Welcome to the Daily Crypto News: A complete News Review, Coin Calendar and Analysis. Enjoy!

🗞 Market Wrap: Bitcoin Steadying Around $52K, Ether Surges on Rising Institutional Interest

Bitcoin hovers around $52,000 as markets wait and see whether the current price level will be held in the next few weeks.

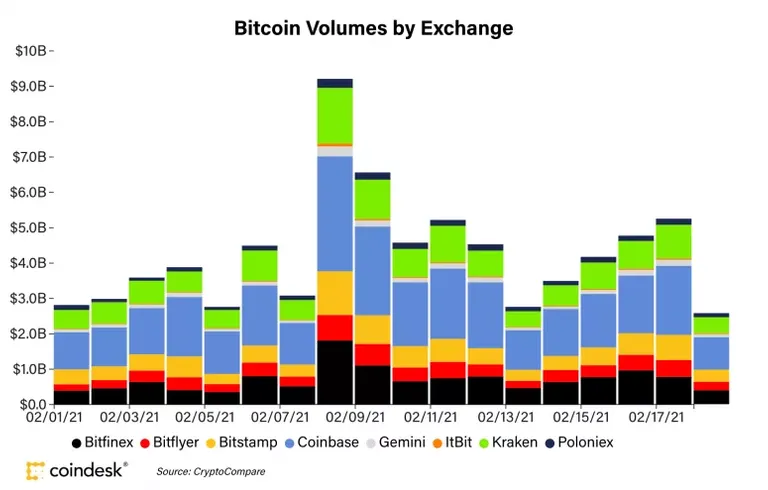

- Bitcoin (BTC) trading around $52,124.59 as of 21:00 UTC (4 p.m. ET). Slipping 0.32% over the previous 24 hours.

- Bitcoin’s 24-hour range: $50,941.99-$52,621.84 (CoinDesk 20)

- BTC trades above its 10-hour and 50-hour averages on the hourly chart, a bullish signal for market technicians.

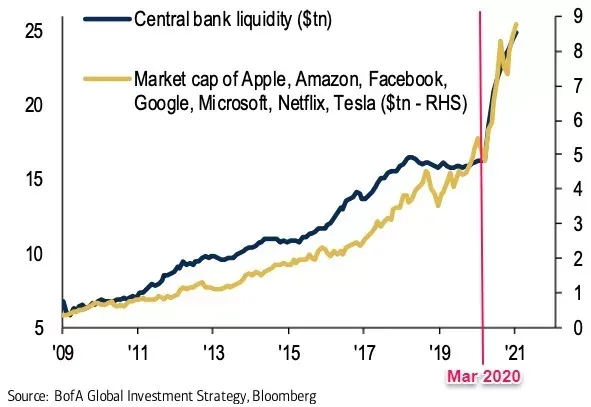

Borrowing costs aren’t just an issue for crypto, of course. U.S. stocks fell slightly Thursday with a rise in the 10-year Treasury bond yield. Investors appear worried the uptick in rates could halt the current rally across the equities market.

The equities market has benefited from the unprecedented liquidity global central banks pumped into the system since last March, QCP Capital said in its Telegram channel. In order to hedge against inflation, many investors bought bitcoin.

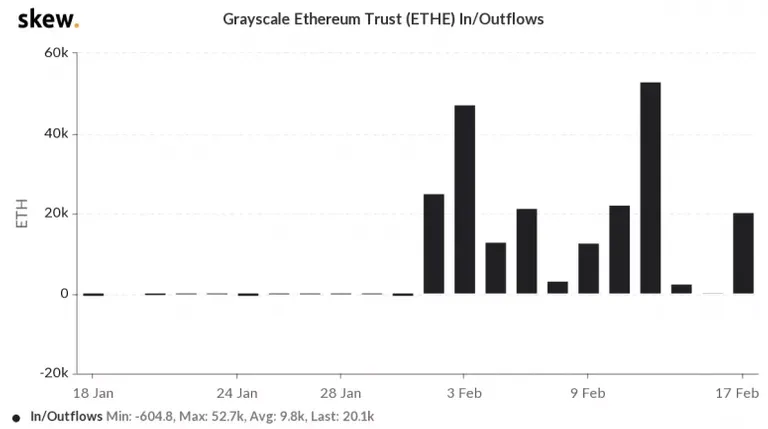

Ether follows bitcoin, surging on institution interest, DeFi and NFTs

“Since Grayscale Ethereum Trust (ETHE) just bought over 197,890 ETH worth $344 million on behalf of its investors in a span of two weeks, we are witnessing an influx of investments in ether only a few months after bitcoin’s institutional influx,” F2Pool’s Mao told CoinDesk.

The growth in the decentralized finance sector, which is largely built on top of Ethereum blockchain, continues after the total value locked in DeFi dropped in the past week, according to data from DeFi Pulse.

The total value locked in DeFi currently stands at $41.8 billion, more than doubled from the beginning of this year.

🗞 Bitcoin Is ‘Here to Stay,’ But Still an 'Economic Side Show': J.P. Morgan

- In a note clients, J.P. Morgan said Bitcoin as an alternative currency is “here to stay.”

- The bank also claims Bitcoin’s flashy bull market is an "economic side show" compared to the rise of fintech.

- J.P. Morgan doesn’t think more “mainstream companies” will copy Tesla’s massive Bitcoin buy.

In a new note for clients, J.P. Morgan was optimistic about the long-term prospects of Bitcoin, though the investment bank has its sights set on what it sees as the "real post-COVID-19 story": the battle between banks and fintech.

“Bitcoin’s competition with gold as an ‘alternative’ currency will likely continue as millennials become a more important component of investors’ universe and given their preference for ‘digital gold’ over traditional gold,” says the paper.

🗞 PancakeSwap Brings Whopping DeFi Volumes to Binance Smart Chain

Imitation is the sincerest form of flattery, right?

Competing decentralized exchanges (DEXs) are trading blows in the world of open-source software as rivals to Ethereum-based Uniswap are catching up to the unicorn project in terms of volume and nominal liquidity.

Leading the charge is PancakeSwap. The automated market maker (AMM) clone of Uniswap on Binance’s own blockchain, Binance Smart Chain (BSC), has seen liquidity grow 1,003% for the year to date. Volumes have been a tad more impressive, up 2,800% from $37 million on Jan. 1 to $1.1 billion on Feb. 17, according to CoinGecko.

Its native CAKE token has shot up some 6,000% since its release last fall and is now trading hands at $12.77, per CoinGecko data.

BNB booster?

Binance’s native token, BNB, is also reaping rewards from the newfound attention on BSC. BNB broke into crypto’s top five coins by market capitalization at $191 per token Thursday after gaining 13% in 24 hours, according to Messari. The token is needed to process transactions on BSC, similarly to ether (ETH) on Ethereum.

🗞 DeFi Money Market closure after SEC probe could set rocky

The SEC’s recent inquiry into the Tim Draper-backed DeFi Money Market platform is the most recent example in a concerning trend of increasing action by regulators against unregistered securities.

The SEC’s recent inquiry into the Tim Draper-backed DeFi Money Market platform is the most recent example in a concerning trend of increasing action by regulators against unregistered securities.

It joins Kik Interactive, Ripple and Coinseed as crypto projects facing the wrath of regulators under aspects of securities law.

The mystery behind DeFi Money Market’s abrupt closure on Feb. 5 was unveiled in the project’s official Telegram channel on Feb. 9, in a statement that revealed the DeFi Money Market Foundation received an investigative subpoena from the United States Securities and Exchange Commission on December 15, 2020.

“We reviewed the subpoena carefully and with the assistance of counsel began complying with the legal requirement to produce documents and make other information available to the SEC,” the post said.

Several other non-DeFi cryptocurrency projects have been unfortunate enough to have been targeted by the SEC recently.

🗞 Daily Crypto Calendar, February, 19th💰

- Fetch.ai (FET), Mettalex (MTLX)

"Stake $FET for 3 months & earn $MTLX."

- Wabi (WABI)

Wabi masternodes rewards distribution.

- TrueFi (TRU)

"Liquid Exit," by February 19th.

"Improved Staking," by February 19th.

- Marlin (POND)

"Subscription starts on February 16 followed by $POND listing on February 19 with our first KRW Flag of South Korea trading pair."

- NavCoin (NAV)

The new xNAV protocol upgrade gets activated bringing back privacy to NavCoin.

- 🗞 Daily Crypto News & Video, February, 18th💰

- 🗞 Daily Crypto News & Video, February, 17th💰

- 🗞 Daily Crypto News & Video, February, 16th💰

- 🗞 Daily Crypto News & Video, February, 15th💰

- 🗞 Daily Crypto News & Video, February, 14th💰

- 🗞 Daily Crypto News & Video, February, 13th💰

- 🗞 Daily Crypto News & Video, February, 12th💰

- 🗞 Daily Crypto News & Video, February, 11th💰

- 🗞 Daily Crypto News & Video, February, 10th💰

➡️ Youtube

➡️ LBRY

➡️ Twitter

➡️ Hive

➡️ Publish0x

➡️ Den.Social

➡️ Torum

➡️ UpTrennd

➡️ Read.cash

➡️ Spotify

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

➡️ Invest and Trade on Binance and get a % of fees back

➡️ Check out my video on Unstoppable Domains and get 10$ off a 40$ domain purchase

➡️ Get 25$ free by ordering a free Visa Card on Crypto.com using this link or using this code qs4ha45pvh

Helps us by delegating to @hodlcommunity