Well... one of the most hotly anticipated events of the crypto year is now upon us... the first rounds of parachain auctions for the Polkadot (DOT) ecosystem. Polkadot (and the testnet Kusama) are modular-type networks where the main relay chain is only used for security and as an anchor for a constellation of parachains which will do all the specific smart contract implementations. This means that each parachain can be highly specialised for its own particular use case and issue their own tokens... forgoing the current need to be all things for all uses. Its almost like a single dApp for each parachain!

It is actually quite an elegant solution that I've been following for quite some time, Cosmos (ATOM) has a similar design philsophy, and there is a possibility that Ethereum is moving to something similar (without the hyper-specialisation) with its L2 constellations.

Anyway, the first round of crowdloans is now live, the bidding for the first parachain slot will begin this week (actually, it has already started!). In preparation, I had unstaked DOT (with the long long unstaking time....) to be ready for these crowdloans... however, I see that many of the major exchanges are also offering crowdloans through their own platforms if that is your preference! The exchange staking is much simpler, but they do take a cut... on the other hand, you "locked" tokens are still relatively liquid as they seem to allow trading into and out of the pool. They seem to act more like a savings product with the payments in the parachain token instead of DOT.

Seeing as I was just a touch late with my DOT unlocking, my DOT will only become available later today. So, I have some time to quickly browse the first batch of 9 crowdloan participants (there are 10 on the above screenshot, but the last one is for the second round of auctions). Anyway... all of this is just me doing some initial thoughts and public thinking about the initial batch... just to get my mind in gear for when I have to make a decision.

Crowdloans are the Polkadot replacement for the ICOs of the past. You loan DOT for the project to bid on the parachain auction. If they are successful, the DOT is locked in for the lease period (up to 96 weeks) and you collect rewards based on what the project has offerred (generally their own tokens). At the end of the lease (or if the bid is unsuccessful), your DOT is returned to you. So, you are sacrificing DOT staking rewards and liquidity in exchange for project tokens. Tough to balance...

Leading the list is the Moonbeam Foundation, which had a runaway hit with Moonriver on the Kusama testnet. It is a parachain that aims to bring Ethereum smart contract compatibility to the Polkadot ecosystem. Well... that is definitely something that I'm interested in, however, there is talk that the crowdloan cap is too high in comparison to the tokens being offered as rewards... that means that it is possible that the rewards might not compensate for the lost staking rewards of the DOT token, especially if the cap is actually reached!

Currently, it is the easiest leader in terms of DOT loaned that can be allocated to the parachain auction, which makes it the clear favourite to win the first slot.

Some people have even put forward the claim that their success on the Kusama testnet has been huge marketing stunt for the benefit of the mainnet bid! Wow... that is a big call there!

Still, this is something that I'm quite interested in... and the success of their Kusama version has been quite something to see. So, even if it is at a loss, it is a project that I'm willing to back!

Acala is one of the first projects that I had heard about near the start of the year that were aiming for a parachain slot. It is another Ethereum compatible chain, but with a heavy focus on DeFi.. and it was one of the leading contenders to win one of the first slots. Since then, DeFi has fallen off most people's radar due to the NFT craze and the success of Moonriver on the testnet.

Still, this is another project that is interesting to me... it still stands a decent enough chance to winning one of the opening slots... and the lower hard cap to contributions in comparison to Moonbeam might make it the better play from a returns point of view... that said, it still needs to be successful in bid and execution! It is currently relatively close behind Moonriver in terms of crowdloan, and the gap between 2nd and 3rd is quite a way behind. So, if nothing too much changes in the next few days and weeks, it is likely to win one of the first batch of five slots.

I know of Clover (CLV) from the initial public sale on CoinList. Unfortunately, this was in the terrible time between the OG Coinlisters and the new priority queue system... and it was one of the sales that was gamed to death by multi-accounts and bots. Sadly... I didn't manage to get an allocation. However, I did make sure to purchase CLV on the open market... just in case! The CoinList projects tend to do pretty okay in the long term! Or maybe I was being dumped on?

Anyway, their project aims to bring cross chain compatibility through their Clover Wallet... and I guess the parachain slot is part of implementing that vision, having a secure and self-launched chain to keep their ledger? All of this is done to essentially hide the horrific multiple blockchain experience away from the end user, something that is sorely lacking at the moment which also deters many newcomers... or at least deters too much cross-pollination!

Anyway, despite the fact that I do agree with the visions and aims of this project... I already have exposure to their token, so it isn't going to be a project that I will back in the crowdloan.

Initially, I had no idea what Astar was (I was a bit tuned out of the Polkadot news for a while)... but it turns out it is what was previously known as Plasm. That is more familiar... and even more familiar, it is aiming to be a Ethereum compatible chain... but with no specific focus (or at least, they just tick all the boxes... DeFi, NFTs and DAOs). It seems to have an impressive amount of ETH in lockdrops... but I'm a little lukewarm on this, I can't clearly see the difference between Astar and Moonbeam. Given that Moonbeam is so far ahead in terms of crowdloan warchest, it becomes harder to back Astar.

I will have to give this one some thought....

Parallel Finance is a project that is aiming to be a DeFi focussed parachain, and it seems to have an impressive list of more sophisticated products in the planning. However, it is up against stiff resistance against other bidders with larger crowdloan warchests (if nothing changes in the near future). Something that is quite interesting is the idea of liquid crowdloans... I haven't looked too closely at this, but it appears to give the crowdloan locked DOTs something of a market to exchange for liquid DOTs? Curious... but would that make it better to buy in afterwards? Hard to say... another one that I will need to mull over.

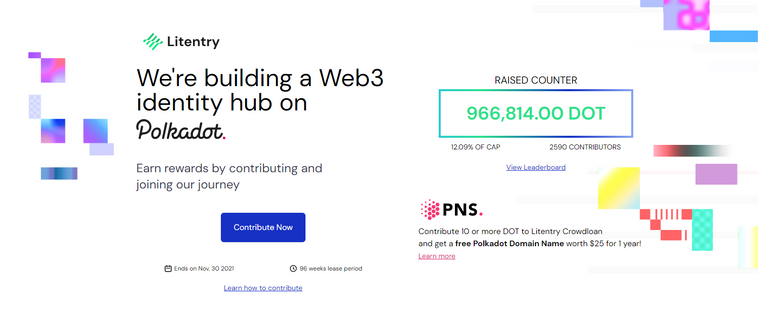

Finally... we hit a project that isn't doing similar things to all the others. Web3 identity and verification... well, this has become a big thing after the ENS launch, and there is the tempting offer of a PNS (Polkadot domain name) for backers of the project. I have already got exposure to the token through a previous Binance Launchpad/pool so there isn't really a huge incentive for me to increase that...

... however, a PNS is just one of those super nerdy cool things that I would really like to have! I think I'm going back it just for that!

Manta Network is another of the little underdogs in terms of crowdloan size... however, it is one of the projects that I consider to be pretty essential to a well functioning Web3. Privacy for transactions... yes please! I just wish that they hadn't referenced Squid Game... I hate it when projects make a reference to popular culture... bleah!

However, it reminded me that there is a different project that I had followed more closely that was also taking an approach of privacy for on-chain transactions. Phala Network (PHA) is the other project, and one that I have some exposure to... which led me to start looking for why they didn't join the first round of auctions. Turns out that they are planning to join the second round of five slots. Could be a good plan not to try and get publicity during the initial hype!

Anyway, seeing as Manta is the only privacy focussed project here... I think I'm going to back this one.

SubGame surprisingly enough (given its name) is aiming more for a Gaming focus for its parachain. Again, this is one of the different approaches from the clear leaders... and so, for me it is interesting to support just because of that. I'm still a little wary of the current batch of crypto-gaming, but that might start to change soon if we move away from the Play to Earn model which I find sort of skews game mechanics in a way that isn't really to my taste.

So, a likely backing from me... just out of curiosity and because they are trying something different!

... and lastly, SubDAO is a project that aims to bring management tools to DAOs. Yes, this is quite sorely needed... on chain voting is a pain in the arse, and even using tools like Snapshot is a bit annoying. It would be nice to have everything under one roof and not try to keep remembering where everything is... of course, that would meant that it would need to gain enough traction for the parachain to become THE place to go for governance. That said, most of the governance at the moment, is a bit chaos. So, despite the fact that it starts behind other projects in this space... there is the opportunity to just make things better!

Very keen to back this... the prevalence of DAOs in the last year has made DAO management tools something of a necessity in the near future! Again, a boring piece of useful infrastructure that so interests me!

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

FTX: Regulated US-based exchange with some pretty interesting and useful discounts on trading and withdrawal fees for FTT holders. Decent fiat on-ramp as well!

MXC: Listings of lots of interesting tokens that are usually only available on DEXs. Avoid high gas prices!

Huobi: One of the largest exchanges in the world, some very interesting listings and early access sales through Primelist.

Gate.io: If you are after some of the weirdest and strangest tokens, this is one of the easiest off-chain places to get them!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Stoic: A USD maximisation bot trading on Binance using long-term long strategies, powered by the AI/human system of Cindicator.

StakeDAO: Decentralised pooled staking of PoS assets.

Poloniex: One of the older regulated exchanges that has come into new ownership. I used to use it quite a lot, but have since stopped.

Account banner by jimramones

Posted Using LeoFinance Beta