Hi investors, it's been yet another quiet week in crypto markets, the large caps are trading sideways on spot, waiting for a catalyst to get their momentum going.

Today we're only covering Bitcoin and I'll share my thoughts on QE. If you're interested in Ethereum I suggest you check out last week's edition of the newsletter as not much has changed since.

Let's dive in!

Bitcoin.

BTC is changing hands at $9072 USD at the time of writing and we're down -0.66% from last week

Trading has been sideways on very thin "real volume" (adjusted to remove the effect of washtrading on shady exchanges):

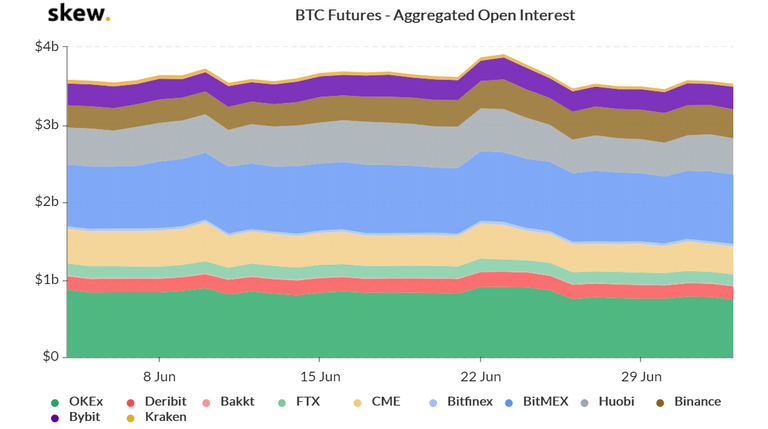

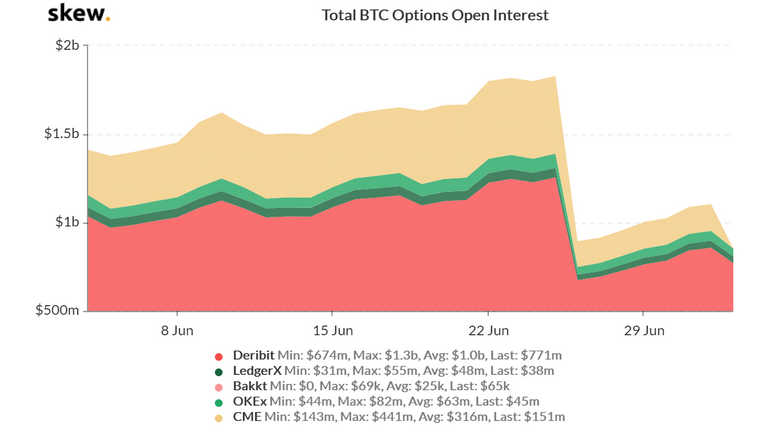

Meanwhile most of the action has moved into more liquid derivative markets.

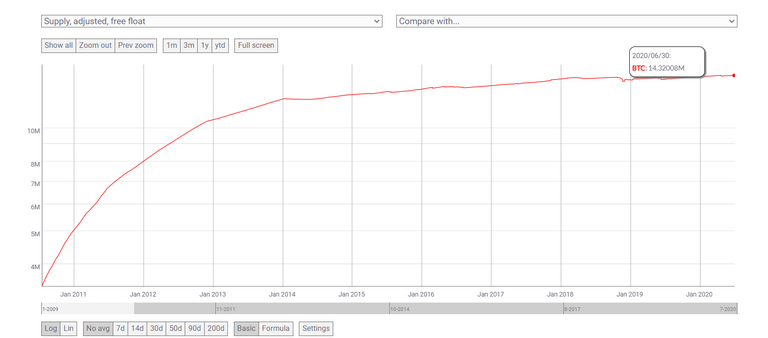

I believe that the lack of volume on spot is due to traders being turned off by thin order books as there just isn't much Bitcoin around to trade with.

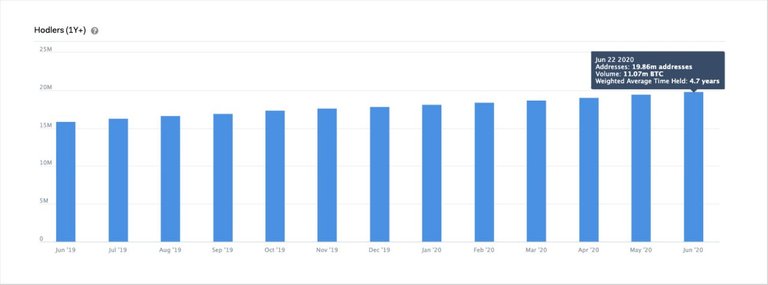

Thanks to the team at CoinMetrics we now know that Bitcoin's free float supply is hovering around just 14 million coins, 11 of which are being held in long-term cold storage and not trading on exchanges:

Adding to that, we've also seen a considerable reduction in selling pressure from miners since the halving.

The digital gold narrative is definitely playing out but at the cost of a complete dry-up of volume on spot exchanges where we see new supply being mostly soaked-up by macro-institutional players waiting for a catalyst that could get the price of Bitcoin going.

Speaking of scarcity and catalyst, let's talk about QE and the macro economy.

Macro Picture & Quantitative Easing.

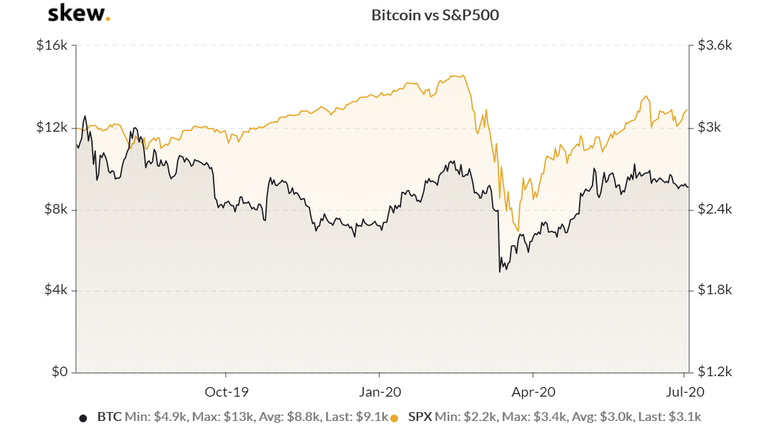

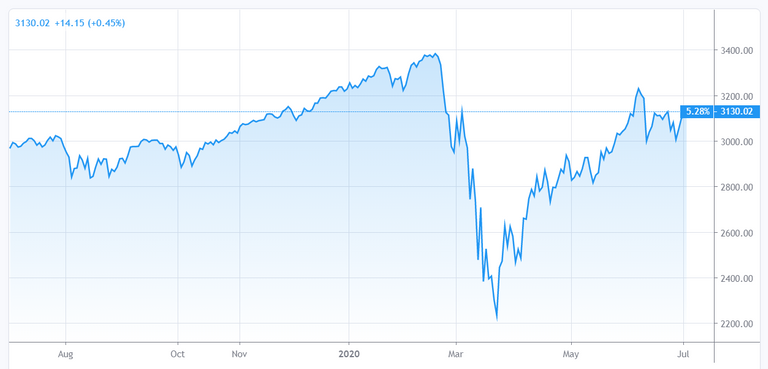

After a calamitous month of March, both Bitcoin and equities have experienced a rapid V-shape recovery.

Indeed, BTC's correlation to the S&P500 is at an historical high...

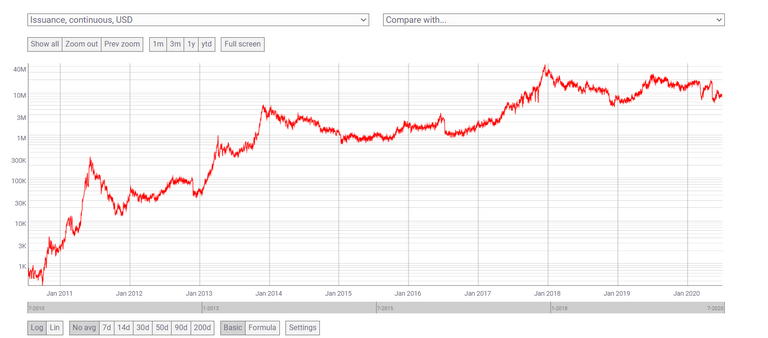

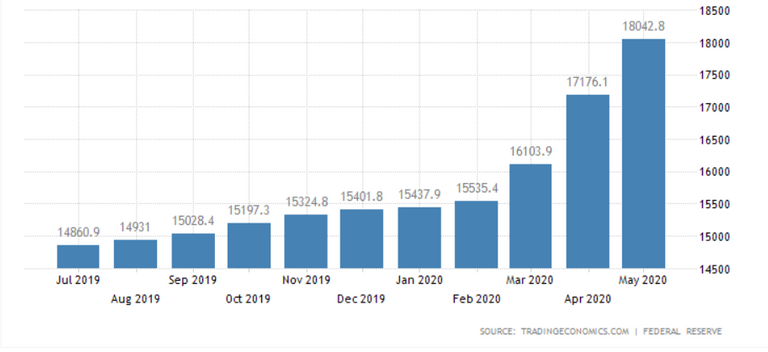

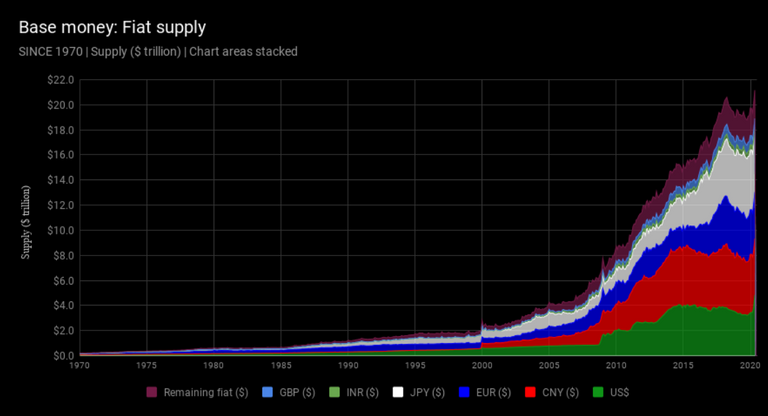

... perhaps a signal that the YtD issuance of unprecedented levels of fiat liquidity via QE is keeping both markets afloat.

However, QE can only keep markets on life support for so long before the chicken come home to roost.

If you haven't noticed by now, the world economy is not in great shape.

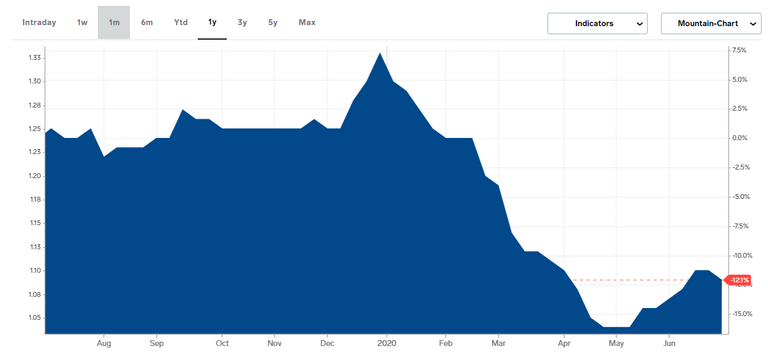

The price of diesel (which generally reflects global economic activity) is low, suggesting weak recovery and reflecting the fact that a large part of global commerce is still frozen due to the COVID crisis.

To make matters worse, the USA (the world's engine of global demand for goods) are in turmoil as COVID and civil unrest are spreading like wild-fire.

To the bafflement of many Bitcoiners though, both the USD and the S&P500 have seemed immune to the grim macro-background and the fears of inflation.

What could possibly explain this disconnect?

With regards to QE, global markets have proven very good at absorbing large issuance of USD over the last decade.

The dollar is reserve currency for the world and most of global commerce including commodity markets and oil is quoted and settled in dollars; which fuels an enormous demand for USD.

On the supply side we have the fact that the USA has grown a very large trade deficit (which is paid in USD). The world economy provides goods and services to the USA, gets paid in USD, reinvest the money into US treasury bonds and this debt is serviced in USD.

Bottom line, unless the dollar loses its status of being the global reserve currency overnight and/or we witness a complete collapse of US consumer demand for goods produced overseas, it's unlikely that we'll see inflation in the short term.

On the long term though, math and history have shown that inflation is inevitable, we just don't want it to happen too fast. Cheering for Bitcoin to take over the monetary system now is basically wishing a lot of pain and economic duress on the USA for the benefit of a few BTC whales, it just doesn't make sense to me.

Also,

Keep in mind that Bitcoin has probably been a net beneficiary of global QE as cheap (free...) new money somehow cascaded into thinly traded crypto markets, pushing returns into the quintuple digits.

As a consequence, it's likely that ending QE would have a deflationary effect on the price of BTC until it gains more adoption and/or become part of a global basket of currency aiming at replacing the dollar as reserve currency.

Second, as I already mentioned, wishing a rapid economic collapse upon the US is... cruel as it would result in a lot of pain and suffering and would not necessarily translate into more Bitcoin adoption as people would likely dump BTC to acquire goods of first necessity.

I think that what we really need is an orderly transition to a system where global commerce is quoted against a basket of currencies and commodities inspired by Keynes' Bancor (not the ICO). I can see Bitcoin having a place in such basket as a non-sovereign asset. Maybe then we would see Bitcoin finally decouples for good with short-term driven markets like the S&P500 and realize its potential of becoming a world-scale reserve currency.

Only time will tell.

That's it for this week's analysis, see you next weekend for more market insights.

Until then,

F0x

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Well you know I agree with both of these conclusions 100% ! This is why I am still waiting a bit before the BIG LONG on BTC xD

You bearish short term @vlemon? Anticipating a big de-leveraging soon?

I believe Financial Markets have been willing to believe to the death that this Covid19 is over and that we are having some kind of V-U shaped recovery.

I believe this is not the case and that we will be on-off economies for the next 12-18 months.

And I believe the upcoming social unrest, unemployment, n’économiser shock is not taken into account !

Biggest shock ever and we are -10% YTd in Europe and in positive territory in the US ? wTF ! ( even with QE).

I might be too “rational” compared to other market participants. For now...

Haha, no I think you're making a good case that the risk might be terribly underpriced by the market. I think the countries (like France) that have made the necessary sacrifices will come out of it stronger though!

I am concerned about the situation in the US though, COVID + massive unemployment +social unrest + elections coming soon, that's a terrible combo..