basic economics, Gresham's law is not less true: "Bad money" (i.e. money which depreciates in value) drives out good (i.e. sound money, money which keeps its value or even increases it over time). That leads to a somewhat paradoxical result: Bitcoin failed in its mission of becoming "peer to peer cash" because it is ... too good!

Therefore, while technically sophisticated, we can today say that its rudimentary economic mechanism design made Bitcoin fail as "peer to peer electronic cash system"

As many or most of the "cryptocurrency" progeny it inspired were created by techies intoxicated with its technological beauty, it is relatively hard today to point to a better designed "currency" (but more on that later). Its most successful heir, Ethereum chose not to improve bitcoin's economic mechanism design but rather took the technology into a totally different direction, that of "trustless computation", a territory where the techies were naturally better equipped to innovate.

Ethereum implemented a fundamentally-flawed economic mechanism design

Because a 20-year old computer prodigy cannot be expected to have as solid a grasp of economics as he has of programming, the Ethereum economic mechanism design "put the worm inside the apple" by pitting the incentives of miners against those of the users. I explained this (and more) in greater detail in a previous analysis.

The fact that, unlike bitcoin miners, Ethereum miners earn vastly more from the fees of complex transactions (the "smart contracts") than they earn from block rewards, combined with their ability to ransom users for high fees by being free to pick and choose from the mempool what transaction to include in the next block (basically auctioning block space) based on the fees bidden, led to Ethereum becoming practically unusable for normal users and the playground of the crypto-rich.

This certainly belied the initial promise of these systems as more democratic and closer to the people than the financial system they professed to have in their aim. It thus appeared that they are yet another exploitative tool helping the computer-proficient to get rich on the back of enthusiastic but not as astute users.

Add to this the fact that Ethereum miners, thanks to their anonymity (shielding them from personal responsibility) and privileged access to the mempool became a special nomenklatura and you might understand why some people have started to warn the unassuming before late.

Ethereum is a dark forest - a horror story

Smart contracts without personal responsibility = licence to steal money

But that was only a tenth of the harm Ethereum unleashed on the unsuspecting. By allowing anyone to deploy smart contracts while hidden behind an anonymous address, it basically started handing "licences to steal". This became apparent at first in the 2017 ICO-boom where everybody and their dogs were able to make outrageous claims and then open a smart contract distributing a token in exchange for valuable ether. As the authorities started signalling unease, the ICO boom turned into a bust. Most tokens proved in time to be useless, as projects failed, either because of adverse market conditions or because they were badly thought out or downright fraudulent in the first place.

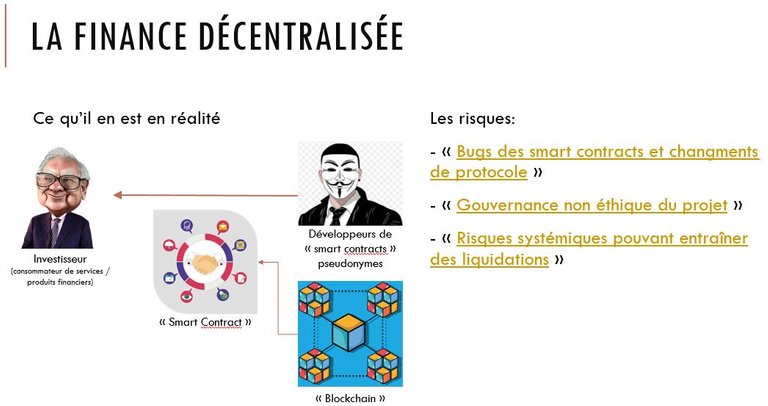

The phenomenon was amplified by the 2020 boom in "decentralized finance" ("DeFi"). As I explained at length in a series of three bilingual posts, DeFi on anonymous blockchain systems is at heart a con act as behind "the blockchain" label hide in reality anonymous coders, about which there is no way to tell (before it's too late) whether they are acting in good faith or merely preparing a "rug pull".

In this setup, the claim that "smart contracts can be audited" is a fig leaf as only the most skilled developers would have the knowledge needed to analyze the code by themselves, all the others needing to rely on the otherwise despised "trusted third parties".

Ethereum imitators amplified the problem

As we can see from the many scams and rug pulls and hacks affecting many of the newer blockchain platforms from Solana to Fantom, the same causes lead to the same result.

Are the critics right?

After reading the damning description of the many flaws in the current cryptoverse above, one might be inclined to think that, despite the detailed rebuttals, the undersigned of the "Responsible Fintech Policy" letter have a point. Can crypto be redeemed?

Personal responsibility is the answer

As I said in the past, the key flaw in the current crypto designs is the lack of personal responsibility which stems from anonymity. Anonimity was (and probably still is) indispensable to Bitcoin, which would not have survived to become "the exit machine" of today. But while Bitcoin had and still has a clear purpose, its imitators were, with a few exceptions, just exercises in technology craftsmanship. They focused on solving technical challenges, such as "the blockchain trilemma" while leaving to smart-contract developers to worry about addressing actual social and economic problems. That would have been a reasonable approach ... had those developers not been also offered anonymity ... Holding them accountable for the code they deployed and invited users to utilize was and still is almost impossible.

In a universe that has spawned on the back of a simple truth, "People respond to incentives", can anyone be surprised that lack of accountability attracted technically skilled chancers with no morale trying to pull off a con for a quick buck?

As governments have the monopoly on monetary issuance, Satoshi knew that they will try to censor Bitcoin. Anonimity was needed in order to make bitcoin resistant to censorship. Much has changed since 2009 and governments seem to have accepted that they have to let Bitcoin live. They starting crafting legal frameworks to accomodate it and its kin, the cryptocurrencies. Most modern cryptocurrencies are not as censorship resistant as Bitcoin, their best protection is ... bitcoin itself, whose aura alone convinced would be censors to make a place for blockchain-based IT systems and let them live.

Do modern cryptocurrencies still need anonimity ? And to what extent (the anonimity offered by Hive is not quite as impenetrable as that of Monero)?

I argue that this is the biggest trade-off for new cryptocurrency systems going forward: moving from a "censorship resistant" ideology to one of "community". In a community you know and care for your fellows, your neighbors, your brothers. Anonimity prevents emotional bonding as transactions are between strings of numbers only loosely attached to actual people. I care for my fellow Gabriela. Nobody would feel anything for STM7YGeiUNLVwe9YAfiFZvCbavofLCapC2vmQxSoUWQwSr5DVQ2VK, her public key. Interacting anonymously protects you in an environment deemed hostile. But if you want to build a community, you need to meet and bond with people and learn their names

Conclusion

I argued years ago that "smart contracts" on "censorship resistant" (i.e. anonymous) blockchains make no sense and for the need to "reinvent blockchain". Crypto people laughed me out of the room. Normies shrugged.

Community is the biggest force of a good cryptocurrency.

And building community needs names, needs social events such as HiveFest. "STM7YGeiUNL..." and "STM8dFXTBcS..." might not be easily identified by law enforcement but they also cannot bond, cannot care for each other, cannot build a community. With names the "censorship resistance" is lost and has to be replaced with law abiding, censorable behaviours.

The current generation of bitcoin imitators will be rendered obsolete by "law abiding", permissioned blockchain systems which will revolutionize business and make government more accountable to citizens.

"I may have been early but I'm not wrong" - Christian Bale as Michael Burry in "The Big Short", 2015

This key STM7YGeiUNLVwe9YAfiFZvCbavofLCapC2vmQxSoUWQwSr5DVQ2VK looks quite sexy to me but it'll be darn hard to be able and remember this in order to address someone with that 😁 Yes, this was a joke comment but I took the article seriously. Yes, the Community is the biggest force of a good cryptocurrency but many times for outsiders this might not be the most important thing they're looking for. Without a good community, Hive would not have existed and a good community means they'll stick with Hive no matter if the price goes on the downside, the community is here to stay.

Thing is, many hivers still hail from the Bitcoin ideology of cryptoanarchy. Community needs names. Even avatars like drlobes are better than STM7YGeiUNLVwe9YAf ... but they make you vulnerable, a lot more easy to identify and locate by a hostile, malicious actor. So there's a trade-off - you either have "censorship resistance" or you have "community". Bitcoin is THE exception to this, but it's a singularity: bitcoin aggreagtes the community of people who don't want to be identified by name. Long term, there can't be two such communities

ah okay - so now privacy is the problem and not our archons

Privacy is not a problem. But you can't have your cake and eat it too, that was my point. Also, privacy is not black and white = there are degrees of privacy - with my name and profile picture I chose 0 privacy. You, as @woelfchen, have a bit more privacy. But if you were identified as

STM5AWhHUGamRtMwdA4wDecBm95ShiDn9dTy2LDLnMiT2gVCXqWbm you'd have even higher privacy, but I would be less able to feel that we are both members of the same community, I would have trouble caring for you, I would have trouble having any emotions interacting with "you" (when identified with public posting key)

I agree - especially in local context.. but do you think this also applies online?

People mostly don't even manage to get local community anymore..

Isnt it too dangerous to speak out freely what your masters dont like and just be cancelled into abyss?

It certainly is. I see at least two ways to deal with it, which are probably not exclusive: 1. speak freely under cover, and

Yay! 🤗

Your content has been boosted with Ecency Points, by @sorin.cristescu.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

This article gave me a very important insight into the crypto universe. Thanks for the excellent work!

Yay!👍 We collecting more Crypto. Reshared your post🔁