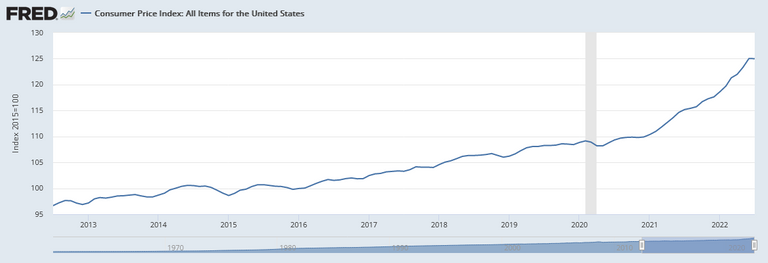

In recent news, the US Federal Reserve is raising interest rates to combat inflation. The idea is that people are borrowing and spending too much, which drives price inflation higher. This hurts the economy because unstable prices make planning for long-term production difficult. The challenge is raising interest rates enough to discourage this consumer-driven price inflation process while avoiding a credit crunch which will result in a recession or depression when funds dry up because the cost of borrowing has increased too much and too quickly.

This is a brief, but hopefully accurate, look at mainstream Keynesian economics as it applies to central banking, interest rates, and inflation. Correct me if I am wrong, please.

Image credit

I lean more toward the Austrian Business Cycle analysis. Our current stagflation is a consequence of prior monetary policies. The crisis is when the consequences of prior error become unavoidable, not the point where problems begin. The solution lies in allowing the correction to occur, and then avoiding the actions which set the crisis in motion in the first place.

In short, inflation results in a massive wealth transfer to the politically-connected. When combined with easy credit, the result is systemic malinvestment. Interest rates are a price signal for the cost of borrowing money. Low interest rates signal a large savings reserve, which makes long-term projects and debt appear worthwhile. When this price of borrowing is set by central banks instead of market supply and demand, the results is unsustainable projects begun under an illusion of prosperity. The wealth is not really there, so sooner or later, market actors must confront this reality and adjust their plans. The sooner this adjustment happens, the better. Shocks in the market will be smaller. Recovery will be faster. Malinvestments can be liquidated.

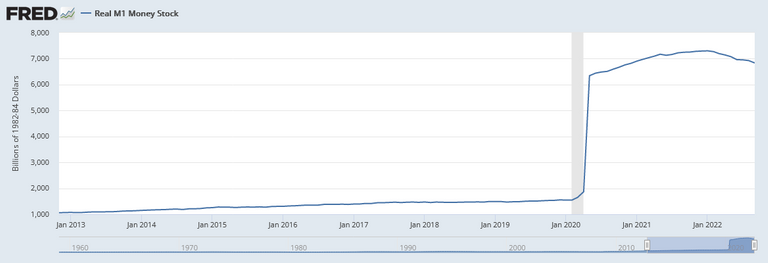

Austrian economists warned of long-term inflation potential when the first round of "COVID relief" bailouts were announced due to the massive spending and debt it would incur on top of the existing economic upheaval. They were dismissed, and instead we got two more rounds of the same "stimulus" driving spending at a time of low productivity. I even offered my own warning and prediction in May of 2021. This demand spike against low supply certainly had a short-term effect on prices, but is not the true cause of systemic long-term inflationary pressure. It was the unprecedented increase in money supply which was the root.

Of course, what we will really see is more of the same actions which created the problem in the first place. Remember when inflation was predicted to be negligible, and then merely "y=transitory," before pundits abandoned such pretense for claims it was actually a good thing? The very people responsible for economic instability now try to shift blame. "Corporate greed" mysteriously spiked. "Animal spirits" arising from investor irrationality drive crowds in Wall Street to madness as they sell off. Whatever the problem, it is something other than the government and its fiscal policy!

Chart source

I am using the official data from the Federal Reserve here, but I suspect they are cooking the books, or at last using measurement tools as flawed as their analysis, to make things look better than they really are. My prejudices as an anarchist do lead me to think less of government analysis. In the interest of fairness, I should note the absolutely massive spike in the M1 chart is due almost entirely to a change in how that metric was being recorded.

Note that Austrian economists do not predict that an increase in the money supply will result in an immediate proportionate increase in prices across the board. The newly-created money must filter through the economy and affects the incentives and purchasing decisions of different sectors in different ways over time. Here, you might see a parallel to Keynesian "velocity of money" analysis, and a contrast with the assumptions by some Chicago school analysis which implies immediate adjustment and market omniscience. However, as prices trend toward an equilibrium over time in the new economic paradigm, Austrians would predict that while a broadly proportionate increase in prices is eventually inevitable, it need not be swift, or even at the same rate for all industries. Those with first access to the new money can spend it at the old prices, and the new apparent wealth will have short term supply and demand distortions. Price volatility is to be expected as markets adjust long before the money supply reaches an equilibrium, and the poorest always suffer as a consequence.

Image credit

So, will tinkering with the interest rates fix inflation? No. Will it change the market enough to trigger the realization of malinvestment, or keep the ship afloat for another few years? I have no idea. I highly recommend Prof CJ's interview with Mark Thornton on the Skyscraper Curse, or just reading the e-book here for free. It delves much deeper into Austrian business cycle theory using the phenomenon of market crashes coinciding with major construction milestones, and explores why this phenomenon occurs so frequently. I should note that this is pre-COVID, and there is prescient commentary on how unforeseen disasters like a pandemic could affect such predictions.

Inflation is here. I don't know how bad it will get, but the government response ignores or even exacerbates the root cause, so take what precautions you can while you can. I'm not saying the sky is falling, but I am saying there is a good chance the past 2-1/2 years are just the tip of the inflation iceberg, and the economic ship is already floundering. Cryptocurrencies like HIVE are a lifeboat. So are barter, your local farmers, and your network of friends and family. If I'm wrong, you'll still forge a stronger community. If I'm sadly right in my pessimism, you won't go down with the ship.

Things are hectic man... Sooner or later there will be a global economic collapse 😂🤔 and it will probably start with the dollar