So you are excited, you are planning to make the jump and buy a house, land, or that new car you wanted. Financing is different in many ways. I do not buy new cars because of the depreciation of them when you drive off the lot. That is the same for almost all vehicles. So less talk about land or that new home.

We just brought property about 5 years ago. It was about 12 acres and was just the land, it had pines trees and scrub oaks on it, there were no buildings at all. It was land we had to clear to make room for what we wanted to do. Land in many places is cheaper like that because someone else has not put in the time to make improvements to the land, like putting in power, well, etc. Those things are something I will get into in a later post. Let's just talk financing the land itself right now.

You can finance the land by these two possible means.

Bank or Credit Union which is conventional mortgages

Government Loans like VA loans Fannie Mae and Freddie Mac insured

loansOwner Financing

For some of these loans, there has to be a dwelling on them in order to get this type of financing or you will have to include a mobile home and other things into that type of financing. There is a mix of requirements from different lenders.

What I want to show you here is the differences between a bank or government loan and owner financing. Many times owner financing is the better way to go if you can do that. There are some downfalls to it, like the interest rate you will have to pay on that type of loan. Many times it is around 10% interest. I will include a screenshot of the amortization table on these two types of financing.

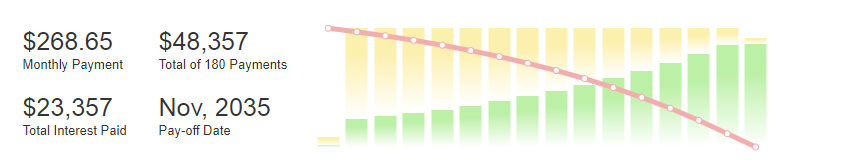

This is a typical table for an owner financed property that has a cost of, for example, $25,000 dollars. The interest rate is 10%. If you have to go this route and there is no other choice it is worthwhile for you. You will almost be paying double what you paid for the land or whatever you are buying this way. If this is bare or wooded land you will have to pay out-of-pocket for things like the land clearing, electricity, and water it can be a well or hooking up to a city or county water system.

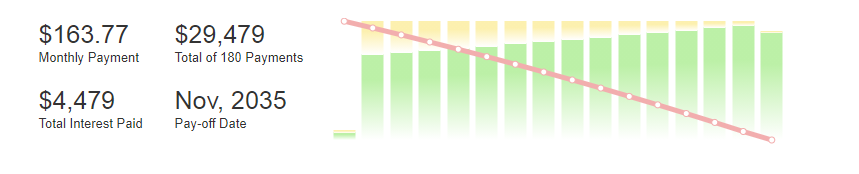

If your credit score is good enough to get a conventional loan. Let's use the same example of the loan of $25,000 dollars. But because it is a conventional loan, they have to compete with the interest rates or they have a set interest rate. Let's say a fixed interest rate. This is what it would look like.

Do you see the difference here? Not only is the payment lower, because the interest rate is lower, but you are also paying less in the overall term of the loan. You could borrow almost double the amount of money with this type of financing, with the owner financing payment.

There are many other factors involved in this, I know, but if you can do a conventional loan and get a mobile home with the land cleared and everything you needed in one loan it is a much better way to go.

I know the way the world is going right now, many do not want to go the way of financing anything. This is just some food for thought to those that are thinking of this. Some want to move from the city and got into a more rural setting with less turmoil.

I know some will have to go the owner financing route as we had to after we lost our house when I came back from Iraq because of the medical problems I had. It was a struggle because we had to save and clear the land, put in the well, and get power into the property. I will go into some of that in a later post and explain some things with that, how we did it, and what we did to make it work.

(Screenshots from this website)

https://www.amortization-calc.com/loan-calculator/

This will be a helpful tool for you to use.

Thanks for reading, I hope our story helps someone and maybe guides them on their journey through life. I hope everyone has a good day/night, whatever it is in their part of the world. ALWAYS FORWARD!

source

Posted Using LeoFinance Beta

This post has received a 100.00% upvote from @fambalam! Join thealliance community to get whitelisted for delegation to this community service.