Airdrop chasing... we've all done it, so there is no shame there. However, if you are looking for quality airdrops, many of them are now done as retrospective airdrops for past use/support of a protocol. This is in stark contrast to the free crypto rain of the past (which still occurs on some smart contract blockchains) which tend to rain low quality or scam tokens on mostly unsuspecting new users.

Now, the core idea behind the retrospective airdrops is to reward loyal users who supported a project in its riskiest stage of development... you know, the people who used something because they had a belief in the project vision and use case, and not because there was a promise of a spray of free tokens to be had in the future. Of course, humans being humans... people like to game the system and try to Sybil attack a potential future airdrop by using multiple addresses.

If you are a project that is in the process of trying to fairly distribute governance tokens that will control the spending of the treasury, handing out control to people who have demonstrated bad faith and a tendency to "be in it for the money first" approach is probably not going to end well for your little baby.

So, it is in the interests of these projects to try and form some sort of screening rules to try and skew the distribution to users who better align with the project future and vision. This means that hard choices will have to be made... as there will be winners and losers under any system... and many people will cry foul.

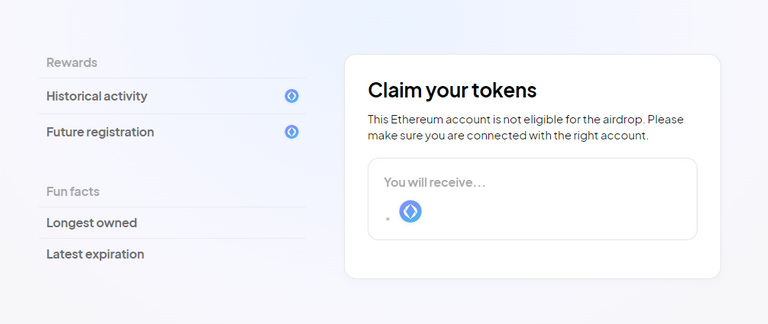

Take the recent ENS (Ethereum Name Server) distribution as an example... you might have seen people on twitter brandishing a .eth name and this is basically an on-chain record that resolves to an ETH address... actually, it can resolve to quite a lot of things, but that is a little bit off-topic for this post!

The ENS team decided to enact some additional manual screening and rules to prevent being Sybil attacked, however, it did mean that holders with multiple ENS names in a single or multiple wallets (or squatters with many many ENS names) got less than their "fair" distribution. And some cried foul...

Now, we have to look at why people bought ENS names in the first place... there are people like me, who just bought names for personal use and out of interest, and then there are others who bought with the expectation of future profit (from name squatting, a common enough thing in the regular DNS space). Both are valid ways to use the protocol... however, no-one who did this EVER did it with he expectation of future token drops... and neither should we.

So, under this reasoning, the future expectation of tokens is ZERO. The fact that we get an ENS distribution is just a very tasty treat! It is like when you get a present for a special event (lets say for a birthday or for Christmas) and it is completely unexpected. It is pretty bad taste to throw a tantrum and scream that it either wasn't worth enough or that you should have deserved more! That is the behaviour of a petulant child... and yet we see quite a bit of it in the crypto space... has the greed over-ridden the reason why we take part in all of this?

Probably a bit of the latter, as we see lots of people starting to splash out on ENS names... in the hopes of getting a retrospective airdrop that was snap-shotted ages ago. Please read people.... but that said, you are getting a pretty useful piece of Web3 infrastructure!

So, today... I had a few things that I needed to do on Ethereum mainnet (poopy poop...), which meant that I needed to keep a close eye on gas fees to see if I should do it today or tomorrow.,.. or regret that I hadn't done it last time I was batching these things. I see that the gas fees are really high.. a good chunk of that is from the ENS token contract... expected.

... however, there was a pretty big entry for the Metamask swap contract! Sigh... people again. Yesterday, there was a possible hint of a Metamask token drop.. and in the past it has been rumoured that it would likely be connected with the usage of the in-app swap. Now, you can probably get better onchain swaps elsewhere... but the point of the swap in extension is to actually support the Metamask team with a small fee included. So, I think that is a good idea, and have used it on occasion.

So, based on that hint... it appears that the swap function of Metamask suddenly has a lot of new fans! Sigh... I hope that the token distribution (if there actually is one!), is based on elapsed time since first transaction. I liked them before it was cool... or profitable!

Friendly Airdrop Reminders!

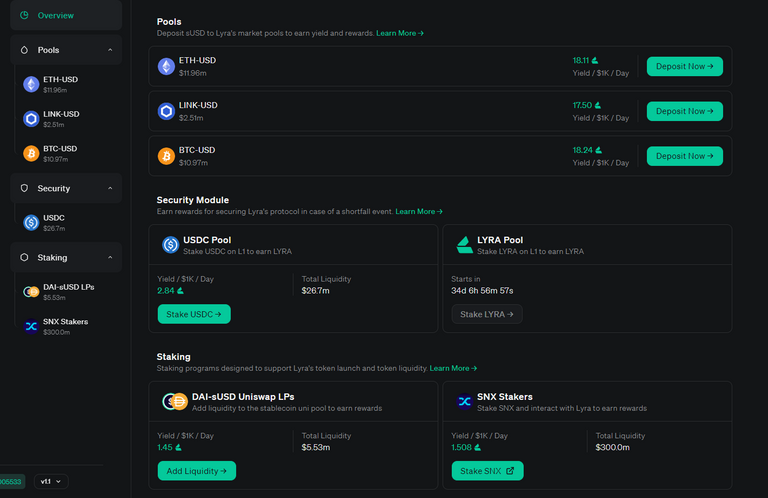

Sythetix is one of the older DeFi protocols on the Ethereum blockchain. Starting last year, they have been staging a migration over to the Optimistic Ethereum (OE) layer 2 and also spinning out different parts of their DeFi protocols to keep each team focussed on their respective core developments. What this means for SNX stakers is that as each part of the spun-out protocols move to OE, there is going to be an airdrop for existing L2 stakers. This has already happened for the THALES rollout, and the incoming LYRA drop is being calculated as a time weighting over the next few weeks.

Interestingly, this Lyra initial drop will include direct liquidity providers and liquidity providers to the Uniswap OE Dai-sUSD pair (at a very specific interval range, read the instructions!). Well.. I'm not really sure that I will end up using Lyra myself... it is a options (put/call) trading platform, and I'm not really so knowledgeable about that sort of thing. I mean, I understand it.... but not well enough to play around with it! Still, I'm happy to be part of the broader Synthentix ecosystem, and the Lyra governance will be part of that!

If you held or staked EGLD in a non-custodial wallet, you will have been part of a months long snap-shotting of balances that determined the initial allocation of MEX for the Elrond blockchain. The snap-shots finished several weeks ago, but there is no harm in checking to see if you are eligible.

MEX (Maiar) is going to be Elrond's version of a DeFi marketplace. I tried the testnet version, and it was pleasantly fast and responsive... although, I'm not sure how it will stack up against the existing giants that are already present on larger blockchains. Still... as a hedge, you could do much worse.

Boba is the airdrop to OMG (OmiseGo) holders. OmiseGo is one of the older projects that enacted a Plasma scaling solution for Ethereum... however, that technology is now being superseded by the newer L2 tech and so OMG is making the transition to the newer L2 versions. As part of that, they are swapping 1:1 the old OMG tokens for the newer BOBA tokens.

Apparently the old Plasma chain will stay in effect, as will the OMG tokens. But we'll see how long that persists into the future if there is much less demand for a solution that is already outdated!

... and of course, the drop that kicked off this post. Ethereum Name Serve (ENS) is aiming to be one of the backbones of Web3. If you had an ENS name before the snapshot, you will have some ENS sitting for you in the claim contract. It will be there for about 6 months, so you can wait for the gas fees to settle down a little bit.

Definitely worth claiming though, the potential is quite huge... and the current market price will be more than enough to offset the gas fees of claiming.

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

FTX: Regulated US-based exchange with some pretty interesting and useful discounts on trading and withdrawal fees for FTT holders. Decent fiat on-ramp as well!

MXC: Listings of lots of interesting tokens that are usually only available on DEXs. Avoid high gas prices!

Huobi: One of the largest exchanges in the world, some very interesting listings and early access sales through Primelist.

Gate.io: If you are after some of the weirdest and strangest tokens, this is one of the easiest off-chain places to get them!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Stoic: A USD maximisation bot trading on Binance using long-term long strategies, powered by the AI/human system of Cindicator.

StakeDAO: Decentralised pooled staking of PoS assets.

Poloniex: One of the older regulated exchanges that has come into new ownership. I used to use it quite a lot, but have since stopped.

Account banner by jimramones

Posted Using LeoFinance Beta

Ouch, I would not be so harsh. Missed opportunities aren't failures but just a different path... Not better or worse, just different!

Yeah, I don't mind the game itself and it is really beautifully designed! . But I can see how it would appeal to hearthstone players, but competitive multiplayer isn't my thing anymore!

I'm much more interested in Immutable X itself!

Immutable X is definitely exciting! I'm quite keen to see how they stack up against FLOW, which is also pursuing a similar design and marketing, but with a standalone chain instead of being backed by Ethereum.