A guy walks into a bar...

The automated door closes behind him as his slick new shoes make a clapping noise during his cool stroll towards the bartender. His beer arrives and the bartender hands over a payment device with a wBTC payment request waiting to be filled. As soon as his eyes gazed upon the wBTC symbol, his hands started to shake and we all shared the same question in our minds - Does his CEX know about his DEX?!

The year is 2035 and our world is a bit different than yours, dear reader. You live at a time when the revolution is almost ripe for execution, but we are the product of that idea. And before you go and reap your DeFi rewards, before you hit that "claim" button and pay a hefty network fee, we would like you to hear this story. Not how it ends, but how it begins...

In the beginning...

There were no limits. The guy with shaky hands still standing at the bar not knowing if he will ever walk out again can tell you just how awesome it was... Too bad he is busy thinking about his transactions from 2025. Since he is unable to speak, let me give you a brief walkthrough.

If you look at him you will recognize a pinch of class but the fact that he wears a tie and drinks beer at noon should be bothering you. This can only lead us to the conclusion that he is an airdrop kamikaze. At least, that is how we used to call them back in the day. Their profession was to interact with as many new protocols on the ETH network as possible. As soon as Uniswap established retroactive rewards as the new standard, this new breed in our society started growing exponentially. They increased our network fees and destroyed countless projects in the process. We look at them as termites. They come, they consume and when there is nothing left, they dump the remains on Uniswap LP providers making their impermanent loss more permanent than ever. Hence the mint suit and expensive shoes. His airdrop money could be staked in vaults to generate even more income. Here, this new breed feelt like home and no one could tell if they are in it for the Honey or for the money.

The Great Divide

2020 was an interesting year for everyone, to be honest. That whole virus thing scared the hell out of big money and they started preparing for an imaginary fallout. Their limited Scifi knowledge triggered a merger between the virtual and the real. Just a few years back they were saying how internet money isn't real and if they can't touch it, why would they buy it? One virus breakout later, they all had their MAXI suits on, armed with knowledge about limited supply and the digital era! Many, that were just as uninformed as they were, started flocking towards this new celestial body that prints money on demand. They just needed to keep buying.

This fresh surge of very valuable dollars triggered a rather different event. The DeFi boys were sitting in the corner for 3 long years and waited for an opportunity like this. This was their golden chariot and they will ride it for as long as they can! Food references in all shapes and colors started blossoming in the great wilderness. Uninhabitable zones became yield farms for smart money that soon evolved into degen gamblers. At first, they were sensitive and responsible with their investments but too many food-labeled rug pulls left manny scars on their wallets and souls. They evolved from prey to predators, became sharks, and started sniffing for blood in the waters.

New money was a blessing that paid for the bridges that we built, the countless farms we opened up and the Lambos that we dreamed of. Once young blood got burnt on the top 10 champs, they started looking for new ideas. If your everyday crypto exchange was a high-stakes casino, DeFi was Las Vegas. We had shiny lights, cool names for our tokens that created value out of thin air... It was a fun time that brought forth some amazing products in return. Divided as they were, these two worlds worked together and created monuments that are probably still unknown in your time. Ever heard of Honeyswap and Badger Finance?

Commercial Break

Since you made it this far, it is safe to assume that you are into DeFi and if that is the case, there are two projects you should know about.

Honeyswap is a Uniswap clone operating on the xDai chain. Transactions on that chin are settled in xDai and since it is pegged to the US dollar, transactions cost a fraction of a cent right now. I know that ETH is the most popular choice out there but it's really not that hard to bridge your tokens to the xDai chain and exchange them like we always intended - free of charge and in a decentralized manner. LPs work just like on Uniswap and if you are just figuring out how liquidity pools operate, why not try it in a cheap and safe way rather than paying $5 for every mistake you make?

Use the Omnibridge and enjoy the amazing technology our communities have built. It's is as simple as it can be to move your coins from one chain to another. Why spend more when you can earn instead? For any additional info on the Honey DAO and 1Hive projects, feel free to drop by at the forum and join the discussion.

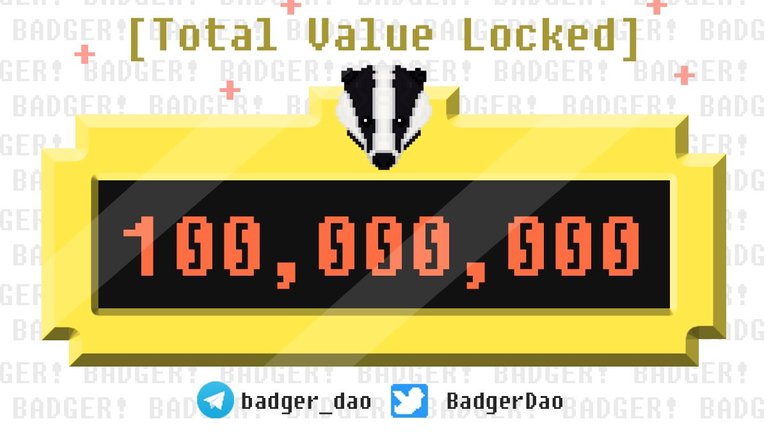

Bitcoiners should also be losing their mind right now about Badger Finance. They are a community that is trying to put BTC to work in the DeFi space for obvious reasons. Too much money is sitting in Bitcoin doing nothing while it could provide valuable liquidity that is much needed for DeFi to take off how it should. The Badger DAO fund is governed in a decentralized manner and all token holders can vote on proposals. The community decides how the money is spent, just like it always should have been.

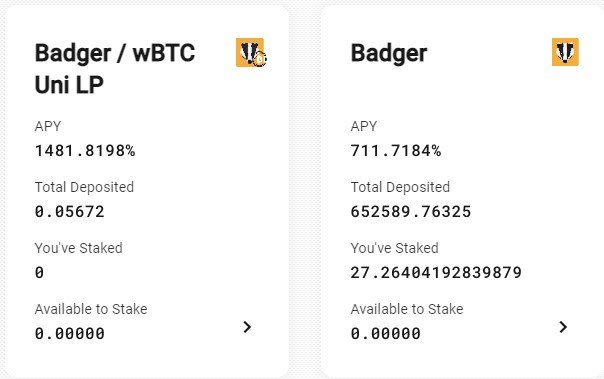

After just two days of staking, the total value locked in Badger Finance vaults has surpassed $100,000,000 and the APY is still massive. I would like to point out that there are some obvious risks involved. On the other hand, if you are comfortable with investing in community-driven projects, there is no better time than now.

A Stupid Idea

Before I tell you how all of this goes to shit, I would like to remind you of an event that already took place in your timeline. Today it is known as the Oxymoron effect. The marketing teams were running out of ideas when DeFi started casting a shadow over their centralized counterparts. If newcomers knew they could have control over their capital, there would be no need for a CEX so they had to make them noob-friendly.

Centralizing something that is decentralized in nature, and then pretending that it still retains its true form, is considered an Oxymoron as far as any half-educated individual is concerned. Everyone was laughing at this new term that made no sense, easily forgetting that the new guys don't really care about the tech. Does it really matter to them what name you gave it? Their Bitcoins are giving birth to more Bitcoins and MR CZ said everything would be just dandy. And so they listened...

The Aftermath

After forking DeFi and creating CeFi or CeDeFi or however they named it, centralized exchanges became giants. All the farms and all the Yield we offered them meant nothing because they didn't want to create a Metamask account. It was just too much work. Years have passed and their APY was dropping constantly. 0.1% was better than the negative interest rates the banks were offering but the DeFi boys were the ones driving Lambos. Once again, the small and fragile retail investor was left with bags filled with many different Bitcoin forks because the real one was too expensive for them. They were desperate and Metamask accounts were the only option.

They pulled up some Google searches, failed a few times, destroyed their balance and started over again... No price was too high for a double-digit monthly percentage on staking. What they didn't' know is that their CEX knew exactly what they are doing. New Metamask addresses were easily connected to individuals that sent selfies holding up their personal information and handing it over to the good guys. Liquidity was going out, and so was the money.

Does your CEX know about your DEX?

You see, dear reader, there will come a time when you will be asking this same question. You will wake up at night and think about all of the transactions you ever made because if your CEX knows about your DEX, you are done. This one little stupid mistake that we all once made is slowly becoming our downfall.

Our giants started losing money and had nothing else to sell except for your personal information. Once they identify your ETH address, they know exactly what coins you hold, how much you invest, and what you are spending that money on. At first, they will annoy you with push notifications. Then, they will make it more personal and try new things if sales keep going down. It will build up to a point where you will need to create multiple addresses just to hide from the ads. And who will pay for all those transaction fees? We still didn't fix that you know.

Your personal information will eventually become tokenized by some self-proclaimed marketing genius. It will be put up for sale and it will be sold to the highest bidder. Is he a serial killer or an owner of a pillow factory? You can never know. You should have thought about it before you made that first gamble because it is time to ante up. Your 2020 gains won't be enough to cover these stakes.

So, what do you think? Does that guy's CEX know about his DEX, or are his hands just shaking because he is an alcoholic that always aspired to become John McAfee?

Posted Using LeoFinance Beta

It was worth turning up to work late and reading this! Great post time traveller! I think there's a bit of John McAfee in your suited bar stayer, depends on how comfortable he is with buying crypto via exchanges that ask for KYC. Everything is traceable these days anyway right?

Posted Using LeoFinance Beta

Thanks for the support, kind stranger.

As much as we make it.

Posted Using LeoFinance Beta