I've never really considered myself retiring from work, as retirement is synonymous with the big O word I don't want to mention!!! Ok, I'm no spring chicken, but I still consider myself relatively youngish. After all, they say 80 is the new 60, and I'm no way near either!!!!

When I stopped working over 5 years ago, I always tell people I'm taking an extended career break, even though I know the chances of me going back to full time work in the capacity I used to be will be next to zero.

In the past couple of years, retirement, particularly early retirement has become kind of cool and not necessarily linked to age. Many have chosen not to work because they can afford not to, and not because they've got to the end of their working shelf life. When you have a choice in life, that becomes a cool thing, and retirement is no longer a taboo subject. I think my mindset has started to change ...

Hey everyone!!! I'm retired!!!!!

My state of affairs

I've been keeping tabs on my financial situation for years coz I'm a minor spreadsheet freak due to my previous working life as a financial analyst. Then I got more serious about it five years ago since I stopped working retired. The first and last time I did a financial review on Hive was seven months ago and I figured it was time to do an update.

My financial review only makes sense if they cover the entire period from five years ago. I need to keep close tabs on things when it's all money out and little income coming in (Just dawned on me!! Is that's why it's called income?!!)

Like all retirees, making sure I have enough money to cover my living expenses is the most important thing in life. But unlike many retirees, I have no pension pot (yet) to help me out. My main income is, or rather was (more on that in a minute) the rent from my UK property I rented out whilst I was living in Taiwan. Other than that, it's some stocks and funds which I've held for years. Crypto is insignificant as I don't trade, and I have excluded the value of my Hive wallet as it has low liquidity.

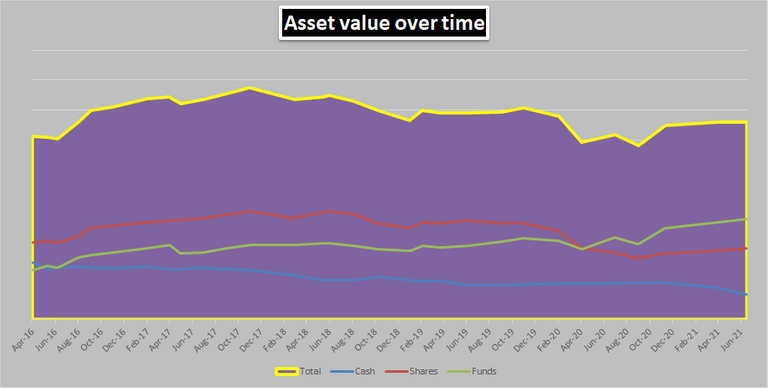

The top yellow line in the chart below is the trend line for my total liquid asset. It's broken down between stocks (the red line), funds (the green line) and most important of all cash (the blue line).

Both stocks and funds grew in value from five years ago. Most notably, the value of my funds have double over this period, but that was mainly because they suffered a heavy dip in the years prior to my retirement. What matters though, is how they perform from the point five years ago when I made my decision to retire. Shares have dropped a little from 5 years ago. That's down to two factors. First, I liquidised some of them to supplement my income and reduce my risk. And second, the market crashed quite a lot at the beginning of 2020 when the pandemic started. You'll see that dip in the red line on the right.

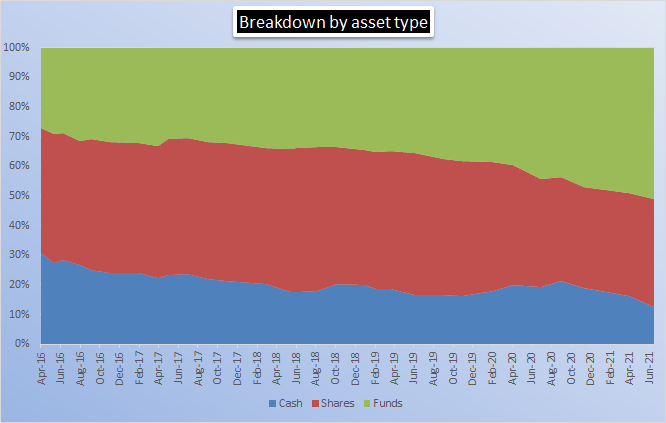

The graph below probably gives a better view of the changes. It shows the breakdown of the three categories over time. Five years ago, 30% of my liquid asset was in cash, as were funds. Stocks made up the remaining 40%. Today cash only makes up 13% of my liquid asset, funds 51% and the remaining are stocks. Whilst the depleting cash is not a nice position to be in, it was kind of a conscious decision I made at the back end of last year,

Depleting cash

My UK rental property has served me ok since retirement, and this was sufficient to cover most of my post retirement living expenses. It averages 5.3% gross return per annum, I think it's considered good in the UK.

In November 2020 my tenant moved out, or to be specific I didn't renew the tenancy with them. With the tenant gone in, I lost 2/3 of my total rental income. My plan was to sell this property and buy something else with better returns near my hometown. I have something in mind already and that would increase my rental income by around 20%. But first of all, I needed to renovate my property. Having four different tenants in there over four and a half years really tires out the property. It cost me £10k to get it back to a saleable condition, digging another deeeper hole in my cash savings.

The first stage of the plan went really well. My builder did a cracking job in doing up my property. The next, and main stage was pants. In the five months since it's been on the market, I've only had 7 viewings. The property market has generally been doing very well in UK. I personally know many have been sold within a month, or even a week after it's been on the market. Sadly not for me. I never have much luck with properties.

The silver lining

So now my plan is hardly moving and there's nothing I can do about it. It's a bit annoying, but c'est la vie. You just have to live with life decisions you make.

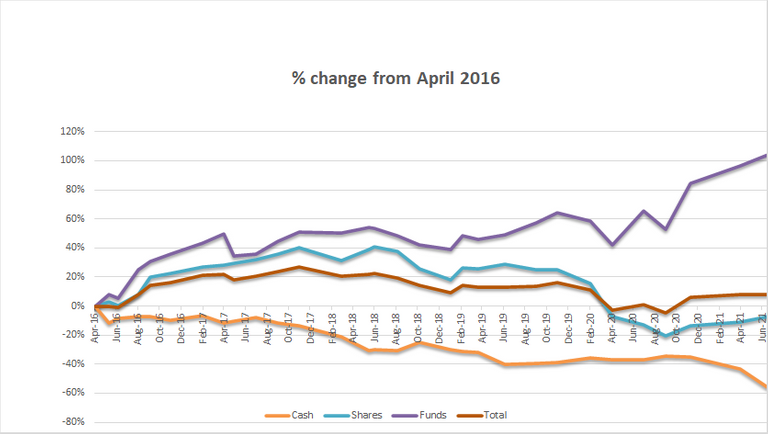

The silver lining to all this, is the total value of my liquid asset (red line) from five years ago is pretty much the the same. In fact, it has increased by 8%, and I have not had to work at all over this period!!!

Cash (the orange line) has dropped by 56% from 5 years ago, but once my plan moves, it will improve again. Funds (the purple line) is the star, it's value has increased by 104% from years ago. True, the value may drop again, but then so will crypto, so will property. I'm not saying funds are the best form of investment - definitely not a wise thing to say considering I've writing this on Hive 😉.

Until I get my head around all this Defi and crypto stuff, I will have to make do with what I have. Hopefully the cyrpto rocket will wait for me 🚀

I didn't realize you were retired!

Congratulations! I hope to make that decision sooner than later. I will be 45 this July!

It seems that you have a good hold of your plans!

Keep managing your finances, and be on top of it.

And I wish you luck, @livinguktaiwan!

Thanks @silversaver888

I've avoided using the word retirement for along, only parents and grand parents do that. But times have changed, or maybe I've aged😅 I guess I might as well embrace it.

Hopefully, you will be able to make a sound choice very soon as well!

!ENGAGE 30

ENGAGEtokens.Wow 45 really? I never would have guessed. Keeping well young lady! xox

It's so true about people 'retiring' at a younger age but the word actually is quite misleading as very few of us retire in the true sense, in fact many become busier with new ventures!

How I wish I knew more about finances, I'm totally stoooopid when it comes to future long term planning! You certainly have things under control and have adapted your strategy like a pro @livinguktaiwan!

I'm sooo happy to see you here in #silverbloggers; I know you've been hard at work with your newbie project! Have you thought of choosing your Silvers name yet?

Have a great weekend further my friend!

Retiring certainly gives one more time and opportunity to explore new hobbies and ventures, I guess Hive is one of them. I don't know how people cope with full time work and being so active on Hive all the time.

Personally I think my financial plan was quite sound, but alas with all things, there were unexpected events that threw a curveball to everything - Brexit and Covid, couldn't have got worse!! 😣

Have a great weekend yourself Lizzie!!

!ENGAGE 30

...and were they unexpected, it's been like living in a scifi movie, absolutely the worst!

But we survived, it's adapt or die not so Sassy LUT;)

ENGAGEtokens.Ha ha if you are old then that makes me old too! It is crazy to think that we are at the stage we saw and remember our parents. It is good too. Congrats on getting all in order and being able to retire!

That's what got me 'worried' getting to my parent's stage!!! But at least I managed to stay young at heart, and I think that's the most important thing!!

!ENGAGE 30

ENGAGEtokens.I retired and came out for COVID. No, I did it before I was old enough, but, made smart choices early in life and accumulated 5 rental house and day trade for a side shuffle. It is a long story that isn't particularly interesting, but, the fact is, COVID is under control, sort of and I will be hiding out out the shore for a while. Until travel works again.

Live your life like you are! It is fun and I wouldn't trade it for anything!

Great on you Denise, definitely don't have to worry about life with your rentals, it should provide you with a more than a comfortable lifestyle, I wish I made some of these smart decisions when I was younger! Anyway, shouldn't complain, I'm content with where I am in life, and that's what matters!!

Take care!

!ENGAGE30

ENGAGEtokens.Hi @livinguktaiwan,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

Nice analysis of your finances. It's always interesting learning what other people are doing financially. I hope your plan works out for your income property. Good luck!

Thanks, Onnce I sell my property I can put the rest of my plan in motion, just need that to get that clog out of the way 😌

Congratz on your retirement, I'm sure you deserve every minute of it. It doesn't have to be linked with age or becoming your parents. As we age we realize some things in life are more important than others. I'm nowhere near retirement but as I age I work less and less and retirement look better and better, I call myself semi retired. I work when I want to, not all year round.

That's what I mean, being able to make choices in life. The gradually tuning down, and working on selected project for periods of time instead of full time is a great way to go.

Yes exactly, it's all about life balance, working all the time isn't healthy for anyone. My motto is I work to live not live to work. Having choices is a huge bonus in life.