Web 3 is Not Going Great

There is a blog very popular among crypto skeptics which documents all the disasters going on in the crypto space. It's called Web 3 Is Going Just Great, and I recommend it to anyone to see just how prevalent scams and financial disasters are in the industry.

Faced with the sheer number and the sheer scale of failures, it is hard if not impossible to argue that the crypto ecosystem is a shambles. If crypto is supposed to be a savior to the problems we face in the existing financial system, why is it that all the worst excesses of the banking system seem to be replicated over and over in the crypto ecosystem? If Bitcoin is supposed to replace cash with peer to peer digital cash, why has its story kept changing from "Digital Cash" to "Store of Value" to "Uncorrelated financial asset" to "Laser Eyes Until $100,000" to "LOL Bitcoin is supposedly dead again".

How does a believer in the values of cryptocurrency justify continuing to support, invest and operate in the space?

The Ills Crypto Was Supposed To Save Us From

1. Money Printing and Devaluation By Corrupted Institutions

We have been told that Bitcoin and crypto would usher in an era of sound money, yet today the vast majority of trading by volume on crypto exchanges is with TetherUSD - a token backed by a company whose executive team hide their locations, who have a fake office in Hong Kong and no known real address, who "attest" to having the token fully backed by fiat currency and have promised over and over that they will release an audit for their reserves, but never do. They have also been found to have lied about their reserves, over and over.

Tether forms the backbone of the crypto exchange ecosystem and the vast majority of trading volume for all major cryptocurrencies. Even if you believe that they are holding sound reserves in earnest - putting so much trust in one small company with barely any employees or proven reserves is way worse than anything in the traditional financial system.

This is to say nothing of the other faulty stablecoins such as TerraUSD and their destabilizing effect on the ecosystem.

2. Fraud

Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable.

Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers.

Satoshi Nakamoto

The Bitcoin white paper makes use of the word "fraud" 3 times and the word "trust" 13 times. The core argument of why Bitcoin was necessary was to remove the cost burden imposed by the requirement of trust and the risk of fraud in online commerce.

Yet fraud is absolutely endemic in the crypto space today. In fact, crypto is the go-to tool for fraudsters of any kind today, because it helps them to take money from unsavvy victims in a way that is impossible to reverse and difficult to trace.

3. Cost

The cost of mediation increases transaction costs, limiting the

minimum practical transaction size and cutting off the possibility for small casual transactions

Satoshi Nakamoto

Low transaction costs were a central argument for crypto proponents for years and years. However as soon as any network started to actually approach limitations of scale, where competition for blockspace suddenly started to rise, crypto developers and proponents changed the story instead of improving the system. Now Bitcoin would be a "settlement layer" and allowed to be of high cost, and people would have to find alternatives, especially "layer 2" solutions for casual payments. In many cases those solutions never appeared, or the solutions that appear fail to meet the properties of money requirements that the layer 1 does (though proponents will act as if they do).

The point here is not to make an exhaustive list of the failures of the crypto space, there are many more, but I will proceed to make the point of this post.

Shakespeare

Yes, really.

I've not read or watched or studied that much Shakespeare, outside of the little I did in secondary school English. There was one scene though in the play Macbeth, the lesson of which has stuck with me all my life. It especially strikes me that I've never seen the same point be made in other fiction. That is the scene of Malcom's Speech in Act 4, Scene 3.

https://nosweatshakespeare.com/macbeth-play/text-act-4-scene-3

Since the old English is hard to parse, I will summarize the point of the scene. Macbeth (the main character) has become a terrible tyrant King at this point, and Macduff has come down to England in search of Malcolm as a potential claimant to the throne, to convince him to return to Scotland so that they can replace Macbeth with Malcolm as king.

Malcolm tests Macduff's motivations, by pretending that he may in fact be an even greater tyrant than Macbeth, to see if Macduff truly wants a better king to rule, or just access to power himself. The essence of the point is in the following line...

Though all things foul would wear the brows of grace,

Yet grace must still look so.

In the world today, fascist dictators and power hungry politicians will try to rise on the promise of "freedom" and "liberty". They will rise on the promise of socialism, of building a utopia, on progressive values or on family values, on environmental sustainability or on economic stability. Does that mean that we should not pursue those values, if others try and hijack them?

Reveal spoiler

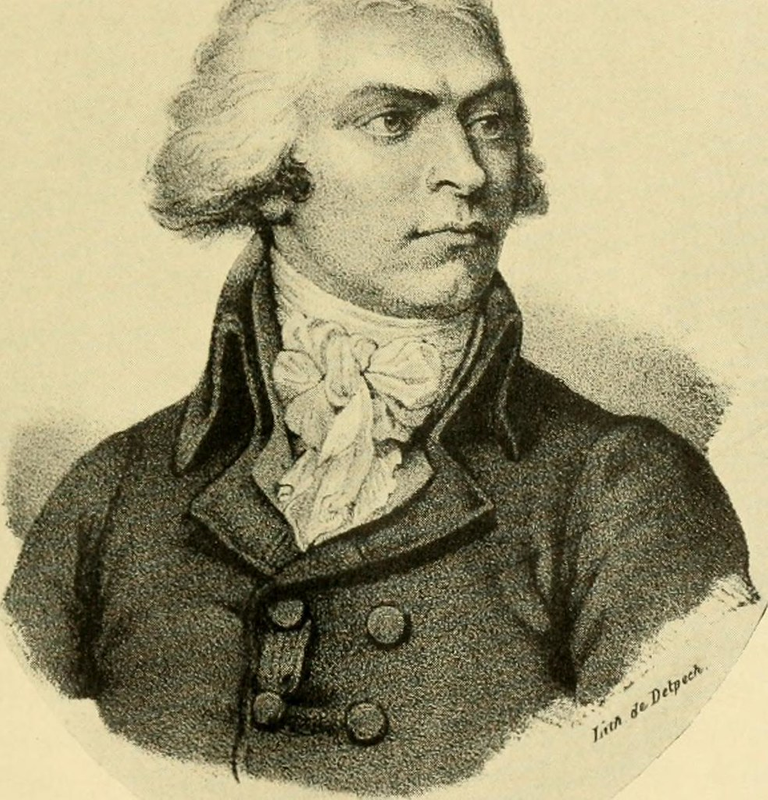

Robespierre aka The Incorruptible

In the world of the past, the French revolution rose with the words "Liberté, égalité, fraternité" - and then they elected Robespierre. Some time later he began a reign of terror, executing all suspected enemies of the revolution. The fervor rose to the point that he himself was executed. Later again Napoleon took charge of the first French republic only to crown himself as emperor, the absolute monarch the revolution had aimed to replace.

The first experiments in banking with paper money were an absolute disaster - see the early Chinese experiments, and John Law and the Mississippi Company, as well as the private notes of the early American banks.

Should the French revolution never have happened? The benefits of republicanism and the downfall of absolute monarchism did not happen for the first generation who experienced the French Revolution. In fact it has taken 5 republics and several returns to monarchism before the country had something close to the ideals espoused by the revolution. That's not a rhetorical question - it may seem morally clear in retrospect but if people knew at the time that the revolution would take hundreds of years to achieve its goals and first involve a collapse into chaos and tyranny, would people have been so eager to participate it?

The chaos and failures of early attempts did not mean that paper money would never work, but while fiat currency eventually was made to work, were the early attempts worth it for the people involved?

Conclusion - Surrounded by False Saviors

The crypto space has become dominated by the false saviors. In seeing the fortunes that can be made, people throw money at the space uncritically. Opportunists and charlatons claim to be the savior in which you should invest your money. Individuals hungry for power and wealth start gatekeeping the system, exchanges-as-casinos list only the centralized projects that act like a new slot machine. Unsavvy investors are exploited and scammed. Some communities become dogmatic, rigid financial cults instead of evolving software solutions. Projects that are actually substantive and honest get underinvested.

If crypto has genuine societal value, if it really can displace the existing financial system and replace it with a better one, we may see some day. Those of us who are earnestly driven to make it happen need not only contend with fighting against the old system, but also the false saviors in the new financial system as well. Be sure to identify when your support for Robespierre should be withdrawn, and don't just replace Macbeth with a greater tyrant.

This is exactly the state of the crypto world right now. The dream seems to change based on personal preferences of the proponents and they've managed to create a strong polarity between the establishment and this new emerging tech. To them, the establishment is a sinking ship that must be shun as fast as possible.

Saludos amigo @demotruk aportando un poco a lo que usted comenta las estafas en el mundo de de las criptomonedas ocurren por el exceso de confianza y mal manejo de claves y keys, es igual que tu des tu clave o contraseña bancaria a cualquier extraño o prestes tu tarjeta de débito o crédito a alguien que no conoces, o aperturas una cuenta bancaria en un banco que no desconocido.

It's true that you can be scammed with traditional banking as well, but it's more prevalent in crypto. If your bank account is compromised, more can be done to reverse the damage, where stolen crypto is usually gone forever with no recourse.

People use sites like that to bash crypto, but not all projects are equivalent. There will be lots of greed and fraud as well as plenty of incompetence. I believe some projects are from people who actually want to change the world. Maybe Satoshi is one of them. It's easy to be cynical about everything and some just choose that option.

It's true that it's easy for an outsider to be cynical about all crypto seeing all the grift that happens every day, but for us within the crypto space, we haven't exactly done much to reign in the scams.

The Hive community is better at self policing than most of crypto is, but even here it is the norm to embrace the crypto casino culture when it comes to other tokens.

I feel like a lot of the problems of the industry would be lessened if people would just learn to keep their own keys and not be so greedy. People are lazy though and are easily enticed by high APRs. I think this will be an ongoing problem as there's no FDIC-like institution in the cryptospace to save small investors when the SHTF.

One of the intractable problems is that the people who could benefit most from financial inclusion in principle are also the ones least likely to have a financial education.

Who is hurt most by lack of access to financial system? The poor.

Who is most likely to lack financial education? The poor.

This is one of the main arguments for gatekeeping on risky investments, but low risk investments lack the risk premium. In general I oppose paternalistic policies that are designed to protect a particular segment of society from themselves. We should come down harder on fraudsters, not exclude people from the financial system.

~~~ embed:1545050471903404032 twitter metadata:U3RlZW1hZGlffHxodHRwczovL3R3aXR0ZXIuY29tL1N0ZWVtYWRpXy9zdGF0dXMvMTU0NTA1MDQ3MTkwMzQwNDAzMnw= ~~~

The rewards earned on this comment will go directly to the people( @steemadi ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @demotruk! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 37000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!