Since the launch of Bitcoin in 2009, we have seen three major bull markets - one in 2011, 2013, and 2017. Each time, the market has crashed more than 90% after reaching its peak, and then gone through an extended bear cycle that lasted for years.

People who have been in crypto for a while have gotten used to this pattern, and some expect it to repeat... But could this time be different?

In order to find out, I think we need to compare what's happening in the real economy to previous cycles.

From Asset Inflation To Real Inflation

Throughout the past decade the central banks have been propping up failing corporations and financial markets through a combination of quantitative easing (money printing) and zero or negative interest rates.

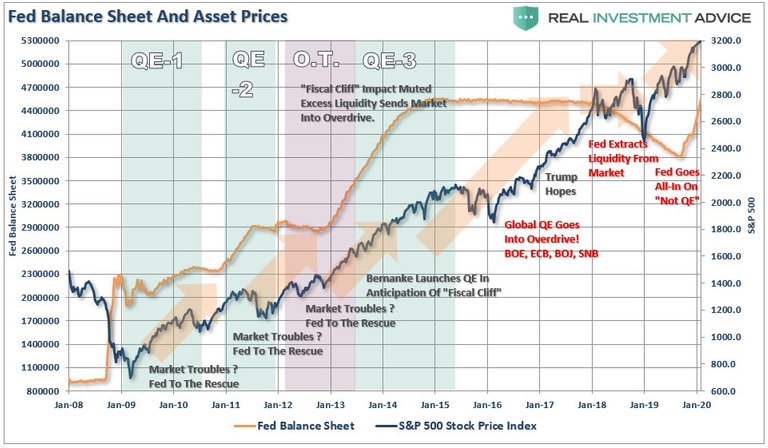

The correlation between money printing and asset prices is clear:

Many economists predicted that quantitative easing would lead to real inflation in goods and services, but in reality most of the printed money over the past decade went into stocks, bonds, and real-estate, enriching those who already owned those assets, and impoverishing those who didn't.

However, since the government-mandated lockdowns of 2020, the money printing has accelerated, and this time it's flowing not only into stocks & bonds, but also directly to citizens in the form of stimulus checks and unemployment insurance.

Roughly 20% of all US dollars were created in 2020 alone. The pace of money creation will quicken throughout 2021 and into 2022 as the US government moves ahead with their 1.8 trillion dollar stimulus package and likely enacts some form of universal basic income.

In other words, we have finally reached the "helicopter money" stage of this decades-long financial experiment.

Why haven't we seen hyperinflation yet?

The velocity of money also impacts inflation, and the lockdowns have suppressed demand and severely restricted the flow of money in the "real world" economy. However, with everyone at home on their devices now, the velocity of money moving into the digital world has started to accelerate.

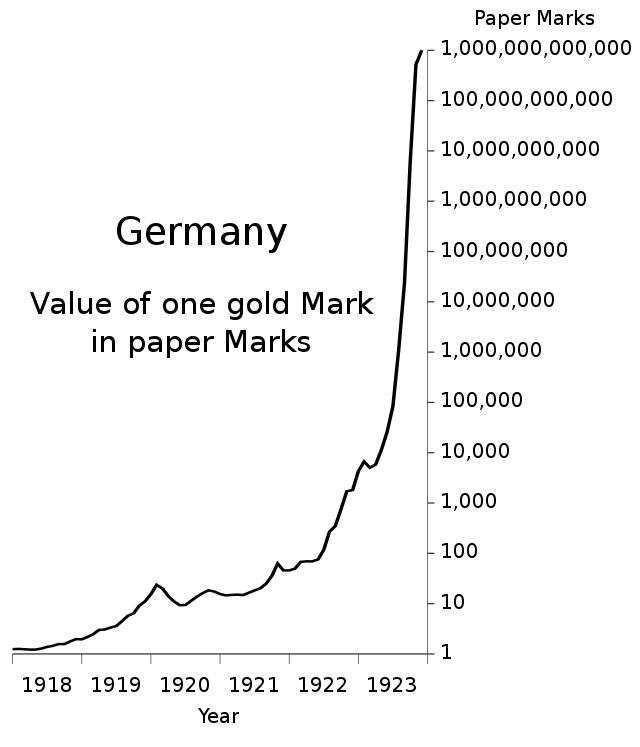

Inflation of goods and services can go undetected by citizens for many years, until the final stage where prices rise exponentially. For a historical reference, check out this chart of the World War 1 era German mark measured against gold:

Could the US dollar be near the end of this chart?

Staggering Unemployment

Unemployment numbers have skyrocketed since the government-mandated lockdowns, and a lot of people are stuck at home collecting stimulus checks, wondering how to get ahead.

Despite the fact that the real economy has been demolished, the stock market continues to rise. When people see their friends on Tik Tok making thousands of dollars in the stock and crypto markets, where do you think their stimulus checks are going to go?

In previous crypto bull runs the real economy wasn't in shambles with millions of people collecting money from the government. Therefore, I believe this crypto bull market will not be like the previous ones.

An Extended Crypto Bull Run

If countries remain on lockdown with unemployment at record highs, and the stimulus checks continue to flow, how will fiat currencies survive at the rate they are being printed? Will investors still see them as a stable store of value in one or two years time?

Corporations like Microstrategies and Tesla have seen the writing on the wall, and have allocated significant portions of their cash holdings into Bitcoin, signifying that this bull run will include institutional money.

Of course we should expect corrections along the way, but how long will they last before another corporation, pension fund, or celebrity throws their fiat into crypto and tweets about it?

These next few years could mark a pivotal moment in financial history, where all traditional financial assets move to blockchains, we restructure our economies to be more decentralized, and have a paradigm shift in the way we think about money.

Question

Do you think this cycle will be similar to previous ones, where we have a 90% drop in crypto asset prices and an extended years-long bear market, or will businesses and individuals be throwing their fiat into crypto to avoid hyperinflation?

Sources

https://www.newsbtc.com/analysis/btc/bitcoin-closes-2020-as-best-performing-asset-of-the-last-decade/

https://moguldom.com/310861/strategist-almost-20-percent-of-all-u-s-dollars-were-created-in-2020-alone/

https://www.wikiwand.com/en/Hyperinflation_in_the_Weimar_Republic

https://www.kitco.com/news/2021-02-17/The-case-for-rising-inflation-and-it-s-implications-on-commodity-markets.html

https://mises.org/wire/dumb-and-dumber-negative-interest-rates-helicopter-money

I'm pretty sure there's going to be another bear market at some point. The only way I see it NOT happening is IF, big if, the price climbed at a nice steady pace with mini-corrections and month long periods of consolidation. Then there might be a chance to avoid some wild swings. But there's no way to predict "how big" the correction/crash will be until we see how high it goes. If it runs to $400k this year, we could easily see a 75%-85% correction. If it goes to $250k, the 60%-75% would be in play. If it only goes to $120k, then maybe we only see 30%-40%. Maybe not even that. But there WILL be a pretty major pullback at some point. The more FOMO that enters the market, the weaker the hands will be and the volatile the price will become. It's just the nature of markets.

Posted Using LeoFinance Beta

Hey dagger,

Yes, I agree there will definitely be severe pullbacks as the total market cap continues to climb. What I'm wondering is if we'll see a years-long bear market, given the rate that fiat currencies are being printed right now. For example, not many Venezuelans would sell their Bitcoin to hold Bolivars, given that the Bolivar is losing so much value every day.

I was actually going to write a post about that tomorrow but I'll give you a sneak peak. :-) There's no way to know how long the "bear" market will last until we know how high the "bull" market goes. If we hit $400k by year end, it could be a long one. If we only go to $100k, there might not be one at all.

Posted Using LeoFinance Beta