Hello!

According to Coinmarketcap there are currently 18,419,093 BTC in circulation, this is more than 87% of the Total Supply. Considering that by the end of next year the 90% of the supply will be mined one could think that we'll reach the 100% really soon.

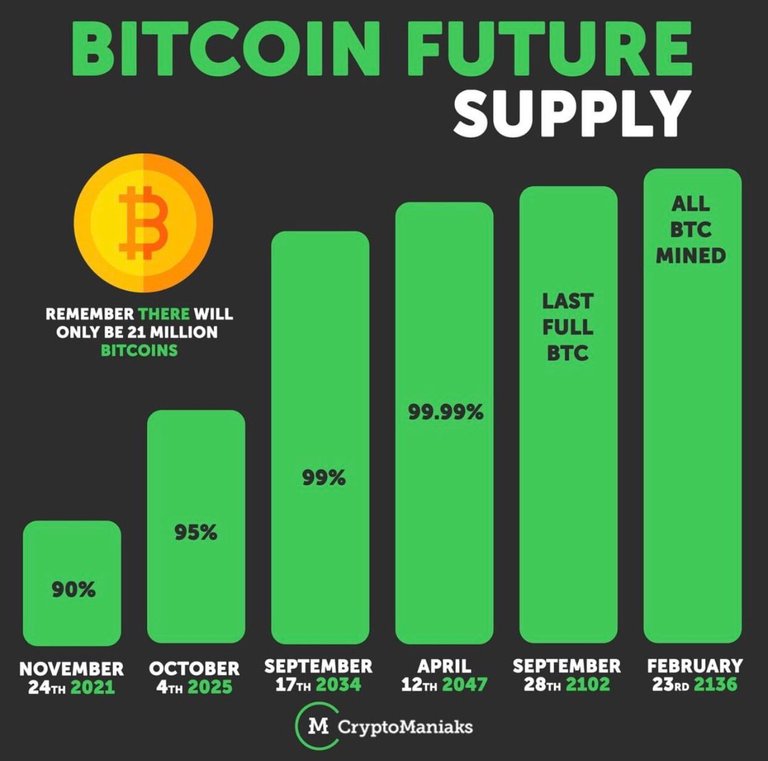

If we took at the estimations we'll see that this moment is predicted to happen approximately in 2136.

This is more than 100 years from now!

Things will get interesting in 5 years, where 95% of the supply will be mined. Then the production of BTC will be halved again and there will be less and less BTC added daily. Given the same demand for the asset this will raise the price almost in 100% of the cases.

I found an interesting chart where the Bitcoin Future Supply is explained. You can take a quick look and figure out how hard it will be to mine 1 BTC in the future. Here it is the chart:

99% of the BTC will be mined in 2034!

At this point things will get really really interesting. I am willing to see what the cryptospace will look like in 2034. I am expecting a lot of innovations, a broader user base, and a lot of dApps transacting in hundreds of cryptocurrencies.

What happens when we 100% of the Total Supply is mined?

It seems that without the incentive for miners to mine Bitcoin after a really costly process they will be forced to leave the network as it will be unprofitable. The truth is that this topic has been always a tough debate for the Bitcoin enthusiasts.

At some point the consensus could agree to expand the supply of Bitcoin to more than 21,000,000 BTC, however this will have a lot of controversy and a lot of detractors of this idea.

According to Investopedia.com the fees are here to solve this issue:

Even when the last bitcoin has been produced, miners will likely continue to actively and competitively participate and validate new transactions. The reason is that every bitcoin transaction has a small transaction fee attached to it. These fees, while today representing a few hundred dollars per block, could potentially rise to many thousands of dollars or more per block as the number of transactions on the blockchain grows and as the price of a bitcoin rises. Ultimately, it will function like a closed economy where transaction fees are assessed much like taxes.

I think that there are still a lot of questions regarding the future of Bitcoin, but I am sure that the community will manage to solve this situation if it really becomes a problem. A lot of things can change in 100 years, maybe we'll have other innovations that are far better than Bitcoin and we don't even need to worry about it.

While this journey happens, I will enjoy the process and think about how the future will be. I love it.

Enjoy! 😊

![]() Follow me on Twitter

Follow me on Twitter

Intriguing for sure. I will be long dead by then LOL hopefully my grandkids will get to have a bit of the Bitcoin old grandpa invested in a few years late but ahead of so many others. Crazy to think of, huh?!

I would love to be that grandpa too! 😊

Shared on twitter #posh: