We are going through a period in which sales are predominant in the crypto market. In such periods, bad news about crypto is also getting more media coverage. Those of us who have invested in crypto are worried about the future of the market. Therefore, I thought it is time to put aside the day-to-day developments and make a general crypto assessment.

The crypto revolution that started with Bitcoin was based on design principles that could be considered extremely demanding. For example, keeping the blockchain history on all computers in the network and hundreds of computers attempting to decrypt simultaneously to confirm a transaction. These design principles, which seem quite inefficient at first glance, allow Bitcoin transactions to occur in a decentralized way. With an initial cap of 21 million, Bitcoin has doubled its price on average every year. The system has been active since 2009, and new people continue to join the Bitcoin network.

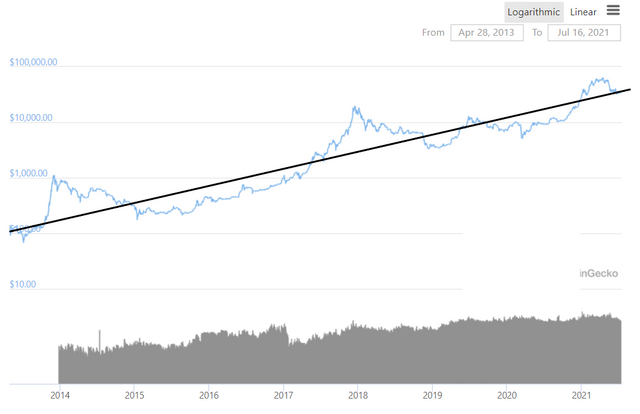

Below is the chart showing the price of Bitcoin from 2013. The chart's scale is logarithmic, so we can clearly see that the price of Bitcoin is increasing exponentially. How can the value of a financial asset double every year? And is this exponential increase sustainable?

Source: https://www.coinecko.com/ - I added the black trendline.

The Law of Accelerated Returns

According to futurist Ray Kurzweil, technology evolves geometrically. According to the law of accelerating returns introduced by Kurzweil on March 7, 2001, the synergy created by innovations provides the exponential development of technology. In other words, when technological innovations that take place independently come together, they create a greater value than the sum of the added value created by both.

Kurzweil states that processor speeds that can be bought for the same money doubling every 18 months, also known as Moore's law, is just one example of the exponential development that has taken place in the fields of communication, health, informatics, and biology. Based on the data he has compiled over the years, he proposes that Moore's law should be corrected as doubling processor speeds every 12 months, not 18 months, since the 1980s.

Another fact revealed by Kurzweil, accompanied by statistics, is that the processing power that can be bought for 1000 dollars doubles every year. For the full article: https://www.kurzweilai.net/the-law-of-accelerating-returns

According to the law of accelerating returns, the demanding design principles of Bitcoin become more affordable as the years progress. This accelerates blockchain adoption.

At this point, I would like to repeat the question I asked above: Is the doubling of the Bitcoin price every year sustainable?

Moore's law was introduced in 1965 and remains valid, as explained by Kurzweil. Therefore, the price increase trend of Bitcoin seems to continue for a long time. How many more years can these prices increase? To answer this question, it is useful to dwell on the dynamics of exponential growth.

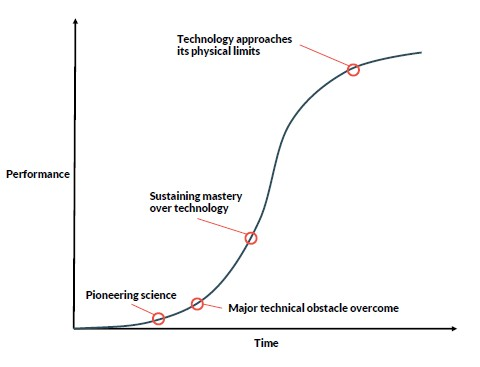

Limits of Exponential Growth

Since exponential growth is not a situation we come across very often in our daily life, we find it difficult to revive it in our minds. The continual exponential growth of things seems illogical because abundant resources are needed to support this increase.

We see exponential increase dynamics in situations such as the proliferation of cells. At the beginning of the growth process, there is a recovery period, then a very rapid increase is observed, and the process slows down at the point where resources cannot support the increase.

Source: English Wikipedia

The rapid development of decentralized finance applications shows that the core value proposition of blockchain technology is related to finance. In other words, the crypto ecosystem is essentially a competitor to the financial industry. According to https://www.statista.com/ data, the size of the global financial sector as of the end of 2019 is 404 trillion dollars. Since the total value of cryptocurrencies is still $1.3 trillion, resources that can support the exponential growth for many years are available in the financial sector.

Ethereum and Other Cryptocurrencies

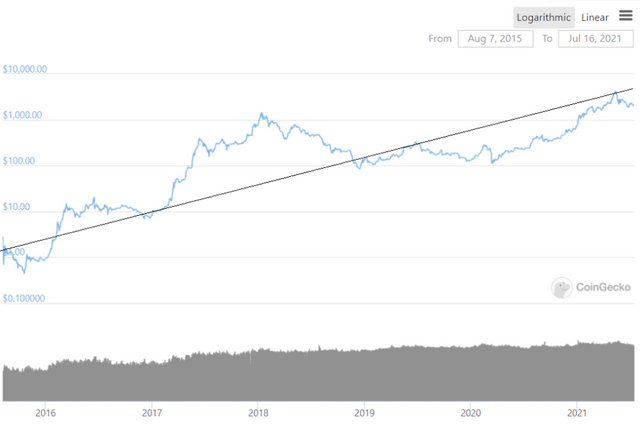

So far, I have made comments mainly on Bitcoin. On the other hand, it is a fact that the prices of other cryptocurrencies are increasing exponentially. The chart below, which shows the price movement in Ethereum since 2015 on a logarithmic scale, supports this argument.

Source: https://www.coinecko.com/ - I added the trendline

Ethereum price increase is more than 2 times per year. The chart here follows a less obvious trend compared to the Bitcoin chart. I attribute this to the relatively long history of Bitcoin and its excess liquidity.

The Ethereum price chart shows periods of extreme enthusiasm and subsequent pessimism, similar to the Bitcoin price chart. If cryptocurrency prices are on a predictable path, why are these periods of enthusiasm and collapse occurring?

Wyckoff's Composite Man

Developed by Richard Wyckoff in the early 1930s, the Wyckoff method consists of principles and strategies designed for investors.

According to Wykoff, the Composite Man represents the big players such as wealthy individuals or institutional investors. This group is moving in the opposite direction of retail buyers like us. Composite man trades in four phases: accumulation, uptrend, distribution, and downtrend.

Composite man accumulates assets when a market is out of favor and not on the agenda. He does this gradually so as not to raise prices.

Once the composite man has amassed enough assets, he starts pushing the market up with strong purchases. This situation attracts the attention of many investors, and a rally is formed. As the market rises, ordinary people begin to get excited and join the game.

In the next stage, the composite man begins to distribute the assets. At this stage, prices follow a horizontal course.

After the composite man distributes most of his assets, prices begin to decline. Temporary rises can be experienced during this recession phase, and the composite man can sell his remaining assets to retail buyers during these temporary rises.

The Wykoff method explains the periods of extreme enthusiasm and pessimism in the market with the interventions of major players and psychological factors.

Crypto Price Theory

I want to summarize the logical results of my explanations so far in the following items.

- Technologies that support the blockchain, and therefore crypto prices, are evolving exponentially.

- It is possible to approximate cryptocurrency prices by modeling historical price data.

- The exponential rise in crypto prices will likely continue for a long time.

As I write these lines, Bitcoin is dancing above the 30.000-31.000 band's resistance, which causes serious decreases in value in altcoins. If this resistance is broken, the Bitcoin price will likely retreat towards 20000. Will this level be broken down? Finally, I would like to talk about the price rallies in the crypto world and the price movements after it. Maybe these data can shed some light on the actual prices.

Price Rallyes of the Past and Possible Future Scenarios

On January 1, 2013, the price of Bitcoin was $13.4. In November 2013, its price rose to $1156. This means that the price of Bitcoin increased 89 times in the same year. This was, of course, followed by a prolonged period of bearish and sideways price action.

On January 4, 2017, the Bitcoin price again reached its peak, which was seen 4 years ago and the rally of 2017 that most of us remember started. On December 16, 2017, the Bitcoin price reached $19,479. This figure marked a 17-fold increase in Bitcoin prices in the same year.

On December 16, 2020, the Bitcoin price again reached the peak of 2017, and on April 16, 2021, it almost tripled to 63,300. Although prices have been retreating since then, we cannot say that we are in a bear market, and prices will not stay low for longer because the last rally was much more modest than the previous ones.

From the long-term price analysis of Bitcoin and Ethereum, I conclude that the prices are now where they should be. I think that these levels present a buying opportunity for an asset class whose value is increasing exponentially.

I should mention that I am not an investment expert, and it would be better for you to do your own research.

We are going through exciting days for crypto. Let's see what the next days will bring us.

Thanks you for reading.

Image Sources: https://unsplash.com/photos/o7bTIZ7j-iw and https://giphy.com/

Congratulations @muratkbesiroglu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 550 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

A full and comprehensive post as always. Thanks for sharing your precious thoughts. 🌸