Source: https://cointelegraph.com/news/bis-facebooks-foray-into-cryptocurrency-poses-new-risks-for-banks

Banks have had a monopoly on money transfers for decades and refused to innovate and now it appears they have waited to long as others are ready to pounce.

This is not unusual. Many companies that enjoyed high profit margins and leadership positions fail to change and go out of business —- look at Blockbuster Video stores.

The banks are now like the “horse and buggy” vs a ‘sportcar” when it comes to cross border money payments. The LARGE banks are the ones with $Billions in profits that they charge for rather poor quality off service on their SWIFT system created in the 1970’s. XRP can either partner with them and give them a tool or competition will slowly erode their business for more than just money transfers.

Sendfriend announced free transfers from NJ (USA) to Philippines— which @ $1B / Month is the market size.

Sendfriend is a Ripple Partner using XRP crypto and XRapid for instant (2-5seconds) payments —- how does a bank compete?

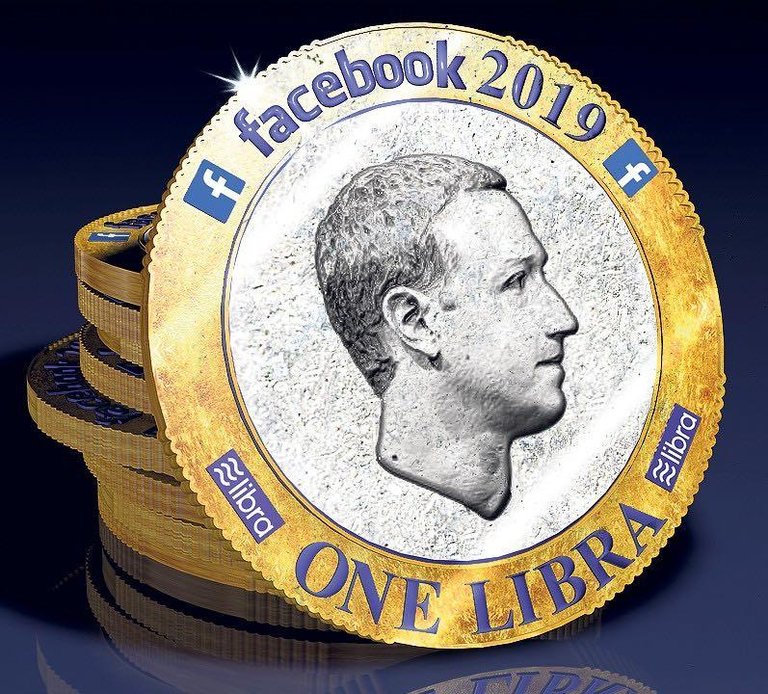

Facebook plans for being a “digital currency” when added with the ability to move to another crypto for saving like Bitcoin/Litecoin .....what will that mean for savings?

Facebooks Libra coin is backed by Fiat currencies which will go DOWN in value —- so why would anyone want to “hold” Libra — but you can take your Bitcoin or XRP and instantly change to Libra to buy socks on-line. Libra is an on/off ramp but not a good place to “keep money” is my guess. Who wants to keep money in something that loses value?

The governments are protesting so we will see what happens with Facebook Libra’s digital currency.

facebook will then use your data like they do today — that data makes them money.

Interesting times for the banks to adapt or lose business/ customers.

The banks are losing out to pay-day stores.

I can't remember the article name, but the point was that banks are slow, and are riddled with hidden fees. The pay-day / check cashing stores have all their fees clearly posted and although the fee is high, the money is now.

The banks have already lost.

Cryptos takes that one step further.

Unfortunately, F-c-book coin is really FED coin packaged through its best public face. F-c-book coin is just a pretty wrapper on the old banking system. And we will see all kinds of blockages and money loss once it starts.

"... oh, we're sorry, transfers to Venezuela have been temporarily suspended. Your transfer will be processed as soon as possible..." As soon as possible meaning when The US decides to lift the bans,...BUT you already sent the money, its gone from your account.

Yes....I believe FBook coin is a “last ditch” effort to be used for control and taxation around the world. Problem is all people and countries like Facebook and it has a crappy record of truth. Banks will do anything to keep power at this point — they could care less if it’s Facebook or Ripple as long as they can keep the doors open and make money. This is a real squeeze for them.

Maybe just pretending to be on our side

Unless there is a “real” govt plan which ends Facebook’s dream, they will be used and no doubt governments around the world will demand the data and find ways to maximize taxation. There will be “quite a mess” the next two years — banks, governments, currencies .....it will not be easy to understand what is going on with so many problems facing so many people.

The technology is moving so fast governments and old ways can't keep up..;

Very true