Just a few days ago, Oddz put up a testnet version of their upcoming options trading market on Binance Smart Chain (BSC). Options trading is something that I've been reading about before, and I have wanted to try it out... it is a sort of hedging tool that is used primarily by people who will tend to make large trades, and it is serves as a sort of insurance against price volatility. I'm not a large trader, so it isn't useful to me directly, but I am curious from the abstract point of view (I'm just a curious cat and like learning how things work...)... and given that I'm a terrible trader, I don't want to play around on "real money" options just to satisfy my curiosity!

If you want to try it out, you can read the relevant article from Oddz here:

https://medium.com/oddz-finance/faqs-oddz-incentivised-testnet-program-cbbd0d5f19d2

and the testnet site is here:

Keep in mind that you will need to have your BSC wallet set up on METAMASK only, as it isn't supporting wallet browsers at the moment. There is some token incentives for participants and feedback, so that is a nice way to play around and potentially pick up a little reward for it as well! Who knows, those might be worth not-zero in the future.... some testnet things that I have played around with in the past have been quite rewarding!

You will also be able to fund your testnet wallet with Peggy tokens from the Oddz faucet once per week, and with testnet BNB from the testnet BNB faucet as well. So, you will have enough to play around with! Keep in mind that the peggy tokens for ETH/BTC/USDC are not standard across the network, so try to stick to the peggy tokens issued by Oddz or you will find that other similarly named tokens with different contract addresses are useless (ARRRGH... why can't there be some standardisation of testnet tokens!).

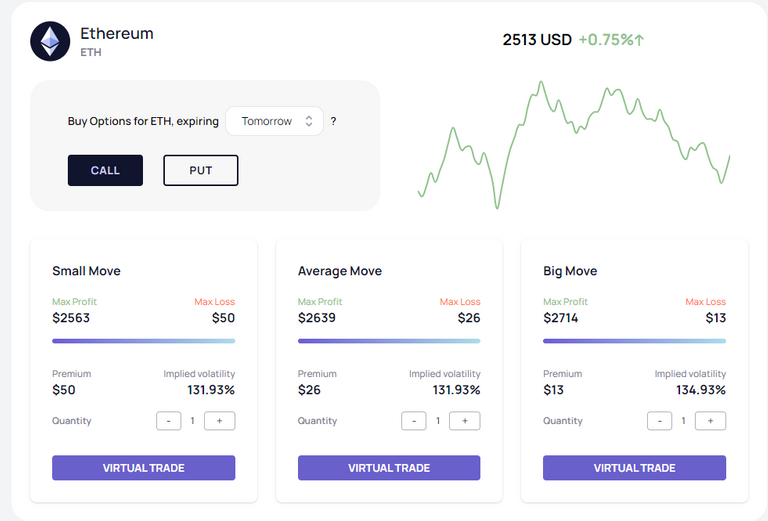

So, at it's most basic, purchasing an option is purchasing a contract for the ability (not obligation) to buy (call) or sell (put) a certain amount of an asset (ETH or BTC in these testnet contracts) at some point in the future for a fixed price. So, it is a good way for large traders or big OTC sales to protect themselves against large price swings after they have performed their trade.

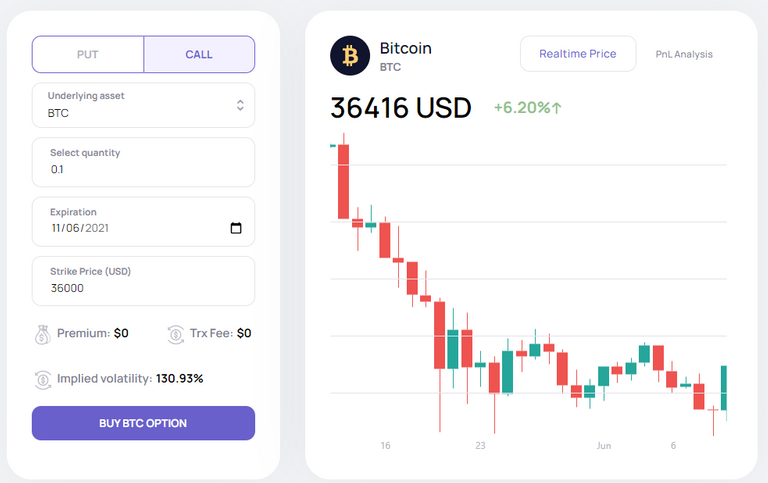

However, purchasing the contract for a potential future sale comes at a fixed cost. The price of the contract will depend on what the strike price is (the price at which the contract will trigger, the more distant the cheaper), the length of the contract (the shorter the cheaper) and the asset amount that you want to have the contract cover. This is paid out in USDC (cash), and the trade can be settled at any point after the strike price is reached and the expiry date hasn't passed.

It is likely that the price also depends on the depth of the counterparty liquidity pool, but I'm not sure about that... I'm pretty sure that any contract requires a counterparty, and that is the only place that I can see where there could exist one on a DeFi protocol!

Settlement is done in either assets (ETH/BTC) or cash (USDC). On the test-net the ETH/BTC peggy tokens appear to be completely useless, as you can't purchase contracts or exchange them... so, cash settled is the way to go on the testnet. In a mainnet, you would be able to use the real ETH/BTC... so it wouldn't be a problem... but I already made that mistake once... and it doesn't help that the contract settlement defaults to asset settlement instead of cash settlement!

At the moment, you can only place options orders on BTC and ETH against USDC. That isn't really a problem, as it is more just to test the protocol... and too much choice would make for a really confusing experience!

At the start, I was playing around with the easy options which had mostly preset conditions for the options. There was some very coarse grained options for times and amounts, but in general this was to just to get a feeling for the concepts of calls and puts.

I have since stepped over to the customisable options, where I have found that it is better to set up multiple smaller options instead of a single large matched option. The main reason for this is that it costs the same for the protocol, but you have to pay for the multiple on-chain transactions... but allows you to exercise your options in a staggered manner. Having a single large option means that you have to go with an all-or-nothing choice in exercising the option, which means that you are trying to time tops/bottoms... and we all know that that is a foolhardy venture!

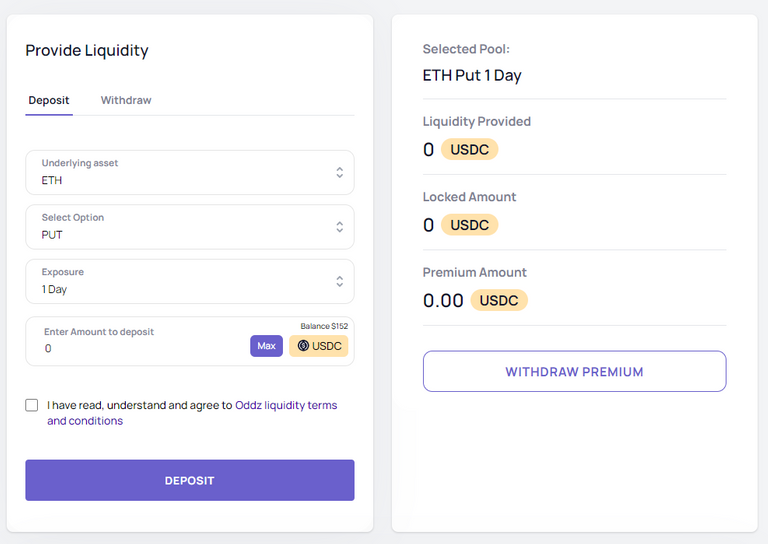

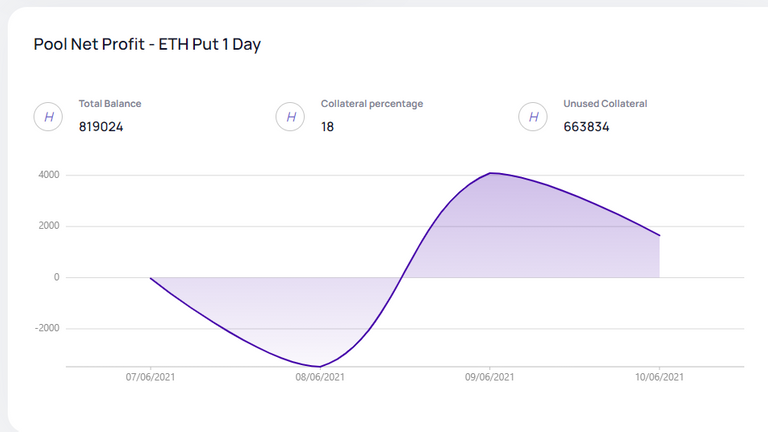

On the testnet, you can also provide liquidity into what appears to be the counterparty pools. this is an interesting side of the protocol that I've not really delved into... mainly because it is more of a passive sort of thing, and I'm more interested in learning the nuts and bolts of how everything works.... that said, I think I will dump a little bit of the USDC peggy in the next weekly drop to see how this all pans out.

I wonder if the risk is covered in these pools or if there is a good chance for losing money here as well if the market goes against you all the time? It appears that by despositing into the liquidity pool, you are making a perpetual call on the put-call side?

... and the chart does look like it is possible to go negative when the market is against you? Still, maybe the fees would cover this? Anywyay, I think I will make symmetric deposits to both sides to see how it pans out over time!

Learning learning learning!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Account banner by jimramones

Posted Using LeoFinance Beta

Thank you for sharing this, I personally am not ready yet to dive into that material (still so much to learn haha) but I think it was a valuable article, so I shared it on Twitter :) Good luck learning more about option trading :)

Posted Using LeoFinance Beta

Thank you for sharing it! Testnet is a good way to learn! No risk, as it is all just play money and not at all real!

View or trade

BEER.Hey @bengy, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.