Hello!

For those who live under a rock and are not familiar with the Stock-to-Flow model from @100trillionUSD, I will try to explain it first and then discuss if it is right or not from my point of view.

First we should define what is STOCK:

Stock is the size of the existing stockpiles or reserves.

And then FLOW:

Flow is the yearly production

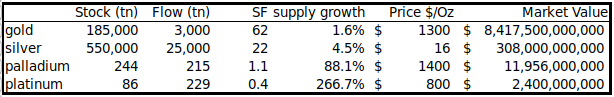

With this 2 definitions we can define the STOCK TO FLOW by the ratio between the Stock divided by the Flow (yearly production). @100trillionUSD did the following calculations for the precious metals and the numbers looked like that:

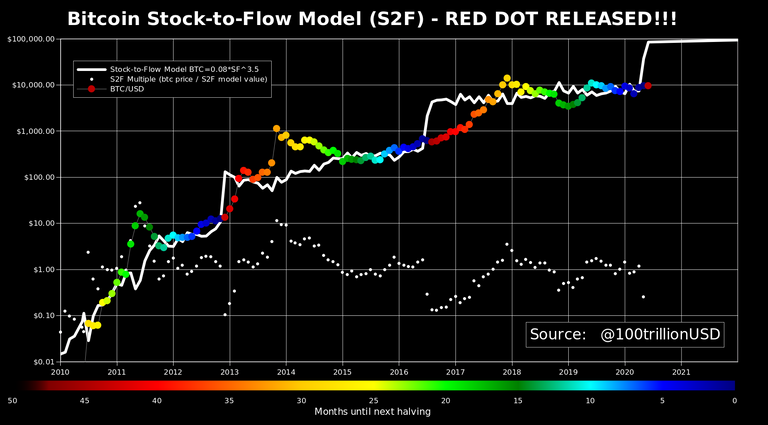

With all this considerations in mind he draw the Bitcoin Stock-to-Flow model (S2F) with their value and expected value over time. He also added colors showing the months until next halving. With this information is really easy to see what are the effects of the Bitcoin halvings over time.

Actually the graph looks like this:

As you can see, the predicted price for Bitcoin after the last 2020 halving is almost 100.000$. On their 2019 article the model predicted a price of 55.000$. Note that the graph is logarithmic and some lines can mislead you, like this one.

Conclusions

I think that this model is based on a really easy principle. The principle that the new yearly supply of an asset have a direct effect on its price.

It also supports that the price of the asset tend to reflect this ratio over time, maybe in a short timeframe can be quite different but in the long run it follows.

On a general basis I agree with that, I think this model is one of the best to follow out there. I am still thinking that there can be major influences that are not considered in this model, such as macroeconomic events like the Coronavirus crisis, actions taken by the government, etc.

If this time it is shown again that the prices are correlated with this model, we will be able to confirm that this model is 100% acurate. I will be patient until the next cycle is confirmed.

Enjoy! 😊

I believe in the model, major influences affect all markets, not just Bitcoin. But I agree there are specific differences in Bitcoin as most of the investors just Hodl and those bitcoins never hit the market, that together with the fact that there are many lost coins makes every whale movement impact much more the markets.

Yes, this whales movements can affwct heavily the market valuations. Howeverif the tendency is to go upwards I don't care about what they are doing in the short term.

Thanks for the support! 😊

The model is created based on historical data and tested to be statistically significant. In other words, it is right until proven wrong in the future 😀

I think it makes sense but of course we should not just follow it with blind faith.

@tipu curate

Upvoted 👌 (Mana: 3/6)

This time is really exciting to analyze it closely!

If it is right we'll see massive gains this years.

Thank you very much for the support! Really appreciated! 😊

Hello @resiliencia,

Nice post as usual. I understand the logic behind it but for example how do you value gold if there was no 'new flows' (let's say we do not find new gold).

This model is very inflationary for the bitcoin price as it is inversely correlated with supply. I hope it is right haha :D

If there was no new flows the SF model cant be used, if you divide something by 0 it equals to "infinite". By the way I think that the value of gold will skyrocket to higher and higher prices over time.

It makes sense given the fact that no new gold can be created and we have a capped supply.

Interesting question my friend @vlemon.

Find here the article where he compares the srock 2 flow model for Bitcoin and Gold and Silver, it seems quite accurate.

https://medium.com/@100trillionUSD/bitcoin-stock-to-flow-cross-asset-model-50d260feed12

I don't think the model works @resiliencia,

Eric Wall did a pretty good mathematical analysis on why S2F doesn't work, it's somewhere on Twitter/Medium

I think the only reason S2F became popular is because it says "Number go up"... Bitcoin twitter loved it and now it's become a meme, retail driven markets want to hear things that confirm their bullish bias... that's all.

Thanks for your thoughtful comment @f0x-society!

I will definitely take a look at Eric Wall and try to find their analysis! I love to see different opinions!

Pleasure!

If the demand stays the same or increases and the supply gets cut in half every 4 years, what do you think is going to happen?

The price must rise significantly, it is inevitable as long as the demand stays the same.

We just need to hope that the demand will stay the same and be really patient! 😊

Exactly. Buying BTC is basically a bet on the future demand of bitcoin.

If you think that the demand will stay the same or increase in these times of worldwide chaos, you buy bitcoin.

Wallet adresses are increasing

Wallet adresses HODLing > 1BTC are increasing

BTC that is stored on exchanges is decreasing for nearly a year now

All of the above is bullish

I didn't know that BTC stored on exchanges is decreasing that constant. Makes a lot of sense.

Shared on twitter #posh: