This weekend brought us our first evidence that the DeFi space is going to absolutely blow up. Until now, we've seen big love go around to all the major DeFi projects like MakerDAO, Compound, Synthetix, Uniswap, etc. But we have yet to see a real divisive BTC v. BCH type battle break out where everyone can get out the popcorn.

The thing is is that all of those projects I mentioned above are based on Ethereum. So of course they all love each other! As well, Ethereum enjoys the second biggest market cap for a cryptocurrency, so when people see awesome stuff getting built on the ETH base layer (and all of those projects above are pretty freakin' awesome) they know that in the long run that's pretty bullish for Ethereum. But the dirty secret for ETH-based DeFi is that gas fees are so damn high right now! That is, if you're going to be doing all the micro-transactions that are necessary for DeFi to work. Folks can work around that, sure, like DeFiZap is doing, but it's not ideal.

But for now, Ethereum is by far the most advanced blockchain out there. Developers all over the world are working on it day in and day out. The ETH token is well distributed across the globe. And the projects that have taken to the BUIDL mantra have really started to hit their stride as of late. One of the more impressive projects is the Uniswap exchange, the world's first coherent example of an automatic market maker (AMM). Yes, Bancor was first, but they were hacked big time, they have their own token that's hard to find the utility for, and the whole interface is a little awkward. I wouldn't call that all that coherent.

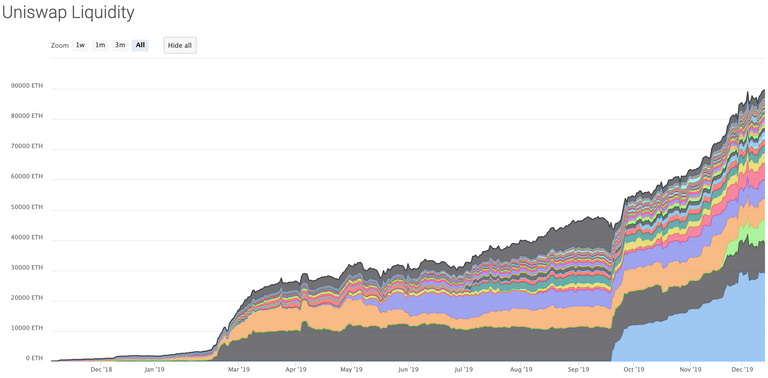

Uniswap, on the other hand, has been killing it. Take a look at the amount of ETH pooled to support their platform since inception:

That's 90,000 ETH (currently ~$12.6mm), according to this fantastic tool, locked up now to provide liquidity and it's growing fast. With over $1 million in fees collected by the asset providers pooling their assets here year to date, you can see that the yield on pooling your assets on Uniswap is pretty nice. Especially so for early providers of capital. Uniswap has been a real poster child for the DeFi movement, which has largely been a very supportive community working hard towards the bigger and vastly more important goal (as compared to making some great yield off muh crypto bags) of disintermediating larger financial institutions.

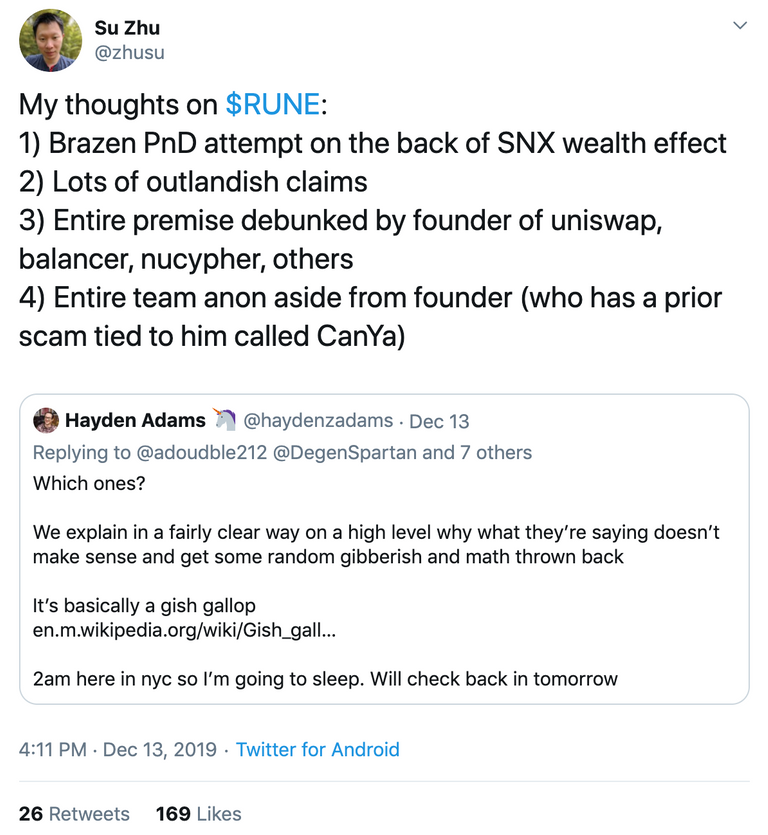

Well, the lovefest in DeFi Land is now over, thanks to a series of tweets starting on Friday from Hayden Adams, the founder of Uniswap and Zhu Su, head of Singapore's Three Arrows Capital. I recently read this wonderful piece Hayden wrote about building Uniswap from code zero to launch. I wondered who this was he was referring to when he wrote, "I reached out to anyone who had expressed interest in providing liquidity at launch. About $30,000 was deposited into the contracts by a single provider..."

Now I guess we know who that single provider was. Man, old Zhu probably made a mint off those liquidity fees on Uniswap! Check out his tweet backing up Hayden's criticism of an up-and-coming rival AMM called THORchain:

Tribalism is defined as "the behaviour and attitudes that stem from strong loyalty to one's own tribe or social group." And that's all this is - plain and simple. ETH hodlers who have been making a mint off providing liquidity on Uniswap are loathe to give up the pole position in the AMM market. Rumors have it that early providers of ETH and ERC20 tokens to Uniswap have netted ridiculously high APRs in the 20-30% range.

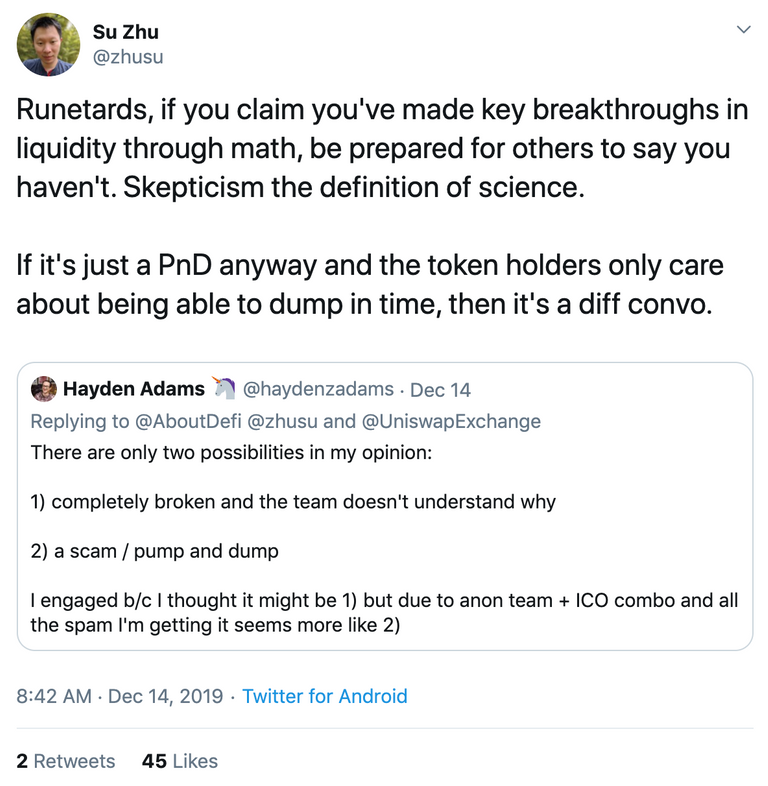

That's a tough gig to give up, I bet, which totally explains these next tweets that came out the next day, after a decent back n forth twitter conversation that the Asgardians took rather well, even while their token was dumping 40% thanks to the out-of-nowhere attack. This next screencap IMO is absolutely classless. Even if THORchain, and its associated RUNE token, turn out to be a disingenuine project, basic common decency dictates that you just don't call someone, or a whole group of someones actually, you don't know a "tard". That's like way juvenile, y'all. Check it out:

To be insinuating "pump n dump" and "scam" when there is a git as active as this one seems a little soon to me. Here we have a competitor product that is about to come out called BEPswap that runs on the THORchain tech. It should be going live in mid February. The plans are to quickly expand that exchange to Ethereum, which was evidenced by a recently announced Nov. 29 partnership with DeFi Darling Synthetix. XRP and BTC, the two most liquid assets in the cryptoverse, will soon follow. Basically, THORchain, once its current vision of Asgardex is fulfilled will be Uniswap's #1 competitor, but

- It's going to be cross-chain.

- It's going to be on a Proof of Stake chain (based on the Cosmos SDK), rather than Proof of Work. That means there will be block rewards to compensate liquidity providers in addition to the fees earned by staking assets into liquidity pools, and transactions will be MUCH faster should that become an issue.

- It's going to be based on a token, so the potential for value capture is exponential. Remember that we just saw Synthetix's SNX token run up a good 25X in the past few months. By contrast, Uniswap is really a drop in the bucket for its utility token - ETH. In other words, only ETH whales really benefit there.

- It's going to allow asymmetric staking as opposed to Uniswap's required symmetric contribution into liquidity pools.

- It might even be based on better tech. THORchain uses a continuous liquidity pool (CLP) model as compared to Uniswap's Vitalik-inspired XYK approach. May be the tech is flawed? That seems to be the criticism. But that doesn't account for changes that the RUNE team might implement after any flaws are detected.

Call me crazy, but that seems like a lot of reasons for the ETH maximalists to FUD out this project right now.

Unlike some, I'm reserving judgment. Right now, Uniswap is an awesome project. It remains to be seen, however, if it will be as good as BEPswap will be and Asgardex claims it will be. But we'll just have to wait until the THORchain team ships out their products.

I'm looking forward to that part. What I'm not looking forward to is likely a whole year of endless ETH v. Cosmos DeFi battles.

Can't we all just get along?

interesting, love defi

This was quite the hornet's nest.

Hi @shanghaipreneur, a free $trendotoken from the TULIP Mania Game!

Round 3 will start soon and full details will follow. Thanks for playing!

Congratulations @busbecq, you successfuly trended the post shared by @shanghaipreneur!

@shanghaipreneur will receive 5.33266538 TRDO & @busbecq will get 3.55511025 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Congratulations @shanghaipreneur, your post successfully recieved 5.33266538 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Thank you for using the #build-it tag. This post has been manually rewarded with BUILD tokens in the form of an upvote. You can buy, stake, and exchange our "BUILD" tokens for steem on steem engine or SteemLeo

Build-it is a central hub for DIY and How-To projects. It's an opportunity to find and share the latest in DIY, and How-To tutorials. The recommended tags required when creating a DIY article are #diy, #build-it. #how-to, or #doityourself. Please read our guide

Chat with us on our discord and telegram channels Discord, Telegram. Are we adding value ? your witness vote will be appreciated! Click here to vote