Bitcoin just got a major fan in its corner...

Paul Tudor of Tudor Investments Corp says he is now investing in bitcoin futures due to the increasing money supply from Central Bank printing as well as the coming digitization of money.

Specifically he said...

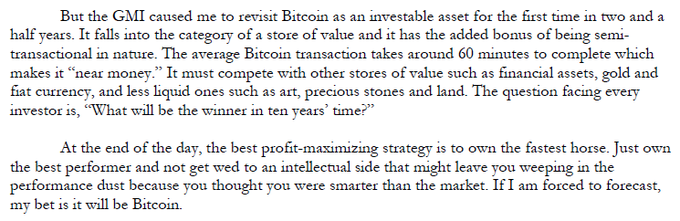

“The best profit-maximizing strategy is to own the fastest horse... and my bet is that will be bitcoin”

(Source: ~~~ embed:1258495362660098048/photo/1) twitter metadata:VHJhdmlzX0tsaW5nfHxodHRwczovL3R3aXR0ZXIuY29tL1RyYXZpc19LbGluZy9zdGF0dXMvMTI1ODQ5NTM2MjY2MDA5ODA0OC9waG90by8xKXw= ~~~

So, he thinks we are going to see inflation due to the excessive money printing going on globally...

This inflation is going to lead to inflating asset prices.

Of those inflating asset prices, he said he wants to own the one that inflates more than the rest, or in this case, the fastest horse.

And according to him, he thinks that fastest horse that will be bitcoin.

He sees an incredible opportunity...

It is more than just a second half of 2020 type of story though...

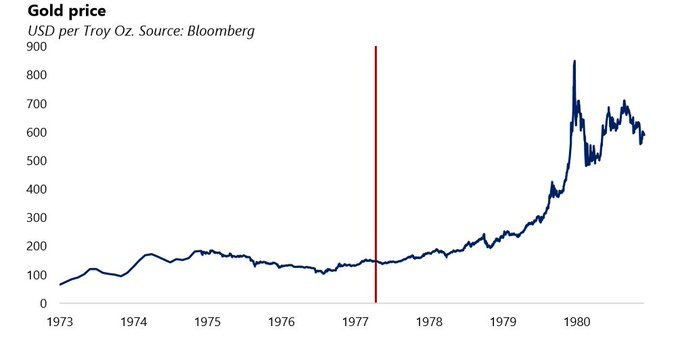

Reading through his letter to his clients he mentions that he sees the opportunity in bitcoin currently similar to the opportunity he saw when he first started his career as a fund manager.

Specifically, the opportunity in the gold market back in the 1970's...

Which if you are not familiar, gold did basically a 5x in terms of returns in a 3 year stretch in the late 70's.

To him, bitcoin is in that same type of place currently:

(Source: ~~~ embed:1258479951155781632) twitter metadata:UGxhZGl6b3d8fGh0dHBzOi8vdHdpdHRlci5jb20vUGxhZGl6b3cvc3RhdHVzLzEyNTg0Nzk5NTExNTU3ODE2MzIpfA== ~~~

Interestingly enough, a 5x return over the course of the next 3 years is actually lower than many in the crypto community are hoping to see as the stock to flow model points to about a 10x return over that same time frame.

Interesting.

One of the most successful investors of the last quarter century is now long bitcoin futures...

Paul runs one of the most successful hedge funds over the past 3+ decades.

They charge higher fees than most because they traditional have higher returns than most.

His claim to fame was shorting the stock market right before Black Monday in 1987 where he tripled his money in a very short time.

Interestingly enough, he was long bitcoin back in 2017 as well, but exited the position near the $20k peak and hadn't touched it since.

He said that now bitcoin looks interesting to him again for the first time in the last 2.5 years.

With the halving only days away and the downtrend likely over, it looks like pretty good timing on his part...

Even if he isn't buying bitcoin directly via spot markets, him getting long bitcoin will likely encourage other funds to pile in as well.

This is hugely bullish for bitcoin and crypto as a whole as a validation of the asset class.

It's going to be a fun next 12 months.

Stay informed my friends.

-Doc

Dump confirmed

Last time this guy bought was in 2016 and he was out near the $20k peak, I'd say the price performed pretty well after he was involved...

"Past performance is not indicative of future results" lol

My meaning is he is lying and is a holder already using his past trades to bring buyers into the market for major selloff point to note $450 million from 3 wallets. Came a ctive after 5 years at the beginning of this year coinciding with the start of pump, last week $100 mil was moved in a few single accounts and rally started after would say price should be closer to $5k/$6k but as markets go when people FOMO and panic sell price gets extended above and lowered below

Well he owns bitcoin futures, and I haven't verified this one yet, but I do know large funds like his have to report their holdings to the SEC. Plus there is the whole issue of stock/asset manipulation.

So, while it is entirely possible he has been in a for a while now, guys like him with such a long track record in the public eye, do have some rules they have to follow...

He doesn't have to be the one trading only work with others

Possible he had bitcoin options also up 1800% in few weeks

https://mobile.twitter.com/Rewkang/status/1258485282430570497

Sure, though he specifically mentioned futures contracts.

If someone says in the same line as me, then it must have some truth behind me... My mom did 6-fold her money with selling real estate. I did 8-fold with selling stocks.

Puts?

eh?

You said you made 8x selling stocks. But you can only make 100% on your money when you short a stock, so I was asking if you were buying puts?

I was playing Russian roulette in local bank... I said to the bank employee that their own stock will crash in few minutes and put all my stocks for sale... Someone bought them at overprice... I was right, the stock price dropped from above 8 EUR to about 1 EUR.

That's good i recently got some

It will be interesting to see how it behaves around the halving, but medium to longer term I think prices are going a lot higher.

What about bitcoin sv? Or just classic btc?

BTC core. The only bitcoin as far as I and most are concerned.

Very bullish news!

I hope he understands the 'not your keys, not your coins' principle. If he only bought Bitcoin futures, he is not a true Bitcoin hodler.

According to the release, he's not, but I don't think he cares much about that.

The fact that one of Wall Street's greatest is putting their weight behind Bitcoin is definitely bullish, and as you've pointed out, a great validation for it, too! I can see more hedge fund managers, and investment groups following his footsteps, and piling their cash into BTC, especially once they see the post-Halving rally coming along later in 2020, and early-2021. Time will tell, though I wonder if the fact that more A-star names like Paul Tudor Jones getting into Bitcoin, will help Main Street recognise its potential too... Maybe speed up with that ETF, eh?

Thank you for this!

You got it.