In this post I'm gonna show why, in my opinion, connecting HIVE with Ethereum blockchain is a huge thing and how the whole HIVE ecosystem can benefit from it. Let's go!

tldr: with WHIVE you can use your BTC and ETH to buy HIVE and still keep your BTC and ETH. Sounds weird but it works!

Now, I'm not gonna write about some theoretical possibilities - instead I will show my own perspective on the HIVE DeFi and how I use it to support HIVE (and get profit ;).

I want to have more HIVE but I don't want to sell my BTC and ETH savings. Solution: DeFi.

I hold some BTC and ETH savings because we all know fiat money is worth sh!@t and will be worth even less soon. But there's one problem - I hodl them in my wallets and they're doing nothing there. They don't generate any income, they don't provide anything useful for me or anyone else other than store of value, they're just sitting there waiting to be cashed out in maybe 10 years or more. This is a huge loss of potential profit, especially in this time-frame but at the same time I don't want to sell them - they're my savings, with 0% APR.

Then there's HIVE - a token where you can get 10%+ APR by supporting other's people work. And you can do it manually or automate it and just check your balances once a month. But even with automated curation, a large number of people will get rewarded for the value they add to the HIVE ecosystem thanks to your investment. Nice.

But as much as I love HIVE community, I won't sell my BTC and ETH to buy HIVE tokens - those are my savings. And here's where we finally get to the point - with DeFi you can keep control over your crypto savings and at the same time use it to invest into new tokens.

Here's how it works: let's say I have ETH worth of 200 USD. I can deposit it on a DeFi lending platform - immediately after doing so I can take a loan worth of 100 USD in other crypto - for example BAT. This locks up my ETH but I can easily get it back by sending back the borrowed BAT plus some small interest.

Now, why would I do that, why not just sell ETH and buy BAT? By doing so I would loose my ETH - and that's not good. ETH has huge potential, it is a backbone of an enormous amount of projects and basically you want to have it in your portfolio. If ETH price goes up x10 and BAT goes up only x2, I would lost a lot of money by selling my ETH for BAT. With DeFi lending I keep my ETH and at the same I can do whatever I want with my borrowed token.

One last thing before we move on - the D in DeFi is quite important. It stands for decentralized and it basically means, that there's no one to steal your funds. The whole lending procedure is executed using smart contracts so someone would need to bring down the whole ETH network to stop it from working. Also - there's no KYC ;)

Next stop: DAI

DAI is a stablecoin worth around 1 USD and it's a central part of the DeFi move - because anyone can create new DAI tokens.

Just go to https://oasis.app/borrow, deposit any of the supported tokens and you will be able to mint new DAI coins backed by your deposit. To get back your deposit, send DAI back. Easy!

Now, the reason why this is a big thing you need to realize that with DAI you are creating additional value. You can basically print money, but not from thin air but from crypto assets, that would otherwise sit in the wallet doing nothing. And most importantly, you're not selling those assets, you still own them and you have new DAI at the same time.

This simple, brilliant idea allowed crypto to thrive in 2020 and unlocked many new possibilities - this is where we get back to HIVE.

Finally: WHIVE

If you wanted to trade, borrow or lend HIVE in the DeFi space - well, you couldn't, because DeFi runs on ETH network. But, as you probably already know - now you can.

WHIVE is a 1:1 HIVE token on a ETH blockchain crated by @fbslo - you can check the announcement post here. Anyone can create WHIVE and use it in the on the DeFi platforms. Currently WHIVE is supported on the uniswap decentralized exchange and you can check the stats here - we hope to bring it to more services soon.

Quick disclaimer: WHIVE is in early stage and it's still under development so that's why it has no icon or you can't see it on uniswap tokens list yet. But we'll get there.

Now, back to buisness - ideally I would like to have WHIVE native support on platforms like aave or compound - this would allow me and others to borrow HIVE and by this:

- increase demand for HIVE

- increase HIVE price

- get nice 10%+ APR

- still keep my BTC and ETH

But this will take time. No problem tho - we have the DAI :)

Here's the plan: I will deposit my ETH to create new DAI, use the DAI to buy WHIVE on uniswap and finally convert WHIVE to HIVE.

Few words about ETH fees: the ETH is actually cheap and fast to transfer, around $0.60 for a transaction in 30 seconds. What's really expensive lately are the interactions with smart contracts, used by all DeFi platforms. Hopefully the situation will get better with both updates to the ETH network and moving to ETH 2.0 later this year maybe?

About the risks: Please be aware that this is not 100% risk free operation. The main problem comes from the smart contracts code - because no software is prefect. The code may have bugs that can be exploited by experienced hackers. Another problem can be ETH network congestion that prevents it's users from performing operations and in result loosing part of the funds. You can read about one of those cases here: https://blog.makerdao.com/the-market-collapse-of-march-12-2020-how-it-impacted-makerdao/

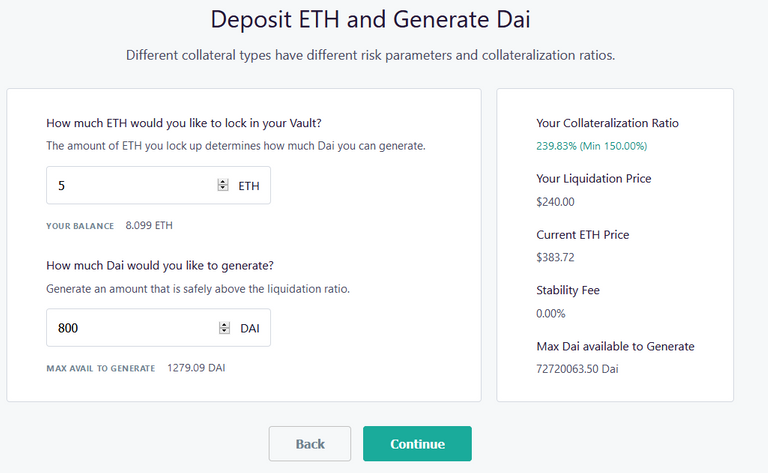

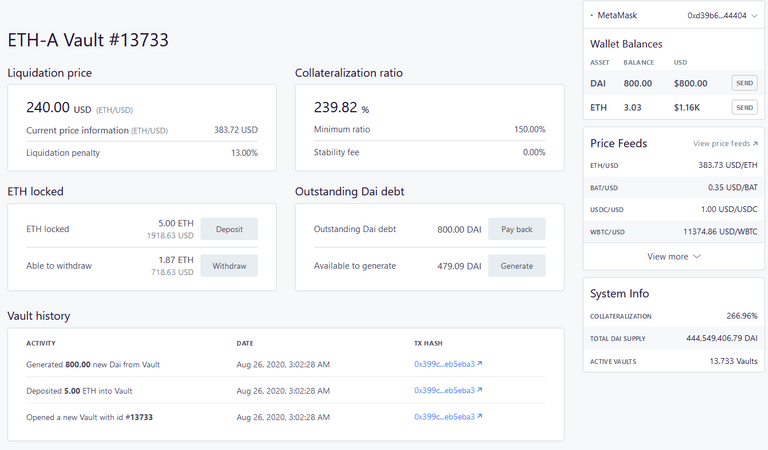

Step 1: creating DAI

Step 2: DAI created and transferred to the wallet

Don't worry, I will cover this one in one of the next episodes.

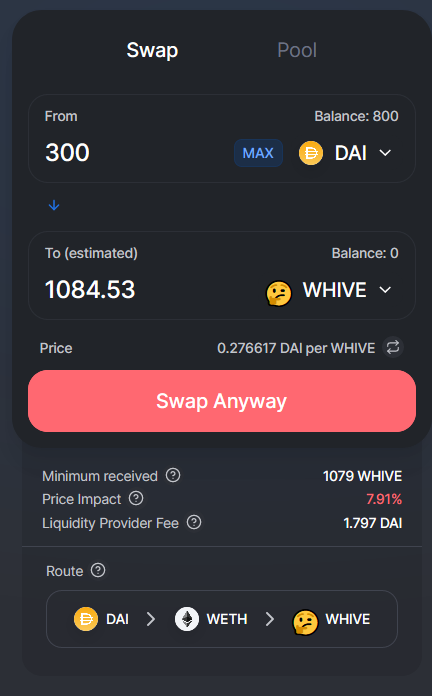

Step 3: uniswap trade

You can see we have a small problem - out trade will move the price by over 7%, even though I'm trading only 300 DAI at the moment. That's because WHIVE liquidity on uniswap is pretty low right now. Anyone can fix it by providing liquidity and earning passive income by doing so - but we'll talk about it in one of the next episodes ;)

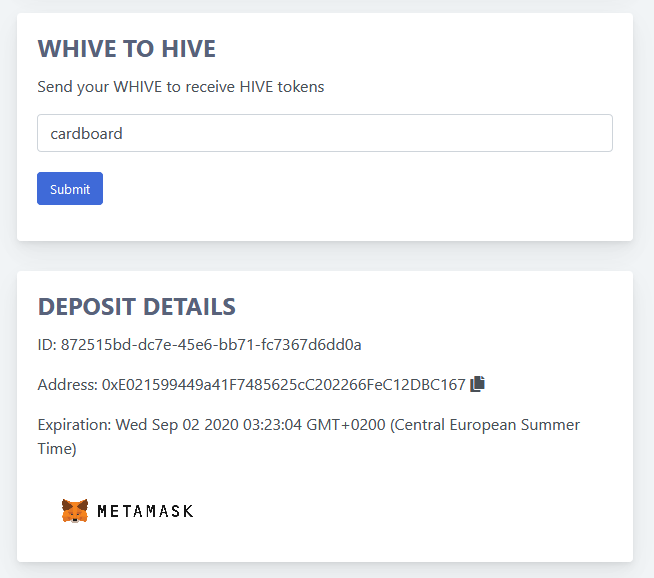

Step 4: bringing HIVE home (WHIVE -> HIVE)

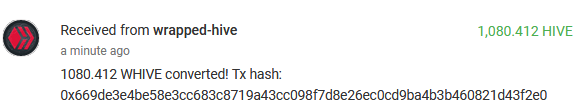

Now all I have to do is go to https://www.whive.network and deposit my WHIVE to provided address to receive HIVE :)

And here it is!

Now, it wasn't a perfect experience - the total fees required to complete all the steps was around $30 :O The bright point is that the most expensive fee (creating DAI vault) needs to be paid only once. Also the fees are not dependent on the transaction volume so paying $30 to move $10,000 sounds a lot better than paying $30 to move $100.

In summary:

This post is already way to long so I will keep this one short: thanks to ability to move HIVE token to the ETH network, we can now invest into HIVE without need to sell our crypto savings. More over, we can use HIVE to generate nice APR, which would be not possible by just holding those mentioned savings. It's like having the cake (locked in your fridge), eating the cake and getting additional 10%+ of the cake per year ;)

Of course there's more so see you soon in DeFi for new-bees part 2!

Can you explain how providing HIVE to the liquidity pool can benefit a Hivean?

Sure - you get share of the trading fees on uniswap (and other defi swap platforms) for providing liquidity. Will write about in soon :) Here's my earnings since yesterday for WHIVE : ETH pair. Please note it might be skewed a little as yesterday WHIVE was overpriced on uniswap.

Also it didn't change much today but that's because of ETH fees that are too high compared to the max trades you can do. In other words - we need more liquidity.

I hope you are aware of impermanent loss, if hive rises than the time you provided liquidity you will have less hive.

Edit: to minimize this balancer would be a better choice since you can create custom pools there instead of 50/50 of uniswap. On balancer you can have 90/10 (hive/dai), you will still have impermanent loss but it will be less and it will be negligible after bal token and other fee earnings.

Posted using Dapplr

Yes, although the theory is that in the long-term the earned fees will be higher then the loss in this case. Of course you can always withdraw your provided liquidity if HIVE price will start to go up and use it to buy move HIVE :)

Man, I need to look into this a bit more but I’m pretty much ready to provide liquidity once I read up on everything to understand the economic and security risks.

You know you can just buy HEX instead, it's basically designed to pump harder than anything else in Human History

Well... Hive can do that for $0 in 3 seconds. :-)

Also you should definitely warn unsmart people (those whoa re still not aware) that there are strings and risks attached.

You're right, will write about it in one of the next episodes where I will go more into detail how it works + edit this post to add info about the risks.

One thing that occurred to me after I finished writing this post is that using DAI backed by your crypto savings was possible also before, on centralized exchanges - but in this case there's no direct DAI:WHIVE pair so more steps is needed. Also in this case trading fees are going to the exchange, not liquidity providers (Hive holders).

30$ seems a bit high for small investors like myself :c

Yep, for now this is more usable for users with some more $$$ in crypto. It's gonna be interesting to see how ETH will deal with this problem.

I think I currently have 60$ in btc and some in Eth xD

Most of my investments is in Hive xD

Ye, it will be interesting to see!

Very cool @cardboard, very cool indeed.

This is great for big time crypto investors.

By the way, the Earned Fees for providing liquidity can be withdrawn? Or will it be added automatically to the liquidity?

It's added automatically to the liquidity but you can withdraw any part of the liquidity at any time.

WOW, amazing.. I sorta understand what DiFi lending is now and why it is neat. Cool. :)

I am looking on Uniswap, but cant find the list that WHIVE is on. Do you know?

This is the message that needs to be broadcasted to all DEFI traders the moment we have everything ready to go.

Sounds like something I might want to explore in the near future. I definitely like the idea.

Don't forget to use a VPN when browsing online.

Thanks for the interesting info and explanations, @cardboard. (reblogged)

I can't wait for part 2!

A huge hug! 🤗

My doubt is: since no one gives anything for nothing, what could be the negative aspects of this operation?

Could it be that we are moving towards a financialization (speculation) as has happened in the real economy? 🤔

Świetnie! Niewiele wciąż rozumiem, ale zawsze coś.

#posh

fantastic post! But now I feel I need to learn so much new stuff again, like when I first learned about cryptos! 😅

That's the definition of having fun! :P

What about the glitch during the creation of smart contracts?

Do you mean possible exploits in the code? Right, I will edit the post to add info about it.

That's right. Sorry took me a while to reply and thank you for adding that on the write up above.

👍

Please don't do this with all of your savings. Smart contracts can just make the money disappear, you never know what bugs are in there.

Of course, I don't put there all of my savings :) You're right, smart contracts may have bugs that can be exploited but the quality of the code gets better all the time.

Hola soy de habla hispana, de Venezuela específicamente, tuve que traducir tu articulo, que me resulto muy interesante, educativo y aprovechable como propuesta, estaré pendiente de lo que escribas.

Looks really cool!

a world of new possibilities!

I will come back to read this. You have gathered so much knowledge about it already, considering that i was seeking knowledge about this from you recently. So i will like visit again

Thank you for this great explanation. You make finance sound easy. I'll definitely follow up on this and your advise.

And follow you, not many people take the time and effort to explain this topic in a way that is easy for non experts, and to share what you believe is a good investment.

Thank you again 😘