Today we want to show a nice example of how we like to structure our market positions. While it is entirely fine to purchase a token and sell it later at a different (hopefully higher price), you can also offer to enter and exit the token at the same time. This is a strategy called 'working the spread'.

Even though the market is shaky, we are still bullish on some tokens, and one of the tokens that we have written about analyzing is NEOXAG. NEOXAG is a very interesting tribe token, in that it is backed by the unique character of @neoxian, a bank with many funds, assets, customers, and a powerfully active discord community. I will probably do a deeper dive into this tribe at a later date.

As a rule, we never trade a token that we wouldn't want to hold.

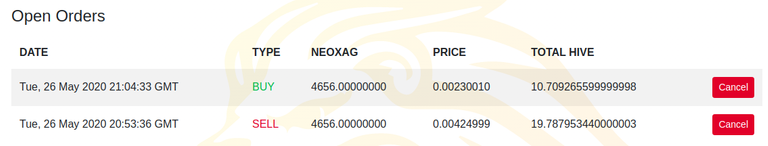

We have decided to use the NEOXAG tokens because we have a nice number on hand. As we were analyzing the market, we were able to make some space to lay out this juicy spread trade:

Just a simple open and close at the market spread price (after a slight adjustment)

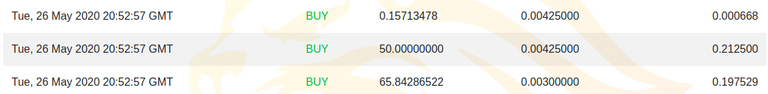

Half a Hive was spent clearing the lane of small sells of tokens, presumably authors selling their post rewards. Now we have the chance to make 9 HIVE on the spread.

19.78 sell - 10.70 buy = 9.08 HIVE profit!

This is classic buy low sell high strategy, and its so easy when you can do it at the same time! The only risk is that one or the other position doesn't close, which would either leave us with 29 Swap.Hive and no NEOXAG or 9300 NEOXAG and no Swap.Hive.

Why do we think people will buy?

Apart from the regular positive social pressure exerted in the discord to power up tokens, currently there is also a bonus city contest to specifically buy tokens off the market, as mentioned in the city paper above:

Why do we think people will sell?

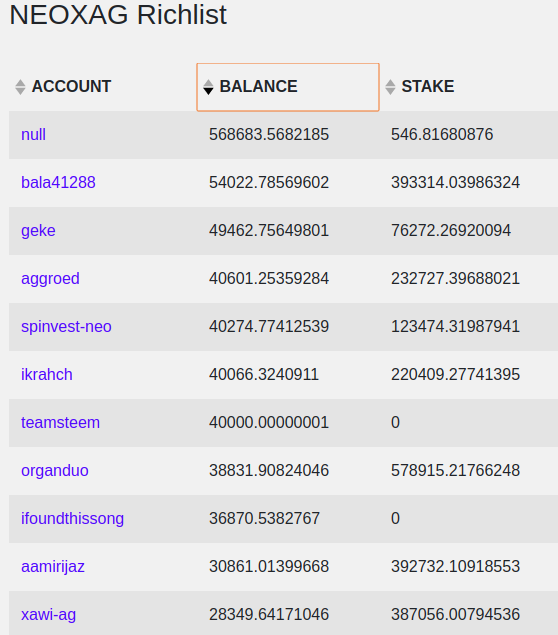

As reported in the last update, we sense sell pressure in the market from miner powerdowns. As we look to the richlist, sorted by liquid stake, we see quite a bit of liquid to go around. Notice @spinvest-neo, an account that sells the NEOXAG it earns to pay delegators.

All in all we believe this trade to be well structured, with considered risks.

This is not advice, this is history. Do your own homework and research your own trades.

Most people just sell their tokens, and some might list them at a higher price. But we hope this simple example in this article shows that you can structure more complicated trades to extract even more value from the markets.

Thank you @ecoinstats, for using the CO2 Compensation Coin (COCO) to reduce your CO2 footprint.