Hello to everyone. These days, I attach great importance to the subject of Defi. The cryptocurrency rally in the last year was thanks to Defi. In the Hive Blockchain, we need to pay more attention to the subject of Defi. There are very good developments in the Hive Engine part of the blockchain. In this article, I will talk about the APR ratios of liquidity pools on Tribaldex.com, another front end of Hive Engine. Certain pools have high APR rates. However, you can choose the liquidity pools of the tokens you like. Or you can choose pools that distribute your favorite tokens as a liquidity provider reward. Let's get to our list.

Pizza Pools:

- Pairs: Hive/Pizza

Liquidity provided: 7427 Hive

Tokens Distributed: Pizza, Hive, Archon, Sps, Utopis, Leo, Vibes, Pal, Neoxag, Sim, Sports, Cent, Ctp, Ape etc.

APR rate: 33.5% - Doubles: Pizza/Dec

Liquidity provided: 22406 Hive

Tokens Distributed: Pizza, Dec, Hive, Sim

APR rate: 344.7% - Doubles: Pizza/Starbits

Liquidity provided: 20799 Hive

Tokens Distributed: Pizza, Starbits, Hive, Sps

APR rate: 512.1%

Bee Pools:

- Pairs: Bee/Busd

Liquidity provided: 18011 Hive

Tokens Distributed: Bee

APR rate: 34.6% - Pairs: Bee/Usdt

Liquidity provided: 14002 Hive

Tokens Distributed: Bee

APR rate: 44.5% - Pairs: Bee/Hbd

Liquidity provided: 9598 Hive

Tokens Distributed: Bee

APR rate: 65%

Cent pools:

- Pairs: Hive/Cent

Liquidity provided: 586 Hive

Tokens Distributed: Hive, Cent, Centg

APR rate: 74.3% - Pairs: Hbd/Cent

Liquidity provided: 161 Hive

Tokens Distributed: Hbd, Cent, Centg

APR rate: 261.8% - Pairs: Cent/Pob

Liquidity provided: 518 Hive

Tokens Distributed: Cent, Pob, Centg

APR rate: 82.5% - Pairs: Cent/Leo

Liquidity provided: 244 Hive

Tokens Distributed: Cent, Leo, Centg

APR rate: 176.6%

Sports pools:

- Pairs: Sports/Hive

Liquidity provided: 81 Hive

Tokens Distributed: Sports

APR rate: 98.7%

Seed pools

- Pairs: Hive/Seed

Liquidity provided: 22342 Hive

Tokens Distributed: Seed

APR rate: 52.3%

Sim pools:

- Pairs: Hive/Sim

Liquidity provided: 129307 Hive

Distributed Tokens: Sim

APR rate: 21.2%

Lassecash pools:

- Pairs: Hive/lassecash

Liquidity provided: 451 Hive

Tokens Distributed: Lassecash, Archon

APR rate: 386.4%

I also gave the provided liquidity value in Hive coin. The tokens distributed are not at the same rate. Generally, those who create the pools distribute their own tokens at a higher rate. APR rates are variable;

- APR rates change as more liquidity is added to pools.

- APR rates change as the price value of tokens that provide liquidity in the pools change.

- Rates change if more prize coins are added to the pools.

- Etc. Etc. :)

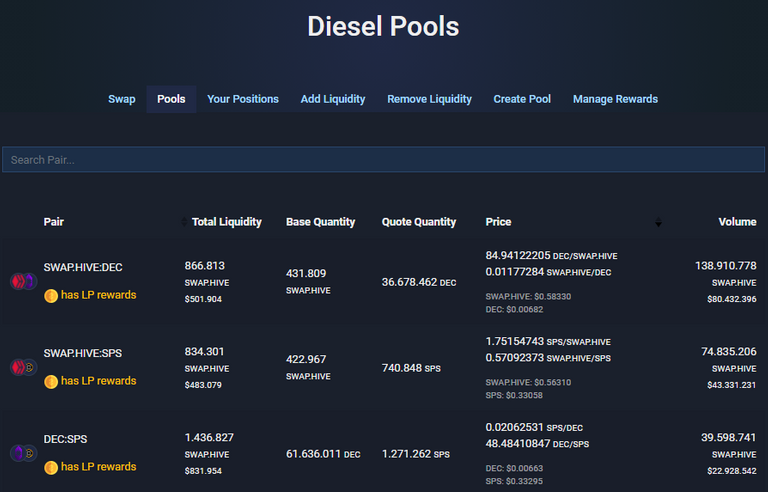

The data was obtained from the /pools page at https://beeswap.dcity.io/swap. You can check the current data from there. Trading the tokens in said pools, adding liquidity, canceling the provided liquidity, creating new liquidity pools etc. You can use https://tribaldex.com/dieselpools/ for transactions. See you in new posts. Stay tuned.

How do you measure APR?

APR rates are calculated annually. The rates I have given above give the annual rate of reward tokens added according to the available liquidity provided. As I mentioned above, it is variable. USD value of your daily income*365=x, USD value of your provided liquidity/x=? etc. You can make an account. Or you can check your own rates by logging in on the site I shared above.

Great information for all Hive investors and I always wondered what APR are the pools providing. I am in SIM pool so is great to see now that I am getting a healthy 21.2% return. It would be great to have this information on TribalDex itself, but being on BeeSwap is complementing that!

Posted Using LeoFinance Beta

I noticed Beeswap a few days ago too. There will be such developments in Tribaldex over time.

Thanks for the info! Great for farmers looking for a great place to farm some yield.

Posted Using LeoFinance Beta

I totally agree. I hope we see more decentralized exchanges and liquidity environments in HiveBlockchain as well.

Same! Have you seen dSwap?

Posted Using LeoFinance Beta

Yeah. I use Dswap regularly.

Seems like the HBD/Cent pool would be great to get involved. Both are quasi-stable coins with a great APR. Or am I missing something?

There is no longer a target of convergence to a certain price value. Cent has become completely volatile. However, it has hovered around the $0.01 price so far. I just can't guarantee that it will continue like this from now on. As a result, it is more consistent and less risky than other token pools due to HBD.

https://peakd.com/hive-173575/@anadolu/update-cent-s-price-has

ok thanks for the update!

I thank you.

one problem for providing liquidity to cent pools is that it's almost impossible to buy a considerable chunk without having a considerable price impact... e.g. where can I buy 250$ worth of cent at a good price? Any solution for this?

There is no alternative for this unfortunately. Follow the Hive/Cent market regularly. You can enter purchase orders. You can regularly monitor and purchase Cent's Leo, Pob, HBD and Hive pools. I wouldn't recommend making too many purchases from the market or pools at once. You will most likely be able to buy at a higher price, as there will be a price shift. More liquidity will be added over time. Likewise, I think that the number and volume of buy-sell orders in the market will increase.

DeFi is really interesting, and I think it is the future

Yeah. It is necessary to research more, learn and take part in the work.