How DeFi is Defying Traditional Finance & Banking

image source

Introduction

While everyone in 2020 has been focusing on the Covid-19 Scamdemic, a silent revolution has been taking place.

What am I talking about?

I am talking about something called DeFi which stands for Decentralized Finance. While others have defined this more completely (see next section below), I will simply refer to it for now as an ALTERNATIVE TO TRADITIONAL FINANCE and BANKING.

The current traditional Finance & Banking sector is broken and has been since the 2007-08 Financial Crisis, if not longer.

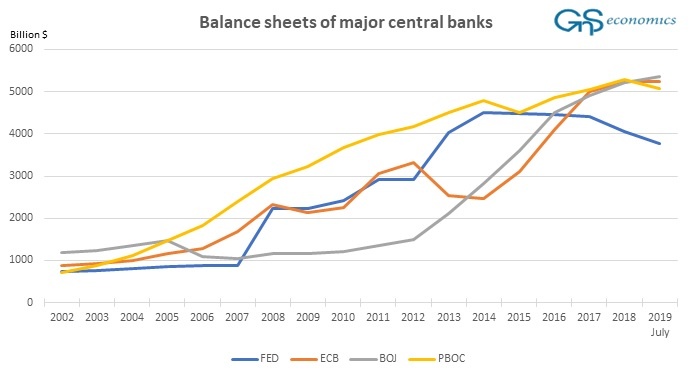

Here is a very telling graph about how the major central banks have expanded their balance sheets (i.e., how they have expanded their money supply - a.k.a. money printing):

Balance Sheets of Central Banks as of July 2019, Source: GnS Economics

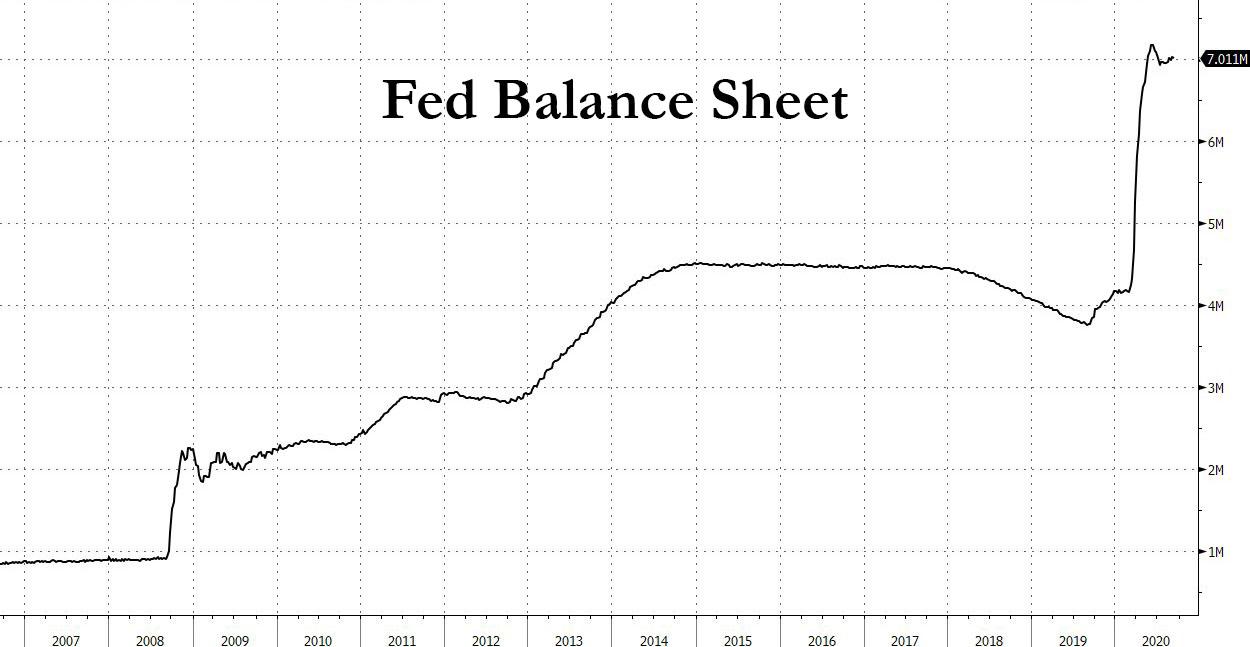

We have seen the extent to which the current system - which supports the global fiat monetary regime - is being utterly destroyed and systematically dismantled since the Covid-19 Scamdemic has reared its ugly head in earnest since the early months of this year.

Countries around the world have certainly not let this crisis go to waste; and in fact, have been using it as a deliberate means to accelerate the crash of the current monetary system.

Just look at the United States where the Federal Reserve has recklessly printed over $3 Trillion:

Image source: ZeroHedge

Even 'ol Benji can't take it.

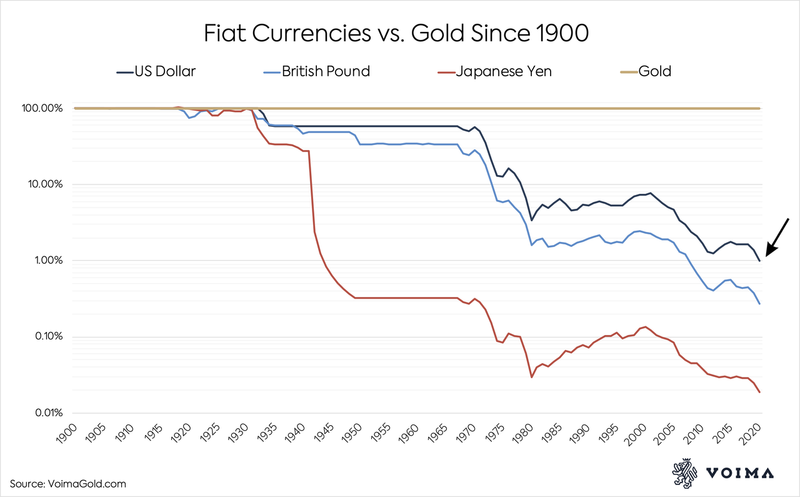

One only need to compare fiat currency against the only real money - GOLD.

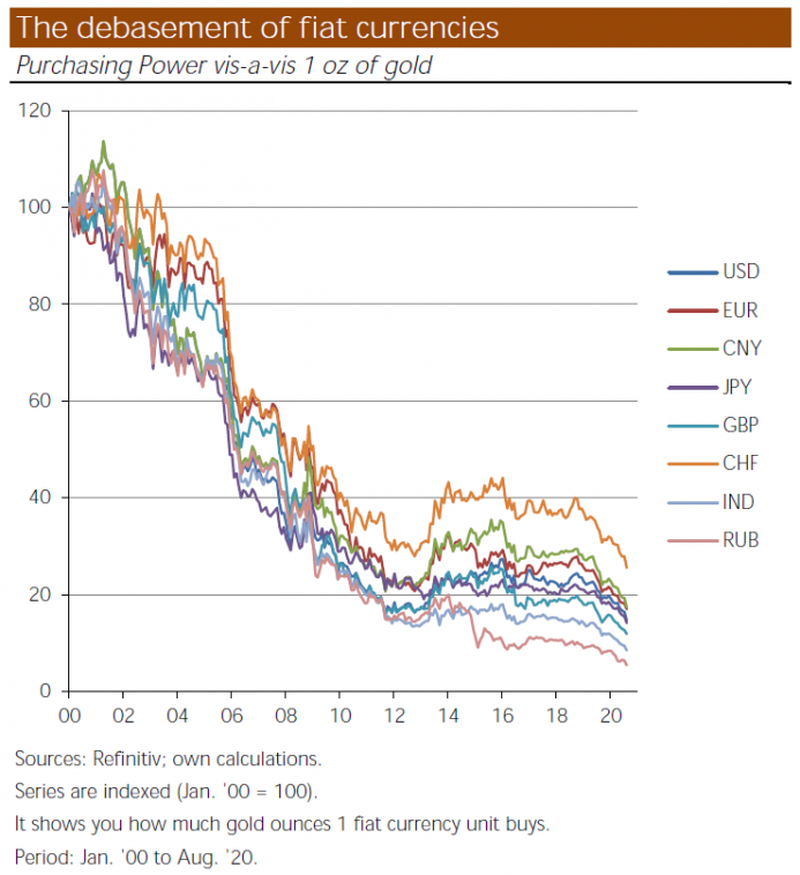

Here are two charts that show you just how much these fiat currencies have been debased against the only yardstick (apart from silver) that has ever been a constant monetary hold of value over millennia:

We can see from the chart above that the US dollar has lost 99% of its purchasing power against gold going back to the start of the last century; and it is even worst for the British Pound and Japanese Yen.

Here is another view for the past 20 years alone (since the year 2000):

Source: Eurasia Review

You see the "old" monetary system which is on its dying legs has to be destroyed for the new one to be launched - one in which they want to implement completely centralized digital bank currencies (CBDC) so that they can more sinisterly ensnare us into a 100% completely digital (i.e., no physical cash or coins) system whereby every single transaction we make will be recorded (and taxed, should they desire).

Worse, new rules with which they are designing this new slave beast system which most likely entail a "kill/flush switch" so to speak whereby they will be able to very easily "unplug" anyone (individual or company) from the system who doesn't play by their rules; this can include any dissidents that expose their corruption or ugly truths, those who deny the climate change hoax, those who opt out of biometric health passports, those who don't take the Bill Gates Covid-19 vaccine, and so on.

From this system will emerge two types of people:

Slaves in the matrix - those who will remain in the centralized banking system, take the UBI (Universal Basic Income), get the mark of the beast chip/vaccine.

Those who will break free from the chains of financial slavery & tyranny - i.e., those who will opt-out and simply chose not to participate (not consent), instead using alternatives for finance, banking, money, insurance, social media, etc.

Which one will you choose?

And when should you start thinking about it and planning for it? Now, or when it will be too late?

What is DeFi (Decentralized Finance)?

Apart from my very simplified definition above, I think we can use a few articles and websites to get a better, more comprehensive definition of DeFi. Here are a couple of takes on it [emphasis added]:

To sum up you can define DeFi (Decentralized Finance) as a universe of decentralized application which enables the use of financial goods or service across the crypto asset exchange, doing Algo trading, lending and borrowing in the market, making synthetic assets, etc. - source

DeFi is essentially just conventional financial tools built on a blockchain — specifically Ethereum. They are mostly predicated on open-source protocols or modular frameworks for creating and issuing digital assets and are designed to confer notable advantages of operating on a public blockchain like censorship-resistance and improved access to financial services. - source

There's an excellent introductory article from Cointelegraph.com entitled The Great Unbanking: How DeFi Is Completing The Job Bitcoin Started that is written in clear, concise and well thought-out terms which I think introduces DeFi really well. Here are a few snippets following an initial mention about how Bitcoin has come to be the pioneer cryptocurrency, or online money:

...a financial services architecture as we know it incorporates a whole lot more in terms of functionality: lending, borrowing, earning interest, paying interest, investing, etc. Bitcoin was never intended to cater to all those mechanisms — but DeFi is.

The next logical step in the evolution of crypto’s gradual assumption of the roles played by traditional finance is being taken by the growing Ethereum-based decentralized finance ecosystem.

DeFi, in many ways, is Bitcoin 2.0. And for that reason, DeFi — although based on Ethereum’s composability and smart contract functionality — furthers the Bitcoin narrative into the future that Bitcoin first allowed us to believe in. With each new DeFi protocol, that future is closing in on us: a world without banks as we have come to know them.

Our banking system is as broken as our COVID-19 response was, but can DeFi actually replace it?

The [banking & finance] sector as a whole has long since stopped serving most of our needs. Checking accounts no longer pay interest, accessing money costs money, and large enterprises find financing easy, while small and medium enterprises are left floundering. Try getting a mortgage as an independent contractor without benefits or job security.

Just a few comments on the above passage, if I may. Firstly, we all know that bank accounts haven't paid interest on savings in decades (they did when I opened my first account in the late 1970s). Accessing money (i.e., loans) can be rather costly with high rates for borrowing. And while big corporations can get loans at nearly less than 1%, small- and medium-sized businesses can't.

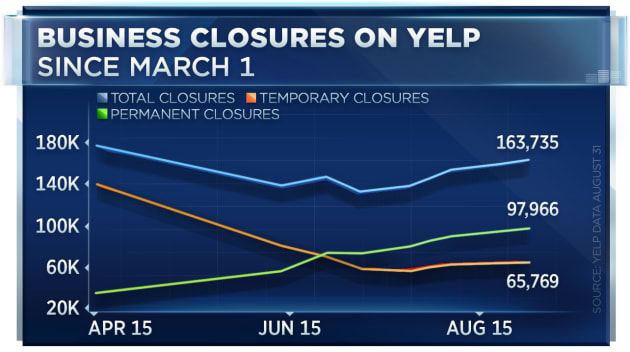

Moreover, when you see recent headlines from CNBC such as 'Yelp data shows 60% of business closures due to the coronavirus pandemic are now permanent' which indicate that nearly 100,000 small- and medium-sized enterprises have PERMANENTLY CLOSED due to the Covid-19 lockdowns, we can easily see that the remaining businesses will struggle even more to get financing in the coming months and years.

Image source

Continuing with the article:

Bitcoin democratized money by freeing us from it in its legacy form. Now, DeFi has captured the imagination of the crypto world as its natural extension — not just the democratization of money but the democratization of finance, promising a seismic shift in the way people bank in the future.

That seismic shift will confer benefits on society we could only have dreamed of a decade ago.

I do agree that this DeFi movement can be a seismic (or paradigm) shift. I say this because those dinosaur banskters and corporate profiteers who are hard at work designing and scheming the new digital financial will doubtfully want to change from their blood(money)-sucking vampire squid ways and expect to be able to continue on looting the gullible masses, as if nobody is being awakened from all their thievery. They are dead wrong. But that is good news for us, as while we let them devise their new Orwellian financial machinations, we can choose to opt-out and join the DeFi movement instead where we will get a fair share of the pie.

We will:

get a fair share of interest earnings on our savings;

choose to lend some of our savings (many in cryptocurrency coins and tokens) to earn interest;

choose insurers with much more favorable rates;

invest in cryptocurrencies that cannot be duplicated and debased at will (like fiat currencies);

transact directly peer-to-peer thus eliminating the middleman (financial intermediaries) whilst avoiding their hefty fees;

send funds to anyone in the world in a matter of seconds (rather than days) at much lower cost;

have our transactions be immutable (unchangeable, "uncheatable") on a blockchain;

post our thoughts and ideas on blockchain-based social media platorms without the worry of being censored by tyrannical governments and tech giants;

etc., etc.

How to Learn More about DeFi and its Possibilities for Me?

Though I am sure there exists a multitude of excellent resources on the matter, I will share some which I find to be particularly useful.

Expert Simon Dixon:

The main one is a person - an ex-banker. Who better to learn about the differences between traditional banking & finance and DeFi than one who has been intimately involved for years in the banking sector who is now a huge DeFi proponent? I am talking about a British guy named Simon Dixon who has started his own DeFi enterprise called Bnk To TheFuture. Here is his bio from the website:

Simon Dixon is the CEO & co-founder of BnkToTheFuture.com. He is also the Fund Manager of Bitcoin Capital & author of the book 'BnkToTheFuture'. An active FinTech & Bitcoin angel investor and ex-director of the UK Digital Currency Association & UK CrowdFunding Association, who regularly speaks on the future of finance to governments, businesses, investors and financial institutions. An ex-investment banker that left corporate in 2006 to work on his book on the future of banking. You will find Simon regularly quoted & appearing in much of the major press & media including BBC, FT, CNBC, Reuters, Bloomberg, Wall Street Journal to mention a few.

I've watched just a few videos made from him, and the guy knows his stuff and can articulate it very well.

I thus invite you to have a listen to a few of his videos.

The first video is Take Your Money Out Of Your Bank (Sept. 9, 2020, duration: 50:51)

The next is a pair: How to live without a #Bank | PART 1 (Sept. 17, 2020, duration: 19:10) & How to live without a #Bank | PART 2 (Sept. 17, 2020, duration: 34:16)

Real Vision Finance: Building A Stronger Financial System: Traditional Finance & Crypto (w/ Raoul Pal and Simon Dixon) (Aug. 21, 2020, duration: 1:09:15)

I particularly like the 3rd video as the interview - Raoul Pal - is a financial genius and the resulting conversation between this pair of financial gurus will absolutely blow your mind.

In addition, he's appeared on RT's Max Keiser numerous times but here are some of the latest ones:

Keiser Report - Simon Dixon predicts bankers could soon riot in the streets (Sept. 11, 2020, duration: 25:49)

Keiser Report - Money Printing, Central Bank Digital Currency & more | Simon Dixon (April 14, 2020, duration: 13:24)

You can find more videos from Simon Dixon and keep up-to-date with this fast-changing DeFi sector on his YouTube channel.

Ready Set Crypto (YouTube channel) - Why DeFi Is Blowing Up Right Now:

This video, Why DeFi Is Blowing Up Right Now from Ready Set Crypto, I also find to be good, as the narrator has been making a lot of crypto-related videos over the past few years and I've found him to be quite objective and level-headed. I think he gives a fairly good overview about DeFi, including how to not necessarily get caught up in the hype - as was the case with the ICO FOMO craze from a year or so ago.

Articles & Resources:

Once again, while I am sure that there must be many good articles (please post some in the comments section below if you wish to share), here are a few I found to be well-presented:

Kraken - What is Decentralized Finance?

BLOCKONOMI - What is DeFi? Understanding The Decentralized Finance Landscape

Cointelegraph - articles with the tag DeFi (In my opinion, I find Cointelegraph to be the single best news site about the cryptos & blockchain space); so, anything that comes out of that outlet will have valuable information to be found.

Note that I may add more DeFi related articles to this section should I find other quality ones.

What Are Some DeFi Platforms and Coins/Tokens?

While this sector is fairly nascent (only a couple/few of years old) it is nevertheless a burgeoning one that is changing practically every day. And it is a challenge to keep up with it all.

From my very limited exposure to this space, here are some DeFi-related projects I find to be worth exploring. The first hyperlinks point to their respective information/chart pages on Coinmarketcap.com.

Decentralized Platforms

- Ethereum (ETH) - (Sept. 27 price; $352.54, rank 2) - https://www.ethereum.org/

Important note: Ethereum is the main platform on which many DeFi-related tokens (and other ERC20 tokens), platforms, smart contracts, and dAPPs (decentralized apps) run.

Chainlink (LINK) - (Sept. 27 price; $10.18, rank 8) - https://chain.link/

Compound (COMP) - (Sept. 27 price; $10.18, rank 44) - https://compound.finance/governance/comp

Aave (LEND) - (Sept. 27 price; $0.55, rank 28) - https://aave.com/ & https://app.aave.com/home

Uniswap (UNI) - (Sept. 27 price; $4.80, rank 40) - https://uniswap.org/ & https://uniswap.org/blog/uni/

Kyber Network (KNC) - (Sept. 27 price; $0.96, rank 64) - https://kyber.network/, https://tracker.kyber.network/#/, & https://tracker.kyber.network/#/tokens

Kava (KAVA) - (Sept. 27 price; $2.07, rank 122) - https://www.kava.io/

Maker (MKR) (to support DAI stablecoin) - (Sept. 27 price; $475.32, rank 36) - https://makerdao.com/en/

Bancor (BNT) - (Sept. 27 price; $0.86, rank 131) - https://www.bancor.network/

Curve Finance (exchange) - https://www.curve.fi/

more networks: https://defi.review/

Though I still have a lot of research to do, I do see Kyber, Aave, Uniswap, and Kava as very interesting projects/exchanges in this space that certainly deserve further exploration.

Select Tokens/Coins/Stablecoins

Dai (DAI) - (Sept. 27 price; $1.01, rank 23) - https://makerdao.com/en/

TrueUSD (TUSD) - (Sept. 27 price; $1.00, rank 35) - https://www.trusttoken.com/ (also note they have TruCAD, among other currency-pegged stablecoins)

CACHE Gold (CGT) - (Sept. 27 price; $59.91, rank 839) - https://cache.gold/ (note that the value of the token is basically pegged to the spot price in $US of 1 gram of gold). Explanatory video about CACHE Gold.

Digix Gold Token (DGX) - (Sept. 27 price; $59.64, rank 623) - https://digix.global/dgx (note that the value of the token is basically pegged to the spot price in $US of 1 gram of gold)

Of course there are many other DeFi related tokens, but I have chosen to choose some basic, "stablecoin" ones because they are core to the various uses on the DeFi platforms.

TrueUSD & DAI are backed by collateral (US dollar equivalent) and CGT & DGX are also backed by collateral (pegged to a gram of gold).

I wanted to include gold-backed stablecoins given the current context of the financial and monetary system described earlier in this post. Both of these projects (CGT & DGX) are based in Singapore and wouldn't be called "stablecoins" (for legal reasons) but they are nonetheless each considered as an “asset-backed token”; in other words, they are backed with real gold stored in vaults (and recorded on the blockchain). And, not only are they backed by physical, but also redeemable for physical (unlike derivatives and CFDs).

It will now really be up to you to do your own research about other DeFi-related coins, tokens, platforms, and projects. To be honest, all of this is a bit beyond my paygrade; so, I'd rather not venture at being any kind of expert in these matters.

But what I do like, are assets backed by something real. To me, even though the stablecoins such as TrueUSD are backed by dollars (funny fiat currency), I would still prefer to own tokens that are backed by gold (real money). Thusly, I may consider purchasing and owning these in the future.

Extra Tools & Links

Here are a few other extras to help supplement the DeFi space:

defiprime.com - DeFi and Open Finance - this space has nice categories for various aspect of DeFi

Defi Pulse, https://defipulse.com/ - this one has a nice chart that shows the marketcap of the entire DeFi space (currently at around US$11 billion, up from $2 billion just 3 months prior) along with other metrics

defi.review, https://defi.review/ - metrics for many DeFi projects; lists projects by platform (Ethereum, EOS, etc.)

https://stablecoinindex.com/ - this one lists some, but not all, stablecoins

Disclaimer:

Note that at the time of this posting, I do not own any of the tokens mentioned in this post; but, I may purchase some of them in the near future.

I have done my best to provide information that is as timely and accurate as possible. Everything stated in this article is my opinion and should not be taken as investment advice. Do your own research before investing in DeFi and the crypto space and be aware that these are nascent, risky, and volatile in nature.

Conclusion:

That being said, I hope you got something useful out of this article and invite you to begin your own research and due diligence about Decentralized Finance (DeFi).

I think this could be a very opportune time to plan for our financial futures - ones whereby we will be the masters of our own financial destinies.

God Bless.

In Peace & Liberty,

"Bitcoin democratized money"

BTC isn't money, so that article's statement is incorrect on its face. Don't you wish financial experts could get money and currency straightened out in their heads?

Gold and silver remain by far the best money. If you don't hold it, you don't own it. If it's gone when the power goes off, you similarly don't really own it.

If we're talking about currencies, though, "DeFi" appears somebody just slapped a gimmicky name on something that already existed - crypto. Even the definition given is just circular wording: "a universe of decentralized application which enables the use of financial goods or service across the crypto asset exchange", which translates directly to "decentralized crypto finances".

No need for a new term, unless DeFi were something new.

Something new would be the ability to use cryptocurrencies privately and decentralized. By private I mean without involving private-destroying devices, without inputting name, address, or phone number, and without showing an identification card or papers. By decentralized I mean not involving large corporations, banks, or governments.

Once that's possible (and I know it currently isn't because I just finished a series called Crypto Lunch where the community and I were unable to use crypto privately or decentralized. The golden standard is purchasing groceries at a local shop with crypto (privately and decentralized). So far nobody has figured out a way to do it. If you can, you'd be the first, and you'd become well-known.

Sounds like you haven't investigated the platforms you're linking to here? If you do, and you find a way to privately use crypto to locally buy groceries - even with 100 steps and fees - please let the world know asap. Millions are on the sidelines, waiting for crypto to get its act together.

Many (like myself) won't use money or currency that destroys the user's privacy, like credit cards. Crypto, so far, has yet to offer anything better. Fiat cash remains the best currency for privacy and decentralization. Gold and silver remain the best money (savings of intrinsic value).

I've advocated crypto since 2011 - years before most people first heard of it - so don't brush me off as a crypto hater. I've done everything I could to make it work for the people, but as yet it does not.

Great job compiling this information - an excellent resource which I'm gona send to folk who are curious about this space and wanna learn more.

BTW, just wondering how come you're not using the #leofinance tag and/or posting on their interface...it's where this b/chain is really beginning to step into the DeFi space!

Thanks. To be honest, I didn't even know about leofinance and had I known, perhaps it would have been much better to use it as my primary tag instead of deepdives. I guess, that is what you get from a newbie like me. Apologies for my ignorance. Thanks again for weighing in.

AFAIK you can use the #leofinance tag as a secondary tag too and it will appear there. Alternatively, you could use their interface at leofinance.io (same login as on Hive coz it's a sub-layer and your post would still appear on your Hive blog under 'all posts'). This content would fit very well over there and, I think, would also be appreciated! Have a look around an see for yourself, there's quite a bit happening atm :)

Good luck!

Added information links:

Top 10 Use Cases and Benefits of the Dai Stablecoin;

How Dai Became A Favorite Crypto in Latin America;

How Ethereum Smart Contracts Power Dai, the Maker Protocol, and DeFi