Last month I was seriously thinking to invest in $TRADE token of Unitrade. In general, I was quite bullish on most projects that were trying to enhance the core feature set of Uniswap.

There was no doubt that Uniswap was the epicenter of all DeFi related activities which was tremendously exploding in volume and TVL. So when Unitrade came up with an idea of putting limit order trades by developing orderbook for Uniswap, I was instantly sold on it. But by the time, I could manage some fund to buy it, its prices were already up.

I also thought of what if Uniswap itself integrate that feature in its platform, because sooner or later it will do something to enable limit order trades.

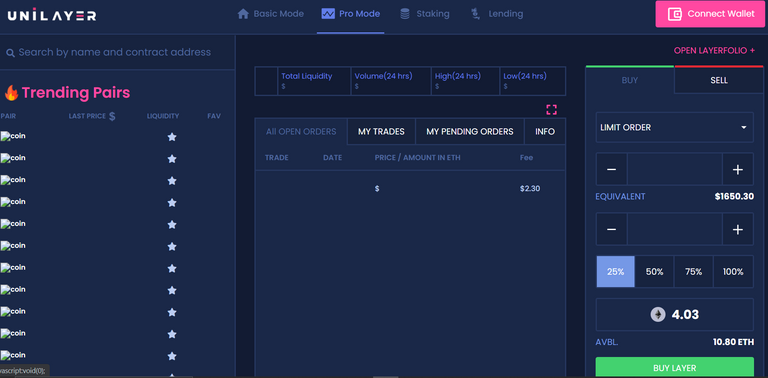

Now Unilayer is trying to launch it quicker than everyone else. And aside Uniswap limit orders, its also integrating a NFT marketplace to capitalize on the rising NFT wave. In its haste, it recently released a demo for its upcoming interface:

Tbh, it wasn't very appealing to me! But there are many who are very excited of it now. Some influencers are taking this opportunity to shill LAYER.

Unilayer is also regularly announcing collaborations and partnerships, Exchange listings, AMAs etc. but none of it is very huge imho. Unifyre, Hacken, BONK etc. have joined hands with Unilayer on some aspect or the other.

But we know that Uniswap is soon coming up with its Version-3 that is addressing all these issues and integrating the best of these features. So I wonder whether all these feature enhancements and Layer-2 projects still have some place?

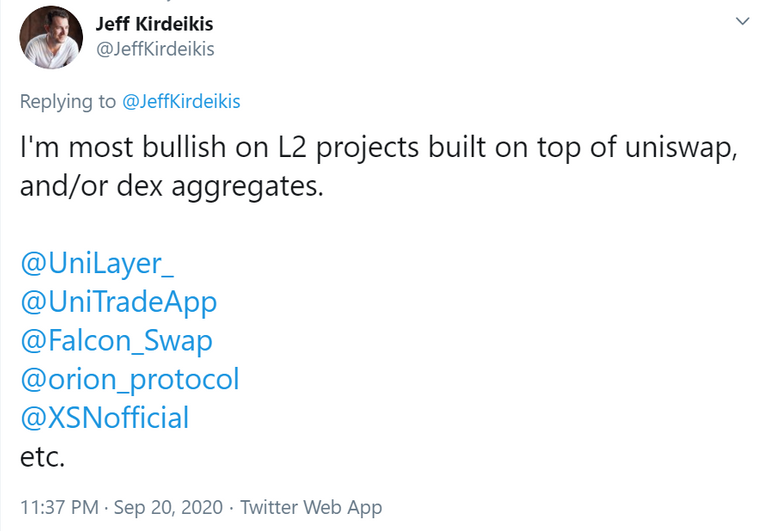

I noticed that TrustSwap & Uptrennd CEO Jeff Kirdeikis is also bullish on all such projects:

So may be, these projects are worth investing for a short term if not for a long HODL. When I face with such a dilemma, I give up on logic and fundamentals and try to gauge the market sentiments. To my thinking, in the short term, market goes with sentiments more than anything else.

However, I've not delved much into sentiment analysis though I try to get some idea with my limited exposure. I tried LunarCrush because even if I can't understand much I can get some idea with LunarCrush's Galaxy scores. Sadly, LAYER was not being tracked by LC.

So I tried comparing LAYER and TRADE on Santiment

Since "trade" is a very generic word with a few more projects using it, it's difficult to ascertain exact correlation with Unitrade. Furthermore, I don't see any data for the current month. And both social volume and social dominance for either of the two terms wasn't any significant.

I don't know of better free tools to gauge social influence. May be, it's not given much importance by most of us.

But yesterday, I attended some sessions of the 4-day ongoing virtual blockchain conference called REIMAGINE 2020: WTFI is DeFi.

Listening to Joshua Frank, CEO of TheTIE, I understood the importance of social data analytics to make better informed decisions. However, I don't have a big enough portfolio to think of paying for their services as of now.

But listening to some of the speakers in this conference drove in the fact that how little I know of the DeFi market.

So today I chose to attend some session in the ongoing Crypto Asia Summit. The best thing about these online conferences is that they bring the top industry executives to us for free! Only you need to spare some time for these events. Sunday was a good day for it.

I got quite impressed by this Algorand Foundation CEO Sean Lee's presentation. No doubt, Algorand is a superb project to be in.

Anyway, coming back to the point of social data analysis, I want to know from you:

- Whether you do any social research before investing?

- What tools do you use for it?

If you have any suggestions for me, I'll be glad if you do share here.

Thank you!

The defy world are a crazy thing only for brave people and with a lot of knowledge, the normal people can not play in this game and we are loses all the opportunity.

Posted Using LeoFinance Beta

AFAIK, it does need deep pockets and an understanding of the pulse of the market to be a rewarding experience but everyone can play it, if one has some risk taking apetite. But I don't feel not playing it means an opportunity lost as it's not that everyone playing it is necessarily making a fortune out of it. Essentially, it's a zero-sum game (if the project isn't fundamentally sound) ...i.e. to say, someone's gain is others' loss! So not everyone in DeFi earn huge rewards. In fact, most have burnt fingers in it!

He is right I have seen many like Yamefinance who have suffered a terrible loss and others who were lost, if he is right it is difficult to play it safe is to go for Leo and Hive for now.

Happy day.

Yes, wLEO-ETH pair is safe and rewarding too. All the best!

Hola xyzashu,

Gracias por destinar correctamente el 100% de las recompensas de está publicación a HP y ayudar al crecimiento de tu cuenta.

Si no deseas recibir notificaciones, responde a este comentario con la palabra

STOP.To listen the audio version of this article click on the link below

play the audio of the post

Brought to you by @text2speech. If you find it useful please consider upvoting the reply.