A little over a week ago, I posted about my frustrations about several projects using the name Unifi with similar projects in DeFi space. So I ignored all of them.

But a couple of days back when cross-chain DeFi project Unifi Protocol launched uTrade on Tron Network, I was willing to give it a try.

Somehow, I recollected that I've a few TRX lying in an old wallet. A couple of years back, I had bought some TRX to play its newly launched Dice games after I lost a lot of my EOS in similar games on EOS. But later I chose to wager on EpicDice on Steem instead of playing on Tron. So that wallet was lying unused on my mobile since then.

However, when I tried to connect that wallet to Unifi Protocol, it didn't work. Strangely enough, you can't even check the liquidity pools and prices for token swaps if your wallet is not connected to their app. I asked for help from the project team but when I didn't get any response from them, I again dropped the idea of experimenting. But today, I realized that I was on a very old (and now discontinued) version of TronLink app. So I restored that wallet in my browser and easily got connected to the uTrade website.

I chose to experiment with 1000 TRX to add some liquidity to TRX-UP pair. It's not the best performing of pools. The most liquidity is with SEED/TRX pair followed by USDT/TRX. But I was more interested in UP. May be, I'd like to see how it's used for cross-chain operations. They plan to integrate a few more blockchains soon:

Unfortunately, Ethereum is listed at 4th position ...if they are actually listed in the priority order of their implementation. I want to see how much gas their token burning and minting mechanism can save by moving out ERC-20 tokens to other chains for transactions.

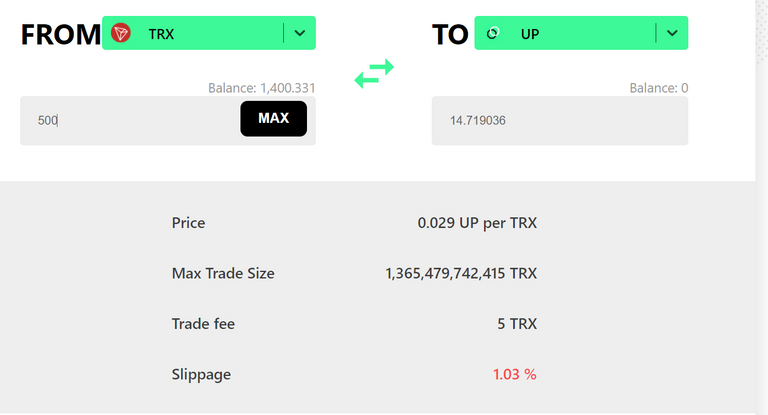

I was not watching the prices of UP vis-a-vis TRX. But since I was going to make a small transaction, I wasn't bothered for it much. So to provide liquidity to TRX/UP pair, I chose to swap 500 TRX for UP:

A transaction fee of 1% seemed high as compared to standard 0.3%. Slippage was also slightly over 1%. So I thought to compare the prices on JustSwap.

JustSwap platform gives users an option to set their Slippage tolerance from as low as 0.1% to 1% along with specifying maximum time for transaction. It also charges Liquidity Provider fee as 0.3% only. So it must come cheaper.

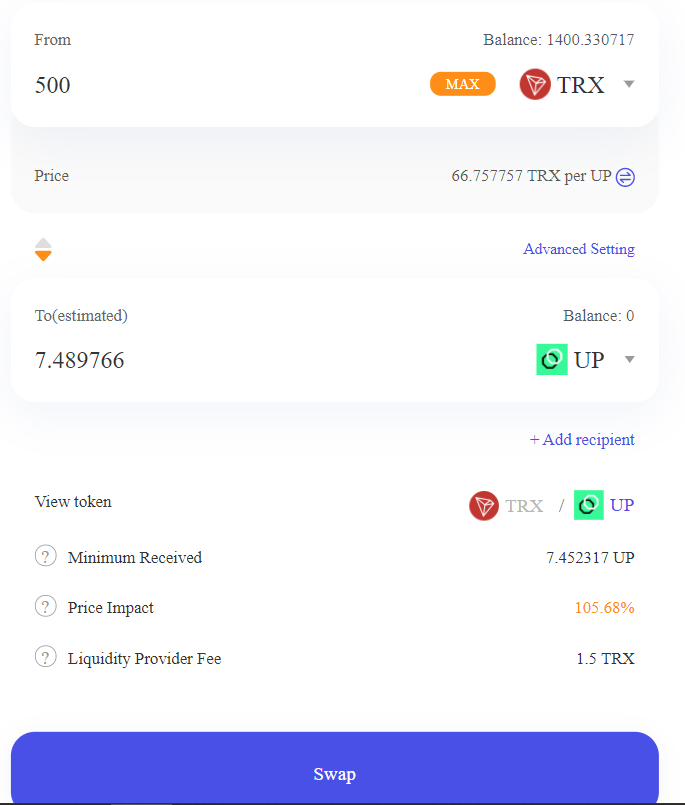

But when I checked JustSwap, I found this:

With 66.75 TRX per UP, prices were almost double than uTrade's about 34 TRX per UP. I set the Slippage at 0.5% but you can see the price impact as 105.68%. Seems liquidity is quite low on this pair there.

Frankly, I didn't get that! What I understood was that I'm going to receive half the no. of coins than I would when using uTrade.

So I went back to Unifi Protocol and completed my transaction and added liquidity using all UP I received and adding 500 TRX to the pair. In return I got 855 uUP tokens.

uUP are redeemable uL tokens issued against the Liquidity we provide. If you provide SEED, you will receive uSEED, for USDT you will receive uUSDT and so on. uUP tokens earn me the share of fee in UP.

Even with low transaction volume (of 31500 in last 24 hours) for my pool, my 855 uUP have earned me 0.15 UP in last 6 hours. If I take this rate to be consistent, I should earn 219 UP in a year i.e. about 7500 TRX per year on an investment of 1000 TRX. Not bad! I do hope volume to increase but prices of UP and also TRX may decline. And increase in liquidity will also dilute my earnings. Still, I hope, I'll reap some profit.

But I ain't putting anything more into it :)

However, it was fun to experiment with insignificant amount and more importantly, without worrying of any exorbitant GAS fee.😀

Edit:

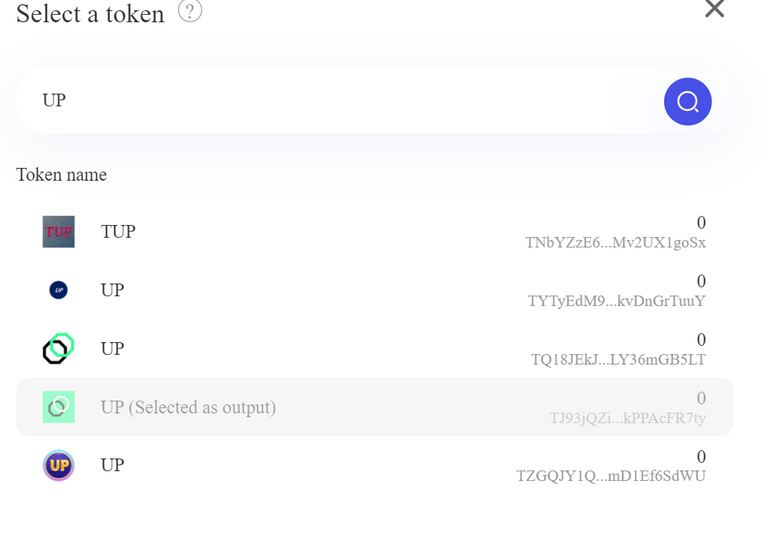

The other thing I forgot to mention while posting this was to warn you of tokens with same or similar name on JustSwap.

Always take care to search with Token Address instead of token name.