A couple of things before I keep going here:

- My 2021 cryptocurrency strategy is to dollar cost average each week in three crypto assets

- The coins are Bitcoin, Ethereum, and Litecoin

- I stack these purchases on Blockfi to generate passive income

- I'm not a financial advisor...therefore I have no idea what I'm talking about

After doing some research on Blockfi, I finally decided to open an account on January 1 to earn some passive returns on my three crypto assets. I know, I know...it's not FDIC insured, and you aren't in control of your keys. It's also not decentralized. Listen, I know the risks; but at the same time, I'm also making an aggressive move to get more passive income in 2021, so I decided to take a chance and use the Blockfi service to generate more crypto. The rates I'm currently getting are as follows :

- Bitcoin - 6% interest income paid out in Bitcoin

- Ethereum - 5.25% interest income paid out in Ethereum (starting in February)

- Litecoin - 6.50% interest income paid out in Litecoin

I know it's not some crazy staking rewards on the hottest new coin on Binance or Kucoin, but I'm trying to keep life simple this year. I also know this strategy isn't timing anything; that's ok too, because I suck at timing markets. I always have, and I always will...so why fight it?

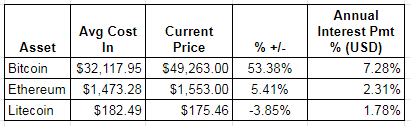

With that said, my updated 2021 dollar cost averaging strategy has gotten me to the following unrealized gains/losses on must my purchases alone:

No real surprise my Litecoin is currently sucking it up.

Yet to be honest, I'm not selling any of these positions, and more importantly, I'm getting dividends/interest payments back to me by keeping these positions on Blockfi.

Adjusted for the USD, at current market rates for BTC, ETH, and LTC, I'm getting a 7.28 % passive income on my USD investment for BTC, 2.31% for ETH, and 1.78 % for LTC. All of these are better than what I'm currently getting at my local credit union. All of this now puts me at a roughly $.46 / day interest income rate. Again, it's not like I'm staking my cash into some insane DEFI project; I'm just not nimble enough for that type of investment currently. Instead, I'm focusing on the long game. More importantly, I believe that BTC, ETH and LTC will still appreciate vs the USD over the next few years, and with it, my Blockfi investment.

What do you think? Am I making a mistake? Should I be putting all of this money on something else? Is Blockfi a concern to others? Or are others using the service? Let me know below!

Not your keys is the biggest scare for me. As well as...

Your biggest gain is BTC at 7%, the others, to me anyway, are negligible for the risk. Maybe depends on how much you have staked as well...

I’ve leased 10K HP to @leofinance and I’m getting about 1-2 LEO a day. Which at current rate is like $1.20....and I still “own” my Hive.

If you’re bullish on Hive and in turn, LEO, then it’s a no brainer. Stack your HP and rake in LEO.

But that’s just me...

yeah i'm all about Hive for sure; Leo muted me a bit ago as I posted a comic book / art work spec piece, so I've avoided the centralized motif of that (just being a baby, I guess)

I do like lots of other staking gcoins too, but I wanted to be lazy this year and focus on the big three (ish). I'd like to start adding cardano to the mix too...but man. so many damn, good projects. I need more money to spread around!