Welcome to the Daily Crypto News: A complete News Review, Coin Calendar and Analysis. Enjoy!

🗞 Coinbase Going Public Isn’t Selling Out – It’s the Start of a Long Game

fter a dramatic week in which the crypto industry’s eyes were on Coinbase’s Nasdaq debut, it’s time to step back and reflect. Plenty of pixels and airtime has already been beamed. Plenty of analysis has been performed about the valuation and growth outlook. But not enough has been said about what I think is the long game.

Some have wondered if Brian Armstrong, Coinbase’s CEO and co-founder, is “selling out” by going public. A business that was built around an asset group created to eliminate the need for centralized gatekeepers ends up joining the centralized system. How could he?

New rules

By joining the ranks of listed companies, Coinbase is now part of the traditional financial establishment. Only, it’s not, really.

It still is a business premised on assets that do not function like traditional assets, and that permit a level and speed of innovation unlike any before in the financial industry. It is still, through and through, a crypto business.

New incentives

Since money speaks louder than words, let’s look at some of Coinbase’s recent investments.

In January, Coinbase acquired Bison Trails, a startup focused on staking services, to expand into the infrastructure-as-a-service segment. This isn’t just any type of infrastructure, though. Staking is based on a new type of consensus protocol, in which the stakeholders of a network (those that hold the assets) vote on transaction validation and other governance issues. In exchange for locking up their ether holdings, stakers earn a yield. In the case of the Beacon chain, Ethereum’s beta transition towards a full proof-of-stake blockchain, this yield can be as much as 11% annually.

New types of asset

Another area to keep an eye on is Coinbase’s actual and potential investments in tokenized securities. In the S-1 filing, the company said (my emphasis):

“Shortly following the effectiveness of the registration statement of which this prospectus forms a part, our board of directors will be authorized, subject to limitations prescribed by Delaware law, to issue common stock in one or more series … in the form of blockchain-based tokens.”

New beginnings

And this is the main point: Coinbase did not “sell out.” It took the “revolution” to the castle. On the way, it got its early investors an exit, gave its shareholders liquidity and set the stage for easier and cheaper capital raises going forward.

🗞 SEC loses a battle to win the war? Ripple dissociates from pumping XRP

When the United States Securities and Exchange Commission filed legal action against Ripple Labs and its top-two executives in December, alleging that its XRP coin was in fact a security and that the firm had raised over $1.38 billion through an unregistered securities offering in 2013, many wondered if XRP would even survive.

Some exchanges delisted XRP; some asset managers sold their XRP tokens. XRP had lost its place as the top 3 currency by market capitalization and was even looking like it could drop from the top 10. But reports of Ripple’s demise were spectacularly exaggerated.

As of mid-April, XRP had increased 532% over the previous 12 months, and things also took a favorable turn recently in the SEC lawsuit, with the defendants prevailing in two discovery rulings — even turning the tables on the regulatory agency by winning access to the SEC’s internal memos and minutes with regard to crypto discussions. “The SEC Is Now On Trial – And Knows It,” sounded Forbes.

“The application of the statute of limitations to token sales; the extraterritorial reach of the securities laws to token sales on worldwide blockchains; the application of the securities laws to digital assets that FinCEN has regulated as a virtual currency [e.g., BTC]; and whether courts will use Bitcoin and Ether as models of non-security digital assets in their legal analysis.”

Not over till it’s over

“[Ripple executives] Garlinghouse and Larsen made a plausible argument that the SEC was over-reaching with its request for eight years of their personal bank records. As the insiders argued, why does the SEC need to know household expenditures in order to make its case?”

“However, although Ripple may discover information that will help its defense as a result of that ‘win,’ the extent to which this will matter in the long run is far from certain,” said Goforth. “The two recent pre-trial discovery rulings have shifted the playing field of the case,” added Payne. “The defendants have gotten traction with some important arguments, but that does not mean they have won the case.”

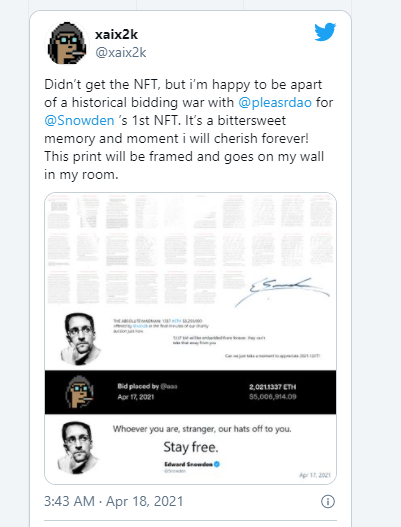

🗞 Why This DAO Bought Snowden’s NFT for $5.4 Million

- PleasrDAO bought the Snowden NFT because its members endorse transparency, just like Snowden.

- The DAO will continue to buy and commission NFT artworks, invest in decentralized finance, and run an incubator to advance its mission.

- Pplpleaser, the digital artist whose NFT the DAO bought in March, has joined PleasrDAO as an honorary member.

A disparate band of NFT art collectors are harnessing the power of smart contracts to create a decentralized digital art investment empire. Their latest purchase: $5.4 million on an NFT minted by NSA whistleblower Edward Snowden.

“If people haven’t started paying attention, they should,” digital artist pplpleaser told Decrypt from her home in Taiwan. She’s responsible for the decentralized autonomous organization (DAO) behind the sales. It’s called PleasrDAO, and formed last month when a group of anonymous buyers used smart contracts to pool money to buy her NFT for $525,000.

🗞 Dogecoin, CryptoCurrency Reddit communities surge as crypto euphoria heats up

With much of the market fixated on Bitcoin’s (BTC) sudden price correction over the weekend, retail interest in digital assets appears to be on the rise, according to the latest statistics from Reddit.

The r/dogecoin community added 145,859 weekly subscribers, according to Subreddit Stats. The gains are hardly surprising given DOGE’s dramatic rally over the past week. The meme-based cryptocurrency skyrocketed 400% during that period, bringing its yearly returns to an eye-watering 5,000%.

DOGE’s parabolic rally moderated over the weekend, with social media sentiment data from The TIE and Cointelegraph indicating more pain in the short term. That’s because price action is often correlated with social media engagement; a decline in the latter is sometimes a precursor to bearish price action in the near term.

*“Past week has been insane in the crypto world, so naturally things here weren't like they normally are. Your curious posts/comments may have been ignored a bit. In the weekend things are a bit more chill, so feel free to ask us anything you want.

Massive shakeouts are nothing new for seasoned cryptocurrency investors. Even during bull markets, declines of 20% or more are fairly common, especially after major rallies. Speculation about an abrupt decline in Bitcoin’s hash power and the possibility of U.S. regulatory action against crypto-friendly banks may have contributed to the decline on Sunday.

🗞 Daily Crypto Calendar, April, 19th💰

- Elrond (EGLD)

"Internet-scale value swaps begin with an epic token distribution: $EGLD owners will be able to claim $MEX tokens."

- Zeppelin Dao (ZEP)

"Zeppelin.dao (ZEP) @ZeppelinDao will make its debut on #BitMart on April 19!"

- Big Data Protocol (BDP)

"The BDP airdrop is under way. Claim the amount you were owed + 20 bonus BDP "

- Genesis Vision (GVT), xDAI (XDAI)

"Genesis Vision Gateway launch on the XDAI."

- Chainlink (LINK), Illuvium (ILV)

"Tune in on Mon, April 19, 2021 7:00 AEST to catch @KieranWarwick on @Chainlink Live's Video Q&A."

- 🗞 Daily Crypto News, April, 18th💰

- 🗞 Daily Crypto News, April, 17th💰

- 🗞 Daily Crypto News, April, 16th💰

- 🗞 Daily Crypto News, April, 15th💰

- 🗞 Daily Crypto News, April, 14th💰

- 🗞 Daily Crypto News, April, 13th💰

- 🗞 Daily Crypto News, April, 12th💰

- 🗞 Daily Crypto News, April, 11th💰

➡️ Youtube

➡️ LBRY

➡️ Twitter

➡️ Hive

➡️ Publish0x

➡️ Den.Social

➡️ Torum

➡️ Spotify

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

➡️ Invest and Trade on Binance and get a % of fees back

➡️ Check out my video on Unstoppable Domains and get 10$ off a 40$ domain purchase

➡️ Get 25$ free by ordering a free Visa Card on Crypto.com using this link or using this code qs4ha45pvh

Helps us by delegating to @hodlcommunity