Richard Heart - No one who has been around in the Bitcoin community knew him before

- He wasn’t on Bitcointalk, he wasn’t in the chat rooms, and for someone so outspoken, I find it very odd that he never once spoke up before 2017.

Richard is a very smooth talker, on the surface he looks incredibly intelligent. However, if

you disagree with him, he becomes very combative and hostile. He begins calling you things like an idiot or a moron or a retard. If he really cares about the crypto community and just wants to help people, how is that constructive?

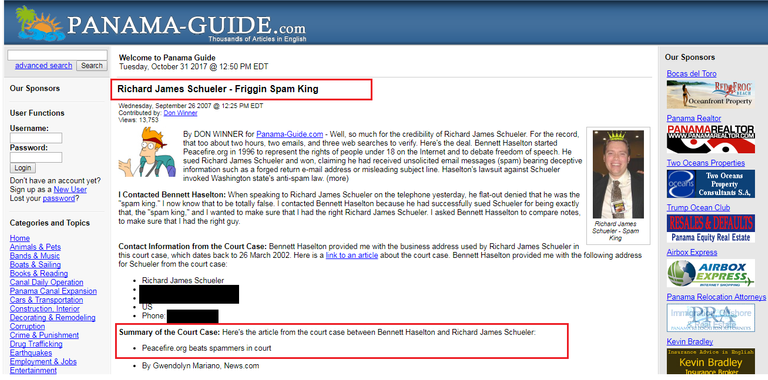

https://steemit.com/cryptocurrency/@isacoin/the-truth-about-richard-heart-aka-richard-j-schueler

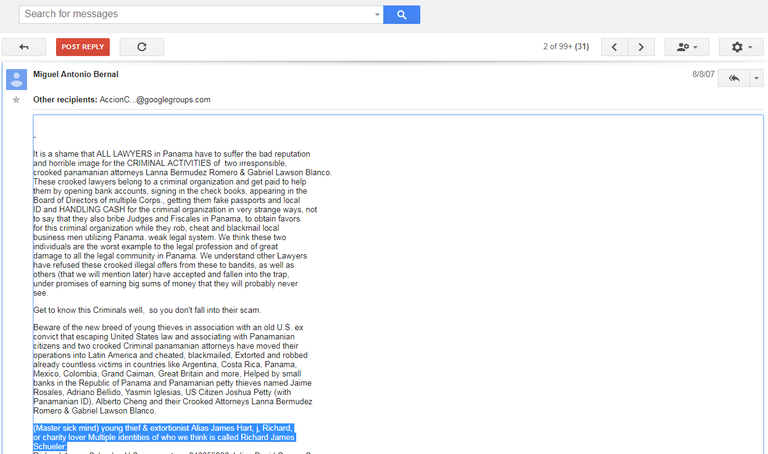

Richard Heart has a history of run-ins with the law and has made multiple identities, he

even has alluded to being associates with .

https://steemit.com/cryptocurrency/@isacoin/the-truth-about-richard-heart-aka-richard-j-schueler

https://imgur.com/a/i8ODR

Richard claims to have retired years ago. If he’s so well off why does he need your

Ethereum? Also, if he’s so wealthy, why couldn’t he pay to have his coin registered with the SEC? He claims that he wishes he could tell everyone that he owns the keys to the flush address and the origin address, THEN WHY DOESN’T HE REGISTER WITH THE SEC? Projects that have something to hide use this tactic of skirting the Howey test grey area. We saw the same thing with block.one and EOS.

HEX is not a CD. It’s not even close to the concept of a CD. When you bring your USD

or whatever currency you use to a bank and put it into a CD, you are essentially becoming a lender to the bank. The bank takes that money and lends it to their patrons for mortgages, credit cards, and personal/business loans. They take the high interest rate returns and offer you a modest interest rate for lending to them. If you decide to remove your money from a CD before the expiration, a small penalty is incurred. Usually all interest is lost and you might lose a small portion of the principal.

None of that is true with HEX. With HEX, you are giving Richard Heart your ETH a valuable asset that can be built upon and will soon be incredibly scalable and he is giving you a worthless ERC-20 token that infinitely inflates over time. The inflation is always changing, depending on the number of people that are currently staking. There is no cap. Not only that, your “interest” that you earn is paid in HEX. So you give him Ether and he pays you in HEX… How does that make sense? When you go to a bank and give them your fiat currency, they pay you interest in that fiat currency. Why does this contract not pay out in ETH? Why does the the flush address keep all the ETH? Why is Richard so scared to tell people that he owns the key to the flush address? It’s because he is breaking the law. https://www.money-zine.com/definitions/investing-dictionary/variable-income-securities/#:~:text=The%20term%20variable%2Dincome%20security,risks%20as%20well%20as%20rewards.

https://www.investopedia.com/terms/f/fixed-incomesecurity.asp

Richard is sending your ETH to exchanges and swapping it for fresh ETH to prop the

price of HEX up to make it more appealing to new customers. https://www.ccn.com/crypto-investors-ethereum-secretly-used-to-prop-up-hex-scam-token/

“Better than Bitcoin” Claim

Satoshi created an open network that anyone could join immediately. No funds required. The value was built from the work.

Satoshi hasn't touched his Bitcoin in 11 years. Richard started spending his ETH

immediately.

Satoshi never made bold price predictions or insinuations. He didn't need to. People saw

the value without that. Richard feels the need to hammer this into his users' brains.

Satoshi never asked anyone for money. Richard takes your ETH that you paid for and

gives you a Token with no real value at all. The value of your token is actually diminishing with the hyperinflation.

Bitcoins number of unique addresses continues to rise. HEX unique addresses are falling sharply.