Hi investors, today we'll cover this week's in Bitcoin and Ethereum markets and I will share my portfolio strategy for the next bull run.

Let's dive in!

Bitcoin.

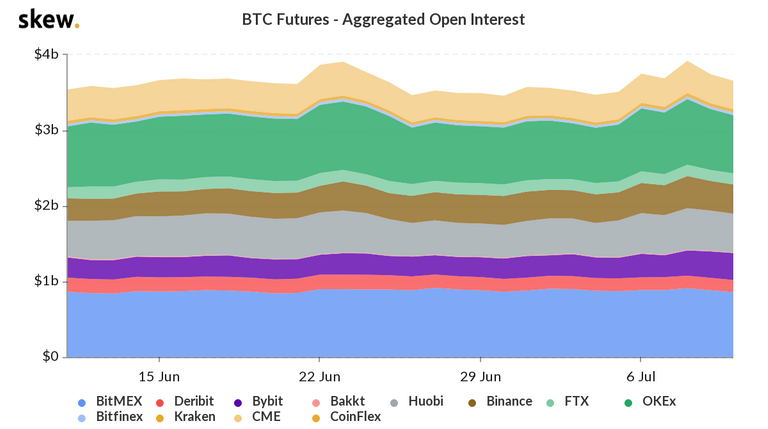

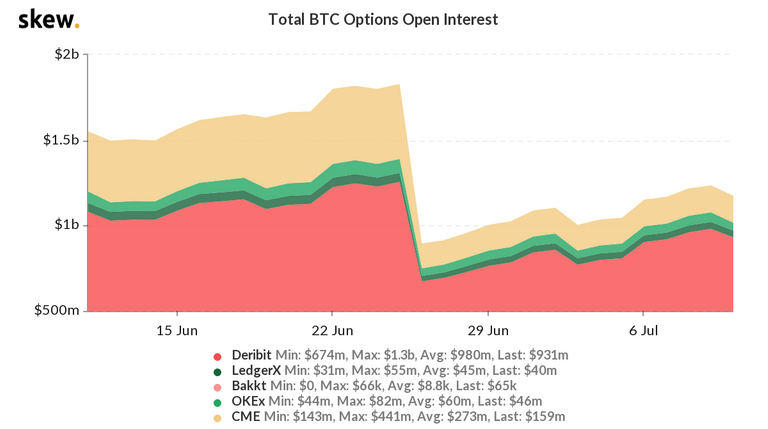

BTC is changing-hands at $9216 USD on spot markets. We're up a miserable +0.90% since last week and most of the trading volume has moved over to derivatives markets.

Source: Trading View

Source: Skew

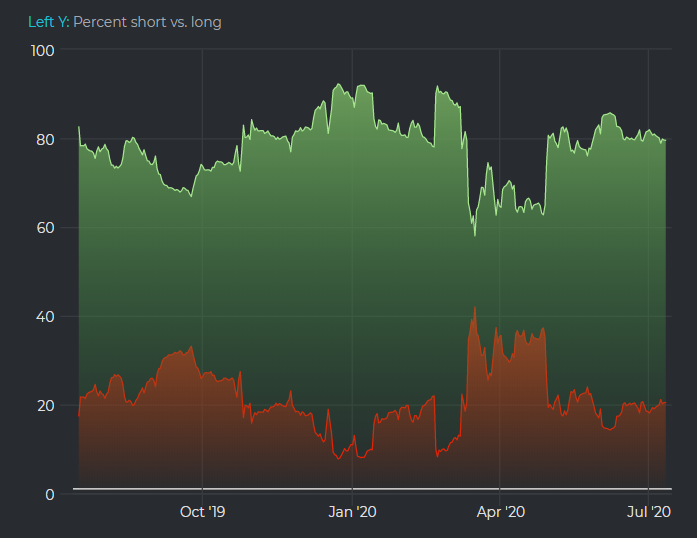

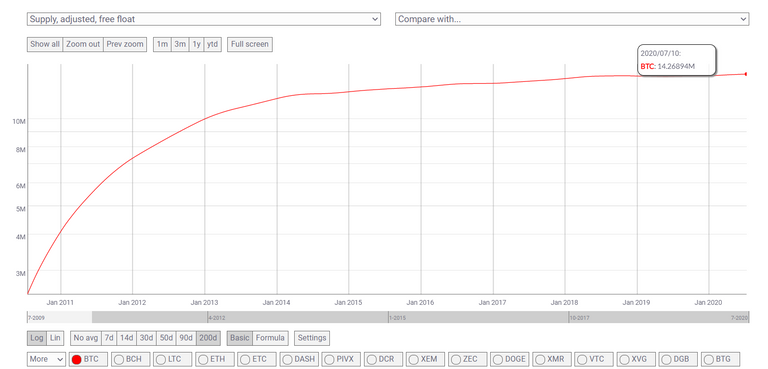

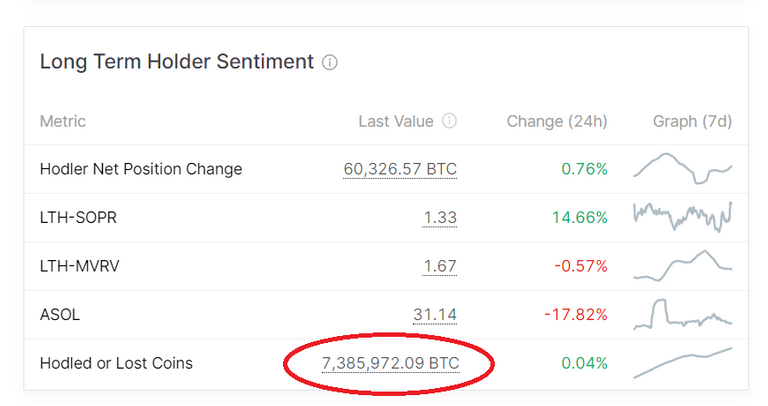

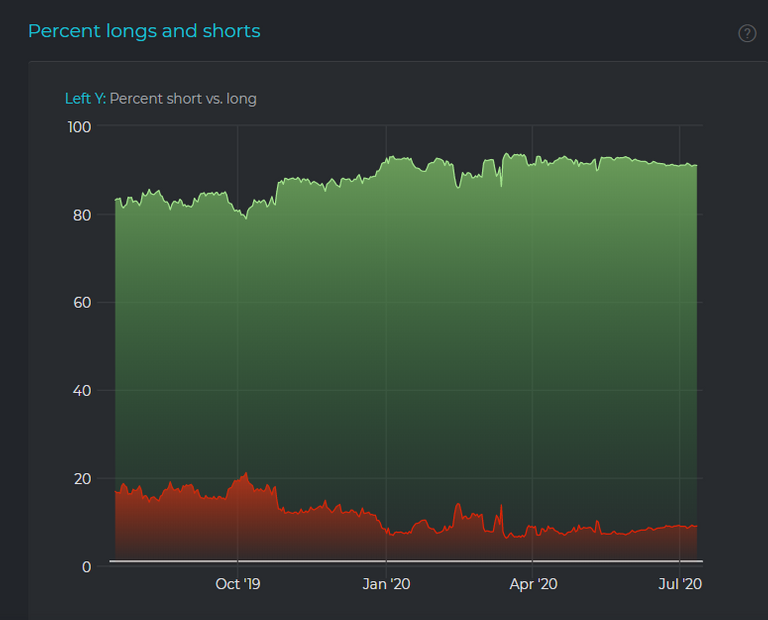

Market sentiment remains overwhelmingly bullish though, the long/short ratio is massively skewed long and it's estimated that over half of BTC's free float supply is being hodled in cold storage.

Source: Datamish.com

Source: CoinMetrics

Source: Glassnode

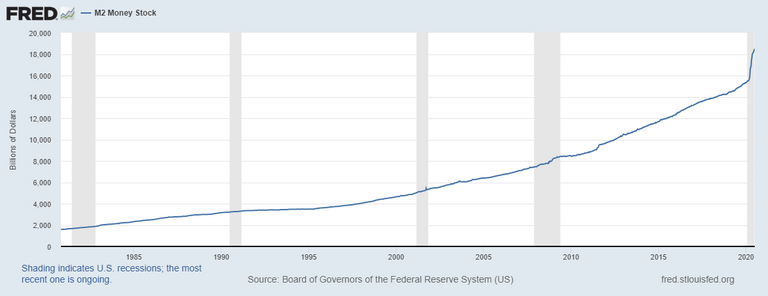

With a macro background mired by hyper-inflation of the monetary base, social unrest in the US and a serious drop in economic activity worldwide, the value proposition of Bitcoin has a hedge against global f*ck up meltdown has never been more relevant.

Source: St.Louis FED

Yet, one cannot but be disappointed by Bitcoin's performance in an environment that many thought would provide a quick catalyst for broader adoption.

Since the beginning of the pandemic Bitcoin has been losing ground against gold.

In times of unlimited fiat QE, comparing Bitcoin to gold does more justice to BTC's value proposition than keeping the score against a massively manipulated USD.

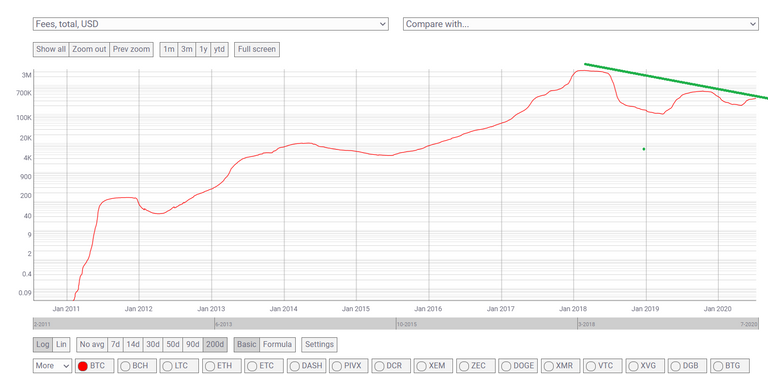

Another potentially bearish force to keep an eye on is the evolution of the fee market on Bitcoin.

We've been in a protracted bearish block-space market for over 2 years now and, with the issuance of new coins quickly diminishing, it's still everyone's guess whether or not Bitcoin can manage to create enough demand for blocks over the next decade to ensure the security of the network.

I remain long Bitcoin but will be watching the fee market like a hawk.

Ethereum.

Ether (ETH) is trading at $239 USD on spot markets, we're up +4.27% since last week.

ETH has clearly found a technical bottom against the USD and is slowly taking off from its local accumulation zone.

ETH is also appreciating against BTC:

Despite rumors of Phase 0 (staking infrastructure) of ETH 2.0 possibly being delayed (again), market sentiment remains extremely bullish.

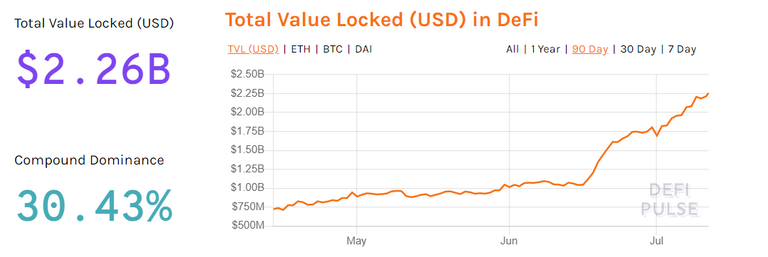

Indeed ETH is driven by extremely strong fundamentals as DeFi is starting to find viral product market fit as permissionless banking (via dApps like Compound and Aave) and global payment infrastructure for crypto-dollars.

Source: DeFi Pulse

Source: Castle Island Venture

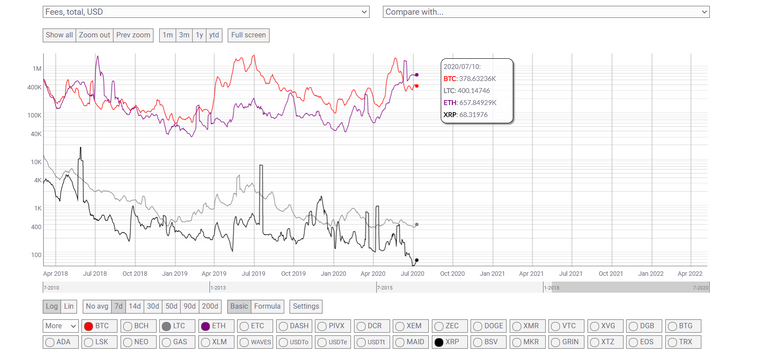

These ATH levels of economic activity on Ethereum have re-propelled fees above Bitcoin's for the past 7 days (Litecoin and Ripple added for scale).

Source: CoinMetrics

This last happened during the summer of 2018 right around the moment when ETH started the second leg of its epic bearish plunge to around $100.

Source: CoinMetrics

In the face of all this activity, I wouldn't be surprised to see a bullish repricing of ETH over the next 6 months as I believe ETH is currently trading at a severe discount to its fundamental value.

Market Strategy.

Disclaimer: This is not financial advice, opinions are my own.

I believe that we're currently in a quiet accumulation phase that is setting up the stage for the next crypto bull market;

I believe DeFi will be the main catalyst for this bull run;

As a result, I think that Bitcoin will under-perform against ETH and ETH will under-perfom against DeFi tokens that can generate capital returns via staking;

The reason why I think BTC will under-perform against ETH is three-fold:

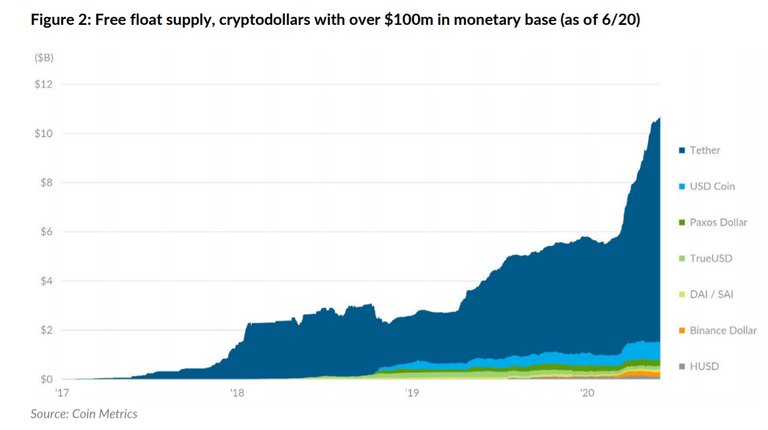

First, unlike during the 2017 bull-market, traders and investors no longer have to acquire Bitcoin to be able to participate in the crypto economy or to trade. The reason being that a cheaper, less volatile option to settle trades and move money around exists in the form of crypto-dollars (USDt, USDC, PAX, etc.). Ethereum is now home to most crypto-dollars and using them requires to pay fees in ETH (which will accrue value to ETH);

Second, I think that DeFi (not Bitcoin) will capture the imagination of the next generation of market participants. These new investors will likely use ETH (or fee-generating crypto-dollars) as a gateway currency to access DeFi banking services (to get yield) or acquire DeFi tokens on DEXes (to stake);

Third, despite numerous delays, ETH 2.0 is too good of a catalyst for ETH to be ignored. However, I think that the market is still under-pricing ETH in the same way it was under-pricing DeFi tokens during Q1 this year.

For all the following reasons I'd rather be mainly in ETH with a secondary position in BTC and a third, much smaller position in DeFi tokens as "leverage";

My goal for the next market cycle is not to trade but to patiently ride the waves until the market reaches a boiling point;

You'll know it's time to sell when Uber drivers start telling you about how they're making a killing moving ETH into obscure DeFi protocols and when CNBC starts chilling ETH on prime-time TV.

What is your strategy for this coming bull market?

What I am Reading:

- Cryptodollars - The Story so Far (by Castle Island Venture)

- Quantitative Easing, MMT, and Inflation/Deflation: A Primer (by Lyn Alden)

That's it for this week's analysis, see you next weekend for more market insights.

Until then,

🦊

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Fully upvoted and reblogged by @hodlcommunity !

We are truly enjoying your weekly reviews.

Thank you @f0x-society

Pleasure is mine @hodlcommunity

:)

Interesting post and strategy, I think despite the current bull we are still in accumulation phase depending on coins/tokens of interest. I think speaking untechnically the crypto market has not fully mature yet in terms of price actions, there is still room for appreciation.

currently for me it is the waiting gain for a pull back to accumulate some crypto with spare cash.