Any Hiver who was around during the previous Bitcoin bull run and the resulting cryptocurrency craze will identify with what is happening now. The heady days of 2016 and 2017 saw projects (Whitepapers) raise millions of dollars via Initial Coin Offering (ICO) based on an idea, a rush to list on an exchange and sit back and watch the money pile in.

Image Source

This is not about then, this is about now and I would like to show how skewed the markets are by highlighting two projects and their market capitalizations.

ORAI

Short description below from their website .....

Now that sounds rather grand. So the investors, thanks to huge hypes from Youtube and Twitter influencers promoting the project, jumped in and drove the price to a recent high of $93 and it is currently trading at $41.

Let us have a closer look at the project though

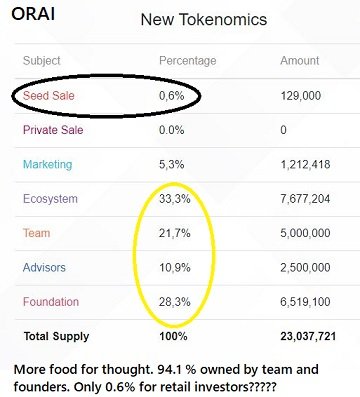

First the Tokenomics

So where does the retail investor fit in all this? 0.6% was sold to finance the project the other 99.4% is retained by the team for various activities clearly visible in the table above. It is also interesting to note the 'new' tokenomics where the team, advisors and foundation all had their stakes increased, and marketing and ecosystems was reduced. Read Here

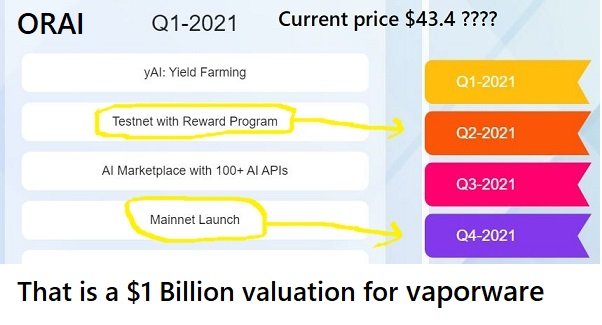

Now let us get to the kicker .... what are you getting for your money. To my mind the next image tells the whole story. My comments on the picture.

Would you be investing in this project at that price where there is no product, minimal liquidity and 99% of tokens are held by the Team and Foundation?

Now let us go to part two of this little exercise where I want to highlight how ludicrous the market is with 'share' valuations. I could have chosen anyone of many projects with lesser valuations yet far advanced product but I settled for one of my favorites which has the SAME MARKET CAPITALIZATION as ORAI

WAVES

What Is Waves (WAVES)?

Waves is a multi-purpose blockchain platform which supports various use cases including decentralized applications (DApps) and smart contracts.

Launched in June 2016 following one of the cryptocurrency industry’s earliest initial coin offerings (ICO), Waves initially set out to improve on the first blockchain platforms by increasing speed, utility and user-friendliness.

Source

Waves is a fully functioning ecosystem with a huge community and multiple products and dApps already productve. Some examples below.

Neutrino.protocol

Neutrino protocol is a multi-assetization protocol, crypto-collateralized, powered by Waves and acting as an interchain toolkit enabling frictionless DeFi on demand.

Tokenization of real-world off-chain assets

Neutrino.protocol enables the tokenization of national currencies or commodities by algorithmically maintaining the economic stability of the synthetic asset rate.

Gravity.Protocol

Gravity protocol facilitates connection between different blockchains that work as one solid system. Gravity empowers all elements of Waves’ ecosystem but, more importantly, it acts as a two-way portal between Waves.tech and the entire open finance ecosystem.

Additionally, Gravity network is a blockchain-agnostic oracle system for cross-chain communication. No-token approach creates a more inclusive, open ecosystem, while addressing future scaling/stability issues.

There is more and you can get more information here including access to the various communities engaged with Waves.

Tokenomics

So how are the tokens distributed within the WAVES ecosystem....

In its ICO — which raised 30,000 BTC — 85% of the supply went to sale participants, 4% to partners and supporters, 9% to the developers and 1% each to early supporters and bounty schemes which occurred after the ICO.

Source

85% went to open market sales participants and 15% to founders and team. Compare that with ORAI where sales participants did not manage 1%.

Summary

ORAI - $43 for a concept which has not yet delivered any product and 99.4% of the tokens are held by the founders.

WAVES - $10 for an established 5 year old project with advanced products, staking, functioning dApp ecosystem and a strong community.

ORAI current market cap $1 Bilion - WAVES current market cap $1.06 Billion

Which one will still be around with value in 5 years time?

Which one would you invest in right now?

I know where my money went for my long term wallet.

Would love to hear your thoughts below!!

Thanks for reading.....

Namaste

Notice how any mention of reality tends to be ignored ...if you did a post saying orai is going to the moon on Leo finance you might get big votes!

Is rather amusing ... but is there fault in my reasoning? I shared it with a Telegram crypto group ... boy did I get it in the neck. Was NOT well received to put it mildly !!

That is usually a sign you are on target