HIVE is being bought and withdrawn in large quantities...

9,773,795 HIVE left the exchanges in just one week. The exodus continues! :)

The charts below show how much HIVE is stored on each custodial exchange where HIVE is listed.

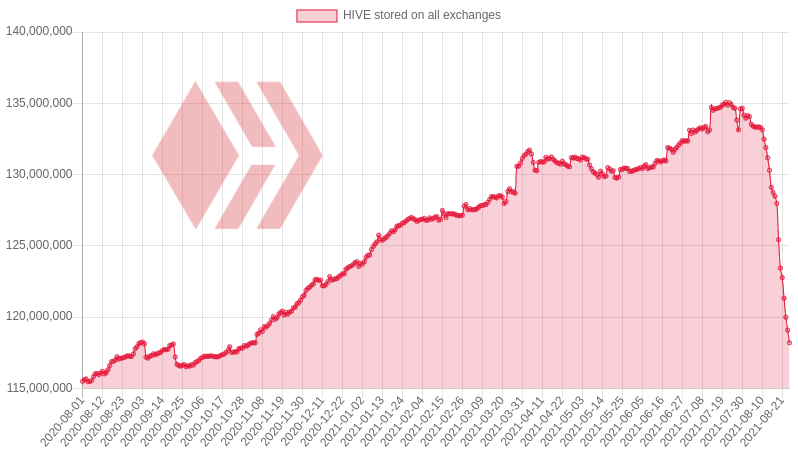

HIVE stored on all exchanges

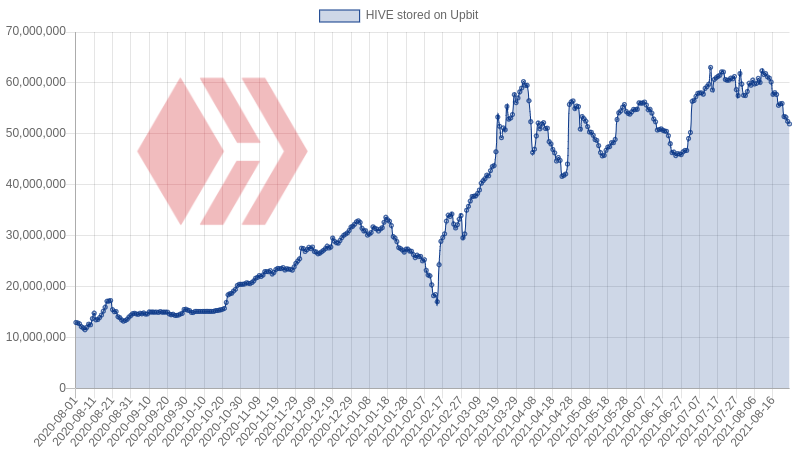

HIVE stored on Upbit

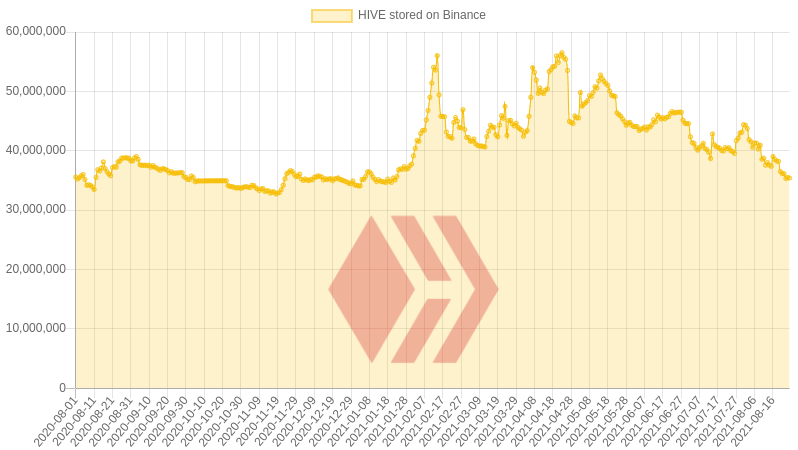

HIVE stored on Binance

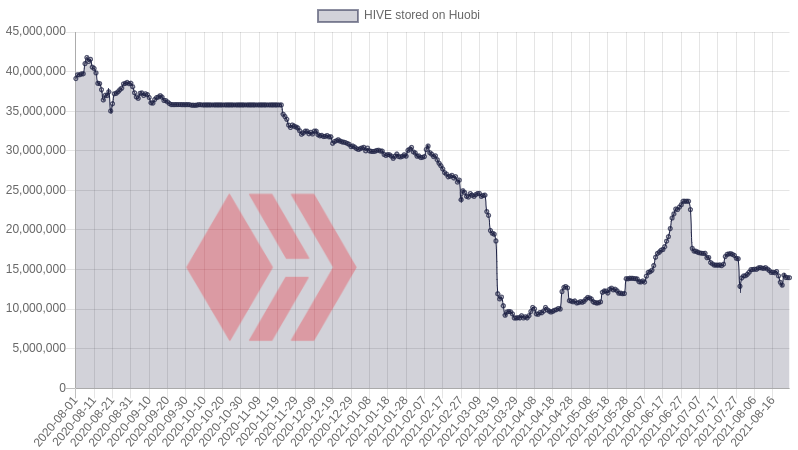

HIVE stored on Huobi

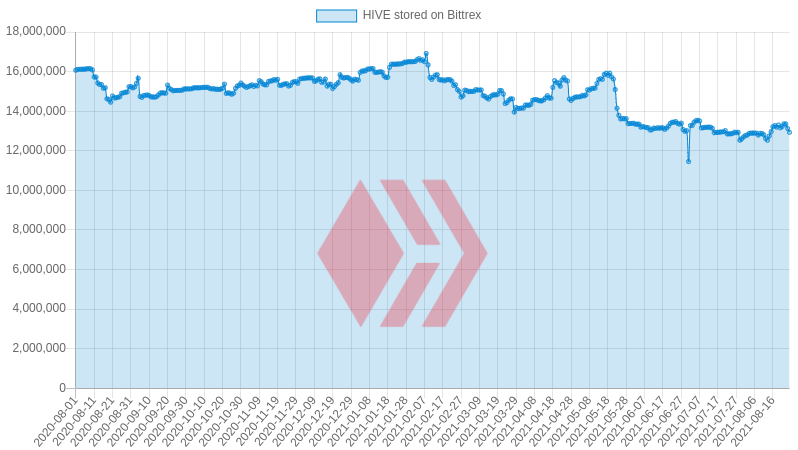

HIVE stored on Bittrex

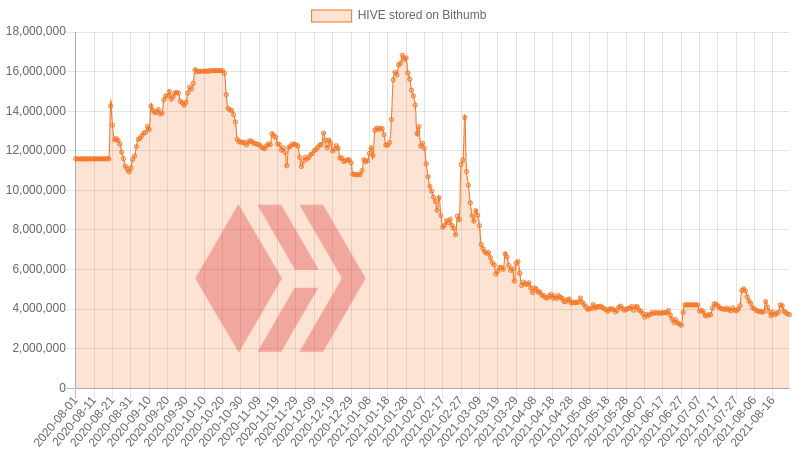

HIVE stored on Bithumb

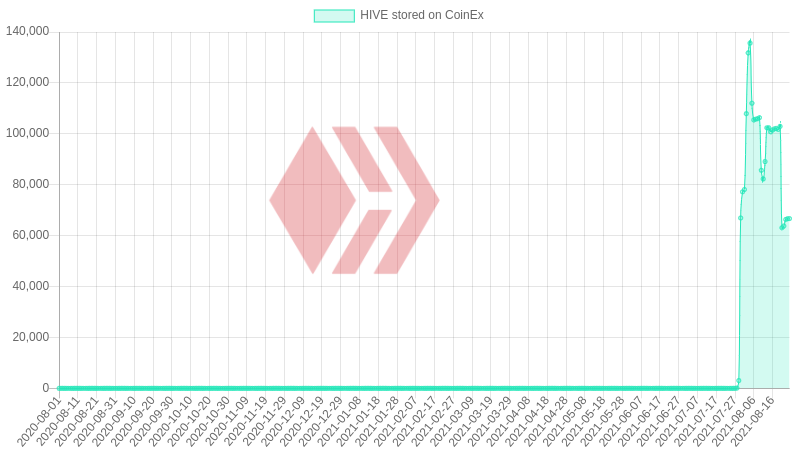

HIVE stored on CoinEx

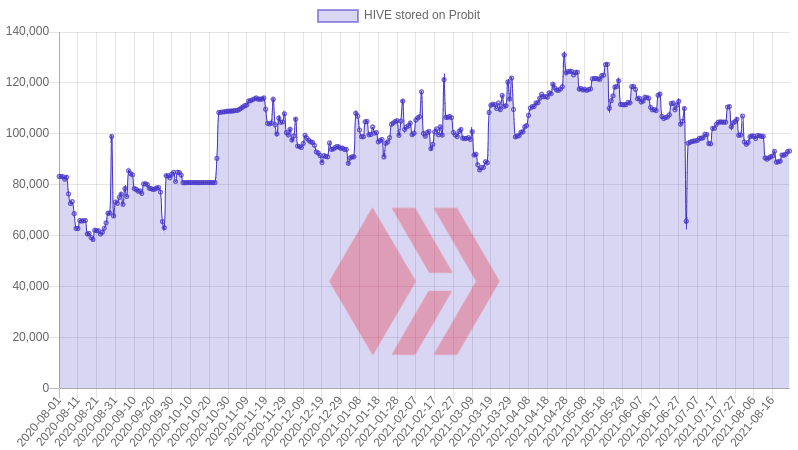

HIVE stored on Probit

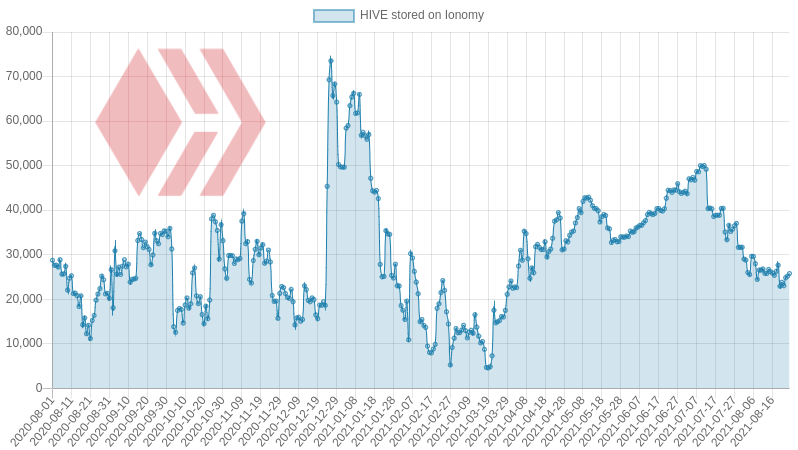

HIVE stored on Ionomy

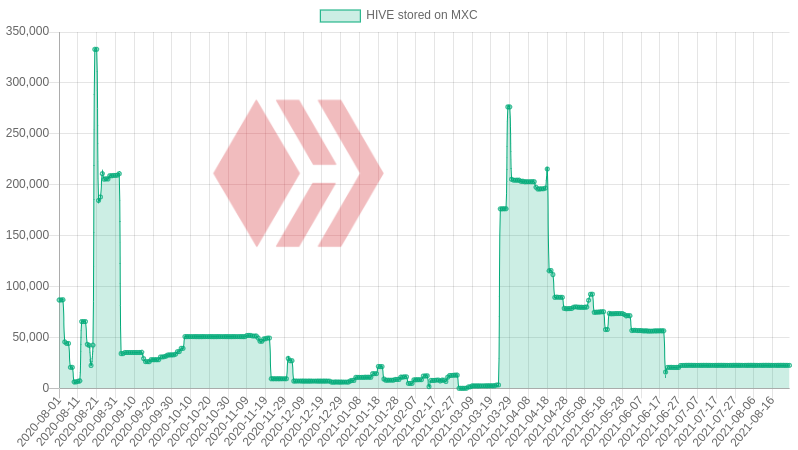

HIVE stored on MXC

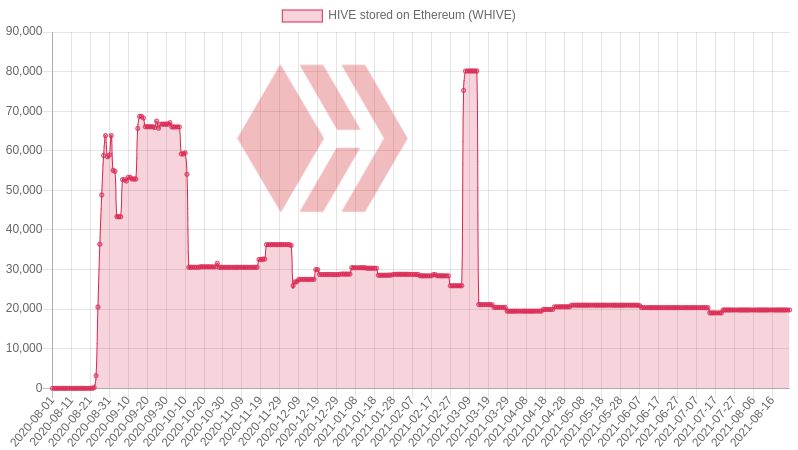

HIVE stored on Ethereum (WHIVE)

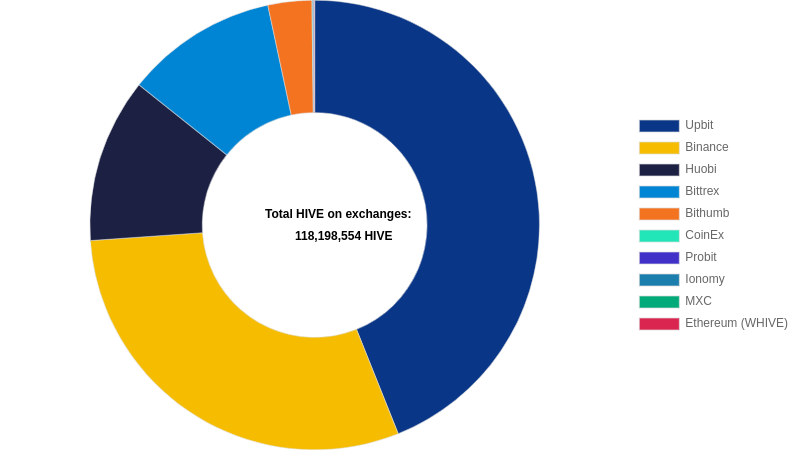

How much HIVE is currently stored on each exchange?

| Exchange | Balance | Last week | Change | % |

|---|---|---|---|---|

| Upbit | 51,938,600 HIVE | 57,724,069 HIVE | -5,785,469 HIVE | -10.0% |

| Binance | 35,408,369 HIVE | 38,257,475 HIVE | -2,849,106 HIVE | -7.4% |

| Huobi | 13,972,369 HIVE | 14,757,009 HIVE | -784,640 HIVE | -5.3% |

| Bittrex | 12,930,413 HIVE | 13,193,358 HIVE | -262,945 HIVE | -2.0% |

| Bithumb | 3,720,722 HIVE | 3,780,810 HIVE | -60,088 HIVE | -1.6% |

| CoinEx | 66,683 HIVE | 102,133 HIVE | -35,450 HIVE | -34.7% |

| Probit | 93,248 HIVE | 88,843 HIVE | +4,405 HIVE | +5.0% |

| Ionomy | 25,776 HIVE | 26,278 HIVE | -502 HIVE | -1.9% |

| MXC | 22,579 HIVE | 22,579 HIVE | 0 HIVE | +0.0% |

| Ethereum (WHIVE) | 19,795 HIVE | 19,795 HIVE | 0 HIVE | +0.0% |

Total amount of HIVE stored on all exchanges: 118,198,554 HIVE

Total HIVE supply: 377,666,660 HIVE

Non-Vested HIVE: 233,383,567 HIVE

- 31.3% of the total supply is stored on the exchanges.

- 50.6% of all non-vested HIVE is stored on the exchanges.

HBD on the exchanges

| Exchange | HBD Balance |

|---|---|

| Upbit | 9,031,330 HBD |

| Bittrex | 451,105 HBD |

| Total | 9,482,435 HBD |

That angle of drop is like the freefall part on a rollercoaster, very pleasing

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

learning about it...

I feel I should add, for it is essential for perspective the total supply of HBD

More than half of all HBD is on centralized exchanges. Now the HBD is 8% of the total Hive/HBD supply. HBD supply gets above 10% at should the price fall below 0.485 USD/HIVE. This would make the HBD no longer 100% backed.

I agree with your central point that HBD supply and virtual supply must be kept in mind here, but HBD in the DAO does not count towards the debt limit. HBD is only 5.3% of the Hive market cap (by the way measured on chain for this purpose) when the DAO is factored out.

If the supply of HBD keeps rising rapidly without a corresponding increase in Hive price, we could see it reach that limit fairly soon.

In theory the contraining supply should force the price of Hive to rise, but it is still quite possible that it does not, or the price is not forced up enough compared to increased demand (and thus supply) for HBD.

The problem with HBD is that it helps burn hive in good times, but then prints more hive in bad times. It burns hive at high prices (burns little amounts of Hive per HBD printed) and prints at low hive prices (prints lots of hive per HBD burned).

If the liquidity gets too bad in a bear market, hive can dump a lot on hbd conversions, causing even more conversions. Raising the debt ceiling for HBD only delays the problem and make it worse when it comes.

It is not guaranteed that HBD is good for the hive supply over the long term. It is definitely good for the people who arbitrage though, including the DAO.

I personally don't like it. When I stake Hive Power, I'd like to know what percentage of governance I will own forever. Unfortunately HBD can simply make that irrelevant and double the quantity of hive in a single bad year.

This makes hive governance worse, and holding hive is more risky because of it. Right now everyone is happy because it's burning hive. Everyone forgets in the end it's just debt and leverage, and it can blow you up simply because of bad timing, even if it is fundamentally good.

It only prints more Hive when conversions happen. Prior to the hbdstabilizer and the recent convert function, I would have agreed with you, but by expanding the supply of HBD more rapidly, while it is a bull market, it forces HBD conversions to happen sooner after the market turns. In the past HBD conversions only happened substantially after the peak of Hive price - because the price would lag above $1 for some time, and conversions only became profitable only once a substantial amount of Hive was added to the Hive virtual supply in this way.

Overall, with the stabilizer and the new convert function making the expansion and contraction of HBD much more dynamic - and a mechanism for Hive stakeholders to profit on both overpriced and underpriced HBD via the DAO and hbdstabilizer, I expect it to be good for Hive inflation.

It does increase the risk to Hive stakeholders overall, I agree with that. However in my view it is a well compensated risk. Essentially the network is taking some risk but generally profits at the expense of speculators, exploiting market inefficiency.

My expectation is that Hive inflation will be substantially reduced compared to prior years of Hive/Steem going forward. With a few years we will have the empirical data to determine if that is correct, until then there is a lot of money to be made or lost placing our bets :-P

This is a great point, it instantly made me feel better about HBD.

I fully agree with this view. As long as speculators are throwing so much money at it, it seems obvious to exploit it. Maybe if people trade it correctly one day then I might change my mind, but by that time, Hive won't be that volatile and there won't be a risk of blowup.

The next bear market will be the biggest risk, after that, I think it will be okay.

Another critic of HBD is that governments usually do dumb shit with debt. And hive governance is a kind of government. Everyone likes free money. 10% rates for locking it 3 days. Sounds very nice of course. At some point it can degenerate, but I trust that the current group of witnesses and stakeholders aren't going to take massive risk. Very long term, when the distribution changes hands and hive is much bigger, I don't know. It can always bite us. We will probably need to move to a system similar to Maker and DAI, which doesn't involve HIVE the token for governance and RCs.

All the other merits/demerits of Hive aside, I want to see it get big merely for the experiment in stakeholder governance. Can stakeholder governance be better than for example representative democracy? Hive, and all the other stakeholder governance networks, will be interesting case studies.

I think that now, with the price of HBD turning below $1 immediately with Bitcoin, while Hive price still relatively high, it supports this theory. It will only be proven with longer term data though.

@marki99

Data showing my point:

Source: @penguinpablo reports

Source: @coingecko

The Steem price peaked in January 2018. SBD conversions didn't get going until long after - July 2018 for the first surge.

Is this so bad? Presumably, the people who convert HBD to Hive in a bear market are those who believe in the long-term success of Hive, that's why they may take the risk of converting their stable-ish HBD to Hive during a bear market. And they may stake it. The others who don't believe in the long-term success of Hive that much (but enough to keep HBD for preserving their wealth and getting an interest) will probably not want to convert to Hive and stake it.

The motive to convert is to make profit from the mispricing of HBD compared to the value that can be extracted from the conversion contract, and you don't need to believe in long term success of Hive to make profit doing conversions. The issue with conversions during a bear market is that the network pays in the form of a high rate of Hive per HBD. In combination with the bias for conversions during a bear market, as existed in the past, the result is substantially higher inflation than the intended schedule.

I've written about it in old posts, though today the dynamics have substantially changed with the hbdstabilizer and collateralised convert contract, so I don't think we will see the same problem again.

A 10% "debt" to equity ratio with "debt" that self-extinguishes in the case of distress is not something anyone should be concerned about. There are a number of issues conflated here, but the root cause of your concern is that you bought the wrong coin:

Neither Steem nor Hive ever worked that way.

Of course not, but without HBD or SBD you can assume the hardcoded inflation rate to be the max dilution.

And since you earn returns on powered up coin, you usually are able to offset the inflation.

HBD and SBD have always been there, so neither Hive nor Steem have ever worked this way

You are pointing out another way that you don't know your future share of the percentage of the governance. Even if you "usually" can offset inflation, you can't be sure that will always be the case. Apart from the possibilty that the earning mechanism might change (as it has multiple times), earnings might become more competitive in some way and you find that you are no longer able to keep up, or don't want to continue to invest the effort to do so.

The only way you could know your share would be with a fixed supply of governance tokens and Steem and Hive have never been anything like that.

I agree with everything you said. I never said that we could have a fixed percentage of governance.

I just said I would like it to be so. HBD does not help that case.

I know, but it's not as significant as the change in supply caused by HBD. Not going to argue over a few percentage change over years, but when we burn 3% of the Hive supply in two weeks, this is not insignificant. That burned tokens could be back and then more at any time too.

To be completely clear, right now, HBD is great for hive given what speculators are doing, the Hardfork changes, and the hbdstabilizer proposal.

It's the next 1-2 years that worry me as we don't know how far down hive can go. The very long term also worries me, if governance somehow becomes irresponsible with its use of HBD, but with the current group of people, I am not worried about that at all.

it could also turn out hive will become at some point Gas/gov token :)

This could make HBD more stable, useless or unstable (theory should be stable with collaterals and no convert) :D

What would be your longterm dream for HBD ( in terms of usecase?)?

The debt ceiling really doesn't matter in the case of HBD. It could be set at 1%, and the problem would be the same, if not worse.

Raising it just buys more time, but in the end the problem is the same. It's just about market timing, not the quantity of debt. If speculators were to sell HBD when hive is at the top, HBD to hive conversions would create very small amounts of additional hive. But that never happens sadly.

The timing of changing the debt ceiling is important though. If we decide to raise the debt ceiling now, it would be a great time, as we will just use that to burn more hive. However, deciding to raise the debt ceiling in a bear market will just make the hive printing occur at even lower prices and result in more inflation.

As demotruk pointed out, we need the HBD to hive conversions to occur as soon as possible in a downturn.

Saying "over time Hive will go up" so HBD will be beneficial long term completely ignores what happens empirically. Hive will probably see 95% dumps (it needs to go up a lot quickly first).

Anyway, as I said in another comment, I feel better about HBD now that conversions will occur much sooner in downturn.

No, it would be completely different because no matter how far the price dropped and how much HBD were created at the top, only an additional 1% HIVE would be created even if 100% were converted entirely after the dump. This would be better, in a way, but it would be worse since there would be less deflationary effect in a rising market too (and also less ability to benefit from natural demand for the HBD "product").

Hive doesn't have a floor, so the ceiling could be breached infinitely many times, causing more inflation every time.

This is only true for a single point in time. But inflation can be infinite with any percentage as long as hive's marketcap keeps dropping.

what if 30 days MA converting price? sucks on spikes but would it make it close to impossible to manipulate the market in one direction. Even in a bear market. With a security feature in time, we could get rid of the 5% fee.

my solution for it was an onchain liquidity pool for Hive/HBD.

10% interest for liquidity provider.

Why this would make sense? Own stablecoin with high liquidity = useful.

Exchanges and other pool could use it for transfers and so on. For bullruns this would be unbelievably useful. (5% fee hurts this)

For the bear market, it should help to stabilize hive in price indirect like DAI for ETH. Depending on pools and defi building on it. But in general, as long as enough money is there, they should be no panic.

I don't know if this eliminates the risk, because people could remove liquidity.

Yes, but if its build right, it could be used for DEFI. They can build on top on that. So it would become the last thing in a longer row.

HBD can only become stable with enough people using it. And in the end, it's like the gold standard ( a security feature).

It needs only people that trade it 1USD to 1HBD. And I'm also not a fan of the converting mechanic. I like stablecoins without fees and collaterals behind.

Lock up Hive = generate HBD. Pay HBD back, you get Hive liquid again. with 500% + for example.

Would also remove sell pressure, because we can lock up right?

That makes the minimal backing price 0.293 / Hive.

it could turn out random

What do you mean?

If we hit 7$ for example and fall back to 0,2$.

Would end up really random IMO.

Oh yes. I see. Sometimes prices seem random.

Since the last hardfork the debt ratio does not count the HBD balance in the DHF (in theory this went into effect on the previous upgrade but there was a bug in the code that was fixed this time around). So the price point where HBD is no longer 100% backd by the virtual supply is (at this moment) 27.5 cents per Hive.

We could still in theory create 10 million more HBD outside of the DHF if the price of Hive stays the same.

wrong! you need to exclude DAO fund :)

An interesting thing about Hive exodus from exchanges is it could reveal if any exchanges have been operating fractional reserves of Hive.

If any are caught with their pants down they would have to market buy somewhere else and fulfill their clients withdrawal requests. A situation we can hope for.

Posted Using LeoFinance Beta

Is that possible? Shouldn't their wallet be verifiable blockchain data?

We know how much they have on chain. We don't know how much their customer balances are in DB.

Posted via D.Buzz

~~~ embed:1430555088582582275 twitter metadata:SGl2ZWJ1bGx8fGh0dHBzOi8vdHdpdHRlci5jb20vSGl2ZWJ1bGwvc3RhdHVzLzE0MzA1NTUwODg1ODI1ODIyNzV8 ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Gimme that hungry man hive data microwave dinner smart penguin

Posted using Dapplr

This is so cool !

Posted Using LeoFinance Beta

lol

Amazing news indeed! We should celebrate it!!!

!LUV

<><

@penguinpablo, you've been given LUV from @toofasteddie.

Check the LUV in your H-E wallet. (2/3)

when you miss 3m+ hive around the corner kinda pointless

my guess is that real change was 8m not 10m :)

but 2m moving to engine and 8m to personal wallets still good news :)

There is tons of volume on arbitrage using engine pools, @dalz is writing monthly posts about engine deposits/withdrawals volume and we will probably see huge spike in volume, and should go up further with liquidity rewards and more liquidity on external tokens(bnb, eth, matic, stables from other chains pooled with hive)

It's almost 20 million measured from the peak a month or so ago.

Probably to convert to HBD?

what does it mean that all these HIVEs leave exchanges?

I didn't think there were so many HIVEs on Binance, thanks for the tip

$WINE

Congratulations, @theguruasia You Successfully Shared 0.500 WINE With @penguinpablo.

You Earned 0.500 WINE As Curation Reward.

You Utilized 5/5 Successful Calls.

Contact Us : WINE Token Discord Channel

WINE Current Market Price : 0.271

Very nice!

Posted Using LeoFinance Beta

A chart on HIVE Power Ups along these would be a great addition.

Posted Using LeoFinance Beta

fear of being kyced?

@penguinpablo please add hive-engine balances to your report - we have an exchange right on HIVE and its balances are swelling!